Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT

(Pursuant to Section 13(e) of the Securities Exchange Act of 1934)

TAOMEE HOLDINGS LIMITED

(Name of the Issuer)

Taomee Holdings Limited

Orient TM Parent Limited

Orient TM Merger Limited

Mr. Benson Haibing Wang

Mr. Roc Yunpeng Cheng

Mr. Jason Liqing Zeng

Joy Union Holdings Limited

Charming China Limited

Frontier Technology Holdings Limited

Dongzhengruibo (Shanghai) Investment Center (Limited Partnership)

Orient Ruide Capital Management (Shanghai) Co., Ltd.

(Names of Persons Filing Statement)

Ordinary shares, par value US$0.00002 per share

American Depositary Shares, each representing 20 ordinary shares

(Title of Class of Securities)

87600Y1061

(CUSIP Number)

|

|

|

Sam Lawn, Chief Financial Officer

Taomee Holdings Limited

16/F, Building No. A-2,

No. 1528 Gumei Road, Xuhui District

Shanghai 200233, People's Republic of China

Tel: +86 (21) 6128-0056 |

|

Mr. Benson Haibing Wang

Mr. Roc Yunpeng Cheng

Mr. Jason Liqing Zeng

Joy Union Holdings Limited

Charming China Limited

Frontier Technology Holdings

c/o 16/F, Building No. A-2,

No. 1528 Gumei Road, Xuhui District

Shanghai 200233, People's Republic of China

Tel: +86 (21) 6128-0056 |

Orient TM Parent Limited

Orient TM Merger Limited

c/o Maricorp Services Ltd.,

P.O. Box 2075, George Town,

Grand Cayman KY1-1105,

Cayman Islands

Tel: + 86 (21) 6332-5888 |

|

Dongzhengruibo (Shanghai) Investment Center

(Limited Partnership)

Orient Ruide Capital Management (Shanghai) Co., Ltd.

c/o 36/F, Building No. 2,

Orient International Finance Center,

318 South Zhong Shan Road,

Shanghai, People's Republic of China

Tel: + 86 (21) 6332-5888

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

With copies to:

|

|

|

|

|

James T. Lidbury

Ropes & Gray LLP

41st Floor, One Exchange Square

8 Connaught Place

Central, Hong Kong

Fax: +852 3664 6454 |

|

Karen M. Yan, Esq.

Fenwick & West LLP

Unit 908, Kerry Parkside Office

No. 1155 Fang Dian Road

Pudong, Shanghai 201204

People's Republic of China

Fax: +86 (21) 8017-1299 |

|

Stephanie Tang, Esq.

Shearman & Sterling

12th Floor, Gloucester Tower

The Landmark

15 Queen's Road, Central

Hong Kong

Tel: +852-2978-8028

|

This

statement is filed in connection with (check the appropriate box):

- a

- o

The filing of solicitation materials or an information statement subject to Regulation 14A,

Regulation 14-C or Rule 13e-3(c) under the Securities Exchange Act of 1934.

- b

- o

The filing of a registration statement under the Securities Act of 1933.

- c

- o

A tender offer

- d

- ý

None of the above

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary

copies: o

Check the following box if the filing is a final amendment reporting the results of the transaction: o

Calculation of Filing Fee

|

|

|

| |

Transactional Valuation*

|

|

Amount of Filing Fee**

|

| |

| $137,216,905.29 |

|

$13,817.74 |

| |

- *

- Calculated

solely for the purpose of determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as

amended. The filing fee is calculated based on the sum of (a) the aggregate cash payment for the proposed per share cash payment of $0.1884 for 711,520,600 issued and outstanding ordinary

shares of the issuer (including shares represented by the American depositary shares, but excluding vested and unvested restricted shares and Rollover Shares) subject to the transaction plus

(b) the product of 6,258,400 ordinary shares issuable under all outstanding and unexercised options multiplied by $0.1232 per share (which is the difference between $0.1884 per share merger

consideration and the weighted average exercise price of $0.0652 per share plus (c) the product of 12,718,700 shares of company restricted shares multiplied by $0.1884 per share ((a),

(b) and (c) together, the "Transaction Valuation")).

- **

- The

amount of the filing fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange Commission Fee Rate Advisory

#1 for Fiscal Year 2016, was calculated by multiplying the Transaction Valuation by 0.00010070.

- o

- Check

box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with

which the offsetting of the fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

- 1

- This

CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing 20 ordinary shares.

TABLE OF CONTENTS

2

Table of Contents

INTRODUCTION

This Rule 13E-3 transaction statement on Schedule 13E-3, together with the exhibits hereto (this "Transaction

Statement"), is being filed with the Securities and Exchange Commission (the "SEC") pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), jointly by

the following persons (each, a "Filing Person," and collectively, the "Filing Persons"): (a) Taomee Holdings Limited, an exempted company with limited liability incorporated under the laws of

the Cayman Islands (the "Company"), the issuer of the ordinary share, par value US$0.00002 per share (each, a "Share"), including the Shares represented by the American depositary shares ("ADSs"),

each representing 20 Shares, that is subject to the transaction pursuant to Rule 13e-3 under the Exchange Act; (b) Orient TM Parent Limited, an exempted company with limited liability

incorporated under the laws of the Cayman Islands ("Parent"); (c) Orient TM Merger Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands ("Merger

Sub"); (d) Mr. Benson Haibing Wang, the co-founder, a director and the chief executive officer of the Company ("Mr. Wang"); (e) Mr. Roc Yunpeng Cheng, the

co-founder, a director and president of the Company ("Mr. Cheng"); (f) Mr. Jason Liqing Zeng, the chairman of the board of directors of the Company ("Mr. Zeng");

(g) Joy Union Holdings Limited, a company incorporated under the laws of the

British Virgin Islands wholly owned by Mr. Wang ("Joy Union"); (h) Charming China Limited, a company incorporated under the laws of the British Virgin Islands wholly owned by

Mr. Cheng ("Charming China"); (i) Frontier Technology Holdings Limited, a company incorporated under the laws of the British Virgin Islands wholly owned by Mr. Zeng ("Frontier

Technology," and collectively with Mr. Wang, Mr. Cheng, Mr. Zeng, Joy Union and Charming China, the "Rollover Shareholders"); (j) Dongzhengruibo (Shanghai) Investment

Center (Limited Partnership), a limited partnership formed under the laws of the PRC; and (k) Orient Ruide Capital Management (Shanghai) Co., Ltd., a company incorporated under

the laws of the PRC (the "Sponsor," and together with Mr. Wang, Mr. Cheng, Joy Union and Charming China, the "Buyer Group").

On

December 11, 2015, Parent, Merger Sub and the Company entered into an agreement and plan of merger (the "Merger Agreement") providing for the merger of Merger Sub with and into

the Company (the "Merger"), with the Company continuing as the surviving corporation after the Merger as a wholly owned subsidiary of Parent. At the effective time of the Merger (the "Effective

Time"), Parent will be beneficially owned by the Rollover Shareholders and the Sponsor.

