|

|

|

|

|

FY2022 |

FY2021 |

FY2020 |

Independent Auditor |

PwC Samil Accounting Corp. |

PwC Samil Accounting Corp. |

PwC Samil Accounting Corp. |

Audit Opinion |

Unqualified |

Unqualified |

Unqualified |

|

Compensation to the Independent Auditor for Audit and Review Services

The following is a description of the fees for audit and review services performed by our independent auditor for the last three years in connection with our financial statements preparation.

|

|

|

|

|

Year |

Auditor |

Payment 1)

(KRW mil.) |

Details |

Working hours |

FY2022 |

PwC Samil Accounting Corp. |

987 (annualized basis) |

Review/Audit of Financial Statements |

9,235 Hours |

PwC Samil Accounting Corp. |

130 (annualized basis) |

K-IFRS Report Package Audit for Shinhan Savings Bank |

1,004 Hours |

FY2021 |

PwC Samil Accounting Corp. |

958 (annualized basis) |

Review/Audit of Financial Statements |

9,283 Hours |

PwC Samil Accounting Corp. |

126 (annualized basis) |

K-IFRS Report Package Audit for Shinhan Savings Bank |

1,078.5 Hours |

PwC Samil Accounting Corp. |

73 (annualized basis) |

Review Consolidation of Asia Trust |

610.5 Hours |

FY2020 |

PwC Samil Accounting Corp. |

976 (annualized basis) |

Review/Audit of Financial Statements |

8,809 Hours |

PwC Samil Accounting Corp. |

120 (annualized basis) |

K-IFRS Report Package Audit for Shinhan Savings Bank |

1,195.5 Hours |

1) Excluding value-added taxes. * In addition to above mentioned description of fees for audit and review services, PwC Samil Accounting Corp. also provided services related to US listing and ICOFR audit in accordance with the standards of the PCAOB which we agreed to pay KRW 2,179 million(excluding value-added taxes) for FY2022. |

5. Corporate Governance

Board of Directors and committees of the Board of Directors

Our board of directors, which currently consists of one executive director, one non-executive director and 12 independent directors, has the ultimate responsibility for the management of our affairs.

Our Articles of Incorporation provide for no less than three but no more than 15 directors, the number of independent directors must be more than 50% of the total number of directors, and we must maintain at least three independent directors. All directors are elected for a term not exceeding three years as determined by the shareholders’ meeting, except that independent directors are elected for a term not exceeding two years, provided that the term of re-election shall not exceed one year and the term cannot be extended in excess of six years. The aggregate term served as an independent director of us or any of our subsidiaries shall not exceed nine years.

Terms are renewable and are subject to the Korean Commercial Code, the Financial Holding Companies Act, the Act on Corporate Governance of Financial Companies and related regulations. See “Item 6.A. Directors and Senior Management” above for information concerning the terms of office of our directors and executive officers.

Our board of directors meets on a regular basis to discuss and resolve material corporate matters. Additional extraordinary meetings may also be convened at the request of the chairman and chief executive officer or a director designated by the board.

Currently, there are no outstanding service contracts between any of our directors or executive officers and us or any of our subsidiaries providing for benefits upon termination of employment by such director or executive officer.

• Committees of the Board of Directors

We currently have seven management committees that serve under the board:

-the Risk Management Committee;

-the Remuneration Committee;

-the Committee for Recommending Candidates for Independent Directors and Members of Audit Committee;

-the Committee for Recommending Candidates for CEO;

-the Environment, Social and Governance (ESG) Strategy Committee; and

-the Committee for Managing Subsidiary’s Business.

Each committee member is appointed by the board of directors, except for members of the Audit Committee, who are elected at the general meeting of shareholders.

