0000860731false00008607312024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 23, 2024 (October 23, 2024)

Date of Report (Date of earliest event reported)

_____________________________________________

TYLER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 1-10485 | | 75-2303920 |

| (State or other jurisdiction of incorporation organization) | | (Commission

File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5101 TENNYSON PARKWAY | PLANO | Texas | 75024 |

| (Address of principal executive offices) | (City) | (State) | (Zip code) |

(972) 713-3700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) | | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| COMMON STOCK, $0.01 PAR VALUE | TYL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 23, 2024, Tyler Technologies, Inc. issued the earnings news release announcing results from operations and financial condition as of September 30, 2024, attached hereto as Exhibit 99.1, which news release is incorporated by reference herein.

| | | | | | | | |

| Exhibit number | | Exhibit description |

| | News Release issued by Tyler Technologies, Inc. dated October 23, 2024 |

| 104 | | Cover Page Interactive Data File (embedded in the Inline XBRL document) |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | TYLER TECHNOLOGIES, INC. |

| | | |

| | | /s/ Brian K. Miller |

October 23, 2024 | | By: | Brian K. Miller

Executive Vice President and Chief Financial

Officer (principal financial officer) |

Tyler Technologies Reports Earnings for Third Quarter 2024

Strong results with 20% growth in SaaS revenues and 49% growth in cash flows

PLANO, Texas – October 23, 2024 – Tyler Technologies, Inc. (NYSE: TYL), a large-cap growth and value equity company, today announced financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights (all comparisons are to the third quarter of 2023):

Revenues

Total revenues were $543.3 million, up 9.8%. On an organic basis, revenues grew 9.4%.

Recurring Revenues

Recurring revenues from subscriptions and maintenance were $462.8 million, up 12.1%, and comprised 85.2% of total revenues, up from 83.4%. On an organic basis, recurring revenues grew 11.8%.

•Subscription revenues were $347.2 million, up 17.6%. On an organic basis, subscription revenues grew 17.3%. Within subscriptions:

◦SaaS revenues grew 20.3% to $166.6 million. On an organic basis, SaaS revenues grew 19.7%.

◦Transaction-based revenues grew 15.2% on an organic basis to $180.6 million.

◦SaaS arrangements comprised approximately 97% of the total new software contract value, up from approximately 80%.

•Annualized recurring revenue (ARR) was $1.85 billion, up 12.1%.

Earnings/EBITDA

•GAAP operating income was $82.8 million, up 29.5%. Non-GAAP operating income was $137.8 million, up 12.4%.

•GAAP net income was $75.9 million, or $1.74 per diluted share, up 61.4%. Non-GAAP net income was $110.0 million, or $2.52 per diluted share, up 20.0%.

•Adjusted EBITDA was $152.4 million, up 15.0%.

Cash Flow

•Cash flow from operations was $263.7 million, up 48.6%.

•Free cash flow was $252.9 million, up 55.5%.

•During the third quarter, cash tax payments included approximately $6 million related to IRC Section 174 capitalization rules.

Tyler Technologies Reports Earnings

for Third Quarter 2024

October 23, 2024

Page 2

"We carried our momentum from the first half of the year into the third quarter and delivered remarkable results," said Lynn Moore, Tyler's president and chief executive officer. "SaaS and transaction revenues fueled our growth, as both exceeded our expectations. Even as SaaS adoption accelerated to 97% of our new software contract value, our non-GAAP operating margin expanded to 25.4%, benefiting from our cloud efficiency initiatives and improved professional services margins. Free cash flow reached a new quarterly high, up 55.5%.

"Activity in the public sector market remains robust and our elevated contract volume in the third quarter reflects solid execution under our go-to-market strategy, including growing cross-sell wins. Annual recurring revenue added from new SaaS contracts in the third quarter increased 55% over last year. We're also pleased that the total contract value signed this quarter for on-premises client flips to the cloud was more than triple that of last year's third quarter. While our progress toward our 2025 and 2030 targets will not be linear, our confidence in achieving those targets continues to grow with our success in executing against each of the pillars supporting those objectives. We have revised our full-year 2024 guidance to reflect our year-to-date results and our positive outlook for the fourth quarter," concluded Moore.

