NBC and CBS Cancel Their In-Person Upfront Pitches to Advertisers

March 12 2020 - 4:40PM

Dow Jones News

By Nat Ives

Viacom CBS Inc.'s CBS network and Comcast Corp.'s NBCUniversal

called off their in-person upfront presentations to advertisers,

which had been scheduled for May, citing concerns over the spread

of the novel coronavirus.

Each had planned stage shows for audiences of marketers and ad

buyers in New York -- CBS at Carnegie Hall and NBC at Radio City

Music Hall -- as part of a yearly ritual in which TV networks vie

to secure billions of dollars in ad spending in their coming

seasons.

Both said they would stream their events instead. NBC said it

would televise it as well.

"This year's upfront presentation will ensure everybody's

safety, while allowing us to give fans and marketers a preview of

the upcoming season, " said Linda Yaccarino, chairman of

advertising and partnerships at NBCUniversal.

"The health and safety of our clients and the ViacomCBS team

comes first, " said Jo Ann Ross, president and chief advertising

revenue officer for ViacomCBS domestic advertising sales.

AT&T Inc.'s WarnerMedia, which owns cable networks such as

TNT and CNN, also said it would replace the in-person upfronts

event that it had planned for May with a remote presentation.

The TV networks' moves came amid a crescendo of postponements,

cancellations and shutdowns as businesses and governments seek to

slow the spread of the coronavirus. Pro basketball, baseball and

hockey all suspended their operations, Broadway shows closed their

doors, and more locations prohibited large gatherings. And the

National Collegiate Athletic Association canceled its marquee March

Madness basketball tournament.

A spokeswoman for Walt Disney Co.'s ABC didn't immediately

respond to a request for comment on its upfronts plan. Fox Corp.'s

Fox network declined to comment on its plan for the upfronts. Fox

Corp. and Wall Street Journal parent News Corp share common

ownership.

Live events are only part of the upfronts process, said

Catherine Sullivan, chief investment officer at Omnicom Media Group

North America, part of Omnicom Group Inc. Ad buyers will still work

with the networks to strike deals for their marketer clients, she

said.

Live presentations can make an impact on ad buyers if they see

others in the audience respond well to a preview for a new TV show,

said Brian Wieser, global president for business intelligence at

the ad-buying giant GroupM, part of WPP PLC. "That can be hard to

replicate."

But locking out the live audience won't hurt the broadcasters'

overall ability to bring in ad dollars, Mr. Wieser said. "It

doesn't change the total amount of money available," he said.

"Their individual marketing teams just have to think about the

events slightly differently."

Cable programmers including A+E Television Networks LLC, AMC

Networks Inc. and Fox Corp.'s Fox News previously called off plans

for crowded, in-person upfront events that had been scheduled for

this month.

And the organizers of the Digital Content NewFronts, an annual

series of events designed to promote digital video to advertisers,

this week encouraged participants to make their presentations

online-only.

Write to Nat Ives at nat.ives@wsj.com

(END) Dow Jones Newswires

March 12, 2020 17:25 ET (21:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

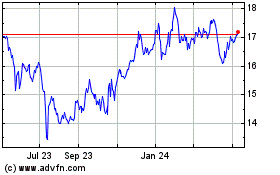

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

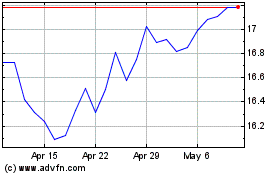

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024