• Risk Management Committee

The Risk Management Committee currently consists of four independent directors, namely Huh-Yong-hak (Chair), Byeon Yang-ho, Lee Yong Guk and Choi Jae Boong. The committee oversees and makes determinations on all issues relating to our comprehensive risk management function. In order to ensure our stable financial condition and to maximize our profits, the committee monitors our overall risk exposure and reviews our compliance with risk policies and risk limits. In addition, the committee reviews risk and control strategies and policies, evaluates whether each risk is at an adequate level, establishes or abolishes risk management divisions, reviews risk-based capital allocations, and reviews the plans and evaluation of internal control. The committee holds regular meetings every quarter.

• Audit Committee

The Audit Committee currently consists of four independent directors, namely Yoon Jaewon (Chair), Kwak Su Keun, Bae Hoon and Sung Jae-ho. The committee oversees our financial reporting and approves the appointment of and interaction with our independent auditors and our internal audit-related officers. The committee also reviews our financial information, audit examinations, key financial statement issues and the administration of our financial affairs by the board of directors. In connection with the general meetings of stockholders, the committee examines the agenda for, and financial statements and other reports to be submitted by, the board of directors for each general meeting of shareholders. The committee holds regular meetings every quarter.

• Remuneration Committee

The Remuneration Committee currently consists of three independent directors, namely Lee Yong Guk (Chair), Byeon Yang-ho and Bae Hoon. At least one-half of the members of this committee must be independent directors and currently all members of Remuneration Committee are independent directors. This committee is responsible for reviewing and approving the management’s evaluation and compensation programs. The committee meetings are called by the chairman of this committee, who must be an independent director.

• Committee for Recommending Candidates for Independent Directors and Members of Audit Committee

The Committee for recommending candidates for independent directors and members of audit committee currently consists of five independent directors, namely Choi Jae Boong (Chair), Kim Jo Seol, Park Ansoon, Yoon Jaewon, and Huh Yong-hak. Members of this committee will be appointed by our board of directors only to the extent necessary to recommend and nominate candidates for our independent director positions, audit committee members and related matters. However, when the procedure for final recommendation of independent director and audit committee member candidates commences, all independent directors are called to participate in the committee and in this case, all independent directors are deemed as enrolled. The committee meetings are called by the chairman of this committee, who must be an independent director. This committee is responsible and authorized for: (i) establishment, review and reinforcement of policies for independent director and audit committee member selection, (ii) recommendation of independent director and audit committee member candidates for approval at the general shareholders’ meeting and (iii) continual recruitment and screening of potential independent director candidates.

• Committee for Recommending Candidates for CEO

The Committee for recommending candidates for Chief Executive Officer (CEO) was established in March 2012 and currently consists of seven directors, namely Sung Jae-ho (Chair), Jin Hyun-duk, Lee Yoon-jae, Kwak Su Keun, Bae Hoon, Lee Yong Guk and Choi Jae Boong. However, when the meeting for final selection of candidates for Chief Executive Officer, all independent directors are called to participate in the committee and in this case, all independent directors are deemed as enrolled. This committee is responsible for matters concerning the recommendation of candidates for the CEO including establishing and reviewing our management succession plan and its operation, setting and evaluating the qualifications and criteria for the CEO and CEO candidate pool and other matters necessary for improving our overall corporate governance structure. The chair of the committee must be an independent director, and the incumbent CEO may be restricted from participating and voting on matters related to the CEO selection.

• Environmental, Social and Governance (ESG) Strategy Committee

The ESG Strategy Committee was established in March 2015 and currently consists of five directors, namely Kwak Su Keun (Chair), Kim Jo Seol, Byeon Yang-ho, Yoon Jaewon and Cho Yong-byoung. This committee is responsible for setting the corporate policy for sustainable management, corporate disclosure of sustainability report and discussing specific business agenda in relation to socially responsible management and other matters such as corporate strategy toward climate change.

• Committee for Managing Subsidiary’s Business

The Committee for managing subsidiary’s business was established in March 2021 and currently consists of five directors, namely Cho Yong-byoung (Chair), Lee Yoon-jae, Huh-Yong-hak, Sung Jae-ho and Park Ansoon. This committee is responsible for matters concerning the evaluation of subsidiary management leadership, establishment of subsidiary CEO qualifications, verification and recommendation of subsidiary CEO candidates and other matters deemed necessary by the committee.

