TransUnion (NYSE:TRU) has signed a definitive agreement to acquire

majority ownership of Trans Union de Mexico, S.A., S.I.C., the

consumer credit business of the largest credit bureau in Mexico,

Buró de Crédito. TransUnion currently owns approximately 26% of

Trans Union de Mexico, has held seats on its board of directors for

over two decades, and serves as one of its technology providers.

TransUnion has agreed to acquire an additional 68% from selling

shareholders, including several of the largest banks operating in

Mexico. Cash consideration for the transaction is approximately MXN

11.5 billion, or $560 million using a USD/MXN exchange rate of

20.53 as of January 14, 2025 based on an enterprise value of MXN

16.8 billion, or $818 million at the previously mentioned exchange

rate. With this transaction, TransUnion’s ownership would increase

to approximately 94%. Buró de Crédito’s commercial credit business

is excluded from the transaction.

“Our expansion in Mexico continues our commitment to making

trust possible in global commerce,” said Chris Cartwright,

President and CEO of TransUnion. “Credit bureaus are a catalyst for

financial inclusion, and we are excited for the opportunity to

bring the benefits of our state-of-the art technology, innovative

solutions and industry expertise to Mexican consumers and

businesses. We also look forward to supporting the country’s

digital transformation objectives to empower consumers with

increased economic opportunity.”

Mexico is the 12th largest global economy and second largest in

Latin America, with a growing population and emerging middle class.

Consumer credit in Mexico is rapidly expanding, and over half of

Mexican adults have at least one financial product. While credit

penetration remains lower in Mexico than other Latin American

countries, it has significantly increased in the past decade, from

34% to 42% of GDP between 2013 and 20231. After the transaction

closes, TransUnion intends to leverage its global operating model

to strengthen Trans Union de Mexico’s services to the Mexican

market, including additional efforts to drive financial

inclusion.

“We anticipate that our planned acquisition of Buró de Crédito’s

consumer credit business will strengthen our leadership position in

Latin America and will make TransUnion the largest credit bureau in

Spanish-speaking Latin America,” said Carlos Valencia, Regional

President of TransUnion Latin America. “We see substantial

opportunity to introduce global products like trended and

alternative credit data, fraud mitigation solutions and consumer

engagement tools. We also plan to expand beyond traditional

financial services into adjacencies such as FinTech and

insurance.”

TransUnion operates in over 30 countries and intends to leverage

a proven playbook for scaling businesses internationally. Its

innovative solutions include products that promote financial

inclusion, mitigate fraud and empower consumers to access credit

and manage their financial health. Its global technology and

operating model support a best-in-class customer experience,

cybersecurity and data governance. TransUnion plans to increase the

number of associates in Mexico over the next several years to

support the execution of the transaction and to further strengthen

the company’s capabilities within the region.

“We anticipate integrating the Buró de Crédito consumer credit

business into our strong global operating model as part of our

International segment,” said Todd Skinner, President, International

of TransUnion. “We expect to deliver strong growth over the long

term, supported by favorable market dynamics and execution against

our growth playbook.”

The target acquisition is expected to generate approximately

$145 million2 of revenue and $70 million2 of Adjusted EBITDA3 in

2024. Based on current foreign exchange and financing assumptions,

the acquisition is expected to be accretive to Adjusted Diluted

Earnings per Share3 in the first year of majority ownership.

The transaction is expected to close by the end of 2025, subject

to the satisfaction of regulatory approvals and customary closing

conditions. TransUnion anticipates funding this transaction through

a combination of debt and cash on hand.

TransUnion will host a conference call and webcast today at 8:30

a.m. Central Time to discuss the transaction agreement and certain

forward-looking information. The session and accompanying

presentation materials may be accessed at www.transunion.com/tru. A

replay of the call will also be available at this website following

the conclusion of the call.

1 Source: IMF2 Estimated total 2024 revenue and Adjusted EBITDA

of Trans Union de Mexico based on 20.53 USD/MXN exchange rate as of

1/14/25.3 Adjusted EBITDA and Adjusted Diluted EPS are

non-GAAP measures which should be reviewed in conjunction with the

relevant GAAP financial measures and are not presented as

alternative measures of GAAP. TransUnion has not provided a

reconciliation of non-GAAP measures to the most comparable GAAP

financial measures because the non-GAAP measures are presented on a

forward-looking basis, and due to the uncertain nature of

acquisition-related expenses, purchase accounting fair value

adjustments and other information related to the acquisition, a

reconciliation could not be prepared without unreasonable effort.

