- Q3 consolidated comparable store sales increased 3%, at the

high-end of the Company’s plan, and were entirely driven by an

increase in customer transactions

- Q3 pretax profit margin of 12.3%, up 0.3 percentage points

versus last year and well above the Company’s plan

- Q3 diluted earnings per share of $1.14, up 11% versus last

year and well above the Company’s plan

- Increases outlook for FY25 pretax profit margin and earnings

per share

- Returned $997 million to shareholders in Q3 through share

repurchases and dividends

- Completed investment for its joint venture with Grupo

Axo

- After the end of Q3, the Company completed its investment in

Brands For Less

- Planning to enter Spain with its TK Maxx banner in early

2026

The TJX Companies, Inc. (NYSE: TJX), the leading off-price

apparel and home fashions retailer in the U.S. and worldwide, today

announced sales and operating results for the third quarter ended

November 2, 2024. Net sales for the third quarter of Fiscal 2025

were $14.1 billion, an increase of 6% versus the third quarter of

Fiscal 2024. Third quarter Fiscal 2025 consolidated comparable

store sales increased 3%. Net income for the third quarter of

Fiscal 2025 was $1.3 billion and diluted earnings per share were

$1.14, up 11% versus $1.03 in the third quarter of Fiscal 2024.

For the first nine months of Fiscal 2025, net sales were $40.0

billion, an increase of 6% versus the first nine months of Fiscal

2024. Consolidated comparable store sales for the first nine months

of Fiscal 2025 increased 3%. Net income for the first nine months

of Fiscal 2025 was $3.5 billion. For the first nine months of

Fiscal 2025, diluted earnings per share were $3.03, up 14% versus

$2.65 in the first nine months of Fiscal 2024.

CEO and President

Comments

Ernie Herrman, Chief Executive Officer and President of The TJX

Companies, Inc., stated, “I am very pleased with our third quarter

results and the strong execution of our off-price business

fundamentals by our teams. Our comp store sales increase of 3% was

at the high-end of our plan, and both pretax profit margin and

earnings per share came in well above our expectations. Across the

Company, customer transactions drove our comp sales increases,

which tells us that our values and treasure hunt shopping

experience are appealing to a wide range of customers. I want to

specifically highlight our European team for their strong results,

which drove the 7% comp increase at our TJX International division.

With our above-plan profitability results in the third quarter, we

are raising our full year guidance for pretax profit margin and

earnings per share. The fourth quarter is off to a strong start,

and we are excited about our opportunities for the holiday selling

season. In stores and online, we are offering consumers an

ever-changing and inspiring shopping destination for gifts at

excellent values, and feel confident that there will be something

for everyone when they shop us. Going forward, we continue to see

great potential to successfully grow TJX around the globe well into

the future.”

Comparable Store Sales by

Division

The Company’s comparable store sales by division for the third

quarter of Fiscal 2025 and Fiscal 2024 were as follows:

Third Quarter

Comparable Store

Sales1

FY2025

FY2024

Marmaxx (U.S.)2

+2%

+7%

HomeGoods (U.S.)3

+3%

+9%

TJX Canada

+2%

+3%

TJX International (Europe &

Australia)

+7%

+1%

TJX

+3%

+6%

1Comparable store sales excludes

e-commerce. 2Includes TJ Maxx, Marshalls, and Sierra stores.

3Includes HomeGoods and Homesense stores.

Net Sales by Division

The Company’s net sales by division for the third quarter of

Fiscal 2025 and Fiscal 2024 were as follows:

Third Quarter Net

Sales

($ in millions)1

Third Quarter

FY2025

Reported Sales

Growth

Third Quarter

FY2025

Sales Growth on a

Constant

Currency Basis2

FY2025

FY2024

Marmaxx (U.S.)3

$8,438

$8,107

+4%

N.A.

HomeGoods (U.S.)4

$2,355

$2,208

+7%

N.A.

TJX Canada

$1,382

$1,317

+5%

+6%

TJX International (Europe &

Australia)5

$1,888

$1,633

+16%

+11%

TJX

$14,063

$13,265

+6%

+5%

1Net sales in TJX Canada and TJX

International include the impact of foreign currency exchange

rates. 2Reflects net sales adjusted for the impact of foreign

currency; see Impact of Foreign Currency Exchange Rates, below.