Note) On January 12, 2023, Byeon Yang-ho, one of independent directors, resigned due to personal reasons.

6. Major Shareholder and Market Price Information of our Common Shares and ADRs

Major Shareholders1) of Shinhan Financial Group as of Dec. 31, 2022

|

|

|

Name |

No. of Common Shares owned |

Ownership%2) |

National Pension Service |

40,476,692 |

7.69% |

BlackRock Fund Advisors3) |

29,063,012 |

5.71% |

Employee Stock Ownership Association4) |

26,121,183 |

5.13% |

1) Shareholders who own beneficial ownership of 5% or more (common share basis). 2) Ownership is based on the total number of common shares issued, 508,784,869 shares. 3) Based on the large equity ownership discloser by BlackRock Fund Advisors with the Financial Supervisory Service on Sep. 27, 2018. 4) The number of stocks owned by Employee Stock Ownership Association is the sum of 26,028,758 shares owned in the Employee Stock Ownership accounts and 92,425 shares in the ESOA account. |

Common Shares Traded on the Korea Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

(KRW, number of shares) |

|

Jul. 2022 |

Aug. 2022 |

Sept. 2022 |

Oct. 2022 |

Nov. 2022 |

Dec. 2022 |

Price per share |

High |

37,900 |

36,600 |

36,950 |

37,050 |

38,100 |

38,500 |

Low |

33,400 |

35,050 |

33,500 |

34,500 |

35,550 |

35,200 |

Avg. |

35,607 |

35,802 |

35,250 |

35,703 |

36,664 |

37,612 |

Trading Volume |

29,319,707 |

24,954,320 |

25,070,098 |

23,982,213 |

24,574,634 |

22,631,657 |

Highest Daily Trading Volume |

2,127,220 |

2,699,201 |

1,746,434 |

1,691,794 |

1,933,239 |

2,489,635 |

Lowest Daily Trading Volume |

818,629 |

603,005 |

644,104 |

808,942 |

481,017 |

538,059 |

American Depositary Receipts traded on the New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

(USD, number of shares) |

|

Jul. 2022 |

Aug. 2022 |

Sept. 2022 |

Oct. 2022 |

Nov. 2022 |

Dec. 2022 |

Price per share |

High |

28.92 |

28.18 |

26.26 |

25.79 |

29.02 |

29.67 |

Low |

25.44 |

26.36 |

23.00 |

23.59 |

24.79 |

27.93 |

Avg. |

27.03 |

27.14 |

25.24 |

24.90 |

27.01 |

28.89 |

Monthly Trading Volume |

3,351,152 |

3,427,721 |

4,632,105 |

4,331,803 |

3,229,569 |

2,129,409 |

Highest Daily Trading Volume |

337,085 |

328,860 |

344,873 |

383,404 |

273,676 |

175,106 |

Lowest Daily Trading Volume |

95,838 |

92,630 |

162,739 |

131,284 |

84,529 |

56,342 |

Note) 1 ADR = 1 Common Shares |

7. Directors, Executive Officers and Employees

Directors and Executive Officers

1) Executive Director

|

|

|

|

|

|

|

(As of Sept. 30, 2022) |

Name |

Month and Year of Birth |

Position |

Service Term |

Cho Yong-byoung |

June 1957 |

- Chairman of Shinhan Financial Group - Chair of Committee for Managing

Subsidiary’s Business - Corporate Social Responsibility

Committee member |

6 years starting from March 23, 2017 |

2) Non-Executive Directors

Non-executive directors are directors who are not our employees and do not hold executive officer positions with us. Independent directors are non-executive directors who also satisfy the requirements set forth under the Financial Investment Services and Capital Markets Act to be independent of our major shareholders, affiliates and management. Our non-executive directors are selected based on the candidates’ talents and skills in diverse areas, such as law, finance, economics, management and accounting. Currently, 13 non-executive directors are in office, all of whom were nominated by our board of directors and approved at a general meeting of shareholders.

