UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 6, 2015

(August

6, 2015)

U.S.

PHYSICAL THERAPY, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

1-11151

|

76-0364866

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File

Number)

|

(I.R.S. Employer

Identification No.)

|

|

1300 West Sam Houston Parkway South, Suite 300, Houston,

Texas

|

77042

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (713)

297-7000

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see

General Instruction A.2. below):

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL RESULTS

On August 6, 2015, U.S. Physical Therapy, Inc. (the “Company”) reported

its results for the second quarter and six months ended June 30, 2015.

In addition, the Company announced that its board of directors declared

a quarterly dividend of $0.15 per share to holders of record of common

stock as of the close of business on August 18, 2015 payable on

September 4, 2015. A copy of the press release is attached hereto as

Exhibit 99.1.

While the Company intends to declare dividends in subsequent quarters,

any future dividends will be at the discretion of the Company’s board of

directors after taking into account various factors, including general

economic and business conditions, tax considerations, the Company’s

strategic plan, the results of operation and financial condition of the

Company, the acquisition and expansion plans of the Company, any

contractual, legal or regulatory restrictions on the payment of

dividends, and such other factors as the board considers relevant.

In accordance with General Instruction B.2 of Form 8-K, the information

in this Current Report on Form 8-K, including the exhibits, shall not be

deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, and shall not be

incorporated by reference into any registration statement or other

document filed under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

ITEM 7.01 REGULATION FD DISCLOSURE

Management currently expects the Company’s earnings from continuing

operations for the year 2015 to be in the range of $21.7 million to

$22.7 million in net income and $1.75 to $1.83 in diluted earnings per

share. Guidance issued previously was for 2015 net income in the range

of $22.3 million to $22.9 million and $1.80 to $1.86 in diluted earnings

per share.

Please note that management’s guidance range represents projected

earnings from existing operations only and excludes future acquisitions.

The annual guidance figures will not be updated unless there is a

material development that causes management to believe that earnings

will be significantly outside the given range.

ITEM 8.01 OTHER EVENTS

See Item 2.02 above. On August 6, 2015, the Company announced a

dividend of $0.15 per share to holders of record of its common stock as

of the close of business on August 18, 2015 payable on September 4, 2015.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

|

Exhibits

|

Description of Exhibits

|

|

|

|

|

99.1

|

Registrant's press release dated August 6, 2015 announcing results

for the second quarter and six months ended June 30, 2015.*

|

*Furnished herewith.

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

U.S. PHYSICAL THERAPY, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

August 6, 2015

|

By: /s/ LAWRANCE W. MCAFEE

|

|

|

|

|

Lawrance W. McAfee

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

(duly authorized officer and principal financial

|

|

|

|

|

and accounting officer)

|

|

INDEX TO EXHIBITS

|

EXHIBIT

|

DESCRIPTION OF EXHIBIT

|

|

|

|

|

99.1

|

Press Release dated August 6, 2015.*

|

|

|

|

|

* Furnished herewith

|

Exhibit 99.1

U.S.

Physical Therapy Reports Second Quarter and First Six Months 2015 Results

Company

Declares $0.15 Per Share Quarterly Dividend

Issues

Updated Earnings Guidance for 2015

HOUSTON--(BUSINESS WIRE)--August 6, 2015--U.S. Physical Therapy, Inc.

(NYSE: USPH), a national operator of outpatient physical therapy

clinics, today reported results for the quarter and six months ended

June 30, 2015.

U.S. Physical Therapy’s net income attributable to common shareholders

prior to revaluation of redeemable non-controlling interests, net of tax

(“operating results”) was $6.3 million for the second quarter of 2015 as

compared to $6.4 million in the second quarter of 2014. Diluted earnings

per share from operating results were $0.51 in the recent quarter as

compared to $0.53 in the comparable 2014 period.

U.S. Physical Therapy’s operating results for the first six months of

2015 were $10.5 million as compared to $10.7 million in the first six

months of 2014. Diluted earnings per share from operating results were

$0.85 in the first half of 2015 as compared to $0.87 in the comparable

2014 period.

Second Quarter 2015 Compared to Second Quarter 2014

-

Net revenues increased 6.5% from $78.2 million in the second quarter

of 2014 to $83.3 million in the second quarter of 2015, due to an

increase in total patient visits of 8.1% from 718,800 to 776,900

offset by a decrease in the average net revenue per visit to $104.85

for the 2015 second quarter from $106.39 for the 2014 second quarter.