3Includes TJ Maxx, Marshalls, and Sierra stores as well as their

e-commerce sites. 4Includes HomeGoods and Homesense stores (and

homegoods.com for FY2024 only). 5Includes TK Maxx and Homesense

stores, as well as TK Maxx e-commerce sites in Europe.

Margins

For the third quarter of Fiscal 2025, the Company’s pretax

profit margin was 12.3%, up 0.3 percentage points versus last

year’s third quarter pretax profit margin of 12.0%.

The Company’s third quarter Fiscal 2025 pretax profit margin was

above the high-end of its plan by 0.4 percentage points, primarily

driven by the timing of certain expenses, expense savings, and

higher net interest income.

Gross profit margin for the third quarter of Fiscal 2025 was

31.6%, up 0.5 percentage points versus last year, primarily due to

an increase in merchandise margin.

Selling, general and administrative (SG&A) costs as a

percent of sales for the third quarter of Fiscal 2025 were 19.5%, a

0.1 percentage point increase versus last year.

Impact of Foreign Currency Exchange

Rates

Changes in foreign currency exchange rates affect the

translation of sales and earnings of the Company’s international

businesses into U.S. dollars for financial reporting purposes. In

addition, ordinary course, inventory-related hedging instruments

are marked to market at the end of each quarter. Changes in

currency exchange rates can have a material effect on the magnitude

of these translations and adjustments when there is significant

volatility in currency exchange rates. Given the global operations

of the Company, to facilitate comparability, the Company has

provided sales growth and inventory on a constant currency basis,

which assumes a constant exchange rate between periods for

translation based on the rate in effect for the prior period.

The movement in foreign currency exchange rates had a one

percentage point positive impact on the Company’s net sales growth

in the third quarter of Fiscal 2025 versus the prior year. The

overall net impact of foreign currency exchange rates had a $.01

positive impact on third quarter Fiscal 2025 diluted earnings per

share.

The movement in foreign currency exchange rates had a neutral

impact on the Company’s net sales growth in the first nine months

of Fiscal 2025 versus the prior year. The overall net impact of

foreign currency exchange rates had a $.01 positive impact on the

first nine months of Fiscal 2025 diluted earnings per share.

A table detailing the impact of foreign currency on TJX’s net

sales and pretax profit margins, as well as those of its

international businesses, can be found in the Investors section of

TJX.com. The foreign currency exchange rate impact to diluted

earnings per share does not include the impact currency exchange

rates have on various transactions, which the Company refers to as

“transactional foreign exchange.”

Inventory

Total inventories as of November 2, 2024 were $8.4 billion,

compared to $8.3 billion at the end of the third quarter of Fiscal

2024. Consolidated inventories on a per-store basis as of November

2, 2024, including distribution centers, but excluding inventory in

transit, the Company’s e-commerce sites, and Sierra stores, were

down 2% on both a reported and constant currency basis versus last

year. Inventory on a constant currency basis reflects inventory

adjusted for the impact of foreign currency exchange rates, if any,

as described above. The Company is well-positioned to take

advantage of the outstanding availability in the marketplace and

deliver an eclectic mix of exciting gifts to its stores and online

throughout this holiday season.

Cash and Shareholder

Distributions

For the third quarter of Fiscal 2025, the Company generated $1.0

billion of operating cash flow and ended the quarter with $4.7

billion of cash.

During the third quarter of Fiscal 2025, the Company returned a

total of $997 million to shareholders. The Company repurchased $574

million of TJX stock, retiring 5.0 million shares, and paid $423

million in shareholder dividends during the quarter.

During the first nine months of Fiscal 2025, the Company

returned a total of $2.9 billion to shareholders. The Company

repurchased a total of $1.7 billion of TJX stock, retiring 15.4

million shares, and paid $1.2 billion in shareholder dividends.

The Company now expects to repurchase approximately $2.25 to

$2.5 billion of TJX stock during the fiscal year ending February 1,

2025. The Company may adjust the amount purchased under this plan

up or down depending on various factors. The Company remains

committed to returning cash to its shareholders while continuing to

invest in the business to support the near- and long-term growth of

TJX.