Our non-executive and independent directors are as follows:

|

|

|

|

|

Name |

Date of Birth |

Position |

Director Since |

Date Term Ends(1) |

Jin Ok-dong |

Feb. 21, 1961 |

Non-Executive Director |

March 27, 2019 |

March 2023 |

Park Ansoon |

Jan. 24, 1945 |

Independent Director |

March 23, 2017 |

March 2023 |

Bae Hoon |

Jun. 30, 1953 |

Independent Director |

March 25, 2021 |

March 2023 |

Byeon Yang-ho* |

Jul. 30, 1954 |

Independent Director |

March 27, 2019 |

March 2023 |

Sung Jae-ho |

Jun. 18, 1960 |

Independent Director |

March 27, 2019 |

March 2023 |

Lee Yong Guk |

May 11, 1964 |

Independent Director |

March 25, 2021 |

March 2023 |

Lee Yoon-jae |

Nov. 3, 1950 |

Independent Director |

March 27, 2019 |

March 2023 |

Kim Jo Seol |

Dec. 5, 1957 |

Independent Director |

March 24, 2022 |

March 2024 |

Choi Jae Boong |

Feb. 18, 1965 |

Independent Director |

March 25, 2021 |

March 2023 |

Huh Yong-hak |

Sep. 10, 1958 |

Independent Director |

March 27, 2019 |

March 2023 |

Kwak Su Keun |

Aug. 16, 1953 |

Independent Director |

March 25, 2021 |

March 2023 |

Yoon Jaewon |

Aug. 29, 1970 |

Independent Director |

March 26, 2020 |

March 2023 |

Jin Hyun-duk |

Sep. 10, 1955 |

Independent Director |

March 26, 2020 |

March 2023 |

Note: The date on which each term will end will be the date of the general shareholders’ meeting in the relevant year.

*On January 12, 2023, Byeon Yang-ho, one of independent directors, resigned due to personal reasons.

Jin Ok-dong has been our non-executive director since March 27, 2019. Mr. Jin previously served as the chief executive officer of Shinhan Bank from 2018 to 2022, the deputy president of Shinhan Financial Group from 2017 to 2018, the deputy president of Shinhan Bank in 2017 and the chief executive officer of Shinhan Bank Japan from 2015 to 2016. Mr. Jin received a master’s degree in business administration from Chung Ang University.

Park Ansoon has been our independent director since March 23, 2017. Mr. Park currently serves as the chairman of Taisei Group Co., Ltd. and the chairman of the Korean Residents Union in Japan. Mr. Park served as the chief executive officer from 1993 to 2012 and held various executive roles at Taisei Group Co., Ltd. from 1968 to 2018. Mr. Park received a bachelor’s degree in philosophy from Waseda University.

Bae Hoon has been our independent director since March 25, 2021. Mr. Bae is a Korean lawyer and Certified Public Accountant in Japan and currently serves as a representative attorney at Orbis Legal Profession Corporation. Mr. Bae received a master’s degree in business administration from Kobe University.

Sung Jae-ho has been our independent director since March 27, 2019. Mr. Sung is currently a professor at Sung Kyun Kwan University School of Law. Mr. Sung previously served as a policy advisor of the Ministry of Unification in 2009 and the Ministry of Foreign Affairs and Trade in 2002. Mr. Sung also served as an independent director of NICE Holdings from 2018 to 2019 and Shinhan Card from 2015 to 2019, and chairman of Korea Council of International Law. Mr. Sung received a Ph.D. in law from Sung Kyun Kwan University.

Lee Yong Guk has been our independent director since March 25, 2021. Mr. Lee is a clinical professor at Seoul National University, School of Law. Mr. Lee was previously an attorney at Cleary Gottlieb Steen & Hamilton LLP for 27 years. Mr. Lee received a J.D. from Harvard University Law School.

Lee Yoon-jae has been our independent director since March 27, 2019. Mr. Lee served as an independent director for various Korean companies, such as LG, KT&G and S-Oil from 2006 to 2015. In addition, he held the chief executive officer position at KorEI from 2001 to 2010. Mr. Lee received a master’s degree in business administration from Stanford Graduate School of Business.

