SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

F

O R M 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of

No November 2024

Commission

File Number 1-32135

SEABRIDGE

GOLD INC.

(Name

of Registrant)

106

Front Street East, Suite 400, Toronto, Ontario, Canada M5A 1E1

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☐ Form 40-F ☒

SEABRIDGE

GOLD INC.

(the

“Company”)

See the Exhibit

Index hereto for a list of the documents filed herewith and forming a part of this Form 6-K.

Exhibits

99.1 and 99.2 hereto are incorporated by reference (as exhibits) to the Company’s registration statements on Form S-8 (File No.

333-211331) and Form F-10 (File No. 333-268485), as may be amended and supplemented.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Seabridge Gold Inc. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Chris Reynolds |

| |

Name: |

Chris Reynolds |

| |

Title: |

VP Finance and CFO |

Date: November 14, 2024

EXHIBIT INDEX

Exhibit

99.1

SEABRIDGE

GOLD INC.

UNAUDITED

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS

AT SEPTEMBER 30, 2024

SEABRIDGE GOLD INC.

Interim Condensed Consolidated Statements of Financial Position

(Expressed in thousands of Canadian dollars)

(Unaudited)

| | |

| | |

September 30, | | |

December 31, | |

| | |

Note | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| |

| Assets | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| | | |

$ | 51,162 | | |

$ | 82,438 | |

| Amounts receivable and prepaid expenses | |

| 3 | | |

| 7,863 | | |

| 7,763 | |

| Investment in marketable securities | |

| 4 | | |

| 5,069 | | |

| 3,750 | |

| | |

| | | |

| 64,094 | | |

| 93,951 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Investment in associate | |

| 4 | | |

| 972 | | |

| 1,247 | |

| Long-term receivables and other assets | |

| 5 | | |

| 119,947 | | |

| 105,947 | |

| Mineral interests, property and equipment | |

| 6 | | |

| 1,220,438 | | |

| 1,128,464 | |

| Reclamation deposits | |

| 8 | | |

| 22,269 | | |

| 21,350 | |

| | |

| | | |

| 1,363,626 | | |

| 1,257,008 | |

| Total assets | |

| | | |

$ | 1,427,720 | | |

$ | 1,350,959 | |

| | |

| | | |

| | | |

| | |

| Liabilities and shareholders’ equity | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| 7 | | |

$ | 18,383 | | |

$ | 32,734 | |

| Flow-through share premium | |

| 10 | | |

| 5,709 | | |

| 5,543 | |

| Lease obligations | |

| | | |

| 349 | | |

| 373 | |

| Provision for reclamation liabilities | |

| 8 | | |

| 3,629 | | |

| 759 | |

| | |

| | | |

| 28,070 | | |

| 39,409 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Secured note liabilities | |

| 9 | | |

| 506,891 | | |

| 573,888 | |

| Deferred income tax liabilities | |

| | | |

| 26,048 | | |

| - | |

| Lease obligations | |

| | | |

| 364 | | |

| 1,063 | |

| Provision for reclamation liabilities | |

| 8 | | |

| 3,493 | | |

| 6,676 | |

| | |

| | | |

| 536,796 | | |

| 581,627 | |

| Total liabilities | |

| | | |

| 564,866 | | |

| 621,036 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| 10 | | |

| 862,854 | | |

| 729,923 | |

| Total liabilities and shareholders’ equity | |

| | | |

$ | 1,427,720 | | |

$ | 1,350,959 | |

Subsequent events (Notes 10 and 12), commitments and contingencies

(Note 16)

The

accompanying notes form an integral part of these unaudited interim condensed consolidated financial statements.

SEABRIDGE GOLD INC.

Interim Condensed Consolidated Statements of Operations and Comprehensive

Income (Loss)

(Expressed in thousands of Canadian dollars except common share and

per common share amounts)

(Unaudited)

| | |

| |

Three months

ended

September 30, | | |

Nine months ended

September 30, | |

| | |

Note | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| |

| | |

| | |

| | |

| |

| Remeasurement gain (loss) on secured notes | |

9 | |

$ | (42,035 | ) | |

$ | 11,742 | | |

$ | 40,720 | | |

$ | 10,375 | |

| Corporate and administrative expenses | |

13 | |

| (4,000 | ) | |

| (3,729 | ) | |

| (13,446 | ) | |

| (11,598 | ) |

| Other income - flow-through shares | |

10 | |

| 3,844 | | |

| 2,596 | | |

| 6,197 | | |

| 4,112 | |

| Foreign exchange gain (loss) | |

| |

| 5,474 | | |

| (11,105 | ) | |

| (13,178 | ) | |

| (5,407 | ) |

| Finance costs, interest expense and other losses | |

| |

| (321 | ) | |

| (174 | ) | |

| (485 | ) | |

| (2,318 | ) |

| Interest income | |

| |

| 896 | | |

| 1,728 | | |

| 2,521 | | |

| 3,227 | |

| Earnings (loss) before income taxes | |

| |

| (36,142 | ) | |

| 1,058 | | |

| 22,329 | | |

| (1,609 | ) |

| Income tax recovery (expense) | |

| |

| 8,591 | | |

| (6,350 | ) | |

| (12,812 | ) | |

| (5,482 | ) |

| Net earnings (loss) for the period | |

| |

$ | (27,551 | ) | |

$ | (5,292 | ) | |

$ | 9,517 | | |

$ | (7,091 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| |

| | | |

| | | |

| | | |

| | |

| Items that will not be reclassified to net income or loss | |

| |

| | | |

| | | |

| | | |

| | |

| Remeasurement of secured notes | |

9 | |

$ | 15,521 | | |

$ | (32,063 | ) | |

$ | 49,600 | | |

$ | (30,936 | ) |

| Change in fair value of marketable securities | |

4 | |

| 566 | | |

| (65 | ) | |

| 1,319 | | |

| (184 | ) |

| Tax impact | |

| |

| (4,267 | ) | |

| 3,665 | | |

| (13,568 | ) | |

| 3,378 | |

| Total other comprehensive income

(loss) | |

| |

| 11,820 | | |

| (28,463 | ) | |

| 37,351 | | |

| (27,742 | ) |

| Comprehensive income (loss) for

the period | |

| |

$ | (15,731 | ) | |

$ | (33,755 | ) | |

$ | 46,868 | | |

$ | (34,833 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| |

| | | |

| | | |

| | | |

| | |

| Basic | |

10 | |

| 89,588,695 | | |

| 83,484,693 | | |

| 87,983,955 | | |

| 82,499,543 | |

| Diluted | |

10 | |

| 89,588,695 | | |

| 83,484,693 | | |

| 88,516,410 | | |

| 82,499,543 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) per common share | |

| |

| | | |

| | | |

| | | |

| | |

| Basic | |

10 | |

$ | (0.31 | ) | |

$ | (0.06 | ) | |

$ | 0.11 | | |

$ | (0.09 | ) |

| Diluted | |

10 | |

$ | (0.31 | ) | |

$ | (0.06 | ) | |

$ | 0.11 | | |

$ | (0.09 | ) |

The

accompanying notes form an integral part of these unaudited interim condensed consolidated financial statements.

SEABRIDGE GOLD INC.