Net revenues for new clinics opened or acquired in the past 12 months

was $4.4 million.

-

Total clinic operating costs were $62.1 million, or 74.6% of net

revenues, in the second quarter of 2015, as compared to $56.4 million,

or 72.1% of net revenues, in the 2014 period. The increase was

primarily attributable to $3.9 million in operating costs of new

clinics opened or acquired in the past 12 months. Total clinic

salaries and related costs, including those from new clinics, were

53.3% of net revenues in the recent quarter versus 51.3% in the 2014

period. Rent, clinic supplies, contract labor and other costs as a

percentage of net revenues were 20.0% for the recent quarter versus

19.4% in the 2014 period. The provision for doubtful accounts as a

percentage of net revenues was 1.3% for both periods.

-

The gross margin for the second quarter of 2015 was $21.1 million or

25.4%, as compared to $21.8 million or 27.9% for the 2014 period.

-

Corporate office costs were $7.6 million in the second quarter of 2015

and 2014. Corporate office costs were 9.1% of net revenues for the

2015 second quarter compared to 9.7% of net revenues for the 2014

period.

-

Operating income for the recent quarter was $13.5 million compared to

$14.2 million in the 2014 second quarter.

-

Interest expense was $0.2 million in the second quarter of 2015 and

$0.3 million in the second quarter of 2014.

-

The provision for income taxes for the 2015 period was $4.2 million

and for the 2014 period $4.5 million. The provision for income taxes

as a percentage of income before taxes less net income attributable to

non-controlling interest was 40.0% in the 2015 second quarter and

41.0% in the 2014 second quarter.

-

Net income attributable to non-controlling interests was $2.8 million

in the recent quarter as compared to $3.0 million in the year earlier

period.

-

Net income attributable to common shareholders prior to revaluation of

redeemable non-controlling interests, net of tax for the three months

ended June 30, 2015 was $6.3 million and $6.4 million for the 2014

period. Diluted earnings per share from operating results were $0.51

for the 2015 period and $0.53 for the 2014 period.

-

Same store visits increased 2.9% for de novo and acquired clinics open

for one year or more and same store revenue increased 1.3% as the

average net rate per visit decreased by $1.60.

First Six Months 2015 Compared to First Six Months 2014

-

Net revenues increased 8.5% from $148.0 million in the first six

months of 2014 to $160.5 million in the first six month of 2015, due

to an increase in total patient visits of 9.3% from 1,362,600 to

1,489,700 offset by a decrease in the average net revenue per visit to

$105.56 for the first half of 2015 from $106.31 for the 2014 period.

Net revenues from new clinics opened or acquired in the past 12 months

was $7.1 million.

-

Total clinic operating costs were $122.5 million, or 76.3% of net

revenues, in the first six months of 2015, as compared to $109.5

million, or 74.0% of net revenues, in the 2014 period. The increase

includes $6.4 million in operating costs of new clinics opened or

acquired in the past 12 months. Total clinic salaries and related

costs, including those from new clinics, were 54.5% of net revenues in

the first six months versus 52.7% in the 2014 period. Rent, clinic

supplies, contract labor and other costs as a percentage of net

revenues were 20.6% for the recent period versus 19.9% in the 2014

period. The provision for doubtful accounts as a percentage of net

revenues was 1.3% for the 2015 period and 1.4% in the 2014 period.

-

The gross margin for the first six months of 2015 was $38.0 million or

23.7%, as compared to $38.5 million or 26.0% for the 2014 period.

-

Corporate office costs were $15.3 million in the first six months of

2015 compared to $14.7 million in the 2014 period. Corporate office

costs were 9.5% of net revenues for the 2015 first six months as

compared to 10.0% of net revenues for the 2014 period.

-

Operating income for the first six months of 2015 was $22.7 million

compared to $23.7 million in the 2014 first six months.

-

Interest expense was $0.5 million in the first six months of 2015

versus $0.6 million in the first six months of 2014.

-

The provision for income taxes for the 2015 period was $7.0 million

and for the 2014 period $7.4 million. The provision for income taxes

as a percentage of income before taxes less net income attributable to

non-controlling interest was 40.0% in the 2015 first six months and

41.0% in the 2014 first six months.