If

the Merger is completed, each Share issued and outstanding immediately prior to the Effective Time will be cancelled and cease to exist and will be converted into and exchanged for

the right to receive US$0.1884 per Share and each issued and outstanding ADS will represent the right to surrender one ADS in exchange for US$3.767 per ADS, in each case, in cash, without interest and

net of any applicable withholding taxes, except for (a) Shares or ADSs held or beneficially held by the Rollover Shareholders (the "Rollover Shares"), which will be cancelled for no

consideration, (b) Shares (including Shares represented by the ADSs) beneficially owned by the Company or held by the Company as treasury shares or held by the Company's depositary that are

reserved (but not yet allocated) by the Company for settlement upon exercise of any Company equity awards, and (c) Shares owned by shareholders who have validly exercised and not effectively

withdrawn or lost their rights to dissent from the Merger pursuant to Section 238 of the Cayman Islands Companies Law, which Shares will be cancelled in accordance with the procedures set out

in Section 238 of the Cayman Islands Companies Law and the holders of such shares shall be entitled to receive the fair value of such Shares determined in accordance with the provisions of

Section 238 of the Cayman Islands Companies Law (the "Dissenting Shares").

In

addition, at the Effective Time,

- •

- vesting of each option (the "Company Option") to purchase Shares granted under the Company's 2009 Stock Option Plan, 2010 Share

Incentive Plan and 2012 Share Incentive Plan, each as amended (collectively, the "Share Incentive Plans") outstanding as of the Effective Time

3

Table of Contents

and

having an exercise price per Share less than US$0.1884 will be accelerated by 12 months, (b) vesting of each Company Option outstanding as of the Effective Time and having an

exercise price per Share equal to or greater than US$0.1884 will be accelerated as to all of the covered Shares, and (c) vesting of each Company restricted share award issued under the Share

Incentive Plans (the "Company Restricted Share", and together with the Company Option, the "Company Equity Award") outstanding as of the effective time of the Merger will be accelerated by

12 months, except for certain awards that will be accelerated by three months or vest immediately prior to the Effective Time;

- •

- each vested Company Option (including after application of any acceleration), will be cancelled and converted into the right to

receive an amount equal to the product of (a) the excess of US$0.1884 over the exercise price payable per Share under such Company Option multiplied by (b) the number of Shares covered

under such vested Company Option, in cash, without interest and net of any applicable withholding taxes; if the exercise price of a Company option is greater than or equal to US$0.1884, such Company

Option will be cancelled at the Effective Time for no consideration;

- •

- each unvested and outstanding Company Option as of the Effective Time will be assumed by Parent and converted into an option to

purchase that number of ordinary shares of Parent equal to the number of Shares subject to such option multiplied by the ratio of (a) US$0.1884 divided by (b) the fair market value of

one ordinary share of Parent at the Effective Time, and rounded down to the nearest whole share, with a per share exercise price determined by dividing the per Share exercise price of such option by

the ratio of (x) US$0.1884 divided by (y) the fair market value of one ordinary share of Parent at the Effective Time, and rounding up to the nearest whole cent; and the terms and

conditions of the assumed option, including vesting conditions, shall otherwise remain unmodified;

- •

- each Company Restricted Share vested and outstanding as of the effective time of the Merger (after application of any acceleration)

will be cancelled and converted into the right to receive US$0.1884 per Share, in cash, without interest and net of any applicable withholding taxes; and

- •

- each unvested and outstanding Company Restricted Share will be assumed by Parent and will cover that number of ordinary shares of

Parent equal to the number of Shares covered thereby multiplied by the ratio of (a) US$0.1884 divided by (b) the fair market value of one ordinary share of Parent at the Effective Time,

rounded down to the nearest whole share; the terms and conditions of the assumed Company Restricted Share, including vesting conditions, shall otherwise remain unmodified.

The

payment in connection with the treatment of applicable vested Company Options and vested Company Restricted Shares will be made by the Surviving Corporation as soon as practicable

following the Effective Time.

The

Merger remains subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, including obtaining the requisite approval of the shareholders of the

Company. The Merger Agreement, the plan of merger required to be filed with the Registrar of Companies of the Cayman Islands in connection with the Merger (the "Plan of Merger") and the transactions

contemplated by the Merger Agreement and the Plan of Merger (collectively, the "Transactions"), including the Merger, must be authorized and approved by a special resolution representing an

affirmative vote of shareholders representing at least two-thirds of the Shares (including Shares represented by ADSs) present and voting in person or by proxy as a single class at the extraordinary

general meeting of the Company's shareholders held in accordance with its memorandum and articles of association.

As

of the date of this Transaction Statement, the Rollover Shareholders beneficially own approximately 45.8% of the total issued and outstanding Shares in the Company. Pursuant to the

terms of the Rollover and Support Agreement, the Rollover Shareholders agreed to vote all of the Shares

4

Table of Contents

beneficially

owned by them in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and the transactions contemplated by the Merger Agreement, including the Merger, at

the extraordinary general meeting of shareholders of the Company. In addition, pursuant to the Rollover and Support Agreement, the Rollover Shareholders also agreed to roll-over a portion of the

Shares owned by them, representing approximately 27.2% of the total issued and outstanding Shares in the Company, in connection with the Merger.

The

Company will make available to its shareholders a proxy statement (the "Proxy Statement," a preliminary copy of which is attached as Exhibit (a)(1) to this Transaction

Statement), relating to the

extraordinary general meeting of the Company's shareholders, at which the Company's shareholders will consider and vote upon, among other proposals, a proposal to authorize and approve the Merger

Agreement, the Plan of Merger and the Transactions, including the Merger.

The

cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required

to be included in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy Statement, including all

annexes thereto, is incorporated in its entirety herein by this reference, and the responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in

the Proxy Statement and the annexes thereto. As of the date hereof, the Proxy Statement is in preliminary form and is subject to completion. Capitalized terms used but not defined in this Transaction

Statement shall have the meanings given to them in the Proxy Statement.

All

information contained in this Transaction Statement concerning each Filing Person has been supplied by such Filing Person. No Filing Person, including the Company, is responsible for

the accuracy of any information supplied by any other Filing Person.

The

filing of this Transaction Statement shall not be construed as an admission by any of the Filing Persons or by any affiliate of a Filing Person, that the Company is "controlled" by

any other Filing Person or that any Filing Person is an "affiliate" of the Company within the meaning of Rule 13e-3 under Section 13(e) of the Exchange Act.

Item 1 Summary of Term Sheet

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

Item 2 Subject Company Information

- (a)

- Name

and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Summary Term Sheet—The Parties Involved in the Merger"

- (b)

- Securities.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "The Extraordinary General Meeting—Record Date; Shares and ADSs Entitled to Vote"

- •

- "The Extraordinary General Meeting—Procedures for Voting"

- •

- "Security Ownership of Certain Beneficial Owners and Management of the Company"

5

Table of Contents

- (c)

- Trading

Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Market Price of the Company's ADSs, Dividends and Other Matters"

- (d)

- Dividends.

The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Market Price of the Company's ADSs, Dividends and Other Matters"

- (e)

- Prior

Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Transactions in Shares and ADSs"

- (f)

- Prior

Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Transactions in Shares and ADSs"

Item 3 Identity and Background of Filing Persons

- (a)

- Name

and Address. Taomee Holdings Limited is the subject company. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

- •

- "Summary Term Sheet—The Parties Involved in the Merger"

- •

- "Annex I—Directors and Executive Officers of Each Filing Person"

- (b)

- Business

and Background of Entities. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—The Parties Involved in the Merger"

- •

- "Annex I—Directors and Executive Officers of Each Filing Person"

- (c)

- Business

and Background of Natural Persons. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—The Parties Involved in the Merger"

- •

- "Annex I—Directors and Executive Officers of Each Filing Person"

Item 4 Terms of the Transaction

- (a)

- -(1) Material

Terms—Tender Offers. Not applicable.