Interim Condensed Consolidated Statements of Changes in Shareholders’ Equity

(Expressed in thousands of Canadian dollars except number of shares) (Unaudited)

| | |

Number

of Shares | | |

Share

Capital | | |

Stock-based

Compensation | | |

Contributed

Surplus | | |

Deficit | | |

Accumulated Other

Comprehensive

Gain (Loss) | | |

Total

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| As at December 31, 2023 | |

| 86,108,019 | | |

$ | 934,608 | | |

$ | 3,400 | | |

$ | 39,484 | | |

$ | (186,643 | ) | |

$ | (60,926 | ) | |

$ | 729,923 | |

| Share issuance - At-The-Market offering | |

| 2,750,609 | | |

| 56,569 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 56,569 | |

| Share issuance - Interest expense paid in shares | |

| 776,519 | | |

| 14,921 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14,921 | |

| Share issuance - Private placement | |

| 575,000 | | |

| 11,609 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,609 | |

| Share issuance - Options exercised | |

| 50,000 | | |

| 1,302 | | |

| (416 | ) | |

| - | | |

| - | | |

| - | | |

| 886 | |

| Share issuance - RSUs vested | |

| 126,133 | | |

| 2,060 | | |

| (2,060 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Share issuance - Other | |

| 5,000 | | |

| 105 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 105 | |

| Share issuance costs | |

| - | | |

| (1,240 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,240 | ) |

| Deferred tax on share issuance costs | |

| - | | |

| 333 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 333 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 2,880 | | |

| - | | |

| - | | |

| - | | |

| 2,880 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 37,351 | | |

| 37,351 | |

| Net earnings for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,517 | | |

| - | | |

| 9,517 | |

| As at September 30, 2024 | |

| 90,391,280 | | |

$ | 1,020,267 | | |

$ | 3,804 | | |

$ | 39,484 | | |

$ | (177,126 | ) | |

$ | (23,575 | ) | |

$ | 862,854 | |

| As at December 31, 2022 | |

| 81,339,012 | | |

$ | 856,462 | | |

$ | 4,655 | | |

$ | 36,160 | | |

$ | (157,377 | ) | |

$ | 633 | | |

$ | 740,533 | |

| Share issuance - At-The-Market offering | |

| 1,569,995 | | |

| 28,279 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 28,279 | |

| Share issuance - Interest expense paid in shares | |

| 977,745 | | |

| 14,761 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14,761 | |

| Share issuance - RSUs vested | |

| 30,000 | | |

| 630 | | |

| (630 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Share issuance costs | |

| - | | |

| (1,180 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,180 | ) |

| Deferred tax on share issuance costs | |

| - | | |

| 313 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 313 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 2,493 | | |

| - | | |

| - | | |

| - | | |

| 2,493 | |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (27,741 | ) | |

| (27,741 | ) |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,090 | ) | |

| - | | |

| (7,090 | ) |

| As at September 30, 2023 | |

| 83,916,752 | | |

$ | 899,265 | | |

$ | 6,518 | | |

$ | 36,160 | | |

$ | (164,467 | ) | |

$ | (27,108 | ) | |

$ | 750,368 | |

The

accompanying notes form an integral part of these unaudited interim condensed consolidated financial statements.

SEABRIDGE GOLD INC.

Interim Condensed Consolidated Statements of Cash Flows

(Expressed in thousands of Canadian dollars)

(Unaudited)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Operating Activities | |

| | | |

| | | |

| | | |

| | |

| Net earnings (loss) | |

$ | (27,551 | ) | |

$ | (5,292 | ) | |

$ | 9,517 | | |

$ | (7,091 | ) |

| Adjustment for non-cash items: | |

| | | |

| | | |

| | | |

| | |

| Remeasurement loss (gain) on secured notes | |

| 42,035 | | |

| (11,742 | ) | |

| (40,720 | ) | |

| (10,375 | ) |

| Unrealized foreign exchange loss (gain) | |

| (5,974 | ) | |

| 12,018 | | |

| 13,377 | | |

| 5,736 | |

| Other income - flow-through shares | |

| (3,844 | ) | |

| (2,596 | ) | |

| (6,197 | ) | |

| (4,112 | ) |

| Stock-based compensation | |

| 833 | | |

| 766 | | |

| 2,880 | | |

| 2,493 | |

| Income tax expense (recovery) | |

| (8,591 | ) | |

| 6,350 | | |

| 12,812 | | |

| 5,482 | |

| Other non-cash items (Note 11) | |

| 756 | | |

| (561 | ) | |

| 368 | | |

| (6 | ) |

| Adjustment for cash items: | |

| | | |

| | | |

| | | |

| | |

| Environmental rehabilitation disbursements | |

| (329 | ) | |

| (1,924 | ) | |

| (499 | ) | |

| (2,794 | ) |

| Changes in working capital items: | |

| | | |

| | | |

| | | |

| | |

| Amounts receivable and prepaid expenses | |

| 720 | | |

| (363 | ) | |

| (2,948 | ) | |

| (2,338 | ) |

| Accounts payable and accrued liabilities | |

| 551 | | |

| (1,912 | ) | |

| (10 | ) | |

| (1,191 | ) |

| Net cash from (used in) operating activities | |

| (1,394 | ) | |

| (5,256 | ) | |

| (11,420 | ) | |

| (14,196 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Investing Activities | |

| | | |

| | | |

| | | |

| | |

| Mineral interests, property and equipment | |

| (28,046 | ) | |

| (73,742 | ) | |

| (78,598 | ) | |

| (166,495 | ) |

| Long-term receivables | |

| (14,000 | ) | |

| (24 | ) | |

| (14,000 | ) | |

| (43,674 | ) |

| Redemption of short-term deposits | |

| - | | |

| 60,030 | | |

| - | | |

| 141,762 | |

| Investment in short-term deposits | |

| - | | |

| (70,121 | ) | |

| - | | |

| (70,164 | ) |

| Investment in reclamation deposits | |

| - | | |

| 201 | | |

| (919 | ) | |

| (339 | ) |

| Net cash used in investing activities | |

| (42,046 | ) | |

| (83,656 | ) | |

| (93,517 | ) | |

| (138,910 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financing Activities | |

| | | |

| | | |

| | | |

| | |

| Secured notes | |

| - | | |

| - | | |

| - | | |

| 198,825 | |

| Share issuance net of costs | |

| 24,100 | | |

| 4,754 | | |

| 73,303 | | |

| 27,099 | |

| Exercise of options | |

| - | | |

| - | | |

| 886 | | |

| - | |

| Payment of lease liabilities | |

| (398 | ) | |

| (206 | ) | |

| (723 | ) | |

| (460 | ) |

| Net cash from financing activities | |

| 23,702 | | |

| 4548 | | |

| 73,466 | | |

| 225,464 | |

| Effects of exchange rate fluctuation on cash and cash equivalents | |

| (409 | ) | |

| 684 | | |

| 195 | | |

| 454 | |

| Net increase (decrease) in cash and cash equivalents during the period | |

| (20,147 | ) | |

| (83,680 | ) | |

| (31,276 | ) | |

| 72,812 | |

| Cash and cash equivalents, beginning of the period | |

| 71,309 | | |

| 202,642 | | |

| 82,438 | | |

| 46,150 | |

| Cash and cash equivalents, end of the period | |

$ | 51,162 | | |

$ | 118,962 | | |

$ | 51,162 | | |

$ | 118,962 | |

The

accompanying notes form an integral part of these unaudited interim condensed consolidated financial statements.

SEABRIDGE

GOLD INC.