Fourth Quarter and Full Year Fiscal

2025 Outlook

For the fourth quarter of Fiscal 2025, the Company continues to

expect consolidated comparable store sales to be up 2% to 3%. The

Company now expects pretax profit margin to be in the range of

10.8% to 10.9% and diluted earnings per share to be in the range of

$1.12 to $1.14. The change in the Company’s fourth quarter pretax

profit margin and earnings per share guidance is due to the

expected reversal of the third quarter benefit from the timing of

certain expenses.

For the full year Fiscal 2025, the Company continues to expect

consolidated comparable store sales to be up 3%. The Company is

increasing its outlook for pretax profit margin to be 11.3% and

raising its diluted earnings per share outlook to be in the range

of $4.15 to $4.17.

As a reminder, last year’s fourth quarter and full year pretax

profit margin and earnings per share benefited from an extra week

in the Company’s fiscal calendar.

Joint Venture in Mexico with Grupo

Axo

During the third quarter of Fiscal 2025, the Company completed

its investment in the joint venture with Grupo Axo, S.A.P.I. de

C.V. (Axo) an operator of global brands in Mexico and South America

that includes both full- and off-price formats. The purchase price

for TJX was $179 million in cash. Under the terms of the definitive

agreements, TJX owns 49% and Axo owns 51% of the joint venture. The

joint venture is comprised of Multibrand Outlet Stores, S.A.P.I. de

C.V., Axo’s off-price, physical store business in Mexico, which

includes a total of over 200 stores for its Promoda, Reduced, and

Urban Store banners. TJX has the option to increase its ownership

interest in the joint venture over the long term. Both TJX and Axo

expect to make additional future investments in the joint venture

to support the expected growth of the business. TJX does not expect

this joint venture to have a material impact on its fourth quarter

or full year Fiscal 2025 financial results.

Investment in Brands for

Less

After the end of the third quarter of Fiscal 2025, the Company

completed its investment for a 35% non-controlling, minority equity

stake in Brands For Less (BFL) for $344 million. BFL is based in

Dubai and is the region’s only major off-price branded apparel,

toys, and home fashions retailer. BFL currently operates over 100

stores, primarily in the UAE and Saudi Arabia, as well as an

e-commerce business. The Company does not expect this investment to

have a material impact on its fourth quarter or full year Fiscal

2025 financial results.

Stores by Concept

During the fiscal quarter ended November 2, 2024, the Company

increased its store count by 56 stores overall to a total of 5,057

stores and increased square footage by 1.1% versus the prior

quarter.

Store Locations1

Third Quarter

FY2025

Gross Square Feet

Third Quarter

FY2025

(in millions)

Beginning

End

Beginning

End

In the U.S.:

TJ Maxx

1,326

1,331

35.9

36.0

Marshalls

1,204

1,219

33.8

34.2

HomeGoods

930

941

21.7

22.0

Sierra

101

109

2.1

2.3

Homesense

62

67

1.7

1.8

In Canada:

Winners

304

307

8.3

8.4

HomeSense

160

160

3.8

3.8

Marshalls

108

109

2.9

2.9

In Europe:

TK Maxx

645

653

17.9

18.1

Homesense

77

77

1.4

1.4

In Australia:

TK Maxx

84

84

1.7

1.7

TJX

5,001

5,057

131.2

132.6

1Store counts above include both

banners within a combo or a superstore.

Global Corporate Responsibility

Report

During the third quarter of Fiscal 2025, the Company issued its

2024 Global Corporate Responsibility Report, covering programs and

progress related to the Company’s four reporting areas of

workplace, communities, environmental sustainability, and

responsible sourcing. As part of the Company’s voluntary corporate

responsibility disclosure, the report also includes greenhouse gas

(GHG) emissions and other corporate responsibility-related data

tables, as well as an index for select metrics from the

Sustainability Accounting Standards Board (SASB) and the United

Nations Sustainable Development Goals (UN SDGs). TJX has reported

on its corporate responsibility efforts since 2011. More

information can be found at TJX.com/responsibility.

About The TJX Companies,

Inc.