Kim Jo Seol has been newly appointed as our independent director since March 24, 2022. Ms. Kim is a Korean-Japanese professor who teaches economics at Osaka University of Commerce and economist with a high awareness of Northeast Asian economics. Ms Kim received a Ph.D. in economics from Osaka City University.

Choi Jae Boong has been our independent director since March 25, 2021. Mr. Choi currently serves as a professor of mechanical engineering at Sung Kyun Kwan University, College of Engineering and director of Human-centered Convergence Design BK(Brain Korea)21+ Project, which is a human resource development program initiated by the Government. Mr. Choi received a Ph.D. in mechanical engineering from University of Waterloo.

Huh Yong-hak has been our independent director since March 27, 2019. Mr. Huh currently serves as the chief executive officer of First Bridge Strategy Limited since 2015. Mr. Huh served as the chief investment officer of alternative investment of the Hong Kong Monetary Authority from 2008 to 2014. Mr. Huh received a master’s degree in international affairs from Columbia University.

Kwak Su Keun has been our independent director since March 25, 2021. Mr. Kwak currently serves as an honorary professor of accounting at Seoul National University, Business School and chair of Corporate Governance Advisory Board at Korea Listed Companies Association. Mr. Kwak received a Ph.D in business administration from University of North Carolina Chapel Hill.

Yoon Jaewon has been our independent director since March 26, 2020. Ms. Yoon is currently a professor at Hongik University College of Business Administration and member of the committee for National Tax Service as well as the committee on national accounting policy of the Ministry of Economy and Finance and Korea Custom Service. Ms. Yoon previously served as a non-executive judge at the Tax Tribunal from 2013 to 2019. Ms. Yoon received a Ph.D in accounting from Korea University.

Jin Hyun-duk has been our independent director since March 26, 2020. Mr. Jin currently serves as the chief executive officer of Phoedra Co., Ltd. since 1988 and councilor of the Korea Educational Foundation. Mr. Jin was previously a professor at Sakushin-gakuin University and Utsunomiya University. Mr. Jin received a master’s degree in business administration from Keio Business School.

Any director wishing to enter into a transaction with Shinhan Financial Group or any of its subsidiaries in his or her personal capacity is required to obtain the prior approval of our board of directors. The director having an interest in the transaction may not vote at the meeting of our board of directors at which the relevant transaction is subject to vote for approval.

3) Executive Officers

In addition to the executive directors who are also our executive officers, we currently have the following executive officers.

|

|

|

|

Name |

Date of Birth |

Position |

In Charge of |

Jang Dong-ki |

Jan. 2, 1964 |

Deputy President |

Global Markets & Securities Business Group |

Wang Ho-min |

Jun. 4, 1964 |

Deputy President and Chief Compliance Officer |

Compliance Team |

Lee Een-kyoon |

Apr. 1, 1967 |

Deputy President and Chief Operation Officer |

Shinhan Leadership Center Management Support Team ICT Planning Team |

Ahn Jun Sik |

May 1, 1965 |

Deputy President and Chief Public Relations Officer |

Brand PR Division |

Kim Soung Jo |

Jan. 18, 1967 |

Deputy President |

Group Audit |

Bang Dong-kwon |

Feb. 10, 1966 |

Deputy President and Chief Risk Officer |

Risk Management Team Risk Model Validation Team Credit Review Team |

Lee Taekyung |

May. 30, 1966 |

Deputy President and Chief Financial Officer |

Finance Management Team Investor Relations Team Accounting Division |

Kim Myoung Hee |

Jan. 16, 1968 |

Deputy President and Chief Digital Officer |

Digital Planning Team |

Koh Seogheon |

Sept. 27, 1968 |

Deputy President and Chief Strategy & Sustainability Officer |

Strategic Planning Team ESG Planning Team |

Kim Tae Youn |

Jul. 7, 1968 |

Executive Director |

Global & Business Development Division |

None of the executive officers have any significant activities independent Shinhan Financial Group.