Guidance for 2024

As of October 23, 2024, Tyler Technologies is providing the following guidance for the full year 2024:

•Total revenues are expected to be in the range of $2.125 billion to $2.145 billion.

•GAAP diluted earnings per share are expected to be in the range of $6.13 to $6.28.

•Non-GAAP diluted earnings per share are expected to be in the range of $9.47 to $9.62.

•Free cash flow margin is expected to be in the range of 21% to 23%.

•Research and development expense is expected to be in the range of $119 million to $122 million.

•Capital expenditures are expected to be in the range of $47 million to $49 million, including approximately $31 million of capitalized software development costs.

Tyler Technologies Reports Earnings

for Third Quarter 2024

October 23, 2024

Page 3

| | | | | |

GAAP to non-GAAP guidance reconciliation | 2024 |

GAAP diluted earnings per share (1) | $6.13 - $6.28 |

| Plus: | |

| Share-based compensation expense | 2.85 |

| Amortization of acquired software and other intangibles | 2.23 |

| Acquisition-related costs | — |

| Lease restructuring costs and other | — |

| Less: | |

Income tax impact (1) | (1.74) |

| Non-GAAP diluted earnings per share | $9.47 - $9.62 |

| Shares used in computing diluted earnings per share (millions) | 43.5 |

| GAAP estimated annual effective tax rate used in computing GAAP diluted earnings per share (1) | 13.5% |

| Non-GAAP estimated annual effective tax rate used in computing non-GAAP diluted earnings per share | 22% |

| |

(1) GAAP diluted earnings per share may fluctuate due to the impact on our annual effective tax rate of discrete tax items, such as stock incentive awards, future acquisitions, changes in tax legislation, and other transactions. | |

Conference Call

Tyler Technologies will hold a conference call on Thursday, October 24, 2024, at 10:00 a.m. ET to discuss its third quarter 2024 results. Participants can pre-register for the teleconference here. Alternatively, participants can also join the teleconference by dialing 646-307-1963 and providing the operator with the conference name or entering access code 89698 to join the live call.

The live audio webcast and archived replay can also be accessed at the Events & Presentations section of Tyler's investor relations website.

About Tyler Technologies, Inc.

Tyler Technologies (NYSE: TYL) is a leading provider of integrated software and technology services for the public sector. Tyler's end-to-end solutions empower local, state, and federal government entities to operate efficiently and transparently with residents and each other. By connecting data and processes across disparate systems, Tyler's solutions transform how clients turn actionable insights into opportunities and solutions for their communities. Tyler has more than 44,000 successful installations across 13,000 locations, with clients in all 50 states, Canada, the Caribbean, Australia, and other international locations. Tyler has been recognized numerous times for growth and innovation, including Government Technology's GovTech 100 list. More information about Tyler Technologies, an S&P 500 company headquartered in Plano, Texas, can be found at tylertech.com.

Non-GAAP Financial Measures

Tyler Technologies has provided in this press release financial measures that have not been prepared in accordance with generally accepted accounting principles (GAAP) and are therefore considered non-GAAP

Tyler Technologies Reports Earnings

for Third Quarter 2024

October 23, 2024

Page 4

financial measures. This information includes non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP earnings per diluted share, EBITDA, adjusted EBITDA, free cash flow, and free cash flow margin. We use these non-GAAP financial measures internally in analyzing our financial results and believe they are useful to investors, as a supplement to GAAP measures, in evaluating Tyler’s ongoing operational performance because they provide additional insight in comparing results from period to period. Tyler believes the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures. Non-GAAP financial measures discussed above exclude share-based compensation expense, employer portion of payroll taxes on employee stock transactions, expenses associated with amortization of intangibles arising from business combinations, acquisition-related expenses, and lease restructuring costs and other. Annualized recurring revenues (ARR) is calculated by annualizing the current quarter's recurring revenues from subscriptions and maintenance.

Tyler currently uses a non-GAAP tax rate of 22.0%. This rate is based on Tyler's estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating Tyler's non-GAAP income, as well as significant non-recurring tax adjustments. The non-GAAP tax rate used in future periods will be reviewed periodically to determine whether it remains appropriate in consideration of factors including Tyler's periodic annual effective tax rate calculated in accordance with GAAP, changes resulting from tax legislation, changes in the geographic mix of revenues and expenses, and other factors deemed significant. Due to differences in tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to Tyler's estimated annual tax rate as described above, the estimated tax rate on non-GAAP income may differ from the GAAP tax rate and from Tyler's actual tax liabilities.

Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial information prepared in accordance with GAAP. The non-GAAP measures used by Tyler Technologies may be different from non-GAAP measures used by other companies. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures, which has been provided in the financial statement tables included below in this press release.

Forward-looking Statements

This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical in nature and typically address future or anticipated events, trends, expectations or beliefs with respect to our financial condition, results of operations or business. Forward-looking statements often contain words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” “plans,” “intends,” “continues,” “may,” “will,” “should,” “projects,” “might,” “could” or other similar words or phrases. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. We believe there is a reasonable basis for our forward-looking statements, but they are inherently subject to risks and uncertainties and actual results could differ materially from the expectations and beliefs reflected in the forward-looking statements. We presently consider the following to be among the important factors that could cause actual results to differ materially from our expectations and beliefs: (1) changes in the budgets or regulatory environments of our clients, primarily local and state governments, that could negatively impact information technology spending; (2) disruption to our business and harm to our competitive position resulting from cyber-attacks, security vulnerabilities and software updates; (3) our ability to protect client information from security breaches and provide uninterrupted operations of data centers; (4)

Tyler Technologies Reports Earnings

for Third Quarter 2024

October 23, 2024

Page 5

our ability to achieve growth or operational synergies through the integration of acquired businesses, while avoiding unanticipated costs and disruptions to existing operations; (5) material portions of our business require the Internet infrastructure to be adequately maintained; (6) our ability to achieve our financial forecasts due to various factors, including project delays by our clients, reductions in transaction size, fewer transactions, delays in delivery of new products or releases or a decline in our renewal rates for service agreements; (7) general economic, political and market conditions, including continued inflation and rising interest rates; (8) technological and market risks associated with the development of new products or services or of new versions of existing or acquired products or services; (9) competition in the industry in which we conduct business and the impact of competition on pricing, client retention and pressure for new products or services; (10) the ability to attract and retain qualified personnel and dealing with rising labor costs, and the loss or retirement of key members of management or other key personnel; and (11) costs of compliance and any failure to comply with government and stock exchange regulations. These factors and other risks that affect our business are described in our filings with the Securities and Exchange Commission, including the detailed “Risk Factors” contained in our most recent annual report on Form 10-K and quarterly report on Form 10-Q. We expressly disclaim any obligation to publicly update or revise our forward-looking statements.

(Comparative results follow)

Contact: Hala Elsherbini

Senior Director, Investor Relations

Tyler Technologies, Inc.

972-713-3770

hala.elsherbini@tylertech.com

Source: Tyler Technologies

#TYL_Financial

24-48

TYLER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenues: | | | | | | | |

| Subscriptions | $ | 347,170 | | | $ | 295,190 | | | $ | 994,095 | | | $ | 873,444 | |

| Maintenance | 115,587 | | | 117,484 | | | 348,114 | | | 349,154 | |

| Professional services | 64,462 | | | 61,126 | | | 201,196 | | | 188,475 | |

| Software licenses and royalties | 6,188 | | | 10,554 | | | 20,251 | | | 30,463 | |

| Hardware and other | 9,930 | | | 10,330 | | | 33,016 | | | 29,281 | |

| Total revenues | 543,337 | | | 494,684 | | | 1,596,672 | | | 1,470,817 | |

| | | | | | | |

| Cost of revenues: | | | | | | | |

| Subscriptions, maintenance, and professional services | 283,750 | | | 247,781 | | | 829,765 | | | 755,985 | |

| Software licenses and royalties | 1,870 | | | 3,120 | | | 4,995 | | | 7,865 | |

| Amortization of software development | 4,961 | | | 3,083 | | | 13,808 | | | 8,568 | |

| Amortization of acquired software | 9,244 | | | 9,035 | | | 27,723 | | | 26,879 | |

| Hardware and other | 6,052 | | | 6,505 | | | 21,439 | | | 23,346 | |

| Total cost of revenues | 305,877 | | | 269,524 | | | 897,730 | | | 822,643 | |

| | | | | | | |

| Gross profit | 237,460 | | | 225,160 | | | 698,942 | | | 648,174 | |

| | | | | | | |

| Sales and marketing expense | 38,203 | | | 35,898 | | | 116,195 | | | 110,104 | |