Notes

to the interim condensed consolidated financial statements

As

at and for the nine months ended September 30, 2024 and 2023

(Amounts

in notes and in tables are in millions of Canadian dollars, except where otherwise indicated) (Unaudited)

Seabridge

Gold Inc. is comprised of Seabridge Gold Inc. (“Seabridge” or the “Company”) and its subsidiaries, KSM Mining

ULC, Seabridge Gold (NWT) Inc., Seabridge Gold (Yukon) Inc., Seabridge Gold Corp., SnipGold Corp. and Snowstorm Exploration (LLC), and

is a Company engaged in acquiring, exploring, and advancing mineral properties, with an emphasis on gold resources, located in Canada

and the United States of America. The Company was incorporated under the laws of British Columbia, Canada on September 14, 1979 and continued

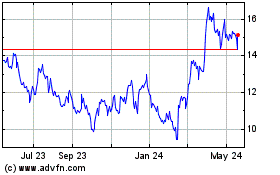

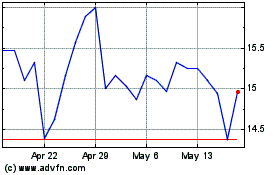

under the laws of Canada on October 31, 2002. Its common shares are listed on the Toronto Stock Exchange trading under the symbol “SEA”

and on the New York Stock Exchange under the symbol “SA”. The Company is domiciled in Canada and the address of its registered

office is 10th Floor, 595 Howe Street, Vancouver, British Columbia, Canada V6C 2T5 and the address of its corporate office is 106 Front

Street East, 4th Floor, Toronto, Ontario, Canada M5A 1E1.

| A. | Statement

of compliance |

These

unaudited interim condensed consolidated financial statements (“consolidated interim financial statements”) were prepared in

accordance with IAS 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”),

using accounting policies consistent with those used by the Company in preparing the annual consolidated financial statements as at and

for the year ended December 31, 2023 and should be read in conjunction with the Company’s annual consolidated financial statements

as at and for the year ended December 31, 2023. They do not include all of the information required for a complete set of financial statements

prepared in accordance with International Financial Reporting Standards (“IFRS”). However, selected explanatory notes are

included to explain events and transactions that are significant to an understanding of the changes in the Company’s financial

position and performance since the last annual financial statements. These consolidated interim financial statements were authorized

for issue by the Company’s board of directors on November 13, 2024.

| B. | Amended

IFRS standard effective January 1, 2024 |

| (i) | On

January 23, 2020 and October 31, 2022, the IASB issued amendments to IAS 1 to clarify that

the classification of liabilities as current or non-current should be based on rights that

exist at the end of the reporting period and that classification is unaffected by expectations

about whether an entity will exercise its right to defer settlement of a liability. For liabilities

with covenants, the amendments clarify that only covenants with which an entity is required

to comply on or before the reporting date affect the classification as current or non-current. |

| (ii) | On

September 22, 2022, the IASB issued amendments to IFRS 16 to add subsequent measurement requirements

for sale and leaseback transactions, particularly those with variable lease payments. The

amendments require the seller-lessee to subsequently measure lease liabilities in a way such

that it does not recognize any gain or loss relating to the right of use it retains. |

| (iii) | On

May 25, 2023, the IASB issued amendments to IAS 7 requiring entities to provide qualitative

and quantitative information about their supplier finance arrangements. In connection with

the amendments to IAS 7, the IASB also issued amendments to IFRS 7 requiring entities to

disclose whether they have accessed, or have access to, supplier finance arrangements that

would provide the entity with extended payment terms or the suppliers with early payment

terms. |

The

Company applied the above amendments to its consolidated interim financial statements for the annual reporting period beginning on January

1, 2024. The application of these amendments did not have an impact on the Company’s consolidated interim financial statements.

| C. | Recent

Accounting Pronouncements Issued Not Yet Adopted |

| (i) | On

April 9, 2024, the IASB issued IFRS 18 “Presentation and Disclosure in the Financial Statements” (“IFRS 18”)

replacing IAS 1. IFRS 18 introduces categories and defined subtotals in the statement of profit or loss, disclosures on management-defined

performance measures, and requirements to improve the aggregation and disaggregation of information in the financial statements. As a

result of IFRS 18, amendments to IAS 7 were also issued to require that entities use the operating profit subtotal as the starting point

for the indirect method of reporting cash flows from operating activities and also to remove presentation alternatives for interest and

dividends paid and received. Similarly, amendments to IAS 33 “Earnings per Share” were issued to permit disclosure of additional

earnings per share figures using any other component of the statement of profit or loss, provided the numerator is a total or subtotal

defined under IFRS 18. IFRS 18 is effective for annual reporting periods beginning on or after January 1, 2027, and is to be applied

retrospectively, with early adoption permitted. The Company is currently assessing the impact of the standard on its financial statements. |

| (ii) | On

May 30, 2024, the IASB issued narrow scope amendments to IFRS 9 “Financial Instruments” and IFRS 7. The amendments include

the clarification of the date of initial recognition or derecognition of financial liabilities, including financial liabilities that

are settled in cash using an electronic payment system. The amendments also introduce additional disclosure requirements to enhance transparency

regarding investments in equity instruments designated at FVOCI and financial instruments with contingent features. The amendments are

effective for annual periods beginning on or after January 1, 2026, with early adoption permitted. The Company is currently assessing

the impact of the amendments on its financial statements. |

| 3. | Amounts

receivable and prepaid expenses |

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| HST | |

| 1,741 | | |

| 4,493 | |

| Prepaid expenses and other receivables | |

| 6,122 | | |

| 3,270 | |

| | |

| 7,863 | | |

| 7,763 | |

| ($000s) | |

| January 1,

2024 | | |

| Fair value through other

comprehensive income (loss) | | |

| Loss of associate | | |

| Additions | | |

| September 30,

2024 | |

| Current assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investments in marketable securities | |

| 3,750 | | |

| 1,319 | | |

| - | | |

| - | | |

| 5,069 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investment in associate | |

| 1,247 | | |

| - | | |

| (275 | ) | |

| - | | |

| 972 | |

| ($000s) | |

| January 1,

2023 | | |

| Fair value through other

comprehensive income (loss) | | |

| Loss of associate | | |

| Additions | | |

| December 31,

2023 | |

| Current assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investments in marketable securities | |

| 3,696 | | |

| 54 | | |

| - | | |

| - | | |

| 3,750 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investment in associate | |

| 1,389 | | |

| - | | |

| (208 | ) | |

| 66

| 1 | |

| 1,247 | |

| 1) | In

2023, the Company received 151,855 common shares of Paramount for payment of interest on the secured convertible note receivable accrued

between July 1, 2022 and December 27, 2023 when the note was repaid. |

The

Company holds a 4.2% (December 31, 2023 – 4.7%) interest in Paramount which is classified as investment in associate and accounted

for using the equity method on the basis that the Company has the ability to exert significant influence through its representation on

Paramount’s board of directors. During the nine months ended September 30, 2024, the Company recorded its proportionate share of

Paramount’s net loss of $0.3 million (2023 – $0.2 million) within finance costs, interest expense and other income on the

interim condensed consolidated statements of operations and comprehensive income (loss). As at September 30 2024, the carrying value

of the Company’s investment in Paramount was $1.0 million (December 31, 2023 - $1.2 million).

| 5. | Long-term

receivables and prepaid expenses |

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| BC Hydro 1 | |

| 106,720 | | |

| 92,720 | |

| Canadian Exploration Expenses 2 | |

| 9,361 | | |

| 9,361 | |

| British Columbia Mineral Exploration Tax Credit 3 | |

| 3,866 | | |

| 3,866 | |

| | |

| 119,947 | | |

| 105,947 | |

| 1) | In

2022, the Company entered into a Facilities Agreement with British Columbia Hydro and Power Authority (“BC Hydro”) covering

the design and construction of facilities by BC Hydro to supply construction phase hydro-sourced electricity to the KSM Project. Pursuant

to signing the Facilities Agreement the Company has made $106.7 million prepayments inclusive of $14.0 million which was accrued during

the second quarter of 2024 and paid during the current quarter. |

| | |

| 2) | As

previously disclosed in the Company’s prior years financial statements, in 2019 the Company received a notice from the Canada Revenue

Agency (“CRA”) that it proposed to reduce the amount of expenditures reported as Canadian Exploration

Expenses (“CEE”) for the three-year period ended December 31, 2016. The Company has funded certain of its exploration expenditures,

from time-to-time, with the proceeds from the issuance of flow-through shares and renounced, to subscribers, the expenditures which

it determined to be CEE. The notice disputes the eligibility of certain types of expenditures previously audited and approved as

CEE by the CRA. The Company strongly disagrees with the notice and responded to the CRA auditors with additional information for their

consideration. In 2020, the CRA auditors responded to the Company’s submission and, although accepting additional expenditures

as CEE, reiterated that their position remains largely unchanged and subsequently issued reassessments to the Company reflecting the

additional CEE expenditures accepted and $2.3 million of Part Xll.6 tax owing. The CRA has reassessed certain investors who subscribed

for the flow-through shares, reducing CEE deductions. Notices of objection to the Company’s and investors’ reassessments

have been filed for all those that have been received and will be appealed to the courts, should the notices of objection be denied.