- (a)

- -(2) Material

Terms—Merger or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

- •

- "Summary Term Sheet"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

- •

- "Special Factors"

- •

- "The Extraordinary General Meeting"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

6

Table of Contents

- (c)

- Different

Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Interests of the Company's Executive Officers and Directors in the Merger"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "The Extraordinary General Meeting—Proposals to be Considered at the Extraordinary General Meeting"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

- (d)

- Appraisal

Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Dissenters' Rights of Shareholders"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

- •

- "Dissenters' Rights"

- •

- "Annex G—Cayman Companies Law Cap. 22 (Law 3 of 1961, as consolidated and revised)—Section 238"

- (e)

- Provisions

for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Provisions for Unaffiliated Security Holders"

- (f)

- Eligibility

of Listing or Trading. Not applicable.

Item 5 Past Contracts, Transactions, Negotiations and Agreements

- (a)

- Transactions.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "Special Factors—Related-Party Transactions"

- •

- "Transactions in Shares and ADSs"

- (b)

- Significant

Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

7

Table of Contents

- (c)

- Negotiations

or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

- (e)

- Agreements

Involving the Subject Company's Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

- •

- "Summary Term Sheet—Rollover and Support Agreement"

- •

- "Summary Term Sheet—Plans for the Company after the Merger"

- •

- "Summary Term Sheet—Financing of the Merger"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Plans for the Company after the Merger"

- •

- "Special Factors—Financing of the Merger"

- •

- "Special Factors—Rollover and Support Agreement"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "The Merger Agreement"

- •

- "Transactions in Shares and ADSs"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

Item 6 Purposes of the Transaction and Plans or Proposals

- (b)

- Use

of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- •

- "Special Factors—Effects of the Merger on the Company"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

- (c)

- (1)-(8) Plans.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—The Merger Agreement"

- •

- "Summary Term Sheet—Purposes of and Effects of the Merger"

8

Table of Contents

- •

- "Summary Term Sheet—Plans for the Company after the Merger"

- •

- "Summary Term Sheet—Financing of the Merger"

- •

- "Summary Term Sheet—Interests of the Company's Executive Officers and Directors in the Merger"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- •

- "Special Factors—Effects of the Merger on the Company"

- •

- "Special Factors—Plans for the Company after the Merger"

- •

- "Special Factors—Financing of the Merger"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

Item 7 Purposes, Alternatives, Reasons and Effects

- (a)

- Purposes.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Purposes and Effects of the Merger"

- •

- "Summary Term Sheet—Plans for the Company after the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- (b)

- Alternatives.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Position of the Buyer Group as to the Fairness of the Merger"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- •

- "Special Factors—Alternatives to the Merger"

- •

- "Special Factors—Effects on the Company if the Merger is not Completed"

- (c)

- Reasons.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Purposes and Effects of the Merger"

- •

- "Special Factors—Background of the Merger"

9

Table of Contents

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Position of the Buyer Group as to the Fairness of the Merger"

- •

- "Special Factors—Purposes of and Reasons for the Merger"

- •

- "Special Factors—Effects of the Merger on the Company"

- (d)

- Effects.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Purposes and Effects of the Merger"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Effects of the Merger on the Company"

- •

- "Special Factors—Plans for the Company after the Merger"

- •

- "Special Factors—Effects on the Company if the Merger is not Completed"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "Special Factors—Material U.S. Federal Income Tax Consequences"

- •

- "Special Factors—Material PRC Income Tax Consequences"

- •

- "Special Factors—Material Cayman Islands Tax Consequences"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

Item 8 Fairness of the Transaction

- (a)

- -(b) Fairness;

Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

- •

- "Summary Term Sheet—Recommendations of the Special Committee and the Board"

- •

- "Summary Term Sheet—Position of the Buyer Group as to Fairness"

- •

- "Summary Term Sheet—Opinion of Duff & Phelps Securities, Financial Advisor to the Special Committee"

- •

- "Summary Term Sheet—Interests of the Company's Executive Officers and Directors in the Merger"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Position of the Buyer Group as to the Fairness of the Merger"

- •

- "Special Factors—Opinions of the Special Committee's Financial Advisors"

10

Table of Contents

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "Annex H—Opinion of Duff & Phelps"

- (c)

- Approval

of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Shareholder Vote Required to Authorize and Approve the Merger Agreement and Plan of Merger"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

- •

- "The Extraordinary General Meeting—Vote Required"

- (d)

- Unaffiliated

Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Opinion of Duff & Phelps, Special Committee's Financial Advisor"

- •

- "Annex H—Opinion of Duff & Phelps"

- (e)

- Approval

of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Recommendations of the Special Committee and the Board"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- (f)

- Other

Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

Item 9 Reports, Opinions, Appraisals and Negotiations

- (a)

- Report,

Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Opinion of Duff & Phelps Securities, Financial Advisor to the Special Committee"

- •

- "Special Factors—Background of the Merger"

- •

- "Special Factors—Opinion of Duff & Phelps, Special Committee's Financial Advisor"

- •

- "Annex H—Opinion of Duff & Phelps"

- (b)

- Preparer

and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

- •

- "Special Factors—Opinion of Duff & Phelps, Special Committee's Financial Advisor"

11

Table of Contents

- •

- "Annex H—Opinion of Duff & Phelps"

- (c)

- Availability

of Documents. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Where You Can Find More Information"

The

reports, opinions or appraisals referenced in this Item 9 will be made available for inspection and copying at the principal executive offices of the Company during its regular business

hours by any interested holder of the Shares and ADSs or his, her or its representative who has been so designated in writing.

Item 10 Source and Amount of Funds or Other Consideration

- (a)

- Source

of Funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Financing of the Merger"

- •

- "Special Factors—Financing of the Merger"

- •

- "The Merger Agreement"

- •

- "Annex A—Agreement and Plan of Merger"

- •

- "Annex B—Plan of Merger"

- (b)

- Conditions.

The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Financing of the Merger"

- •

- "Special Factors—Financing of the Merger"

- (c)

- Expenses.

The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Special Factors—Fees and Expenses"

- (d)

- Borrowed

Funds. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Summary Term Sheet—Financing of the Merger"

- •

- "Special Factors—Financing of the Merger"

Item 11 Interest in Securities of the Subject Company

- (a)

- Securities

Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Interests of the Company's Executive Officers and Directors in the Merger"

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "Security Ownership of Certain Beneficial Owners and Management of the Company"

- (b)

- Securities

Transactions. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "Transactions in the Shares and ADSs"

12

Table of Contents

Item 12 The Solicitation or Recommendation

- (d)

- Intent

to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

- •

- "Summary Term Sheet—Interests of the Company's Executive Officers and Directors in the Merger"

- •

- "Summary Term Sheet—Rollover and Support Agreement"

- •

- "Questions and Answers about the Extraordinary General Meeting and the Merger"

- •

- "Special Factors—Rollover and Support Agreement"

- •

- "The Extraordinary General Meeting—Vote Required"

- •

- "Security Ownership of Certain Beneficial Owners and Management of the Company"

- (e)

- Recommendations

of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—Recommendations of the Special Committee and the Board"

- •

- "Summary Term Sheet—Position of the Buyer Group as to Fairness"

- •

- "Summary Term Sheet—Rollover and Support Agreement"

- •

- "Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board"

- •

- "Special Factors—Position of the Buyer Group as to the Fairness of the Merger"

- •

- "Special Factors—Support Agreement"

- •

- "The Extraordinary General Meeting—the Board's Recommendation"

Item 13 Financial Statements

- (a)

- Financial

Information. The audited financial statements of the Company for the two years ended December 31, 2013 and 2014 are incorporated herein by

reference to the Company's Form 20-F for the year ended December 31, 2014, originally filed on April 15, 2015 (see page F-1 and following pages).

