-- Q1 2010 comparable(i) earnings per share of $0.31 versus $0.18 in Q1

2009

-- Cash flow from operations increased $91 million to $174 million

-- Fleet availability in the quarter of 91.4%

-- Completed Summerview II wind farm and announced 54 MW expansion of its

Kent Hills wind farm

-- Successfully completed a US $300 million senior notes offering

-- Announced Memorandum of Understanding with the State of Washington

TransAlta Corporation (TransAlta) (TSX: TA) (NYSE: TAC) today

reported comparable earnings for the first quarter of 2010 of $67

million ($0.31 per share) versus $36 million ($0.18 per share) for

the same period in 2009. Net earnings for the quarter were also $67

million ($0.31 per share) compared to $42 million ($0.21 per share)

in the first quarter of 2009.

Comparable earnings increased in the quarter due to higher fleet

availability and production as a result of lower planned and

unplanned outages primarily at the Alberta coal plants. Also

included in comparable earnings was a $10 million after tax

reduction in decommissioning costs related to Wabamun IV. These

gains were partially offset by lower electricity pricing in Alberta

and the Pacific Northwest.

"Our fleet performed well in the quarter with all key operating

parameters trending positively, and although wind volumes were

below historical averages in the first quarter, past years have

shown a recovery of volume in subsequent months in an El Nino

year," said Steve Snyder, TransAlta's president and CEO. "With over

90 per cent of our total portfolio contracted for the remainder of

the year sustaining our targeted operating performance will allow

us to achieve our earnings and cash flow objectives. However,

electricity markets continue to be challenging due to both low

prices and low demand. I do not expect to see these conditions

change quickly."

Cash flow from operations for the quarter was $174 million

compared to $83 million a year ago. The increase in cash flow from

operations was primarily related to more favourable movements in

working capital. For the full year, TransAlta expects to achieve

$850 - $950 million in cash flow from operations.

Fleet availability for the first quarter increased to 91.4 per

cent compared to 86.4 per cent in the first quarter of 2009 due to

lower planned outages at the Keephills and Sundance plants and

lower unplanned outages at the Keephills and Wabamun plants. For

the year, TransAlta expects total fleet availability to average

approximately 90 per cent.

(i)Presenting comparable earnings from period to period is

provided to help management and shareholders evaluate earnings

trends more readily in comparison with prior periods' results. An

explanation and reconciliation of this non-GAAP financial measure

can be found beginning on page 22 of the MD&A.

In the quarter, TransAlta began commercial operations of its 66

MW Summerview II wind facility and announced a $100 million, 54 MW

expansion to its Kent Hills wind farm. The Kent Hills expansion was

awarded a 25-year power purchase agreement (PPA) with the New

Brunswick Power Distribution and Customer Service Corporation. The

expansion is expected to begin commercial operations by the end of

2010. The company also retired its Wabamun IV unit on March 31. The

Wabamun power station served Alberta electricity customers for 54

years.

Also during the quarter, TransAlta successfully completed a US

$300 million offering of 6.50 per cent senior notes due in 2040.

Proceeds from the issuance are being used to repay borrowings under

existing credit facilities and for general corporate purposes.

Subsequent Events

On April 26, 2010 TransAlta announced it signed a memorandum of

understanding (MOU) with the State of Washington to enter

discussions on an agreement to significantly reduce greenhouse gas

emissions from the Centralia coal-fired plant and provide

replacement capacity by 2025.

The MOU reflects a shared interest between TransAlta, Gov. Chris

Gregoire and the Washington state Department of Ecology in reducing

emissions while providing Washington citizens and businesses with

secure, reliable power. It sets forth clear objectives and a

definitive timeline to develop an agreement to transition the state

to cleaner energy sources while protecting jobs and the local

economy. The MOU also recognizes the need to protect the value that

Centralia brings to TransAlta's shareholders.

The MOU follows Gov. Gregoire's 2009 Executive Order on Climate

Change which directed the Washington state Department of Ecology to

work with TransAlta to reduce the Centralia facility's greenhouse

gas emissions by 2025.