The Company has indemnified the investors that subscribed for the flow-through shares and that have been reassessed by depositing the

amount of their reassessments, including interest charges, into the accounts of the reassessed investors with the Receiver General in

return for such investors agreement to object to their respective reassessments and to repay the Company any refund of the amount deposited

on their behalf upon resolution of the Company’s appeal. During 2021, 2022 and 2023, the Company deposited $9.4 million into the

accounts of certain investors with the Receiver General. The deposits made have been recorded as long-term receivables on the statement

of financial position as at September 30, 2024. The potential tax indemnification to the investors is estimated to be $10.8 million,

plus $3.5 million potential interest. No provision has been recorded related to the tax, potential interest, nor the potential indemnity

as the Company and its advisors do not consider it probable that there will ultimately be an amount payable. |

| | |

| 3) | During

2016, upon the completion of an audit of the application by tax authorities of the British Columbia Mineral Exploration Tax Credit (“BCMETC”)

program, the Company was reassessed $3.6 million, including accrued interest for expenditures that the tax authority has categorized

as not qualifying for the BCMETC program. The Company recorded a $3.6 million provision within non-trade payables and accrued expenses

on the consolidated statements of financial position as at December 31, 2016 with a corresponding increase in mineral interests. In 2017

the Company filed an objection to the reassessment with the appeals division of the tax authorities and paid one-half of the accrued

balance to the Receiver General and reduced the provision by $1.8 million. In 2019, the Company received a decision from the appeals

division that the Company’s objection was denied, and the Company filed a Notice of Appeal with the British Columbia Supreme Court.

The Attorney General of Canada replied to the facts and arguments in the Company’s Notice of Appeal and stated its position that

the Company’s expenditures did not qualify for the BCMETC program. During the first quarter of 2023, the Company completed the

discovery process with the Department of Justice that included settling an agreed statement of facts. The Company presented its case

in the BC Supreme Court during the current quarter. Based on the facts and circumstances of the Company’s objection and its arguments

made in court, the Company concludes that it is more likely than not that it will be successful in its objection. As at September 30,

2024, the Company has paid $1.6 million to the Receiver General, and the CRA has withheld $2.3 million of HST credits due to the Company

that would fully cover the residual balance, including interest, should the Company be unsuccessful in its challenge. The amount recorded

in long-term receivables as of September 30, 2024 of $3.9 million includes the initial reassessment of $3.6 million, plus accrued interest. |

| 6. | Mineral

Interests, Property and Equipment |

| ($000s) | |

| Mineral

interests | | |

| Construction

in progress | | |

| Property &

equipment | | |

| Right-of-use

assets 1 | | |

| Total | |

| Cost | |

| | | |

| | | |

| | | |

| | | |

| | |

| As at January 1, 2023 | |

| 687,074 | | |

| 121,201 | | |

| 72,404 | | |

| 2,437 | | |

| 883,116 | |

| Additions | |

| 69,732 | | |

| 178,764 | | |

| 1,187 | | |

| 781 | | |

| 250,464 | |

| Transfers | |

| - | | |

| (101,899 | ) | |

| 101,899 | | |

| - | | |

| - | |

| As at December 31, 2023 | |

| 756,806 | | |

| 198,066 | | |

| 175,490 | | |

| 3,218 | | |

| 1,133,580 | |

| Additions | |

| 36,883 | | |

| 57,994 | | |

| - | | |

| 90 | | |

| 94,967 | |

| Disposals 3 | |

| - | | |

| - | | |

| - | | |

| (1,316 | ) | |

| (1,316 | ) |

| As at September 30, 2024 | |

| 793,689 | | |

| 256,060 | | |

| 175,490 | | |

| 1,992 | | |

| 1,227,231 | |

| Accumulated Depreciation | |

| | | |

| | | |

| | | |

| | | |

| | |

| As at January 1, 2023 | |

| - | | |

| - | | |

| 1,070 | | |

| 549 | | |

| 1,619 | |

| Depreciation expense 2 | |

| - | | |

| - | | |

| 2,517 | | |

| 980 | | |

| 3,497 | |

| As at December 31, 2023 | |

| - | | |

| - | | |

| 3,587 | | |

| 1,529 | | |

| 5,116 | |

| Depreciation expense 2 | |

| - | | |

| - | | |

| 1,948 | | |

| 697 | | |

| 2,645 | |

| Disposals 3 | |

| - | | |

| - | | |

| - | | |

| (968 | ) | |

| (968 | ) |

| As at September 30, 2024 | |

| - | | |

| - | | |

| 5,535 | | |

| 1,258 | | |

| 6,793 | |

| Net Book Value | |

| | | |

| | | |

| | | |

| | | |

| | |

| As at December 31, 2023 | |

| 756,806 | | |

| 198,066 | | |

| 171,903 | | |

| 1,689 | | |

| 1,128,464 | |

| As at September 30, 2024 | |

| 793,689 | | |

| 256,060 | | |

| 169,955 | | |

| 734 | | |

| 1,220,438 | |

| 1) | Right-of-use

assets consist of property and equipment related to assets leased and accounted for under

IFRS 16 |

| 2) | Depreciation

expense related to camps, equipment, and right-of-use assets associated with the KSM construction

is capitalized to construction in progress |

| 3) | Disposals

relate to equipment lease cancellations at KSM. |

Mineral

interests, property and equipment additions by project are as follows:

| | |

Nine months ended September 30, 2024 | |

| ($000s) | |

Mineral

interests | | |

Construction

in progress | | |

Property &

equipment | | |

Right-of-

use assets | | |

Total

Additions | |

| Additions | |

| | |

| | |

| | |

| |

| KSM additions 1 | |

| 10,528 | | |

| 57,994 | | |

| - | | |

| 90 | | |

| 68,612 | |

| Courageous Lake | |

| 752 | | |

| - | | |

| - | | |

| - | | |

| 752 | |

| Iskut | |

| 15,294 | | |

| - | | |

| - | | |

| - | | |

| 15,294 | |

| Snowstorm | |

| 742 | | |

| - | | |

| - | | |

| - | | |

| 742 | |

| 3 Aces | |

| 9,567 | | |

| - | | |

| - | | |

| - | | |

| 9,567 | |

| | |

| 36,883 | | |

| 57,994 | | |

| - | | |

| 90 | | |

| 94,967 | |

| | |

Year ended December 31, 2023 | |

| ($000s) | |

Mineral

interests | | |

Construction

in progress | | |

Property &

equipment | | |

Right-of-

use assets | | |

Total

Additions | |

| Additions | |

| | |

| | |

| | |

| |

| KSM additions 1 | |

| 40,490 | | |

| 178,764 | | |

| 1,187 | | |

| 781 | | |

| 221,222 | |

| Courageous Lake | |

| 3,520 | | |

| - | | |

| - | | |

| - | | |

| 3,520 | |

| Iskut | |

| 14,174 | | |

| - | | |

| - | | |

| - | | |

| 14,174 | |

| Snowstorm | |

| 4,897 | | |

| - | | |

| - | | |

| - | | |

| 4,897 | |

| 3 Aces | |

| 6,651 | | |

| - | | |

| - | | |

| - | | |

| 6,651 | |

| Total | |

| 69,732 | | |

| 76,865 | | |

| 103,086 | | |

| 781 | | |

| 250,464 | |

| 1) | The

KSM construction in progress additions includes $24.3 million of capitalized borrowing costs (year ended December 31, 2023 - $19.4 million).