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

- •

- "Financial Information"

- •

- "Where You Can Find More Information"

- (b)

- Pro

Forma Information. Not applicable.

Item 14 Persons/Assets, Retained, Employed, Compensated or Used

- (a)

- Solicitation

or Recommendations. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

- •

- "The Extraordinary General Meeting—Solicitation of Proxies"

- (b)

- Employees

and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

- •

- "Summary Term Sheet—The Parties Involved in the Merger"

13

Table of Contents

- •

- "Special Factors—Interests of Certain Persons in the Merger"

- •

- "Annex I—Directors and Executive Officers of Each Filing Person"

Item 15 Additional Information

- (b)

- Other

Material Information. The information contained in the Proxy Statement, including all annexes thereto, is incorporated herein by reference.

Item 16 Exhibits

|

|

|

| (a)-(1) |

|

Preliminary Proxy Statement of the Company dated , 2016 (the "Proxy Statement"). |

(a)-(2) |

|

Notice of Extraordinary General Meeting of Shareholders of the Company, incorporated herein by reference to the Proxy Statement. |

(a)-(3) |

|

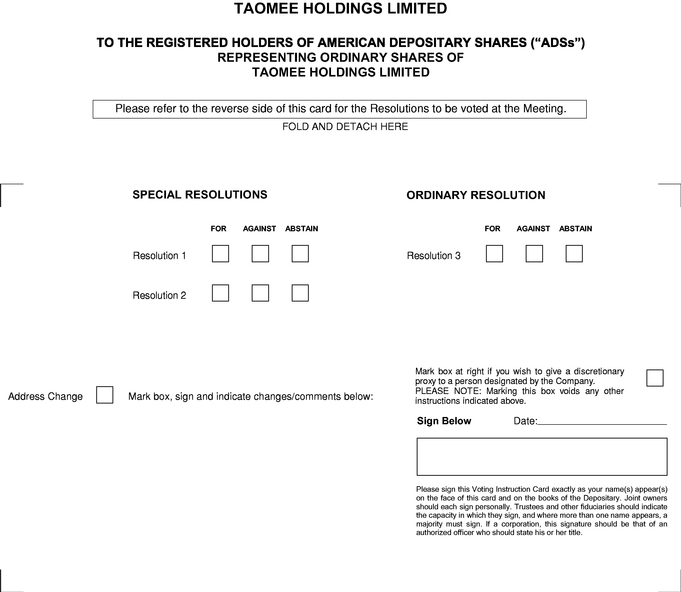

Form of Proxy Card, incorporated herein by reference to the Proxy Statement. |

(a)-(4) |

|

Form of ADS Voting Instruction Card, incorporated herein by reference to the Proxy Statement. |

(a)-(5) |

|

Press Release issued by the Company, dated December 11, 2015, incorporated herein by reference to Exhibit 99.1 to the Report on Form 6-K furnished by the Company to the SEC on December 11,

2015. |

(b)-(1) |

|

Equity Commitment Letter by and between Orient Ruide Capital Management (Shanghai) Co., Ltd. and Orient TM Parent Limited, dated December 11, 2015. |

(b)-(2) |

|

Rollover and Support Agreement by and among Orient TM Parent Limited, Mr. Benson Haibing Wang, Joy Union Holdings Limited, Mr. Roc Yunpeng Cheng, Charming China Limited, Mr. Jason Liqing Zeng and

Frontier Technology Holdings Limited, dated December 11, 2015 incorporated herein by reference to Annex C-1 to the proxy statement. |

(b)-(3) |

|

Amended and Restated Rollover and Support Agreement by and among Orient TM Parent Limited, Mr. Benson Haibing Wang, Joy Union Holdings Limited, Mr. Roc Yunpeng Cheng, Charming China Limited, Mr. Jason

Liqing Zeng and Frontier Technology Holdings Limited, dated December 31, 2015 incorporated herein by reference to Annex C-2 to the proxy statement. |

(b)-(4) |

|

Limited Guaranty of Orient Ruide Capital Management (Shanghai) Co., Ltd. in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex D to this proxy

statement. |

(b)-(5) |

|

Limited Guaranty of Mr. Benson Haibing Wang and Joy Union Holdings Limited in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex E to this proxy

statement. |

(b)-(6) |

|

Limited Guaranty of Mr. Roc Yunpeng Cheng and Charming China Limited in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex F to this proxy

statement |

(c)-(1) |

|

Opinion of Duff & Phelps, dated December 11, 2015, incorporated herein by reference to Annex H to the Proxy Statement. |

(c)-(2) |

|

Discussion Materials prepared by Duff & Phelps for discussion with the Special Committee of the board of directors of Taomee Holdings Limited, dated December 11, 2015. |

14

Table of Contents

|

|

|

| (d)-(1) |

|

Agreement and Plan of Merger, dated as of December 11, 2015, among Taomee Holdings Limited, Orient TM Parent Limited and Orient TM Merger Limited incorporated herein by reference to Annex A and Annex B to

the Proxy Statement. |

(f)-(1) |

|

Dissenters' Rights, incorporated herein by reference to the section entitled "Dissenters' Rights" in the Proxy Statement. |

(f)-(2) |

|

Section 238 of the Cayman Islands Companies Law Cap. 22 (Law 3 of 1961, as consolidated and revised), incorporated herein by reference to Annex G to the Proxy Statement. |

(g) |

|

Not applicable. |

15

Table of Contents

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date:

January 5, 2016

|

|

|

|

|

|

|

| |

|

Taomee Holdings Limited |

|

|

By |

|

/s/ SAM LAWN

|

| |

|

|

|

Name: Sam Lawn

Title: CFO |

|

|

Orient TM Parent Limited |

|

|

By |

|

/s/ HAI FENG

|

| |

|

|

|

Name: Hai Feng

Title: Director |

|

|

Orient TM Merger Limited |

|

|

By |

|

/s/ HAI FENG

|

| |

|

|

|

Name: Hai Feng

Title: Director |

|

|

Mr. Benson Haibing Wang |

|

|

/s/ BENSON HAIBING WANG

Benson Haibing Wang |

|

|

Mr. Roc Yunpeng Cheng |

|

|

/s/ ROC YUNPENG CHENG

Roc Yunpeng Cheng |

|

|

Mr. Jason Liqing Zeng |

|

|

/s/ JASON LIQING ZENG

Jason Liqing Zeng |

16

Table of Contents

|

|

|

|

|

|

|

| |

|

Joy Union Holdings Limited |

|

|

By |

|

/s/ BENSON HAIBING WANG

|

| |

|

|

|

Name: Benson Haibing Wang

Title: Director |

|

|

Charming China Limited |

|

|

By |

|

/s/ ROC YUNPENG CHENG

|

| |

|

|

|

Name: Roc Yunpeng Cheng

Title: Director |

|

|

Frontier Technology Holdings Limited |

|

|

By |

|

/s/ LIQING ZENG

|

| |

|

|

|

Name: Liqing Zeng

Title: Director |

|

|

Dongzhengruibo (Shanghai) Investment Center (Limited Partnership) |

|

|

By |

|

/s/ HAI FENG

|

| |

|

|

|

Name: Hai Feng

Title: Authorized Signatory |

|

|

Orient Ruide Capital Management (Shanghai) Co., Ltd. |

|

|

By |

|

/s/ BO CHEN

|

| |

|

|

|

Name: Bo Chen

Title: Chairman of the Board of Directors |

17

Table of Contents

EXHIBIT INDEX

|

|

|

| (a)-(1) |

|

Preliminary Proxy Statement of the Company dated , 2016 (the "Proxy

Statement"). |

| (a)-(2) |

|

Notice of Extraordinary General Meeting of Shareholders of the Company, incorporated herein by reference to the Proxy Statement. |

| (a)-(3) |

|

Form of Proxy Card, incorporated herein by reference to the Proxy Statement. |

| (a)-(4) |

|

Form of ADS Voting Instruction Card, incorporated herein by reference to the Proxy Statement. |

| (a)-(5) |

|

Press Release issued by the Company, dated December 11, 2015, incorporated herein by reference to Exhibit 99.1 to the Report on Form 6-K furnished by the Company to the SEC on December 11,

