TPG RE Finance Trust, Inc. (NYSE: TRTX) (“TRTX” or the

“Company”) reported its operating results for the quarter ended

June 30, 2024.

Regarding second quarter results, Doug Bouquard, Chief Executive

Officer of TRTX, said: “Our investment portfolio delivered strong

performance in the face of an uncertain macroeconomic and real

estate investing environment. During the quarter, TRTX generated

Distributable Earnings of $0.28 per share representing a dividend

coverage ratio of 1.2x. TRTX maintained both ample liquidity of

$389 million and a conservative debt-to-equity ratio of 2:1 which

enhances our ability to seek new investment opportunities across

the evolving real estate credit landscape.”

SECOND QUARTER 2024 ACTIVITY

- Recognized GAAP net income attributable to common stockholders

of $21.0 million, or $0.26 per common share, based on a diluted

weighted average share count of 80.9 million common shares. Book

value per common share was $11.40 as of June 30, 2024.

- Generated Distributable Earnings of $22.3 million, or $0.28 per

common share, based on a diluted weighed average share count of

80.9 million common shares.

- Declared on June 17, 2024 a cash dividend of $0.24 per share of

common stock which was paid on July 25, 2024 to common stockholders

of record as of June 27, 2024. The Company paid on June 28, 2024 to

stockholders of record as of June 18, 2024 a quarterly dividend on

its 6.25% Series C Cumulative Redeemable Preferred Stock of $0.3906

per share.

- Received loan repayments of $186.1 million, including three

full loan repayments of $162.5 million, involving the following

property types: 51.5% office; 35.8% industrial; 11.1% multifamily;

and 1.6% hotel. Additionally, funded $18.1 million of future

funding obligations associated with previously originated and

acquired loans.

- Weighted average risk rating of the Company’s loan portfolio

was 3.0 as of June 30, 2024, unchanged from March 31, 2024.

- Carried at quarter-end an allowance for credit losses of $69.6

million, a decrease of $4.5 million from $74.1 million as of March

31, 2024. The quarter-end allowance equals 208 basis points of

total loan commitments as of June 30, 2024 compared to 210 basis

points as of March 31, 2024.

- Ended the quarter with $389.4 million of near-term liquidity:

$244.2 million of cash-on-hand available for investment, net of

$15.0 million held to satisfy liquidity covenants under the

Company’s secured financing agreements; undrawn capacity under

secured financing arrangements of $127.7 million; and undrawn

capacity under asset-specific financing arrangements and secured

revolving credit facility of $2.4 million.

- Non-mark-to-market borrowings represented 78.7% of total

borrowings at June 30, 2024.

- Filed an S-3 registration statement, which the SEC declared

effective on June 28, 2024, to register the resale of approximately

2.6 million common shares that were acquired by an affiliate of

Starwood Capital Group pursuant to its exercise of warrants in May

2024.

SUBSEQUENT EVENTS

- Closed one first mortgage loan with a total loan commitment of

$96.0 million and initial funding of $95.5 million. The first

mortgage loan is secured by two multifamily properties.

- Received a full loan repayment of one mixed-use first mortgage

loan with a total loan commitment and unpaid principal amount of

$36.4 million and $33.9 million, respectively.

The Company issued a supplemental presentation detailing its

second quarter 2024 operating results, which can be viewed at

http://investors.tpgrefinance.com/.

CONFERENCE CALL AND WEBCAST INFORMATION

The Company will host a conference call and webcast to review

its financial results with investors and other interested parties

at 9:00 a.m. ET on Wednesday, July 31, 2024. To participate in the

conference call, callers from the United States and Canada should

dial +1 (877) 407-9716, and international callers should dial +1

(201) 493-6779, ten minutes prior to the scheduled call time. The

webcast may also be accessed live by visiting the Company’s

investor relations website at

http://investors.tpgrefinance.com/event.

REPLAY INFORMATION

A replay of the conference call will be available after 12:00

p.m. ET on Wednesday, July 31, 2024 through 11:59 p.m. ET on

Wednesday, August 14, 2024. To access the replay, listeners may use

+1 (844) 512-2921 (domestic) or +1 (412) 317-6671 (international).

The passcode for the replay is 13745185. The replay will be

available on the Company’s website for one year after the call

date.

ABOUT TRTX

TPG RE Finance Trust, Inc. is a commercial real estate finance

company that originates, acquires, and manages primarily first

mortgage loans secured by institutional properties located in

primary and select secondary markets in the United States. The

Company is externally managed by TPG RE Finance Trust Management,

L.P., a part of TPG Real Estate, which is the real estate

investment platform of global alternative asset management firm TPG

Inc. (NASDAQ: TPG). For more information regarding TRTX, visit

https://www.tpgrefinance.com/.

FORWARD-LOOKING STATEMENTS

This earnings release contains “forward‐looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward‐looking statements are subject to various

risks and uncertainties, including, without limitation, statements

relating to the performance of the investments of TPG RE Finance

Trust, Inc. (the “Company” or “TRTX”); global economic trends and

economic conditions, including heightened inflation, slower growth

or recession, changes to fiscal and monetary policy, higher

interest rates, stress to the commercial banking systems of the

U.S. and Western Europe, labor shortages, currency fluctuations and

challenges in global supply chains; the Company's ability to

originate loans that are in the pipeline and under evaluation by

the Company; financing needs and arrangements; and the risks,

uncertainties and factors set forth under the heading “Risk

Factors” in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, as such risk factors may be updated

from time to time in the Company’s periodic filings with the

Securities and Exchange Commission (the “SEC”), which are

accessible on the SEC’s website at www.sec.gov. Forward‐looking

statements are generally identifiable by use of forward‐looking

terminology such as “may,” “will,” “should,” “potential,” “intend,”

“expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,”

“could,” “project,” “predict,” “continue” or other similar words or

expressions. Forward‐looking statements are based on certain

assumptions, discuss future expectations, describe existing or

future plans and strategies, contain projections of results of

operations, liquidity and/or financial condition or state other

forward‐looking information. Statements, among others, relating to

the Company’s ability to seek new investment opportunities across

the evolving real estate credit landscape, are forward-looking

statements, and the Company cannot assure you that it will achieve

such results. The ability of TRTX to predict future events or

conditions or their impact or the actual effect of existing or

future plans or strategies is inherently uncertain. Although the

Company believes that such forward‐looking statements are based on

reasonable assumptions, actual results and performance in the

future could differ materially from those set forth in or implied

by such forward‐looking statements. You are cautioned not to place

undue reliance on these forward‐looking statements, which reflect

the Company’s views only as of the date of this earnings release.

Except as required by law, neither the Company nor any other person

assumes responsibility for the accuracy and completeness of the

forward‐looking statements appearing in this earnings release. The

Company does not undertake any obligation to update any

forward-looking statements contained in this earnings release as a

result of new information, future events or otherwise. Past

performance is not indicative nor a guarantee of future returns.

Yield data are shown for illustrative purposes only and have

limitations when used for comparison or for other purposes due to,

among other matters, volatility, credit or other factors.

Non-GAAP Financial Measures Reconciliation

Distributable Earnings

Distributable Earnings is a non-GAAP measure, which we define as

GAAP net income (loss) attributable to our common stockholders,

including realized gains and losses from loan write-offs, loan

sales and other loan resolutions (including conversions to real

estate owned (“REO”)), regardless of whether such items are

included in other comprehensive income or loss, or in GAAP net

income (loss), and excluding (i) non-cash stock compensation

expense, (ii) depreciation and amortization expense, (iii)

unrealized gains (losses) (including credit loss expense (benefit),

net), and (iv) certain non-cash or income and expense items. The

exclusion of depreciation and amortization expense from the

calculation of Distributable Earnings only applies to debt

investments related to real estate to the extent we foreclose upon

the property or properties underlying such debt investments.

We believe that Distributable Earnings provides meaningful

information to consider in addition to our net income (loss) and

cash flow from operating activities determined in accordance with

GAAP. We generally must distribute at least 90% of our net taxable

income annually, subject to certain adjustments and excluding any

net capital gains, for us to continue to qualify as a real estate

investment trust for U.S. federal income tax purposes. We believe

that one of the primary reasons investors purchase our common stock

is to receive our dividends. Because of our investors’ continued

focus on our ability to pay dividends, Distributable Earnings is an

important measure for us to consider when determining our

distribution policy and dividends per common share. Further,

Distributable Earnings helps us to evaluate our performance

excluding the effects of certain transactions and GAAP adjustments

that we believe are not necessarily indicative of our current loan

investment and operating activities.

Distributable Earnings excludes the impact of our credit loss

provision or reversals of our credit loss provision, but only to

the extent that our credit loss provision exceeds any realized

credit losses during the applicable reporting period.

A loan will be written off as a realized loss when it is deemed

non-recoverable or upon a realization event. Such a realized loss

would generally be recognized at the time the loan receivable is

settled, transferred or exchanged, or in the case of foreclosure,

when the underlying property is foreclosed upon or sold.

Non-recoverability may also be concluded by us if, in our

determination, it is nearly certain that all amounts due will not

be collected. A realized loss may equal the difference between the

cash or consideration received or expected to be received, and the

net book value of the loan, reflecting our economics as it relates

to the ultimate realization of the asset.

Distributable Earnings does not represent net income (loss) or

cash generated from operating activities and should not be

considered as an alternative to GAAP net income (loss), an

indication of our GAAP cash flows from operations, a measure of our

liquidity, or an indication of funds available for our cash needs.

In addition, our methodology for calculating Distributable Earnings

may differ from the methodologies employed by other companies to

calculate the same or similar supplemental performance measures,

and accordingly, our reported Distributable Earnings may not be

comparable to the Distributable Earnings reported by other

companies.

Reconciliation of GAAP Net Income Attributable to Common

Stockholders to Distributable Earnings

The table below reconciles GAAP net income attributable to

common stockholders and related diluted per share amounts to

Distributable Earnings and related diluted per share amounts ($ in

thousands, except per share data):

Three Months Ended,

June 30, 2024

Per Diluted Share(1)

Net income attributable to common

stockholders

$

21,026

$

0.26

Depreciation and amortization

4,156

0.05

Non-cash stock compensation expense

1,688

0.02

Credit loss (benefit), net

(4,537

)

(0.06

)

Distributable earnings before realized

losses from loan sales and other loan resolutions

$

22,333

$

0.28

Realized loss on loan write-offs, loan

sales and REO conversions

—

—

Distributable earnings

$

22,333

$

0.28

Weighted average common shares

outstanding, diluted

80,907,705

_______________________________

(1) Numbers presented may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730453870/en/

INVESTOR RELATIONS CONTACT +1 (212) 405-8500

IR@tpgrefinance.com

MEDIA CONTACT TPG RE Finance Trust, Inc. Courtney Power

+1 (415) 743-1550 media@tpg.com

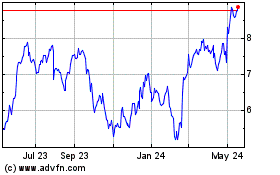

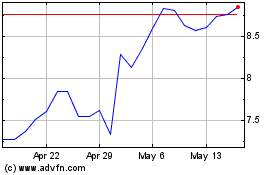

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Dec 2023 to Dec 2024