| General and administrative expense | 72,460 | | | 78,519 | | | 220,590 | | | 228,560 | |

| Research and development expense | 30,120 | | | 28,282 | | | 88,504 | | | 83,421 | |

| Amortization of other intangibles | 13,850 | | | 18,526 | | | 45,813 | | | 55,300 | |

| | | | | | | |

| Operating income | 82,827 | | | 63,935 | | | 227,840 | | | 170,789 | |

| | | | | | | |

| Interest expense | (1,235) | | | (5,808) | | | (4,672) | | | (19,879) | |

| Other income, net | 4,504 | | | 787 | | | 8,232 | | | 2,676 | |

| Income before income taxes | 86,096 | | | 58,914 | | | 231,400 | | | 153,586 | |

| Income tax provision | 10,199 | | | 11,903 | | | 33,595 | | | 26,570 | |

| Net income | $ | 75,897 | | | $ | 47,011 | | | $ | 197,805 | | | $ | 127,016 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 1.78 | | | $ | 1.12 | | | $ | 4.64 | | | $ | 3.02 | |

| Diluted | $ | 1.74 | | | $ | 1.10 | | | $ | 4.56 | | | $ | 2.97 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 42,714 | | | 42,087 | | | 42,592 | | | 42,002 | |

| Diluted | 43,694 | | | 42,841 | | | 43,424 | | | 42,736 | |

TYLER TECHNOLOGIES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Amounts in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Reconciliation of non-GAAP gross profit and margin | | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP gross profit | | $ | 237,460 | | $ | 225,160 | | $ | 698,942 | | $ | 648,174 |

| Non-GAAP adjustments: | | | | | | | | |

| | | | | | | | |

Add: Share-based compensation expense included in cost of

revenues | | 7,972 | | 6,847 | | 22,982 | | 19,626 |

| Add: Amortization of acquired software | | 9,244 | | 9,035 | | 27,723 | | 26,879 |

| Non-GAAP gross profit | | $ | 254,676 | | $ | 241,042 | | $ | 749,647 | | $ | 694,679 |

| GAAP gross margin | | 43.7 | % | | 45.5 | % | | 43.8 | % | | 44.1 | % |

| Non-GAAP gross margin | | 46.9 | % | | 48.7 | % | | 47.0 | % | | 47.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Reconciliation of non-GAAP operating income and margin | | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP operating income | | $ | 82,827 | | $ | 63,935 | | $ | 227,840 | | $ | 170,789 |

| Non-GAAP adjustments: | | | | | | | | |

| | | | | | | | |

| Add: Share-based compensation expense | | 31,187 | | 26,981 | | 88,460 | | 80,905 |

Add: Employer portion of payroll tax related to employee stock

transactions | | 625 | | 43 | | 2,303 | | 1,191 |

| Add: Acquisition-related costs | | — | | 183 | | 29 | | 255 |

Add: Lease restructuring costs and other | | 35 | | 3,812 | | (124) | | 5,357 |

| Add: Amortization of acquired software | | 9,244 | | 9,035 | | 27,723 | | 26,879 |

Add: Amortization of other intangibles | | 13,850 | | 18,526 | | 45,813 | | 55,300 |

| Non-GAAP adjustments subtotal | | 54,941 | | 58,580 | | 164,204 | | 169,887 |

| Non-GAAP operating income | | $ | 137,768 | | $ | 122,515 | | $ | 392,044 | | $ | 340,676 |

| GAAP operating margin | | 15.2 | % | | 12.9 | % | | 14.3 | % | | 11.6 | % |

| Non-GAAP operating margin | | 25.4 | % | | 24.8 | % | | 24.6 | % | | 23.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Reconciliation of non-GAAP net income and earnings per share | | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP net income | | $ | 75,897 | | $ | 47,011 | | $ | 197,805 | | $ | 127,016 |

| Non-GAAP adjustments: | | | | | | | | |

| Add: Total non-GAAP adjustments to operating income | | 54,941 | | 58,580 | | 164,204 | | 169,887 |

| | | | | | | | |

| Less: Income tax impact | | (20,829) | | (13,946) | | (53,438) | | (44,594) |

| Non-GAAP net income | | $ | 110,009 | | $ | 91,645 | | $ | 308,571 | | $ | 252,309 |

| GAAP earnings per diluted share | | $ | 1.74 | | $ | 1.10 | | $ | 4.56 | | $ | 2.97 |

| Non-GAAP earnings per diluted share | | $ | 2.52 | | $ | 2.14 | | $ | 7.11 | | $ | 5.90 |