2015. |

| (b)-(1) |

|

Equity Commitment Letter by and between Orient Ruide Capital Management (Shanghai) Co., Ltd. and Orient TM Parent Limited, dated December 11, 2015. |

| (b)-(2) |

|

Rollover and Support Agreement by and among Orient TM Parent Limited, Mr. Benson Haibing Wang, Joy Union Holdings Limited, Mr. Roc Yunpeng Cheng, Charming China Limited, Mr. Jason Liqing Zeng and Frontier

Technology Holdings Limited, dated December 11, 2015 incorporated herein by reference to Annex C-1 to the proxy statement. |

| (b)-(3) |

|

Amended and Restated Rollover and Support Agreement by and among Orient TM Parent Limited, Mr. Benson Haibing Wang, Joy Union Holdings Limited, Mr. Roc Yunpeng Cheng, Charming China Limited, Mr. Jason

Liqing Zeng and Frontier Technology Holdings Limited, dated December 31, 2015 incorporated herein by reference to Annex C-2 to the proxy statement. |

| (b)-(4) |

|

Limited Guaranty of Orient Ruide Capital Management (Shanghai) Co., Ltd. in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex D to this proxy

statement. |

| (b)-(5) |

|

Limited Guaranty of Mr. Benson Haibing Wang and Joy Union Holdings Limited in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex E to this proxy

statement. |

| (b)-(6) |

|

Limited Guaranty of Mr. Roc Yunpeng Cheng and Charming China Limited in favor of Taomee Holdings Limited dated December 11, 2015, incorporated herein by reference to Annex F to this proxy

statement |

| (c)-(1) |

|

Opinion of Duff & Phelps, dated December 11, 2015, incorporated herein by reference to Annex H to the Proxy Statement. |

| (c)-(2) |

|

Discussion Materials prepared by Duff & Phelps for discussion with the Special Committee of the board of directors of Taomee Holdings Limited, dated December 11, 2015. |

| (d)-(1) |

|

Agreement and Plan of Merger, dated as of December 11, 2015, among Taomee Holdings Limited, Orient TM Parent Limited and Orient TM Merger Limited incorporated herein by reference to Annex A and Annex B to

the Proxy Statement. |

| (f)-(1) |

|

Dissenters' Rights, incorporated herein by reference to the section entitled "Dissenters' Rights" in the Proxy Statement. |

| (f)-(2) |

|

Section 238 of the Cayman Islands Companies Law Cap. 22 (Law 3 of 1961, as consolidated and revised), incorporated herein by reference to Annex G to the Proxy Statement. |

| (g) |

|

Not applicable. |

18

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Exhibit (a)-(1)

PRELIMINARY

PROXY STATEMENT OF THE COMPANY

,

2016

Shareholders

of Taomee Holdings Limited

Re: Notice of Extraordinary General Meeting of Shareholders

Dear Shareholder:

You

are cordially invited to attend an extraordinary general meeting of shareholders of Taomee Holdings Limited, an exempted company with limited liability incorporated under the laws of

the Cayman Islands (the "Company"), to be held on , 2016 at

(Beijing time). The meeting will be held at the

offices of 16/F, Building No. A-2, No. 1528 Gumei Road, Xuhui District, Shanghai, China. The accompanying notice of the extraordinary general meeting and proxy statement provide

information regarding the matters to be considered and voted on at the extraordinary general meeting, including at any adjournment thereof.

The

Company entered into an agreement and plan of merger, dated as of December 11, 2015, with Orient TM Parent Limited, an exempted company with limited liability incorporated

under the laws of the Cayman Islands (the "Parent"), and Orient TM Merger Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned

subsidiary of Parent (the "Merger Sub"). Such agreement and plan of merger, as may be amended from time to time, is referred to herein as the "Merger Agreement" and a copy of which is attached as

Annex A to the accompanying proxy statement. Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Company (the "Merger"), with the Company continuing as the surviving

corporation (the "Surviving Corporation") and becoming a wholly owned subsidiary of Parent.

At

the extraordinary general meeting, you will be asked to consider and vote upon a proposal to approve and authorize the Merger Agreement and the plan of merger required to be filed

with the Registrar of Companies of the Cayman Islands (the "Cayman Registrar") in connection with the Merger (the "Plan of Merger"), and the transactions contemplated by the Merger Agreement and the

Plan of Merger (collectively, the "Transactions"), including the Merger. Merger Sub is formed solely for purposes of the Merger. Immediately following the consummation of the Merger, Parent will be

beneficially owned by (i) an affiliate of Orient Ruide Capital Management (Shanghai) Co., Ltd. (the "Sponsor"); (ii) Mr. Benson Haibing Wang, the co-founder, chief

executive officer and a director of the Company ("Mr. Wang"), (iii) Joy Union Holdings Limited, a company incorporated under the laws of the British Virgin Islands that is wholly-owned

by Mr. Wang ("Joy Union"), (vi) Mr. Roc Yunpeng Cheng, the co-founder, president and a director of the Company, (v) Charming China Limited, a company incorporated under the

laws of the British Virgin Islands that is wholly-owned by Mr. Cheng ("Charming China"), (vi) Mr. Jason Liqing Zeng, the chairman of the board of directors of the Company

("Mr. Zeng") and (vii) Frontier Technology Holdings Limited, a company incorporated under the laws of the British Virgin Islands that is wholly-owned by Mr. Zeng ("Frontier

Technology"). Mr. Wang, Joy Union, Mr. Cheng, Charming China, Mr. Zeng and Frontier Technology are collectively referred to as the "Rollover Shareholders". Mr. Wang, Joy

Union, Mr. Cheng, Charming China and the Sponsor are collectively referred to as the "Buyer Group".

As

of the date of the accompanying proxy statement, Mr. Wang, himself and through Joy Union Holdings Limited, beneficially owns 86,706,592 Shares, representing approximately 12.2%

of the total number of issued and outstanding Shares, Mr. Cheng, himself and through Charming China Limited, beneficially owns 71,706,593 Shares, representing approximately 10.1% of the total

number of issued

and outstanding Shares, and Mr. Zeng, through Frontier Technology and Speednext Industrial Limited, beneficially owns 167,568,540 Shares, representing approximately 23.5% of the total number of

issued and outstanding Shares, respectively, in the Company. Pursuant to a rollover and support agreement entered among Mr. Wang, Joy Union, Mr. Cheng, Charming China, Mr. Zeng,

Frontier Technology and Parent, dated as of December 11, 2015 and as amended and restated on December 31, 2015 (the "Rollover and Support Agreement"), (a) Mr. Wang,

Mr. Cheng and Mr. Zeng have agreed to vote

Table of Contents

all 325,981,725

Shares beneficially owned by them, which represented approximately 45.8% of the total voting power thereof, in favor of the authorization and approval of the Merger Agreement

and the Merger, and (b) Mr. Wang has agreed to roll-over 86,392,592 Shares beneficially held him, Mr. Cheng has agreed to roll-over 71,392,593 Shares beneficially held by him, and

Mr. Zeng has agreed to roll-over 35,576,008 Shares beneficially held by him through Frontier Technology, respectively, in the Company, which collectively represent approximately 27.2% of the

total number of issued and outstanding Shares (the "Rollover Shares") and which will be cancelled at the effective time ("Effective Time") of the Merger for no consideration. If completed, the Merger

will result in the Company becoming a privately-held company and its American depositary shares (the "ADSs") will no longer be listed on the New York Stock Exchange, or the "NYSE;" and the American

depositary shares program for the ADSs will terminate.