First Quarter 2010 Highlights:

----------------------------------------------------------------------------

In millions, unless otherwise stated 3 months ended 3 months ended

March 31, 2010 March 31, 2009

----------------------------------------------------------------------------

Availability (%) 91.4 86.4

----------------------------------------------------------------------------

Production (GWh) 12,914 12,173

----------------------------------------------------------------------------

Revenue $ 723 $ 756

----------------------------------------------------------------------------

Gross margin(1) $ 401 $ 381

----------------------------------------------------------------------------

Operating income(1) $ 131 $ 85

----------------------------------------------------------------------------

Net earnings $ 67 $ 42

----------------------------------------------------------------------------

Comparable earnings(1) $ 67 $ 36

----------------------------------------------------------------------------

Basic and diluted earnings per share $ 0.31 $ 0.21

----------------------------------------------------------------------------

Comparable earnings per share(1) $ 0.31 $ 0.18

----------------------------------------------------------------------------

Earnings before interest, taxes,

depreciation, and amortization

(EBITDA)(1) $ 245 $ 212

----------------------------------------------------------------------------

Cash flow from operations $ 174 $ 83

----------------------------------------------------------------------------

Cash flow from operations per share(1) $ 0.79 $ 0.42

----------------------------------------------------------------------------

(1)Gross margin, operating income, comparable earnings, comparable earnings

per share, EBITDA, and cash flow from operations per share are not

defined under Canadian GAAP. Refer to the non-GAAP financial measures

section beginning on page 22 of the MD&A for an explanation and

reconciliation.

The complete first quarter report for 2010, including

Management's Discussion and Analysis and unaudited financial

statements, is available on the Investors section of our website:

www.transalta.com.

TransAlta will hold a conference call and web cast at 9 a.m. MT

(11 a.m. ET) today to discuss results. The call will begin with a

short address by Steve Snyder, President and CEO, and Brian Burden,

Chief Financial Officer, followed by a question and answer period

for investment analysts, investors, and other interested parties. A

question and answer period for the media will immediately

follow.

Please contact the conference operator five minutes prior to the

call, noting "TransAlta Corporation" as the company and "Jennifer

Pierce" as moderator.

Dial-in numbers:

For local Toronto participants - 1-416-340-8061

Toll-free North American participants - 1-866-225-0198

A link to the live webcast will be available via TransAlta's

website, www.transalta.com, under Web Casts in the Investor

Relations section. If you are unable to participate in the call,

the instant replay is accessible at 1- 800-408-3053 with TransAlta

pass code 2235047. A transcript of the broadcast will be posted on

TransAlta's website once it becomes available.

Note: If using a hands-free phone, lift the handset and press

one to ask a question.

TransAlta is a power generation and wholesale marketing company

focused on creating long-term shareholder value. TransAlta

maintains a low-to-moderate risk profile by operating a highly

contracted portfolio of assets in Canada, the United States and

Australia. TransAlta's focus is to efficiently operate our biomass,

geothermal, wind, hydro, natural gas and coal facilities in order

to provide our customers with a reliable, low-cost source of power.

For 100 years, TransAlta has been a responsible operator and a

proud contributor to the communities where we work and live.

TransAlta is recognized for its leadership on sustainability by the

Dow Jones Sustainability North America Index, the FTSE4Good Index

and the Jantzi Social Index.

This news release may contain forward-looking statements,

including statements regarding the business and anticipated

financial performance of TransAlta Corporation. These statements

are based on TransAlta Corporation's belief and assumptions based

on information available at the time the assumption was made. These

statements are subject to a number of risks and uncertainties that

may cause actual results to differ materially from those

contemplated by the forward-looking statements. Some of the factors

that could cause such differences include legislative or regulatory

developments, competition, global capital markets activity, changes

in prevailing interest rates, currency exchange rates, inflation

levels and general economic conditions in geographic areas where

TransAlta Corporation operates.

Note: All financial figures are in Canadian dollars unless noted

otherwise.

Contacts: TransAlta Corporation Jennifer Pierce Vice President,

Communications & Investor Relations (403) 267-7622 TransAlta

Corporation Jess Nieukerk Manager, Investor Relations (403)

267-3607 investor_relations@transalta.com www.transalta.com

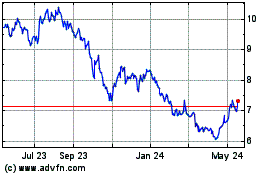

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jul 2023 to Jul 2024