TYLER TECHNOLOGIES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Amounts in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Detail of share-based compensation expense | | 2024 | | 2023 | | 2024 | | 2023 |

| Subscriptions, maintenance, and professional services | | $ | 7,972 | | $ | 6,847 | | $ | 22,982 | | $ | 19,626 |

| Sales and marketing expense | | 3,259 | | 2,628 | | 9,383 | | 7,388 |

| General and administrative expense | | 19,956 | | 17,506 | | 56,095 | | 53,891 |

| Total share-based compensation expense | | $ | 31,187 | | $ | 26,981 | | $ | 88,460 | | $ | 80,905 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Reconciliation of EBITDA and adjusted EBITDA | | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP net income | | $ | 75,897 | | $ | 47,011 | | $ | 197,805 | | $ | 127,016 |

| Amortization of other intangibles | | 13,850 | | 18,526 | | 45,813 | | 55,300 |

| Depreciation and amortization included in cost of revenues, sales and marketing expense, general and administrative expense, and research and development expense | | 20,007 | | 17,420 | | 60,728 | | 55,199 |

| Interest expense | | 1,235 | | 6,640 | | 4,672 | | 19,879 |

| Income tax provision | | 10,199 | | 11,903 | | 33,595 | | 26,570 |

| EBITDA | | $ | 121,188 | | $ | 101,500 | | $ | 342,613 | | $ | 283,964 |

| | | | | | | | |

| Share-based compensation expense | | 31,187 | | 26,981 | | 88,460 | | 80,905 |

| Acquisition-related costs | | — | | 183 | | 29 | | 255 |

| Lease restructuring costs and other asset write-offs | | 35 | | 3,812 | | (124) | | 5,357 |

| Adjusted EBITDA | | $ | 152,410 | | $ | 132,476 | | $ | 430,978 | | $ | 370,481 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| Reconciliation of free cash flow | | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 263,716 | | | $ | 177,496 | | | $ | 399,859 | | | $ | 233,021 | |

| Less: additions to property and equipment | | (2,884) | | | (6,136) | | | (16,734) | | | (12,506) | |

| Less: investment in software development | | (7,919) | | | (8,694) | | | (24,412) | | | (27,447) | |

| Free cash flow | | $ | 252,913 | | | $ | 162,666 | | | $ | 358,713 | | | $ | 193,068 | |

| Free cash flow margin | | 46.5 | % | | 32.9 | % | | 22.5 | % | | 13.1 | % |

TYLER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 538,296 | | | $ | 165,493 | |

| Accounts receivable, net | 619,508 | | | 619,704 | |

| Short-term investments | 5,985 | | | 10,385 | |

| Prepaid expenses and other current assets | 74,775 | | | 65,003 | |

| | | |

| Total current assets | 1,238,564 | | | 860,585 | |

| | | |

| Accounts receivable, long-term portion | 7,331 | | | 8,988 | |

| Operating lease right-of-use assets | 34,741 | | | 39,039 | |

| Property and equipment, net | 165,272 | | | 169,720 | |

| | | |

| Other assets: | | | |

| Software development costs, net | 76,580 | | | 67,124 | |

| Goodwill | 2,531,653 | | | 2,532,109 | |

| Other intangibles, net | 855,099 | | | 928,870 | |

| Non-current investments | 3,884 | | | 7,046 | |

| Other non-current assets | 83,384 | | | 63,182 | |

| Total assets | $ | 4,996,508 | | | $ | 4,676,663 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 306,075 | | | $ | 304,897 | |