The

Buyer Group intends to fund the merger consideration through equity financing provided by the Sponsor in an aggregate amount equal to US$97,547,052 pursuant to an equity commitment

letter issued by the Sponsor. In calculating this amount, the Buyer Group did not consider the value of the Rollover Shares, which will be cancelled for no consideration pursuant to the merger

agreement.

If

the Merger Agreement and the Plan of Merger are approved and authorized by the requisite vote of the Company's shareholders and the Merger is completed, each Share (including Shares

represented by the ADSs) issued and outstanding immediately prior to the Effective Time of the Merger will be cancelled and cease to exist in exchange for the right to receive US$0.1884 per Share or

US$3.767 per ADS, in each case, in cash, without interest and net of any applicable withholding taxes, except for (a) the Rollover Shares, (b) Shares (including Shares represented by the

ADSs) beneficially owned by the Company or held by the Company as treasury shares or held by the Company's depositary that are reserved (but not yet allocated) by the Company for settlement upon

exercise of any Company equity awards, and (c) Shares owned by shareholders who have validly exercised and not effectively withdrawn or lost their rights to dissent from the Merger pursuant to

Section 238 of the Cayman Islands Companies Law, which Shares will be cancelled in accordance with the procedures set out in Section 238 of the Cayman Islands Companies Law and the

holders of such shares shall be entitled to receive the fair value of such Shares determined in accordance with the provisions of Section 238 of the

Cayman Islands Companies Law (the "Dissenting Shares"). The Rollover Shares will be cancelled for no consideration. The Dissenting Shares will be cancelled for their fair value or other agreed value

as described in more detail below.

In

addition, at the Effective Time,

- •

- (a) vesting of each option (the "Company Option") to purchase Shares granted under the Company's 2009 Stock Option Plan, 2010 Share

Incentive Plan and 2012 Share Incentive Plan, each as amended (the "Share Incentive Plan") issued and outstanding as of the effective time of the Merger and having an exercise price per Share less

than US$0.1884 will be accelerated by 12 months, (b) vesting of each Company Option issued and outstanding as of the effective time of the Merger and having an exercise price per Share

equal to or greater than US$0.1884 will be accelerated as to all of the covered Shares, and (c) vesting of each Company restricted share award issued under the Share Incentive Plan (the

"Company Restricted Share") issued and outstanding as of the effective time of the Merger will be accelerated by 12 months, except for certain awards that will be accelerated by three months or

vest immediately prior to the Effective Time;

- •

- each vested Company Option (including after application of any acceleration), will be cancelled and converted into the right to

receive an amount equal to the product of (a) the excess of US$0.1884 over the exercise price payable per Share under such Company Option multiplied by (b) the number of Shares covered

under such vested Company Option, in cash, without interest and net of any applicable withholding taxes; if the exercise price of a Company option is greater

ii

Table of Contents

The

payment in connection with the treatment of applicable vested Company Options and vested Company Restricted Shares will be made by the Surviving Corporation as soon as practicable

following the Effective Time.

An

independent committee of the board of directors of the Company (the "Special Committee"), composed solely of directors unrelated to any of the management members of the Company,

Parent and Merger Sub, reviewed and considered the terms and conditions of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. The Special Committee, after due

consideration, has unanimously determined that (a) the Merger, on the terms and subject to the consideration set forth in the Merger Agreement and the Plan of Merger, is substantively and

procedurally fair to, and in the best interests of, the Company and its unaffiliated shareholders, and declared it advisable to enter into the merger agreement, (b) approved the Merger

Agreement, the Plan of Merger and the Transactions, including the Merger, and (c) recommended that the board of directors of the Company approve and authorize the Merger Agreement, the Plan of

Merger and the Transactions, including the Merger.

The

board of directors of the Company, after carefully considering all relevant factors, including the unanimous determination and recommendation of the independent committee, in a

meeting held on December 11, 2015, unanimously (other than Mr. Wang and Mr. Cheng who abstained from the vote) (a) determined that the Merger, on the terms and subject to

the consideration set forth in the Merger Agreement and the Plan of Merger, is substantively and procedurally fair to, and in the best interests of, the Company and its unaffiliated shareholders, and

declared it advisable to enter into the Merger Agreement, (b) approved the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and (c) recommended that the

Company's shareholders vote FOR the approval and authorization of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger.

The Company's board of directors unanimously (other than Mr. Wang and Mr. Cheng who abstained from the vote) recommends that you vote FOR the

proposal to approve and authorize the

iii

Table of Contents

Merger Agreement, the Plan of Merger and the Transactions, including the Merger, FOR the proposal THAT the directors of the Company be authorized to do all things necessary to give effect to the

Merger Agreement, the Plan of Merger and the Transactions, including the Merger and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional

proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general

meeting.

When

considering the recommendation of the Special Committee and the board of directors of the Company, you should be aware that some of the Company's directors and executive officers

have interests in the Merger that are different from, or in addition to, the interests of the Company's shareholders generally. Mr. Wang, Mr. Cheng and Mr. Zeng have elected to

roll-over the Rollover Shares.

The

accompanying proxy statement provides you with detailed information about the Merger and the extraordinary general meeting. We encourage you to read the entire document and all of

the attachments and other documents referred to or incorporated by reference herein carefully. You may also obtain more information about the Company from documents the Company has filed with the

Securities and Exchange Commission, referred to herein as the "SEC", which are available for free at the SEC's website www.sec.gov.

Regardless

of the number of the Shares you own, your vote is very important. The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions,

including the Merger, are approved by a special resolution (as defined in the Cayman Islands Companies Law), being a resolution passed by an affirmative vote of at least two-thirds of the Shares

present and voting in

person or by proxy as a single class at the extraordinary general meeting of which notice specifying the intention to prepare the resolution as a special resolution has been duly given, referred to

herein as a "special resolution." Whether or not you plan to attend the extraordinary general meeting, please complete the enclosed proxy card, in accordance with the instructions set forth on your

proxy card, as promptly as possible. The deadline to lodge your proxy card is , 2016 at

(Beijing time). Voting

at the extraordinary general meeting will take place by poll voting, each shareholder having one vote for each Share held as of the close of business in the Cayman Islands on

, 2016.