Jang Dong-ki has been our deputy president since January 1, 2018. Mr. Jang previously served as Chief Financial Officer of Shinhan Financial Group, the head of finance management team, managing director and the head of the capital market and trading division of Shinhan Bank. Mr. Jang received a bachelor’s degree in economics from Seoul National University.

Wang Ho-min has been our deputy president and chief compliance officer since January 1, 2019. Mr. Wang previously served as the branch manager of Southern Jam-sil branch, Seoul Southern District Court branch and the head of corporate culture development team. Mr. Wang received a bachelor’s degree in law from Hankuk University of Foreign Studies.

Lee Een-kyoon has been our deputy president and chief operation officer since January 1, 2019. Mr. Lee previously served as the head of management support team and the head of secretary’s office of Shinhan Bank. Mr. Lee received a bachelor’s degree in English literature from Hanyang University.

Ahn Jun Sik has been our deputy president and chief public relations officer since January 1, 2021. Mr. Ahn previously served as the head of Seocho Division at Shinhan Bank. Mr. Ahn received a bachelor’s degree in economics from Pusan National University..

Kim Soung Jo has been our deputy president since January 1, 2021. Mr. Kim previously served as the head of audit team at Shinhan Financial Group. Mr. Kim received a bachelor’s degree in economics from Seoul National University.

Bang Dong-kwon has been our chief risk officer since January 1, 2020. Mr. Bang previously served as the head of risk management department of Shinhan Bank. Mr. Bang received a bachelor’s degree in English language and literature from Sung Kyun Kwan University.

Lee Taekyung has been our deputy president and chief financial officer since January 1, 2022. Mr. Lee previously served as the CEO of Shinhan Bank Vietnam and the CEO of Shinhan Bank Cambodia. Mr. Lee received a bachelor’s degree in economics from Seoul National University.

Kim Myoung Hee has been our deputy president and chief digital officer since January 1, 2022. Before joining Shinhan Financial Group, Ms. Kim was the CEO, Hancom MDS Inc. Ms. Kim received a Ph.D. in Knowledge Consulting from Dankook University and master’s degree in Management Information System from Sogang University.

Koh Seogheon has been our deputy president & chief Strategy & sustainability officer since January 1, 2023. Mr. Koh previously served as the head of business management division and strategic planning team of Shinhan Financial Group. Mr. Koh received a bachelor’s degree in economics from Seoul National University.

Kim TaeYoun has been our executive director since January 1, 2022. Mr. Kim previously served as the managing director of finance management team of Shinhan Financial Group. Mr. Kim received a bachelor’s degree in economics from Yonsei University.

There are no family relationships among our directors and/or executive officers.

Compensation to Directors

1) Total Amount Approved at the Meeting of Shareholders

|

|

|

|

(As of Dec. 31, 2022) |

|

Total number of persons |

Total amount approved at shareholders’ meeting (KRW millions) |

Notes |

Directors (Independent directors) |

14(12) |

3,500 |

- |

Note) Represents the aggregate amount for all directors (including independent directors) excluding long-term incentives. |