-

Net income attributable to non-controlling interests was $4.8 million

for the six months of 2015 as compared to $5.1 million in the year

earlier period.

-

Net income attributable to common shareholders prior to revaluation of

redeemable non-controlling interests, net of tax for the six months

ended June 30, 2015 was $10.5 million compared to $10.7 million for

the six months ended June 30, 2014. Diluted earnings per share from

operating results were $0.85 for the 2015 period and $0.87 for the

2014 period.

-

Same store visits increased 3.1% for de novo and acquired clinics open

for one year or more and same store revenue increased 2.5%. The

average net rate per visit decreased by $0.65.

Chris Reading, Chief Executive Officer, said, “During May and June we

experienced an unexpected net rate decline in an otherwise busy patient

visits quarter. Management, working together with the affected

partnerships, has recently taken a number of operational steps to

improve the net rate and appropriately adjust costs. Our updated

earnings guidance reflects these actions and the rate change. We

continue our emphasis on increasing the workers comp portion of our

payor mix. Internal de novo clinic development and particularly

prospective acquisition activity is strong.”

Larry McAfee, Chief Financial Officer, noted, “During the quarter, the

Company produced excellent net cash flow based on record receivables

collections with the average A/R days outstanding at 38 days as of June

30th.”

U.S. Physical Therapy Declares Quarterly Dividend

The third quarterly dividend of 2015 for $0.15 per share will be paid on

September 4 to shareholders of record as of August 18.

2015 Earnings Guidance Update

Management currently expects the Company’s earnings from continuing

operations for the year 2015 to be in the range of $21.7 million to

$22.7 million in net income and $1.75 to $1.83 in diluted earnings per

share. Guidance issued previously was for 2015 net income in the range

of $22.3 million to $22.9 million and $1.80 to $1.86 in diluted earnings

per share.

Please note that management’s guidance range represents projected

earnings from existing operations only and excludes future acquisitions.

The annual guidance figures will not be updated unless there is a

material development that causes management to believe that earnings

will be significantly outside the given range.

Second Quarter 2015 Conference Call

U.S. Physical Therapy's Management will host a conference call at 10:30

a.m. Eastern Time, 9:30 a.m. Central Time, on Thursday, August 6, 2015

to discuss the Company’s Quarter Ended June 30, 2015 results. Interested

parties may participate in the call by dialing 1-888-335-5539 or

973-582-2857 and entering reservation number 80627966 approximately 10

minutes before the call is scheduled to begin. To listen to the live

call via web-cast, go to the Company's website at www.usph.com at

least 15 minutes early to register, download and install any necessary

audio software. The conference call will be archived and can be accessed

until October 6, 2015.

Forward-Looking Statements

This press release contains statements that are considered to be

forward-looking within the meaning under Section 21E of the Securities

Exchange Act of 1934, as amended. These statements contain

forward-looking information relating to the financial condition, results

of operations, plans, objectives, future performance and business of our

Company. These statements (often using words such as “believes”,

“expects”, “intends”, “plans”, “appear”, “should” and similar words)

involve risks and uncertainties that could cause actual results to

differ materially from those we expect. Included among such statements

may be those relating to new clinics, availability of personnel and the

reimbursement environment. The forward-looking statements are based on

our current views and assumptions and actual results could differ

materially from those anticipated in such forward-looking statements as

a result of certain risks, uncertainties, and factors, which include,

but are not limited to:

-

changes as the result of government enacted national healthcare reform;

-

changes in Medicare guidelines and reimbursement or failure of our

clinics to maintain their Medicare certification status;

-

business and regulatory conditions including federal and state

regulations;

-

governmental and other third party payor investigations and audits;

-

compliance with federal and state laws and regulations relating to the

privacy of individually identifiable patient information, and

associated fines and penalties for failure to comply;

-

changes in reimbursement rates or payment methods from third party

payors including government agencies and deductibles and co-pays owed

by patients;

-

transition to ICD-10 coding system;

-

revenue and earnings expectations;

-

general economic conditions;

-

availability and cost of qualified physical and occupational

therapists;

-

personnel productivity;

-

competitive, economic or reimbursement conditions in our markets which

may require us to reorganize or close certain operations and thereby

incur losses and/or closure costs including the possible write-down or

write-off of goodwill and other intangible assets;

-

acquisitions, purchase of non-controlling interests (minority

interests) and the successful integration of the operations of the

acquired businesses;

-

maintaining adequate internal controls;

-

availability, terms, and use of capital; and

-

weather and other seasonal factors.