JPMorgan

Chase Bank, N.A., in its capacity as the ADS depositary and referred to herein as the "ADS Depositary", holds on deposit the Shares that are represented by the ADSs. The ADS

Depositary will endeavor to vote (or will endeavor to cause the vote of) the Shares it holds on deposit at the extraordinary general meeting in accordance with the voting instructions timely received

from holders of the ADSs as of the close of business in New York City on , 2016, the ADS record date. The ADS Depositary must receive such

instructions no

later than New York City time on , 2016. Holders of the ADSs will not be able to attend the

extraordinary

general meeting unless they cancel their ADSs and become holders of the Shares prior to the close of business in the Cayman Islands on , 2016, the Share

Record Date. ADS holders who wish to cancel their ADSs need to make arrangements to deliver the ADSs to the ADS Depositary for cancellation before the close of business in New York City on

, 2016, together with (a) delivery instructions for the corresponding Shares (name and address of person who will be the registered holder of the

Shares), (b) payment of the ADS cancellation fees (US$0.05 per ADS to be cancelled) and related expenses and taxes (such as stamp taxes and share transfer taxes), and (c) a certification

that the ADS holder either (i) held the ADSs as of the applicable ADS record date for the extraordinary general meeting and has not given, and will not give, voting instructions to the ADS

depositary as to the ADSs being cancelled, or has given voting instructions to the ADS Depositary as to the ADSs being cancelled but undertakes not to vote the corresponding Shares at the

extraordinary general meeting, or (ii) did not hold the ADSs as of the applicable ADS record date for the extraordinary general meeting and undertakes not to vote the corresponding Shares at

the extraordinary general meeting. Upon cancellation of the ADSs,

iv

Table of Contents

the

ADS Depositary will arrange for J.P. Morgan Chase Banks N.A., Hong Kong Branch (DCC), the custodian holding the Shares, to transfer registration of the Shares to the former ADS holder (or a person

designated by the former ADS holder). If after the registration of Shares in your name you wish to receive a certificate evidencing the Shares registered in your name, you will need to request the

registrar of the Shares to issue and mail a certificate to your attention.

Voting

at the extraordinary general meeting will take place by poll voting, as required by the Company's articles of association.

Shareholders

who continue to hold their Shares until the consummation of the Merger will have the right to seek appraisal and payment of the fair value of their Shares, but only if they

deliver to the

Company, before the vote is taken, a written objection to the Merger and subsequently comply with all procedures and requirements of Section 238 of the Cayman Islands Companies Law for the

exercise of appraisal rights, which is attached as Annex G to the accompanying proxy statement. The fair value of your Shares as determined under the Cayman Islands Companies Law could be more

than, the same as, or less than the merger consideration you would receive pursuant to the Merger Agreement if you did not exercise appraisal rights with respect to your Shares.

ADS HOLDERS WILL NOT HAVE THE RIGHT TO EXERCISE DISSENTERS' RIGHTS AND RECEIVE PAYMENT OF THE FAIR VALUE OF THE SHARES UNDERLYING THE ADSs. THE ADS DEPOSITARY

WILL NOT EXERCISE OR ATTEMPT TO EXERCISE ANY DISSENTERS' RIGHTS WITH RESPECT TO ANY OF THE SHARES THAT IT HOLDS, EVEN IF AN ADS HOLDER REQUESTS THE ADS DEPOSITARY TO DO SO. ADS HOLDERS WISHING TO

EXERCISE DISSENTERS' RIGHTS MUST SURRENDER THE ADSs TO THE ADS DEPOSITARY, PAY THE ADS DEPOSITARY'S FEES REQUIRED FOR THE CANCELLATION OF THEIR ADSs, PROVIDE INSTRUCTIONS FOR THE REGISTRATION OF THE

CORRESPONDING SHARES IN THE COMPANY'S REGISTER OF MEMBERS, CERTIFY THAT THEY HAVE NOT GIVEN, AND WILL NOT GIVE, VOTING INSTRUCTIONS AS TO TH ADSs (OR, ALTERNATIVELY, THAT THEY WILL NOT VOTE THE

CORRESPONDING SHARES) BEFORE (NEW YORK CITY TIME) ON

, 2016 AND BECOME REGISTERED HOLDERS OF SHARES BEFORE THE

VOTE ON THE MERGER IS TAKEN AT THE EXTRAORDINARY GENERAL MEETING. THEREAFTER, SUCH FORMER ADS HOLDERS MUST COMPLY WITH THE PROCEDURES AND REQUIREMENTS FOR EXERCISING DISSENTERS' RIGHTS WITH RESPECT TO

THE SHARES UNDER SECTION 238 OF THE CAYMAN ISLANDS COMPANIES LAW. IF THE MERGER IS NOT COMPLETED, THE COMPANY WOULD CONTINUE TO BE A PUBLIC COMPANY IN THE UNITED STATES AND ADSs WOULD CONTINUE

TO BE LISTED ON THE NYSE. SHARES ARE NOT LISTED AND CANNOT BE TRADED ON ANY STOCK EXCHANGE OTHER THAN THE NYSE, AND IN SUCH CASE ONLY IN THE FORM OF ADSs. AS A RESULT, IF A FORMER ADS HOLDER HAS

CANCELLED OR CONVERTED HIS, HER OR ITS ADSs TO EXERCISE DISSENTERS' RIGHTS AND THE MERGER IS NOT COMPLETED AND SUCH FORMER ADS HOLDER WISHES TO BE ABLE TO SELL HIS, HER OR ITS SHARES ON A STOCK

EXCHANGE, SUCH FORMER ADS HOLDER WOULD NEED TO DEPOSIT HIS, HER OR ITS SHARES INTO THE COMPANY'S ADS PROGRAM FOR THE ISSUANCE OF THE CORRESPONDING NUMBER OF ADSs, SUBJECT TO THE TERMS AND CONDITIONS

OF APPLICABLE LAW AND THE DEPOSIT AGREEMENT, INCLUDING, AMONG OTHER THINGS, PAYMENT OF RELEVANT FEES OF THE ADS DEPOSITARY FOR THE ISSUANCE OF ADSs AND APPLICABLE SHARE TRANSFER TAXES (IF ANY) AND

RELATED CHARGES PURSUANT TO THE DEPOSIT AGREEMENT.

Neither

the SEC nor any state securities regulatory agency has approved or disapproved the Merger, passed upon the merits or fairness of the Merger or passed upon the adequacy or

accuracy of the disclosure in this letter or in the accompanying notice of the extraordinary general meeting or proxy statement. Any representation to the contrary is a criminal offense.

v

Table of Contents

If

you have any questions or need assistance voting your Shares, please call our Investor Relations Department at +86(21) 6128-0056 Ext 8651.

Thank

you for your cooperation and continued support.

|

|

|

Sincerely, |

|

Sincerely, |

Shengwen Rong |

|

Jason Liqing Zeng |

Chairman of the Special Committee |

|

Chairman of the Board |

The accompanying proxy statement is dated , 2016, and is first being mailed to the Company's shareholders and ADS

holders on or about , 2016.

vi

Table of Contents

TAOMEE HOLDINGS LIMITED

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD

ON

, 2016

Dear

Shareholder:

Notice

is hereby given that an extraordinary general meeting (the "EGM") of the shareholders of Taomee Holdings Limited (referred to herein alternately as "the Company," "us," "we" or

other terms

correlative thereto), will be held on 2016 at

(Beijing time) at the offices of 16/F, Building No. A-2,

No. 1528 Gumei Road, Xuhui District, Shanghai, China.