This information could be material to TransUnion’s results computed

in accordance with GAAP.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with

over 13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great

experiences and personal empowerment for millions of people around

the world. http://www.transunion.com/business

About Buró de CréditoBuró de Crédito is the

leading company in Mexico that manages the most complete and secure

credit database for individuals and businesses. Buró de Crédito is

comprised of two credit bureaus: Trans Union de México, S.A.

(credit bureau for individuals) and Dun & Bradstreet, S.A.

(credit bureau for individuals with business activities and

corporations). With 29 years in the market, Buró de Crédito

provides services on the collection, management, delivery or

forwarding of information related to the credit history of

individuals and companies. Its other complementary products and

services are also essential for individuals, companies and credit

grantors as they facilitate the management and analysis of

financial risks. In this way, Buró de Crédito helps to streamline

and facilitate decision making for the generation of business and

the healthy expansion of credit, thus contributing to the economic

development of the country. http://www.burodecredito.com.mx

TransUnion Forward-Looking StatementsThis press

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on the current beliefs and expectations of

TransUnion’s management and are subject to significant risks and

uncertainties. Actual results may differ materially from those

described in the forward-looking statements. Any statements made in

this press release that are not statements of historical fact,

including statements about our beliefs and expectations, are

forward-looking statements. Forward-looking statements include

information concerning anticipated benefits of the transaction,

including strategic, business and to our results of operations, the

expected timeline for completing the transaction, expected sources

of funding for the acquisition, and descriptions of our business

plans, prospects and strategies. These statements often include

words such as “anticipate,” “expect,” “guidance,” “suggest,”

“plan,” “believe,” “intend,” “estimate,” “target,” “project,”

“should,” “could,” “would,” “may,” “will,” “forecast,” “outlook,”

“potential,” “continues,” “seeks,” “predicts,” or the negatives of

these words and other similar expressions.

Factors that could cause actual results to differ materially

from those described in the forward-looking statements include:

failure to realize the synergies and other benefits expected from

the proposed acquisition of Trans Union de Mexico; the

risk that required regulatory approvals are not obtained or are

obtained subject to conditions that are not anticipated; the

failure of any of the closing conditions in the definitive purchase

agreement to be satisfied on a timely basis or at all; delay in

closing the proposed acquisition; the possibility that the proposed

acquisition, including the integration of Trans Union de Mexico,

may be more costly to complete than anticipated; business

disruption during the pendency of the proposed acquisition and

following the acquisition closing; risks related to disruption of

management time from ongoing business operations and other

opportunities due to the proposed acquisition; the effects of

pending and future legislation and regulatory actions and

reforms; macroeconomic and industry trends and adverse

developments in the debt, consumer credit and financial services

markets and other macroeconomic factors beyond TransUnion’s

control; risks related to TransUnion’s indebtedness,

including our ability to make timely payments on principal and

interest and our ability to satisfy covenants in the agreements

governing our indebtedness; and other one-time events and

other factors that can be found in our Annual Report on Form 10-K

for the year ended December 31, 2023, and any subsequent Annual

Report on Form 10-K, Quarterly Report on Form 10-Q or Current

Report on Form 8-K, which are filed with the Securities and

Exchange Commission and are available on TransUnion’s website

(www.transunion.com/tru) and on the Securities and Exchange

Commission’s website (www.sec.gov). Many of these factors are

beyond our control. The forward-looking statements contained in

this press release speak only as of the date of this press release.

We undertake no obligation to publicly release the result of any

revisions to these forward-looking statements to reflect the impact

of events or circumstances that may arise after the date of this

press release.

|

Contact |

Dave

Blumberg |

| |

TransUnion |

| |

|

| E-mail |

david.blumberg@transunion.com |

| |

|

| Telephone |

312-972-6646 |

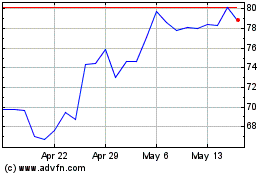

TransUnion (NYSE:TRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

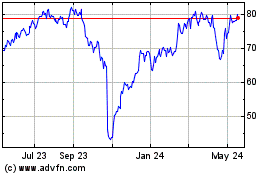

TransUnion (NYSE:TRU)

Historical Stock Chart

From Feb 2024 to Feb 2025