2) Total Amount Paid

|

|

|

|

|

(As of Dec. 31, 2022) |

|

Total number of Persons |

Total compensation (KRW million) |

Average compensation per person (KRW million) |

Notes |

Registered Directors |

2 |

851 |

426 |

- |

Independent Directors |

8 |

621 |

78 |

- |

Audit committee members or internal auditor |

4 |

342 |

85 |

- |

Notes : Represents the total number of applicable persons as of Dec. 31, 2022. |

Compensation to Non-registered directors

|

|

|

|

|

(As of Dec. 31, 2022) |

|

Total number of persons |

Total compensation

(KRW million) |

Average Compensation per person (KRW million) |

Notes |

Non-registered directors |

14 |

1,814 |

130 |

- |

Stock Options

None

Employees

|

|

|

|

|

Gender |

Number of Employees |

Average length of Service |

Total Salaries and wages paid in 2020 (KRW million) |

Average Payment per person (KRW million) |

Male |

132 |

3 yrs 3 mths (15 yrs 8 mths) 1) |

26,025 |

178 |

Female |

39 |

3 yrs 6 mths (10 yrs 10mths) 1) |

5,298 |

118 |

Total |

171 |

3 yrs 4 mths (14 yrs 6 mths) 1) |

31,323 |

164 |

1) Average length of service including services within group subsidiaries |

8. Related Party Transactions

Loans to Subsidiaries

|

|

|

|

|

|

|

|

|

|

(KRW billion) |

Loans to Subsidiaries

(in KRW bil.) |

Type |

Origination Date |

Maturity Date |

Lending Rate |

Beginning Balance (Jan. 1, 2022) |

Decrease |

Increase |

Others1) |

Ending Balance (Sept. 30, 2022) |

Shinhan Card |

Loan |

2017-03-22 |

2022-03-22 |

2.22% |

150 |

150 |

- |

- |

- |

Loan |

2017-04-20 |

2022-04-20 |

2.21% |

100 |

100 |

- |

- |

- |

Loan |

2017-05-12 |

2022-05-12 |

2.35% |

50 |

50 |

- |

- |

- |

Loan |

2018-02-22 |

2023-02-22 |

2.90% |

100 |

- |

- |

- |

100 |

Loan |

2019-04-18 |

2024-04-18 |

2.04% |

100 |

- |

- |

- |

100 |

Loan |

2019-04-18 |

2026-04-18 |

2.09% |

100 |

- |

- |

- |

100 |

Loan |

2019-10-22 |

2024-10-22 |

1.76% |

40 |

- |

- |

- |

40 |

Loan |

2019-10-22 |

2026-10-22 |

1.81% |

60 |

- |

- |

- |

60 |

Loan |

2020-09-17 |

2025-09-17 |

1.48% |

200 |

- |

- |

- |

200 |

Loan |

2020-10-29 |

2023-10-29 |

1.24% |

150 |

- |

- |

- |

150 |

Loan |

2020-10-29 |

2025-10-29 |

1.46% |

150 |

- |

- |

- |

150 |

Loan |

2021-02-18 |

2026-02-18 |

1.54% |

150 |

- |

- |

- |

150 |

Loan |

2021-02-24 |

2026-02-24 |

1.62% |

150 |

- |

- |

- |

150 |

Loan |

2021-11-11 |

2024-11-11 |

2.39% |

170 |

- |

- |

- |

170 |

Loan |

2021-11-11 |

2026-11-11 |

2.55% |

10 |

- |

- |

- |

10 |

Loan |

2022-04-20 |

2025-06-20 |

3.71% |

- |

- |

100 |

- |

100 |

Loan |

2022-07-18 |

2025-07-18 |

4.21% |

- |

- |

100 |

- |

100 |

Loan |

2022-07-18 |

2027-07-18 |

4.25% |

- |

- |

100 |

- |

100 |

Loan |

2019-11-19 |

2025-02-04 |

2.79% |

474 |

- |

- |

33 |

507 |

Loan |

2021-05-26 |

2026-05-12 |

1.53% |

36 |

- |

- |

2 |

38 |

Financial assets at FVPL |

2022-03-17 |

2052-03-17 |

4.01% |

- |

- |

400 |

-57 |

343 |

Shinhan Securities |

Loan |

2019-11-19 |

2025-02-04 |

2.79% |

107 |

- |

- |

7 |

114 |

Loan |

2020-08-20 |

2025-08-20 |

2.55% |

589 |

- |

- |

41 |

630 |

Financial assets at FVPL |