| Operating lease liabilities | 10,653 | | | 11,060 | |

| Current income tax payable | 22,485 | | | 2,466 | |

| Deferred revenue | 682,422 | | | 632,914 | |

| Current portion of term loans | — | | | 49,801 | |

| Total current liabilities | 1,021,635 | | | 1,001,138 | |

| | | |

| | | |

| | | |

| Convertible senior notes due 2026, net | 597,502 | | | 596,206 | |

| Deferred revenue, long-term | — | | | 291 | |

| Deferred income taxes | 36,660 | | | 78,590 | |

| Operating lease liabilities, long-term | 33,674 | | | 39,822 | |

| Other long-term liabilities | 31,925 | | | 22,621 | |

| Total liabilities | 1,721,396 | | | 1,738,668 | |

| | | |

| Shareholders' equity | $ | 3,275,112 | | | $ | 2,937,995 | |

| Total liabilities and shareholders' equity | $ | 4,996,508 | | | $ | 4,676,663 | |

TYLER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 75,897 | | | $ | 47,011 | | | $ | 197,805 | | | $ | 127,016 | |

Adjustments to reconcile net income to cash

provided by operations: | | | | | | | | |

| Depreciation and amortization | | 34,530 | | | 38,450 | | | 108,766 | | | 114,198 | |

(Gains) losses from sale of investments | | (1) | | | (1) | | | (2) | | | 1 | |

| Share-based compensation expense | | 31,187 | | | 26,981 | | | 88,460 | | | 80,905 | |

| | | | | | | | |

| | | | | | | | |

| Operating lease right-of-use assets expense | | 2,397 | | | 5,689 | | | 7,262 | | | 12,258 | |

| Deferred income tax benefit | | (4,697) | | | (4,335) | | | (41,504) | | | (44,000) | |

| Other | | 38 | | | (47) | | | 228 | | | 398 | |

Changes in operating assets and liabilities,

exclusive of effects of acquired companies | | 124,365 | | | 63,748 | | | 38,844 | | | (57,755) | |

| Net cash provided by operating activities | | 263,716 | | | 177,496 | | | 399,859 | | | 233,021 | |

| | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Additions to property and equipment | | (2,884) | | | (6,136) | | | (16,734) | | | (12,506) | |

| Purchase of marketable security investments | | — | | | — | | | — | | | (10,617) | |

| Proceeds and maturities from marketable security investments | | 1,349 | | | 8,345 | | | 7,700 | | | 45,452 | |

| | | | | | | | |

| | | | | | | | |

| Investment in software development | | (7,919) | | | (8,694) | | | (24,412) | | | (27,447) | |

| Cost of acquisitions, net of cash acquired | | (93) | | | (33,665) | | | (1,395) | | | (35,540) | |

| Other | | 147 | | | 32 | | | 168 | | | 48 | |

| Net cash used by investing activities | | (9,400) | | | (40,118) | | | (34,673) | | | (40,610) | |

| | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| | | | | | | | |

| Payment on term loans | | — | | | (135,000) | | | (50,000) | | | (255,000) | |

| | | | | | | | |

| | | | | | | | |

| Payment of debt issuance costs | | (2,637) | | | — | | | (2,637) | | | — | |

| | | | | | | | |

| Proceeds from exercise of stock options, net of withheld shares for taxes upon equity award settlement | | 31,548 | | | 6,315 | | | 47,433 | | | 8,438 | |

| | | | | | | | |

| Contributions from employee stock purchase plan | | 4,347 | | | 4,029 | | | 12,821 | | | 11,780 | |

| Net cash provided (used) by financing activities | | 33,258 | | | (124,656) | | | 7,617 | | | (234,782) | |

| | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | 287,574 | | | 12,722 | | | 372,803 | | | (42,371) | |

| Cash and cash equivalents at beginning of period | | 250,722 | | | 118,764 | | | 165,493 | | | 173,857 | |

| | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 538,296 | | | $ | 131,486 | | | $ | 538,296 | | | $ | 131,486 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

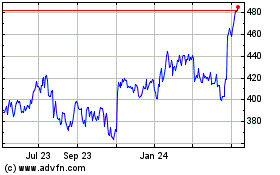

Tyler Technologies (NYSE:TYL)

Historical Stock Chart

From Dec 2024 to Jan 2025

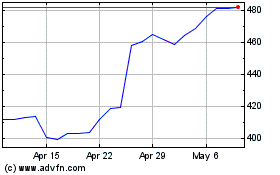

Tyler Technologies (NYSE:TYL)

Historical Stock Chart

From Jan 2024 to Jan 2025