The capitalized costs were net of $0.5 million (2023 - $6.9 million) of interest income earned on the residual balance of the borrowed

funds which is reported within the investment in mineral interests, property and equipment line on the consolidated statements of cash

flows. |

Included

in the capitalized exploration expenditures were certain lease payments and project holding costs.

| 7. | Accounts

payable and accrued liabilities |

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| Trade payables | |

| 11,631 | | |

| 27,302 | |

| Non-trade payables and accrued expenses | |

| 6,752 | | |

| 5,432 | |

| | |

| 18,383 | | |

| 32,734 | |

| 8. | Provision

for reclamation liabilities |

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| Beginning of the period | |

| 7,435 | | |

| 10,846 | |

| Disbursements | |

| (499 | ) | |

| (3,664 | ) |

| Accretion | |

| 186 | | |

| 253 | |

| End of the period | |

| 7,122 | | |

| 7,435 | |

| | |

| | | |

| | |

| Provision for reclamation liabilities – current | |

| 3,629 | | |

| 759 | |

| Provision for reclamation liabilities – long-term | |

| 3,493 | | |

| 6,676 | |

| | |

| 7,122 | | |

| 7,435 | |

The

estimate of the provision for reclamation obligations as at September 30, 2024 was calculated using the estimated discounted cash flows

of future reclamation costs of $7.2 million (December 31, 2023 - $7.4 million) and the expected timing of cash flow payments required

to settle the obligations between the current year and 2026. As at September 30, 2024, the undiscounted future cash outflows are estimated

at $7.6 million (December 31, 2023 - $8.1 million). The nominal discount rate used to calculate the present value of the reclamation

obligations was 2.9% at September 30, 2024 (December 31, 2023 - 3.9%). During the nine months ended September 30, 2024, reclamation disbursements

amounted to $0.5 million (2023 - $3.7 million).

As

at September 30, 2024, the Company has placed a total of $22.3 million (December 31, 2023 - $21.4 million) on deposit with financial

institutions or with government regulators that are pledged as security against reclamation liabilities. The deposits are recorded on

the consolidated statements of financial position as reclamation deposits. As at September 30, 2024 and December 31, 2023, the Company

had $10.0 million of uncollateralized surety bonds, issued pursuant to arrangements with an insurance company, in support of environmental

closure costs obligations, related to the KSM Project.

| 9. | Secured

Note Liabilities |

On

February 25, 2022, the Company, through its wholly-owned subsidiary, KSM Mining ULC (“KSMCo”) signed a definitive agreement

to sell a secured note (“2022 Secured Note”) that is to be exchanged at maturity for a silver royalty on its 100% owned KSM

Project (“KSM”) to institutional investors (“Investors”) for US$225 million. The transaction closed on March

24, 2022. The key terms of the 2022 Secured Note include:

| ● | When

the 2022 Secured Note matures, the Investors will use all of the principal amount repaid on maturity to purchase a 60% gross silver royalty

(the “Silver Royalty”). Maturity occurs upon the first to occur of: |

| a) | Commercial

production being achieved at KSM; and |

| b) | Either

on March 24, 2032, the 10-year anniversary, or if the Environmental Assessment Certificate (“EAC”) expires and the Investors

do not exercise their right to put the 2022 Secured Note to the Company, on March 24, 2035, the 13-year anniversary of the issue date

of the 2022 Secured Note. |

| ● | Prior

to its maturity, the 2022 Secured Note bears interest at 6.5% per annum, payable quarterly in arrears. The Company can elect to satisfy

interest payments in cash or by delivering common shares. |

| ● | The

Company has the option to buyback 50% of the Silver Royalty, once exchanged, on or before 3 years after commercial production has been

achieved, for an amount that provides the Investors a minimum guaranteed annualized return. |

| ● | If

project financing to develop, construct and place KSM into commercial production is not in place by March 24, 2027, the Investors can

put the 2022 Secured Note back to the Company for US$232.5 million, with the Company able to satisfy such amount in cash or by delivering

common shares at its option. This right expires once such project financing is in place. If the Investors exercise this put right, the

Investors’ right to purchase the Silver Royalty terminates. |

| ● | If

KSM’s EAC expires at anytime while the 2022 Secured Note is outstanding, the Investors can put the 2022 Secured Note back to the

Company for US$247.5 million at any time over the following nine months, with the Company able to satisfy such amount in cash or by delivering

common shares at its option. If the Investors exercise this put right, the Investors’ right to purchase the Silver Royalty terminates. |

| ● | If

commercial production is not achieved at KSM prior to March 24, 2032, the Silver Royalty payable to the Investors will increase to a

75% gross silver royalty (if the EAC expires during the term of the 2022 Secured Note and the corresponding put right is not exercised

by the Investors, this uplift will occur at the thirteenth anniversary from closing). |

| ● | No

amount payable shall be paid in common shares if, after the payment, any of the Investors would own more than 9.9% of the Company’s

outstanding shares. |

| ● | The

Company’s obligations under the 2022 Secured Note are secured by a charge over all of the assets of KSMCo and a limited recourse

guarantee from the Company secured by a pledge of the shares of KSMCo. |

On

July 26, 2024, KSM received the “Substantially Started” designation from the BC government. This designation affirms the

validity of the EAC for the life of the KSM Project.

To

satisfy the interest payment on the 2022 Secured Note, during 2024, the Company issued 776,519 common shares in respect of the interest

incurred during nine months ended September 30, 2024 (year ended December 31, 2023 - 1,285,178 common shares).

A

number of the above noted options within the agreement represent embedded derivatives. Management has elected to not separate these embedded

derivatives from the underlying host secured note, and instead account for the entire secured note as a financial liability at fair value

through profit or loss.

The

2022 Secured Note was recognized at its estimated fair value at initial recognition of $282.3 million (US$225 million) using a discounted

cash flow model with a Monte Carlo simulation. This incorporated several scenarios and probabilities of the EAC expiring, achieving commercial

production and securing project financing, silver prices forecast from quoted forward price, and the discount rates. During the nine

months ended September 30, 2024, the fair value of the 2022 Secured Note decreased, and the Company recorded a $28.5 million gain (year

ended December 31, 2023 - $30.8 million loss) on the remeasurement.

During

the second quarter of 2024, the Company re-estimated the timelines for achieving key milestones for commercial production. The following

inputs and assumptions were used in the determination of fair value:

| Inputs and assumptions | |

| September 30,

2024 | | |

| December 31,

2023 | |

| Forecast silver production in thousands of ounces | |

| 166,144 | | |

| 166,144 | |

| Long term silver price as at September 30, 2031 | |

US$ | 37.05 | | |

US$ | 28.62 | |

| Risk-free rate | |

| 4.1 | % | |

| 4.0 | % |

| Credit spread | |

| 3.7 | % | |

| 4.0 | % |

| Share price volatility | |

| 60 | % | |

| 60 | % |

| Silver royalty discount factor | |

| 10.8 | % | |

| 9.2 | % |

The

carrying amount for the 2022 Secured Note is as follows:

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| Fair value beginning of the period | |

| 294,363 | | |

| 263,541 | |

| Change in fair value loss (gain) through profit and loss | |

| (12,972 | ) | |

| 3,096 | |

| Change in fair value loss (gain) through other comprehensive income (loss) | |

| (22,222 | ) | |

| 34,830 | |

| Foreign currency translation loss (gain) | |

| 6,742 | | |

| (7,104 | ) |

| Total change in fair value | |

| (28,452 | ) | |

| 30,822 | |

| | |

| | | |

| | |

| Fair value end of the period | |

| 265,911 | | |

| 294,363 | |

Sensitivity

Analysis:

For

the fair value of the 2022 Secured Note, reasonably possible changes at the reporting date to one of the significant inputs, holding

other inputs constant, would have the following effects:

| Key Inputs | |

Inter-relationship between significant inputs and fair value measurement | |

Increase (decrease) (millions) | |

| Key observable inputs | |

The estimated fair value would increase (decrease) if: | |

| |

| ● Silver price forward curve | |

● Future silver prices were 10% higher | |

$ | 13.9 | |

| | |

● Future silver prices were 10% lower | |

$ | (14.1 | ) |

| | |

| |

| | |

| ● Discount rates | |

● Discount rates were 1% higher | |

$ | (25.0 | ) |

| | |

● Discount rates were 1% lower | |

$ | 29.5 | |

| Key unobservable inputs | |

| |

| | |

| ● Forecasted silver production | |

● Silver production indicated silver ounces were 10% higher | |

$ | 13.9 | |

| | |

● Silver production indicated silver ounces were 10% lower | |

$ | (14.1 | ) |

On

May 11, 2023, the Company announced that it, through its wholly-owned subsidiary, KSM Mining ULC (“KSMCo”), had agreed to

the principal terms of a royalty agreement under which Sprott Resource Streaming and Royalty Corp. (“Sprott”) would pay KSMCo

US$150 million and KSMCo would grant Sprott up to 1.2% net smelter royalty (“NSR”) on the KSM Project. Thereafter, the Company

and Sprott agreed to restructure the proposed transaction as the sale of a secured note and, on June 28, 2023, the Company and KSMCo,

signed a definitive agreement to sell a secured note (“2023 Secured Note”) that is to be exchanged at maturity for a net

smelter returns royalty (the “NSR”) on its 100% owned KSM Project (“KSM”) to Sprott for US$150 million. The transaction

closed on June 29, 2023. The key terms of the 2023 Secured Note include:

| ● | When

the 2023 Secured Note matures, Sprott will use all of the principal amount repaid on maturity

to purchase a 1% NSR, subject to adjustment of the amount as described below. Maturity occurs

upon the first to occur of: |

| a) | Commercial

production being achieved at KSM; and |

| b) | Either

on March 24, 2032 or, if the Environmental Assessment Certificate (“EAC”) expires and the Investors do not exercise their

right to put the 2023 Secured Note to the Company, on March 24, 2035. |

| ● | Prior

to its maturity, the 2023 Secured Note bears interest at 6.5% per annum, payable quarterly

in arrears. However, payment of quarterly interest due on or before June 29, 2025 (the “Deferred

Interest”) will be deferred and the Deferred Interest plus interest accrued on it (the

“Interest Deferral Amount”) is payable in a lump sum on or before December 29,

2025. |

| ● | KSMCo

can pay the Interest Deferral Amount (US$21.5M) in cash or Seabridge common shares or KSMCo

can elect to increase the size of the NSR to be sold to Sprott on the Maturity Date from

a 1% NSR to a 1.2% NSR (the “Royalty Increase Election”). |

| ● | The

Company can elect to satisfy quarterly interest payments, including the Deferral Amount due,

by paying in cash or Seabridge common shares. The requirement to make quarterly interest

payments expires on the maturity date. |

| ● | No

amount payable shall be paid in common shares if, after the payment, Sprott would own more

than 9.9% of the Company’s outstanding shares. |

| ● | If

commercial production is not achieved at the KSM Project prior to March 24, 2032, the size

of the NSR to be sold to Sprott on the Maturity Date will increase to 1.25% if KSMCo paid

the Interest Deferral Amount in cash or shares, or to 1.5% if KSMCo made the Royalty Increase

Election (the applicable increase being the “Production Delay Increase”). |

| ● | The

Company has the option to purchase the NSR amount down (after the NSR is sold to Sprott)

to a 0.5% NSR (or to 0.625% if the Production Delay Increase occurred) on or before three

years after commercial production has been achieved, for an amount that provides Sprott a

minimum guaranteed annualized return. |

| ● | If

project financing to develop, construct and place KSM into commercial production is not in

place by March 24, 2027, Sprott can put the 2023 Secured Note back to the Company for: |

| a) | if

the Company is obligated to sell Sprott a 1% NSR on the Maturity Date at the time, US$155 million plus accrued and unpaid interest, or |

| b) | if

the Company is obligated to sell Sprott a 1.2% or 1.5% NSR on the Maturity Date at the time, US$180 million plus accrued and unpaid interest. |

This

Sprott put right expires once such project financing is in place. If Sprott exercises this put right, Sprott’s right to purchase

the NSR terminates.

| ● | If

KSM’s EAC expires at anytime while the 2023 Secured Note is outstanding, Sprott can

put the 2023 Secured Note back to the Company at any time over the following nine months

for: |

| a) | if

the Company is obligated to sell Sprott a 1% NSR on the Maturity Date at the time, US$165

million plus accrued and unpaid interest, or |

| b) | if

the Company is obligated to sell Sprott a 1.2% NSR on the Maturity Date at the time, US$186.5

million plus accrued and unpaid interest. |

If

Sprott exercises this put right, Sprott’s right to purchase the NSR terminates.

| ● | The

Company can elect to satisfy payments due on Sprott’s exercise of either of its put

rights in cash or by delivering common shares. |

| ● | No

amount payable shall be paid in common shares if, after the payment, Sprott would own more

than 9.9% of the Company’s outstanding shares. |

| ● | The

Company’s obligations under the 2023 Secured Note are secured by a charge over all

of the assets of KSMCo and a limited recourse guarantee from the Company secured by a pledge

of the shares of KSMCo. |

On

July 26, 2024, KSM received the Substantially Started designation from the BC government. This designation affirms the validity of the

EAC for the life of the KSM Project.

A

number of the above noted options within the agreement represent embedded derivatives. Management has elected to not separate these embedded

derivatives from the underlying host secured note, and instead account for the entire secured note as a financial liability at fair value

through profit or loss.

The 2023 Secured Note was recognized at its estimated fair value at initial recognition of $198.8 million (US$150 million) using a discounted

cash flow model with a Monte Carlo simulation. This incorporated several scenarios and probabilities of the EAC expiring, achieving commercial production and securing project financing, metal prices forecast and discount rates. During the nine months ended September 30, 2024,

the fair value of the 2023 Secured Note decreased, and the Company recorded a $38.5 million gain (year ended December 31, 2023 - $80.7

million loss) on the remeasurement.

During

the second quarter of 2024, the Company re-estimated the timelines for achieving key milestones for commercial production. The following

inputs and assumptions were used in the determination of fair value:

| Inputs and assumptions | |

September 30,

2024 | | |

December

31,

2023 | |

| Forecast NSR: | |

| | |

| |

| Gold in thousands of ounces | |

| 10,500 | | |

| 10,500 | |

| Silver in thousands of ounces | |

| 29,876 | | |

| 29,876 | |

| Copper in millions of pounds | |

| 19,322 | | |

| 19,322 | |

| Molybdenum in millions of pounds | |

| 152 | | |

| 152 | |

| Long term metal price as at September 30, 2031 | |

| | | |

| | |

| Gold per ounce | |

US$ | 3,078.09 | | |

US$ | 2,553.60 | |

| Silver per ounce | |

US$ | 37.06 | | |

US$ | 28.62 | |

| Copper per pound | |

US$ | 4.71 | | |

US$ | 4.08 | |

| Molybdenum per pound | |

US$ | 27.63 | | |

US$ | 24.89 | |

| Risk-free rate | |

| 4.1 | % | |

| 4.0 | % |

| Credit spread | |

| 3.7 | % | |

| 4.0 | % |

| Share price volatility | |

| 60 | % | |

| 60 | % |

| NSR discount factor | |

| 10.8 | % | |

| 9.2 | % |

The

carrying amount for the 2023 Secured Note is as follows:

| ($000s) | |

| September 30,

2024 | | |

| December 31,

2023 | |

| Fair value beginning of the period | |

| 279,525 | | |

| 198,825 | |

| Change in fair value loss (gain) through profit and loss | |

| (17,801 | ) | |

| 33,182 | |

| Change in fair value loss (gain) through other comprehensive income (loss) | |

| (27,378 | ) | |

| 49,563 | |

| Foreign currency translation loss (gain) | |

| 6,633 | | |

| (2,045 | ) |

| Total change in fair value | |

| (38,546 | ) | |

| 80,700 | |

| | |

| | | |

| | |

| Fair value end of the period | |

| 240,979 | | |

| 279,525 | |

Sensitivity

Analysis:

For

the fair value of the 2023 Secured Note, reasonably possible changes at the reporting date to one of the significant inputs, holding

other inputs constant, would have the following effects:

| Key Inputs | |

Inter-relationship between significant inputs and fair value measurement | |

Increase (decrease) (millions) | |

| Key observable inputs | |

The estimated fair value would increase (decrease) if: | |

| |

| ● Metals price forward curve | |

● Future metal prices were 10% higher | |

$ | 16.1 | |

| | |

● Future metal prices were 10% lower | |

$ | (16.4 | ) |

| | |

| |

| | |

| ● Discount rates | |

● Discount rates were 1% higher | |

$ | (30.2 | ) |

| | |

● Discount rates were 1% lower | |

$ | 36.5 | |

| Key unobservable inputs | |

| |

| | |

| ● Forecasted metal production | |

● Metal production indicated volumes were 10% higher | |

$ | 15.6 | |

| | |

● Metal production indicated volumes were 10% lower | |

$ | (15.8 | ) |

The

Company is authorized to issue an unlimited number of preferred shares and common shares with no par value. No preferred shares have

been issued or were outstanding at September 30, 2024 or December 31, 2023.

The

Company manages its capital structure and makes adjustments to it, based on the funds available to the Company, in order to support the

acquisition, exploration and development of mineral properties. The Board of Directors does not establish quantitative return on capital

criteria for management, but rather relies on the expertise of the Company’s management to sustain future development of the business.

The

properties in which the Company currently has an interest are in the pre-operating stage, as such the Company is dependent on external

financing to fund its activities. In order to carry out the planned exploration and pay for administrative costs, the Company will spend

its existing working capital and raise additional amounts as needed.

Management

reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company,

is reasonable. There were no changes in the Company’s approach to capital management during 2024. The Company considers its capital to

be share capital, stock-based compensation, contributed surplus and deficit. The Company is not subject to externally imposed capital

requirements.

During

the first quarter of 2021, the Company entered into an agreement with two securities dealers, for an At-The-Market (“ATM”)

offering program, entitling the Company, at its discretion, and from time to time, to sell up to US$75 million in value of common shares

of the Company. This program was in effect until the Company’s US$775 million Shelf Registration Statement, that expired in December

2022, was replaced with a new US$750 million Shelf Registration Statement the same month. During the first quarter of 2023, a US$100

million prospectus supplement was filed and the program was renewed. In the first quarter of 2023, the Company entered into a new agreement

with two securities dealers, for an ATM offering program, entitling the Company, at its discretion, and from time to time, to sell up

to US$100 million in value of common shares of the Company. This program can be in effect until the Company’s US$750 million Shelf

Registration Statement expires in 2025.

In

2023, the Company issued 2,516,839 shares, at an average selling price of $17.36 per share, for net proceeds of $42.8 million under the

Company’s At-The-Market offering. During nine months ended September 30, 2024, the Company issued 2,750,609 shares, at an average

selling price of $20.57 per share, for net proceeds of $55.4 million under the Company’s At-The-Market offering. As at September

30, 2024, US$26.0 million was available under the ATM. Subsequent to the quarter end, the Company issued

583,940 shares, at an average selling price of $24.87 per share, for net proceeds of $14.2 million under the Company’s At-The-Market

offering.

On

June 5, 2024, the Company issued a total of 575,000 flow-through common shares at an average $31.26 per common share for aggregate gross

proceeds of $18.0 million. The Company committed to renounce its ability to deduct qualifying exploration expenditures for the equivalent

value of the gross proceeds of the flow-through financing and transfer the deductibility to the purchasers of the flow-through shares.

The effective date of the renouncement was December 31, 2024. At the time of issuance of the flow-through shares, $6.4 million premium

was recognized as a liability on the interim condensed consolidated statements of financial position. During the current quarter, the

Company incurred $1.8 million of qualifying exploration expenditures and $0.7 million of the premium was recognized through other income

on the consolidated statements of operations and comprehensive income (loss).

Subsequent

to the quarter end on October 22, 2024, the Company issued a total of 80,500 flow-through common shares at an average $31.08 per common

share for aggregate gross proceeds of $2.5 million. The Company committed to renounce its ability to deduct qualifying exploration expenditures

for the equivalent value of the gross proceeds of the flow-through financing and transfer the deductibility to the purchasers of the

flow-through shares. The effective date of the renouncement was December 31, 2024. At the time of issuance of the flow-through shares,

$0.2 million premium was recognized as a liability on the interim condensed consolidated statements of financial position.

In

December 2023, the Company issued a total of 875,150 flow-through common shares at an average $22.34 per common share for aggregate gross

proceeds of $19.6 million. The Company committed to renounce its ability to deduct qualifying exploration expenditures for the equivalent

value of the gross proceeds of the flow-through financing and transfer the deductibility to the purchasers of the flow-through shares.

The effective date of the renouncement was December 31, 2023. At the time of issuance of the flow-through shares, $5.5 million premium

was recognized as a liability on the consolidated statements of financial position. During the nine months ended September 30, 2024,

the Company incurred $19.6 million of qualifying exploration expenditures and the $5.5 million of the premium was recognized through

other income on the consolidated statements of operations and comprehensive income (loss).

In

December 2022, the Company issued a total of 675,400 flow-through common shares at an average $22.24 per common share for aggregate gross

proceeds of $15.0 million. The Company committed to renounce its ability to deduct qualifying exploration expenditures for the equivalent

value of the gross proceeds of the flow-through financing and transfer the deductibility to the purchasers of the flow-through shares.

The effective date of the renouncement was December 31, 2022. At the time of issuance of the flow-through shares, $4.2 million premium

was recognized as a liability on the consolidated statements of financial position. During the year ended December 31, 2023, the Company

incurred $15.0 million of qualifying exploration expenditures and the $4.2 million premium was recognized through other income on the

consolidated statements of operations and comprehensive income (loss).

| b) | Stock

options and restricted share units |

The

Company provides compensation to directors and employees in the form of stock options and RSUs. Pursuant to the Share Option Plan, the

Board of Directors has the authority to grant options, and to establish the exercise price and life of the option at the time each option

is granted, at a price not less than the closing price of the common shares on the Toronto Stock Exchange on the date of the grant of

such option and for a period not exceeding five years. All exercised options are settled in equity. Pursuant to the Company’s RSU

Plan, the Board of Directors has the authority to grant RSUs, and to establish terms of the RSUs including the vesting criteria and the

life of the RSUs.

Stock

option and RSU transactions were as follows:

| | |

Options | | |

RSUs | | |

Total | |

| | |

Number of Options | | |

Weighted Average Exercise Price ($) | | |

Amortized Value of options ($000s) | | |

Number of RSUs | | |

Amortized Value of RSUs ($000s) | | |

Stock-based Compensation ($000s) | |

| Outstanding January 1, 2024 | |

| 50,000 | | |

| 17.72 | | |

| 416 | | |

| 697,726 | | |

| 2,984 | | |

| 3,400 | |

| Exercised option or vested RSU | |

| (50,000 | ) | |

| 17.72 | | |

| (416 | ) | |

| (126,133 | ) | |

| (2,060 | ) | |

| (2,476 | ) |

| Amortized value of stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,880 | | |

| 2,880 | |

| Outstanding at September 30, 2024 | |

| - | | |

| - | | |

| - | | |

| 571,593 | | |

| 3,804 | | |

| 3,804 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercisable at September 30, 2024 | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Options | | |