Many factors are beyond our control. Given these uncertainties, you

should not place undue reliance on our forward-looking statements.

Please see our periodic reports filed with the Securities and Exchange

Commission for more information on these factors. Our forward-looking

statements represent our estimates and assumptions only as of the date

of this press release. Except as required by law, we are under no

obligation to update any forward-looking statement, regardless of the

reason the statement is no longer applicable.

About U.S. Physical Therapy, Inc.

Founded in 1990, U.S. Physical Therapy, Inc. operates 501 outpatient

physical and occupational therapy clinics in 42 states. The Company's

clinics provide preventative and post-operative care for a variety of

orthopedic-related disorders and sports-related injuries, treatment for

neurologically-related injuries and rehabilitation of injured workers.

In addition to owning and operating clinics, the Company manages 19

physical therapy facilities for third parties, including hospitals and

physician groups.

More information about U.S. Physical Therapy, Inc. is available at www.usph.com.

The information included on that website is not incorporated into this

press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. PHYSICAL THERAPY, INC. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF NET INCOME

|

|

(IN THOUSANDS, EXCEPT PER SHARE DATA)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2015

|

|

2014

|

|

|

2015

|

|

2014

|

|

Net patient revenues

|

|

|

$

|

81,451

|

|

|

$

|

76,470

|

|

|

|

$

|

157,258

|

|

|

$

|

144,867

|

|

|

Other revenues

|

|

|

|

1,837

|

|

|

|

1,731

|

|

|

|

|

3,271

|

|

|

|

3,101

|

|

|

Net revenues

|

|

|

|

83,288

|

|

|

|

78,201

|

|

|

|

|

160,529

|

|

|

|

147,968

|

|

|

Clinic operating costs:

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and related costs

|

|

|

|

44,398

|

|

|

|

40,109

|

|

|

|

|

87,450

|

|

|

|

78,051

|

|

|

Rent, clinic supplies, contract labor and other

|

|

|

|

16,681

|

|

|

|

15,205

|

|

|

|

|

33,006

|

|

|

|

29,421

|

|

|

Provision for doubtful accounts

|

|

|

|

1,062

|

|

|

|

1,054

|

|

|

|

|

2,052

|

|

|

|

2,004

|

|

|

Closure costs

|

|

|

|

5

|

|

|

|

(2

|

)

|

|

|

|

37

|

|

|

|

11

|

|

|

Total clinic operating costs

|

|

|

|

62,146

|

|

|

|

56,366

|

|

|

|

|

122,545

|

|

|

|

109,487

|

|

|

Gross margin

|

|

|

|

21,142

|

|

|

|

21,835

|

|

|

|

|

37,984

|

|

|

|

38,481

|

|

|

Corporate office costs

|

|

|

|

7,593

|

|

|

|

7,614

|

|

|

|

|

15,250

|

|

|

|

14,746

|

|

|

Operating income

|

|

|

|

13,549

|

|

|

|

14,221

|

|

|

|

|

22,734

|

|

|

|

23,735

|

|

|

Interest and other income, net

|

|

|

|

16

|

|

|

|

-

|

|

|

|

|

24

|

|

|

|

1

|

|

|

Interest expense

|

|

|

|

(245

|

)

|

|

|

(332

|

)

|

|

|

|

(510

|

)

|

|

|

(585

|

)

|

|

Income before taxes

|

|

|

|

13,320

|

|

|

|

13,889

|

|

|

|

|

22,248

|

|

|

|

23,151

|

|

|

Provision for income taxes

|

|

|

|

4,203

|

|

|

|

4,469

|

|

|

|

|

6,980

|

|

|

|

7,408

|

|

|

Net income including non-controlling interests

|

|

|

|

9,117

|

|

|

|

9,420

|

|

|

|

|

15,268

|

|

|

|

15,743

|

|

|

Less: net income attributable to non-controlling interests

|

|

|

|

(2,813

|

)