2021-06-14 |

- |

2.93% |

317 |

- |

- |

-32 |

285 |

Shinhan Capital |

Loan |

2019-02-01 |

2024-02-01 |

2.23% |

50 |

- |

- |

- |

50 |

Loan |

2019-05-24 |

2024-05-24 |

1.92% |

20 |

- |

- |

- |

20 |

|

|

|

|

|

|

|

|

|

|

|

Loan |

2020-04-10 |

2025-04-10 |

1.75% |

200 |

- |

- |

- |

200 |

Loan |

2020-12-23 |

2025-12-23 |

1.57% |

160 |

- |

- |

- |

160 |

Loan |

2021-03-16 |

2026-03-16 |

1.83% |

150 |

- |

- |

- |

150 |

Loan |

2021-05-13 |

2026-05-12 |

1.53% |

237 |

- |

- |

16 |

253 |

Financial assets at FVPL |

2020-04-22 |

2050-04-22 |

3.56% |

99 |

- |

- |

-9 |

90 |

Financial assets at FVPL |

2021-07-28 |

2051-07-28 |

3.38% |

148 |

- |

- |

-20 |

128 |

Shinhan Asset Management |

Loan |

2020-03-16 |

2023-03-16 |

1.42% |

38 |

- |

- |

- |

38 |

Shinhan Savings Bank |

Loan |

2017-06-23 |

2022-06-23 |

2.27% |

50 |

50 |

- |

- |

- |

Loan |

2020-05-28 |

2025-05-28 |

1.52% |

50 |

- |

- |

- |

50 |

Loan |

2021-04-26 |

2026-04-26 |

1.85% |

50 |

- |

- |

- |

50 |

Loan |

2021-05-28 |

2026-05-28 |

1.99% |

50 |

- |

- |

- |

50 |

Shinhan DS |

Loan |

2019-02-01 |

2022-02-01 |

2.15% |

24 |

24 |

- |

- |

- |

Loan |

2022-02-03 |

2023-02-02 |

2.30% |

- |

- |

20 |

- |

20 |

Shinhan Venture |

Loan |

2021-11-03 |

2022-01-28 |

1.94% |

16 |

16 |

- |

- |

- |

Loan |

2022-01-28 |

2022-04-28 |

2.04% |

- |

20 |

20 |

- |

- |

Loan |

2022-04-28 |

2022-07-28 |

2.01% |

- |

20 |

20 |

- |

- |

Loan |

2022-05-13 |

2022-07-28 |

2.10% |

- |

20 |

20 |

- |

- |

Loan |

2022-07-28 |

2022-10-27 |

3.38% |

- |

40 |

40 |

- |

- |

|

Loan |

2022-10-27 |

2022-12-27 |

5.28% |

- |

40 |

40 |

- |

- |

|

Loan |

2022-12-27 |

2023-03-27 |

4.38% |

- |

- |

40 |

- |

40 |

Total |

4,545 |

568 |

900 |

-19 |

4,858 |

9. Material Information after the reporting period

Announcement on Acquisition and Cancellation of Shares

In accordance with the resolution of the Board of Directors on February 8, 2023, the Group resolved to acquire and cancel the treasury shares within the profits available for dividends.

Number of Shares to be Acquired and Cancelled: 3,676,470 common shares

Estimated Acquisition and Cancellation Amount: KRW 150,000,000,000

Scheduled Acquisition Period: February 9, 2023 ~ May 8, 2023

Note) “Estimated Amount to be Cancelled” are calculated using the closing share price of common shares of SFG on February 7, 2023 (one day prior to this announcement). The actual number of shares to be cancelled is subject to change depending on share price fluctuation.

For more detailed information, please refer to the Independent Accountant’s Audit Report, which was reported on Form 6-K on March 6, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shinhan Financial Group Co., Ltd. |

|

|

|

|

(Registrant) |

|

|

|

|

Date: March 15, 2023 |

|

|

|

By: |

|

/s/ Lee Taekyung |

|

|

|

|

|

|

|

|

|

|

Name: Lee Taekyung |

|

|

|

|

Title: Chief Financial Officer |

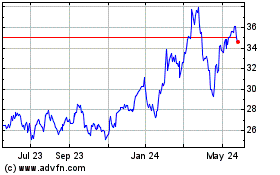

Shinhan Financial (NYSE:SHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shinhan Financial (NYSE:SHG)

Historical Stock Chart

From Dec 2023 to Dec 2024