Only

registered holders of ordinary shares of the Company, par value US$0.00002 per share (each, a "Share"), as of the close of business in the Cayman Islands on

(the "Share Record Date")

or their proxy holders are entitled to attend and vote at this extraordinary general meeting or any adjournment thereof. At the

extraordinary general meeting, you will be asked to consider and vote upon the following resolutions:

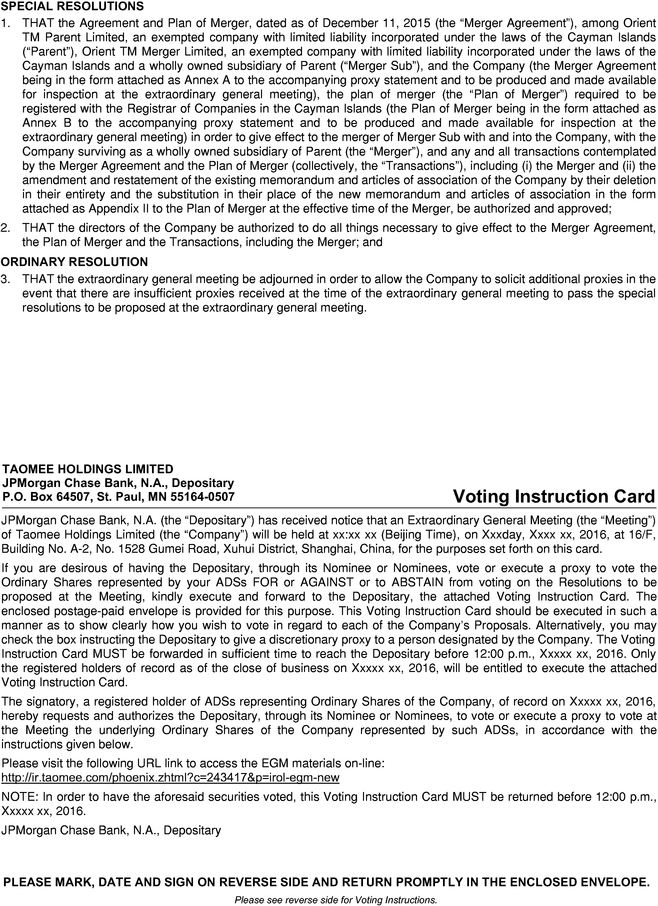

as

special resolutions:

THAT the Agreement and Plan of Merger, dated as of December 11, 2015 (the "Merger

Agreement"), among Orient Tm Parent Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands

("Parent"), Orient TM Merger Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned

subsidiary of Parent ("Merger Sub"), and the Company (the Merger Agreement being in the form attached as Annex A to the accompanying proxy

statement and to be produced and made available for inspection at the extraordinary general meeting), the plan of merger (the "Plan of Merger") required

to be registered with the Registrar of Companies in the Cayman Islands (the Plan of Merger being in the form attached as Annex B to the accompanying proxy statement and to be produced and made

available for inspection at the extraordinary general meeting) in order to give effect to the merger of Merger Sub with and into the Company, with the Company surviving as a wholly owned subsidiary of

Parent (the "Merger"), and any and all transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the

"Transactions"), including (i) the Merger and (ii) the amendment and restatement of the existing memorandum and articles of association of

the Company by their deletion in their entirety and the substitution in their place of the new memorandum and articles of association in the form attached as Appendix II to the Plan of Merger

at the effective time of the Merger, be authorized and approved;

THAT the directors of the Company be authorized to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and

the Transactions, including the Merger; and

as

ordinary resolution (if necessary):

THAT the extraordinary general meeting be adjourned in order to allow the Company to solicit additional proxies in the event that there

are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

Please

refer to the accompanying proxy statement, which is attached to and made a part of this notice. A list of the Company's shareholders will be available at its principal executive

offices at 16/F, Building

No. A-2, No. 1528 Gumei Road, Xuhui District, Shanghai 200233, People's Republic of China, during ordinary business hours for the two business days immediately prior to the

extraordinary general meeting.

Certain

existing shareholders of the Company, namely Mr. Benson Haibing Wang, the co-founder, chief executive officer and a director of the Company ("Mr. Wang"),

Mr. Roc Yunpeng Cheng, the

vii

Table of Contents

co-founder,

president and a director of the Company ("Mr. Cheng"), Mr. Jason Liqing Zeng, the chairman of the board of directors of the Company ("Mr. Zeng") have entered into a

rollover and support agreement, dated as of December 11, 2015 and as amended and restated on December 31, 2015 (as may be amended from time to time, the "Rollover and Support

Agreement"), with Parent, pursuant to which they have agreed, among other things, that: (a) Mr. Wang, Mr. Cheng and Mr. Zeng will vote all 325,981,725 Shares beneficially

owned by them, which represent approximately 45.8% of the total voting power thereof, in favor of the authorization and approval of the Merger Agreement and the Merger, and (b) Mr. Wang

has agreed to roll-over 86,392,592 Shares beneficially held him, Mr. Cheng has agreed to roll-over 71,392,593 Shares beneficially held by him, and Mr. Zeng has agreed to roll-over

35,576,008 Shares beneficially held by him through Frontier Technology, respectively, in the Company, which collectively represent approximately 27.2% of the total number of issued and outstanding

Shares (the "Rollover Shares") and which will be cancelled at the Effective Time of the Merger for no consideration.

As

of the date of the accompanying proxy statement, Mr. Wang, himself and through Joy Union Holdings Limited ("Joy Union"), beneficially owns 86,706,592 Shares, representing

approximately 12.2% of the total number of issued and outstanding Shares, Mr. Cheng, himself and through Charming China Limited ("Charming China"), beneficially owns 71,706,593 Shares,

representing approximately 10.1% of the total number of issued and outstanding Shares, and Mr. Zeng, through Frontier Technology Holdings Limited and Speednext Industrial Limited, beneficially

owns 167,568,540 Shares, representing approximately 23.5% of the total number of issued and outstanding Shares. Immediately following the consummation of the Merger, Parent will be beneficially owned

by (i) an affiliate of Orient Ruide Capital Management (Shanghai) Co., Ltd. (the "Sponsor"); and (ii) Mr. Wang, Mr. Cheng (together with Mr. Wang and

the Sponsor, the "Buyer Group"), and Mr. Zeng, who have elected to roll-over an aggregate of 193,361,193 ordinary shares of the Company (the "Shares") in connection with the Merger (the

"Rollover Shares").

After

careful consideration and upon the unanimous recommendation of a special committee (the "Special Committee") of the board of directors of the Company (the "Board"), composed solely

of directors who are unaffiliated with any of the management members of the Company, Parent and Merger Sub, the Board, acting upon the unanimous recommendation of the Special Committee, unanimously

(other than Mr. Wang and Mr. Cheng who abstained from the vote) (a) determined that it was fair to, advisable and in the best interests of the Company and its shareholders and ADS

holders,

other than the members of the Buyer Group (or any of their respective affiliates) and the directors and officers of the Company (such shareholders and ADS holders, other than the members of the Buyer

Group (or any of their respective affiliates) and the directors and officers of the Company, are referred to herein as the "Unaffiliated Holders") for the Company to enter into the Merger Agreement,

the Plan of Merger and the Transactions, including the Merger; (b) authorized and approved the execution, delivery and performance by the Company of the Merger Agreement, the Plan of Merger and

the Limited Guaranties executed by each of the Sponsor, Mr. Wang and Joy Union, and Mr. Cheng and Charming China in favor of the Company (the "Limited Guaranties"), and the consummation

of the Transactions, including the Merger and the Limited Guaranties; and (c) resolved to recommend in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and t

the Transactions, including the Merger, to the shareholders of the Company and directed that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, be submitted to a vote

of the shareholders of the Company for authorization and approval.

Regardless

of the number of Shares that you own, your vote is very important. The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions,

including the Merger, are authorized and approved by a special resolution of the Company passed by an affirmative vote of shareholders representing two-thirds or more of Shares (including Shares

represented by ADSs) present and voting in person or by proxy as a single class at the extraordinary general meeting. Given

viii

Table of Contents

the

Mr. Wang, Mr. Cheng and Mr. Zeng's beneficial ownership as described above and assuming they comply with their voting undertakings under the Rollover and Support Agreement,

based on the number of Shares expected to be issued and outstanding and entitled to vote as of the close of business in the Cayman Islands on the Share Record Date,

Shares (representing approximately % of the number of Shares expected to be issued and

outstanding and