RSUs | | |

Total | |

| | |

Number of Options | | |

Weighted Average Exercise Price ($) | | |

Amortized Value of options ($000s) | | |

Number of RSUs | | |

Amortized Value of RSUs ($000s) | | |

Stock-based Compensation ($000s) | |

| Outstanding at January 1, 2023 | |

| 477,500 | | |

| 15.85 | | |

| 4,117 | | |

| 345,266 | | |

| 538 | | |

| 4,655 | |

| Granted | |

| - | | |

| - | | |

| - | | |

| 399,300 | | |

| 144 | | |

| 144 | |

| Exercised option or vested RSU | |

| (50,000 | ) | |

| 15.46 | | |

| (460 | ) | |

| (41,840 | ) | |

| (823 | ) | |

| (1,283 | ) |

| Options surrendered for cash | |

| (273,500 | ) | |

| 15.46 | | |

| (2,355 | ) | |

| - | | |

| - | | |

| (2,355 | ) |

| Expired | |

| (104,000 | ) | |

| 16.17 | | |

| (886 | ) | |

| (5,000 | ) | |

| (33 | ) | |

| (919 | ) |

| Amortized value of stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,158 | | |

| 3,158 | |

| Outstanding at December 31, 2023 | |

| 50,000 | | |

| 17.72 | | |

| 416 | | |

| 697,726 | | |

| 2,984 | | |

| 3,400 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercisable at December 31, 2023 | |

| 50,000 | | |

| | | |

| | | |

| | | |

| | | |

| | |

In

December 2023, 273,500 options, with exercise price of $15.46 per option, were surrendered for cash at the weighted average rate of $0.18

cash payment per option. During the second quarter of 2024, the remaining 50,000 outstanding share options with an exercise price of

$17.72 were exercised and were exchanged for common shares of the Company.

In

December 2023, 379,300 RSUs were granted to the Board members, members of senior management, and to other employees of the Company. Of

those, 277,500 was granted to senior management, with vesting dependent on certain corporate objectives including the completion of a

bankable feasibility study at KSM, and the Company’s share price outperforming certain market benchmarks. The fair value of RSUs

granted with vesting dependent on market conditions was valued using a Monte-Carlo simulation. The fair value of total RSU grants, of

$4.6 million, was estimated as at the grant date to be amortized over the expected service period of the grants. The expected service

period ranges from one year to three years from the date of the grant and is dependent on the corporate objectives being met.

In

December 2022, 310,266 RSUs were granted to the Board members, members of senior management, and to other employees of the Company. Of

those, 232,266 was granted to senior management, with vesting dependent on certain corporate objectives including the Company submitting

its formal application to the regulator for the KSM Project to be designated as Substantially Started, notification from the regulator

that the KSM Project has been designated as Substantially Started, and announcement of KSM joint venture agreement, or other transformative

transaction affecting the ownership and control of KSM. The fair value of the total RSU grants, of $5.1 million, was estimated as at

the grant date to be amortized over the expected service period of the grants. The expected service period ranges from nine months to

three years from the date of the grant and is dependent on the corporate objectives being met. During first quarter of 2024, upon the

Company submitting its formal application to regulators for the KSM Project to be designated as Substantially Started, 58,066 RSUs vested

and were exchanged for common shares of the Company. During the current quarter, and upon the Company receiving the Substantially Started

designation for the KSM Project, further 58,067 RSUs vested and were exchanged for common shares of the Company.

| c) | Basic

and diluted net income (loss) per common share |

Basic

and diluted net income (loss) attributable to common shareholders of the Company for the three and nine months ended September 30, 2024

was $27.6 million net loss and $9.5 million net income, respectively (three and nine months ended September 30, 2023 - $5.3 million and

$7.1 million net loss, respectively).

Earnings

(loss) per share has been calculated using the weighted average number of common shares and common share equivalents issued and outstanding

during the period. Stock options are reflected in diluted earnings per share by application of the treasury method. The following table

details the weighted average number of outstanding common shares for the purpose of computing basic and diluted earnings (loss) per common

share for the following periods:

| |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| (Number of common shares) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Basic weighted average shares outstanding | |

| 89,588,695 | | |

| 83,484,693 | | |

| 87,983,955 | | |

| 82,499,543 | |

| Weighted average shares dilution adjustments: | |

| | | |

| | | |

| | | |

| | |

| Stock options 1 | |

| - | | |

| - | | |

| - | | |

| - | |

| RSUs | |

| - | | |

| - | | |

| 532,455 | | |

| - | |

| Diluted weighted average shares outstanding | |

| 89,588,695 | | |

| 83,484,693 | | |

| 88,516,410 | | |

| 82,499,543 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares dilution exclusions: 2 | |

| | | |

| | | |

| | | |

| | |

| Stock options 1 | |

| - | | |

| 1,574 | | |

| - | | |

| 31,220 | |

| RSUs | |

| 537,133 | | |

| 142,679 | | |

| - | | |

| 154,675 | |

| 1) | Dilutive

stock options were determined using the Company’s average share price for the period. For the three and nine months ended September

30, 2023, the average share price used was $15.9 and $16.96, respectively. |

| 2) | Excluded

in the diluted weighted average number of common shares outstanding as their exercise or settlement would be anti-dilutive in the loss

per share calculation. |

Adjustment

for other non-cash items within operating activities:

| | |

| |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| ($000s) | |

Notes | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Equity loss of associate | |

4 | |

| 250 | | |

| 45 | | |

| 275 | | |

| 165 | |

| Unrealized gain on convertible notes receivable | |

| |

| - | | |

| - | | |

| - | | |

| 37 | |

| Accrued interest income on convertible notes receivable | |

| |

| - | | |

| (21 | ) | |

| - | | |

| (41 | ) |

| Depreciation | |

6 | |

| 34 | | |

| 34 | | |

| 102 | | |

| 99 | |

| Finance costs, net | |

| |

| 63 | | |

| 65 | | |

| 186 | | |

| 188 | |

| Effects of exchange rate fluctuation on cash and cash equivalents | |

| |

| 409 | | |

| (684 | ) | |

| (195 | ) | |

| (454 | ) |

| | |

| |

| 756 | | |

| (561 | ) | |

| 368 | | |

| (6 | ) |

| 12. | Fair

value of financial assets and liabilities |

Fair

value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. The fair value hierarchy establishes three levels to classify the inputs to valuation techniques used to measure

fair value.

Level

1: Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level

2: Inputs are quoted prices in markets that are not active, quoted prices for similar assets or liabilities in active markets, inputs

other than quoted prices that are observable for the asset or liability (for example, interest rate and yield curves observable at commonly

quoted intervals, forward pricing curves used to value currency and commodity contracts, volatility measurements used to value option

contracts and observable credit default swap spreads to adjust for credit risk where appropriate), or inputs that are derived principally

from or corroborated by observable market data or other means.

Level

3: Inputs are unobservable (supported by little or no market activity).

The

fair value hierarchy gives the highest priority to Level 1 inputs and the lowest priority to Level 3 inputs.

The

Company’s fair values of financial assets and liabilities were as follows:

| | |

September 30, 2024 | |

| ($000s) | |

Carrying Amount | | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total

Fair Value | |

| Assets | |

| | |

| | |

| | |

| |

| Investment in marketable securities | |

| 5,069 | | |

| 5,069 | | |

| - | | |

| - | | |

| 5,069 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | |

| Secured note liabilities | |

| 506,891 | | |

| - | | |

| - | | |

| 506,891 | | |

| 506,891 | |

| | |

December 31, 2023 | |

| ($000s) | |

Carrying Amount | | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total

Fair Value | |

| Assets | |

| | |

| | |

| | |

| |

| Investment in marketable securities | |

| 3,750 | | |

| 3,750 | | |

| - | | |

| - | | |

| 3,750 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | |

| Secured note liabilities | |

| 573,888 | | |

| - | | |

| - | | |

| 573,888 | | |

| 573,888 | |

The

carrying value of cash and cash equivalents, amounts receivable, long-term receivables and accounts payable and accrued liabilities approximate

their fair values due to their short-term maturities.

The

Company’s financial risk exposures and the impact on the Company’s financial instruments are summarized below:

Credit

Risk

The

Company’s credit risk is primarily attributable to receivables included in amounts receivable and prepaid expenses. The Company has no