|

|

|

(2,988

|

)

|

|

|

|

(4,798

|

)

|

|

|

(5,083

|

)

|

|

Net income attributable to common shareholders

|

|

|

$

|

6,304

|

|

|

$

|

6,432

|

|

|

|

$

|

10,470

|

|

|

$

|

10,660

|

|

|

Basic earnings per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

From operations prior to revaluation of redeemable non-controlling

interests, net of tax

|

|

|

$

|

0.51

|

|

|

$

|

0.53

|

|

|

|

$

|

0.85

|

|

|

$

|

0.88

|

|

|

Charges to additional paid-in-capital - revaluation of redeemable

non-controlling interests, net of tax

|

|

|

|

(0.03

|

)

|

|

|

(0.01

|

)

|

|

|

|

(0.03

|

)

|

|

|

(0.09

|

)

|

|

Basic

|

|

|

$

|

0.48

|

|

|

$

|

0.52

|

|

|

|

$

|

0.82

|

|

|

$

|

0.79

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

From operations prior to revaluation of redeemable non-controlling

interests, net of tax

|

|

|

$

|

0.51

|

|

|

$

|

0.53

|

|

|

|

$

|

0.85

|

|

|

$

|

0.87

|

|

|

Charges to additional paid-in-capital - revaluation of redeemable

non-controlling interests, net of tax

|

|

|

|

(0.03

|

)

|

|

|

(0.01

|

)

|

|

|

|

(0.03

|

)

|

|

|

(0.09

|

)

|

|

Diluted

|

|

|

$

|

0.48

|

|

|

$

|

0.52

|

|

|

|

$

|

0.82

|

|

|

$

|

0.78

|

|

|

Shares used in computation:

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

12,409

|

|

|

|

12,224

|

|

|

|

|

12,362

|

|

|

|

12,177

|

|

|

Diluted

|

|

|

|

12,409

|

|

|

|

12,226

|

|

|

|

|

12,362

|

|

|

|

12,184

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share

|

|

|

$

|

0.15

|

|

|

$

|

0.12

|

|

|

|

$

|

0.30

|

|

|

$

|

0.24

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. PHYSICAL THERAPY, INC AND SUBSIDIARIES

CONSOLIDATED EARNINGS PER SHARE

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30, 2015

|

|

|

June 30, 2014

|

|

|

|

June 30, 2015

|

|

|

June 30, 2014

|

|

Earnings attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From operations prior to revaluation of redeemable non-controlling

interests, net of tax

|

|

|

$

|

6,304

|

|

|

|

$

|

6,432

|

|

|

|

|

$

|

10,470

|

|

|

|

$

|

10,660

|

|

|

Charges to additional paid-in-capital - revaluation of redeemable

non-controlling interests, net of tax

|

|

|

|

(376

|

)

|

|

|

|

(119

|

)

|

|

|

|

|

(376

|

)

|

|

|

|

(1,086

|

)

|

|

|

|

|

$

|

5,928

|

|

|

|

$

|

6,313

|

|

|

|

|

$

|

10,094

|

|

|

|

$

|

9,574

|

|

|

Basic earnings per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From operations prior to revaluation of redeemable non-controlling

interests, net of tax

|

|

|

$

|

0.51

|

|

|

|

$

|

0.53

|

|

|

|

|

$

|

0.85

|

|

|

|

$

|

0.88

|

|

|

Charges to additional paid-in-capital - revaluation of redeemable

non-controlling interests, net of tax

|

|

|

|

(0.03

|

)

|

|

|

|

(0.01

|

)

|

|

|

|

|

(0.03

|

)

|

|

|

|

(0.09

|

)

|

|

|

|

|

$

|

0.48

|

|

|

|

$

|

0.52

|

|

|

|

|

$

|

0.82

|

|

|

|

$

|

0.79

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From operations prior to revaluation of redeemable non-controlling

interests, net of tax

|

|

|

$

|

0.51

|

|

|

|

$

|

0.53

|

|

|

|

|

$

|

0.85

|

|

|

|

$

|

0.87

|

|

|

Charges to additional paid-in-capital - revaluation of redeemable

non-controlling interests, net of tax

|

|

|

|

(0.03

|

)

|

|

|

|

(0.01

|

)

|

|

|

|

|

(0.03

|

)