The TJX Companies, Inc., a Fortune 100 company, is the leading

off-price retailer of apparel and home fashions in the U.S. and

worldwide. Our mission is to deliver great value to customers every

day. We do this by offering a rapidly changing assortment of

quality, fashionable, brand name, and designer merchandise at

prices generally 20% to 60% below full-price retailers’ regular

prices on comparable merchandise. We operate over 5,000 stores

across nine countries, including TJ Maxx, Marshalls, HomeGoods,

Homesense, and Sierra in the U.S.; Winners, HomeSense, and

Marshalls in Canada; TK Maxx and Homesense in Europe, and TK Maxx

in Australia. We also operate e-commerce sites for TJ Maxx,

Marshalls, and Sierra in the U.S. and three sites for TK Maxx in

Europe. Our value mission extends to our corporate responsibility

efforts, which are focused on supporting our Associates, giving

back in the communities we serve, the environment, and operating

responsibly. Additional information about TJX’s press releases,

financial information, and corporate responsibility are available

at TJX.com.

Third Quarter Fiscal 2025 Earnings

Conference Call

At 11:00 a.m. ET today, Ernie Herrman, Chief Executive Officer

and President of TJX, will hold a conference call to discuss the

Company’s third quarter Fiscal 2025 results, operations, and

business trends. A real-time webcast of the call will be available

to the public at TJX.com. A replay of the call will also be

available by dialing (866) 367-5577 (toll free) or (203) 369-0233

through Tuesday, November 26, 2024, or at TJX.com.

Non-GAAP Financial

Information

The Company reports its financial results in accordance with

generally accepted accounting principles in the U.S. (GAAP).

However, management believes that certain non-GAAP financial

measures may provide users of this financial information additional

meaningful comparisons between current results and results in prior

operating periods and between results in prior periods and

expectations for future periods. Management believes that these

non-GAAP financial measures can provide additional meaningful

reflection of underlying trends of the business because they

provide a comparison of historical information that excludes

certain items that affect overall comparability. Non-GAAP financial

measures used in this press release include sales growth on a

constant currency basis and inventory on a constant currency basis.

The Company uses these non-GAAP financial measures in making

financial, operating, and planning decisions and in evaluating the

Company’s performance, including relative to others in the market.

Management also uses these non-GAAP measures to consider underlying

trends of the Company’s business and believes presenting these

measures also provides information to investors and others for

understanding and evaluating trends in the Company’s operating

results or measuring performance in the same manner as the

Company’s management. Non-GAAP financial measures should be

considered in addition to, and not as an alternative for, the

Company’s reported results prepared in accordance with GAAP. The

use of these non-GAAP financial measures may differ from similar

measures reported by other companies and may not be comparable to

other similarly titled measures.

Important Information at

Website

Archived versions of the Company’s conference calls are

available in the Investors section of TJX.com after they are no

longer available by telephone, as are reconciliations of non-GAAP

financial measures to GAAP financial measures and other financial

information. The Company routinely posts information that may be

important to investors in the Investors section at TJX.com. The

Company encourages investors to consult that section of its website

regularly.

Forward-looking

Statement

Various statements made in this release are forward-looking, and

are inherently subject to a number of risks and uncertainties. All

statements that address activities, events or developments that we

intend, expect or believe may occur in the future are

forward-looking statements, including, among others, statements

regarding the Company’s anticipated operating and financial

performance, business plans and prospects, investments, dividends

and share repurchases, and fourth quarter and full-year Fiscal 2025

outlook. These statements are typically accompanied by the words

“aim,” “anticipate,” “aspire,” “believe,” “continue,” “could,”

“should,” “estimate,” “expect,” “forecast,” “goal,” “hope,”

“intend,” “may,” “plan,” “project,” “potential,” “seek,” “strive,”

“target,” “will,” “would,” or similar words, although not all

forward-looking statements contain these identifying words. Each

forward-looking statement contained in this press release is

inherently subject to risks, uncertainties and potentially

inaccurate assumptions that could cause actual results to differ

materially from those expressed or implied by such statement. We

cannot guarantee that the results and other expectations expressed,

anticipated or implied in any forward-looking statement will be

realized. Applicable risks and uncertainties include, among others,

execution of buying strategy and inventory management; customer

trends and preferences; competition; various marketing efforts;

operational and business expansion; management of large size and

scale; merchandise sourcing and transport; data security and

maintenance and development of information technology systems;

labor costs and workforce challenges; personnel recruitment,

training and retention; corporate and retail banner reputation;

evolving corporate governance and public disclosure regulations and

expectations with respect to environmental, social and governance

matters; expanding international operations; fluctuations in

quarterly operating results and market expectations; inventory or

asset loss; cash flow; mergers, acquisitions, or business

investments and divestitures, closings or business consolidations;

real estate activities; economic conditions and consumer spending;

market instability; severe weather, serious disruptions or

catastrophic events; disproportionate impact of disruptions during

this fiscal year; commodity availability and pricing; fluctuations

in currency exchange rates; compliance with laws, regulations and

orders and changes in laws, regulations and applicable accounting

standards; outcomes of litigation, legal proceedings and other

legal or regulatory matters; quality, safety and other issues with

our merchandise; tax matters; and other factors set forth under

Item 1A of our most recent Annual Report on Form 10-K, as well as

other information we file with the Securities and Exchange

Commission ( “SEC”).

We caution investors, potential investors and others not to

place considerable reliance on the forward-looking statements

contained in this release. You are encouraged to read any further

disclosures we may make in our future reports to the SEC, available

at www.sec.gov, on our website, or otherwise. Our forward-looking

statements in this release speak only as of the date of this

release, and we undertake no obligation to update or revise any of

these statements, unless required by law, even if experience or

future changes make it clear that any projected results expressed

or implied in such statements will not be realized. Our business is

subject to substantial risks and uncertainties, including those

referenced above. Investors, potential investors, and others should

give careful consideration to these risks and uncertainties.

The TJX Companies, Inc. and

Consolidated Subsidiaries

Financial Summary

(Unaudited)

(In Millions Except Per Share

Amounts)

Thirteen Weeks Ended

Thirty-Nine Weeks Ended

November 2,

2024

October 28,

2023

November 2,

2024

October 28,

2023

Net sales

$

14,063

$

13,265

$

40,010

$

37,806

Cost of sales, including buying and

occupancy costs

9,622

9,139

27,741

26,423

Selling, general and administrative

expenses

2,748

2,578

7,814

7,375

Interest (income) expense, net

(43

)

(41

)

(139

)

(116

)

Income before income taxes

1,736

1,589

4,594

4,124

Provision for income taxes

439

398

1,128

1,053

Net income

$

1,297

$

1,191

$

3,466

$

3,071

Diluted earnings per share

$

1.14

$

1.03

$

3.03

$

2.65

Cash dividends declared per share

$

0.375

$

0.3325

$

1.125

$

0.9975

Weighted average common shares –

diluted

1,141

1,158

1,144

1,161

The TJX Companies, Inc. and

Consolidated Subsidiaries

Condensed Balance Sheets

(Unaudited)

(In Millions)

November 2,

2024

October 28,

2023

Assets:

Current assets:

Cash and cash equivalents

$

4,718

$

4,290

Accounts receivable and other current

assets

1,263

1,231

Merchandise inventories

8,371

8,285

Total current assets

14,352

13,806

Net property at cost

7,136

6,262

Operating lease right of use assets

9,570

9,289

Goodwill

95

94

Other assets

1,283

900

Total assets

$

32,436

$

30,351

Liabilities and shareholders' equity:

Current liabilities:

Accounts payable

$

5,617

$

5,425

Accrued expenses and other current

liabilities

4,758

4,533

Current portion of operating lease

liabilities

1,642

1,682

Total current liabilities

12,017

11,640

Other long-term liabilities

1,002

908

Non-current deferred income taxes, net

172

133

Long-term operating lease liabilities

8,207

7,976

Long-term debt

2,865

2,861

Shareholders’ equity

8,173

6,833

Total liabilities and shareholders'

equity

$

32,436

$

30,351

The TJX Companies, Inc. and

Consolidated Subsidiaries

Condensed Statements of Cash

Flows

(Unaudited)

(In Millions)

Thirty-Nine Weeks Ended

November 2,

2024

October 28,

2023

Cash flows from operating activities:

Net income

$

3,466

$

3,071

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

795

712

Deferred income tax provision

58

13

Share-based compensation

131

114

Changes in assets and liabilities:

(Increase) in accounts receivable and

other assets

(98

)

(19

)

(Increase) in merchandise inventories

(2,415

)

(2,528

)

(Increase) in income taxes recoverable

(59

)

(17

)

Increase in accounts payable

1,760

1,666

(Decrease) increase in accrued expenses

and other liabilities

(141

)

156

(Decrease) increase in net operating lease

liabilities

(7

)

75

Other, net

(78

)

14

Net cash provided by operating

activities

3,412

3,257

Cash flows from investing activities:

Property additions

(1,404

)

(1,280

)

Purchase of equity investment

(192

)

—

Purchase of investments

(29

)

(22

)

Sales and maturities of investments

18

21

Net cash (used in) investing

activities

(1,607

)

(1,281

)

Cash flows from financing activities:

Repayment of debt

—

(500

)

Payments for repurchase of common

stock

(1,661

)

(1,687

)

Cash dividends paid

(1,226

)

(1,105

)

Proceeds from issuance of common stock

254

203

Other

(42

)

(29

)

Net cash (used in) financing

activities

(2,675

)

(3,118

)

Effect of exchange rate changes on

cash

(12

)

(45

)

Net (decrease) in cash and cash

equivalents

(882

)

(1,187

)

Cash and cash equivalents at beginning of

year

5,600

5,477

Cash and cash equivalents at end of

period

$

4,718

$

4,290

The TJX Companies, Inc. and

Consolidated Subsidiaries

Selected Information by Major

Business Segment

(Unaudited)

(In Millions)

Thirteen Weeks Ended

Thirty-Nine Weeks Ended

November 2,

2024

October 28,

2023

November 2,

2024

October 28,

2023

Net sales:

In the United States:

Marmaxx

$

8,438

$

8,107

$

24,633

$

23,376

HomeGoods

2,355

2,208

6,535

6,185

TJX Canada

1,382

1,317

3,739

3,578

TJX International

1,888

1,633

5,103

4,667

Total net sales

$

14,063

$

13,265

$

40,010

$

37,806

Segment profit:

In the United States:

Marmaxx

$

1,207

$

1,134

$

3,495

$

3,246

HomeGoods

290

228

679

547

TJX Canada

209

223

533

532

TJX International

137

88

271

158

Total segment profit

1,843

1,673

4,978

4,483

General corporate expense

150

125

523

475

Interest (income) expense, net

(43

)

(41

)

(139

)

(116

)

Income before income taxes

$

1,736

$

1,589

$

4,594

$

4,124

The TJX Companies, Inc. and Consolidated

Subsidiaries Notes to Consolidated Condensed Statements

- During the third quarter ended November 2, 2024, the Company

returned $997 million to shareholders, repurchasing and retiring

5.0 million shares of its common stock at a cost of $574 million

and paid $423 million in shareholder dividends. During the nine

months ended November 2, 2024, the Company returned $2.9 billion to

shareholders, repurchasing and retiring 15.4 million shares of its

common stock at a cost of $1.7 billion and paid $1.2 billion in

shareholder dividends. In February 2024, the Company announced that

the Board of Directors had approved a new stock repurchase program

that authorizes the repurchase of up to an additional $2.5 billion

of TJX common stock from time to time. Under this program, TJX had

approximately $1.9 billion available for repurchase as of November

2, 2024.

- During the third quarter ended November 2, 2024, the Company

completed its investment in the joint venture with Grupo Axo,

S.A.P.I. de C.V. (Axo) for a 49% interest in Multibrand Outlet

Stores, S.A.P.I. de C.V., Axo’s off-price, physical store business

for $192 million, which includes a purchase price of $179 million

and acquisition costs of $13 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119733451/en/

Debra McConnell Global Communications (508) 390-2323

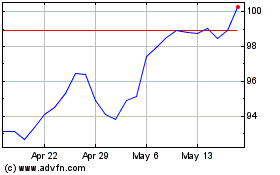

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Oct 2024 to Nov 2024

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Nov 2023 to Nov 2024