|

|

|

|

(0.09

|

)

|

|

|

|

|

$

|

0.48

|

|

|

|

$

|

0.52

|

|

|

|

|

$

|

0.82

|

|

|

|

$

|

0.78

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share - weighted-average shares

|

|

|

|

12,409

|

|

|

|

|

12,224

|

|

|

|

|

|

12,362

|

|

|

|

|

12,177

|

|

|

Effect of dilutive securities - stock options

|

|

|

|

-

|

|

|

|

|

2

|

|

|

|

|

|

-

|

|

|

|

|

7

|

|

|

Denominator for diluted earnings per share - adjusted

weighted-average shares

|

|

|

|

12,409

|

|

|

|

|

12,226

|

|

|

|

|

|

12,362

|

|

|

|

|

12,184

|

|

|

|

|

|

|

|

|

|

|

U.S. PHYSICAL THERAPY, INC. AND SUBSIDIARIES

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(IN THOUSANDS, EXCEPT SHARE DATA)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2015

|

|

|

December 31, 2014

|

|

ASSETS

|

|

|

(unaudited)

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

12,972

|

|

|

|

$

|

14,271

|

|

|

Patient accounts receivable, less allowance for doubtful accounts of

$1,618 and $1,669, respectively

|

|

|

|

34,830

|

|

|

|

|

32,891

|

|

|

Accounts receivable - other, less allowance for doubtful accounts of

$198 and $198, respectively

|

|

|

|

1,338

|

|

|

|

|

1,503

|

|

|

Other current assets

|

|

|

|

6,509

|

|

|

|

|

6,186

|

|

|

Total current assets

|

|

|

|

55,649

|

|

|

|

|

54,851

|

|

|

Fixed assets:

|

|

|

|

|

|

|

|

Furniture and equipment

|

|

|

|

43,495

|

|

|

|

|

42,003

|

|

|

Leasehold improvements

|

|

|

|

24,107

|

|

|

|

|

22,806

|

|

|

|

|

|

|

67,602

|

|

|

|

|

64,809

|

|

|

Less accumulated depreciation and amortization

|

|

|

|

51,098

|

|

|

|

|

49,045

|

|

|

|

|

|

|

16,504

|

|

|

|

|

15,764

|

|

|

Goodwill

|

|

|

|

170,914

|

|

|

|

|

147,914

|

|

|

Other intangible assets, net

|

|

|

|

24,167

|

|

|

|

|

24,907

|

|

|

Other assets

|

|

|

|

1,086

|

|

|

|

|

1,115

|

|

|

|

|

|

$

|

268,320

|

|

|

|

$

|

244,551

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Accounts payable - trade

|

|

|

$

|

1,451

|

|

|

|

$

|

1,782

|

|

|

Accrued expenses

|

|

|

|

19,446

|

|

|

|

|

22,839

|

|

|

Current portion of notes payable

|

|

|

|

800

|

|

|

|

|

883

|

|

|

Total current liabilities

|

|

|

|

21,697

|

|

|

|

|

25,504

|

|

|

Notes payable

|

|

|

|

1,059

|

|

|

|

|

234

|

|

|

Revolving line of credit

|

|

|

|

41,000

|

|

|

|

|

34,500

|

|

|

Deferred rent

|

|

|

|

1,040

|

|

|

|

|

991

|

|

|

Other long-term liabilities

|

|

|

|

10,925

|

|

|

|

|

8,732

|

|

|

Total liabilities

|

|

|

|

75,721

|

|

|

|

|

69,961

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

Redeemable non-controlling interests

|

|

|

|

10,585

|

|

|

|

|

7,376

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

U. S. Physical Therapy, Inc. shareholders' equity:

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value, 500,000 shares authorized, no

shares issued and outstanding

|

|

|

|

-

|

|

|

|

|

-

|

|

|

Common stock, $.01 par value, 20,000,000 shares authorized,

14,635,674 and 14,487,346 shares issued, respectively

|

|

|

|

146

|

|

|

|

|

145

|

|

|

Additional paid-in capital

|

|

|

|

45,829

|

|

|

|

|

43,577

|

|

|

Retained earnings

|

|

|

|

140,933

|

|

|

|

|

134,186

|

|

|

Treasury stock at cost, 2,214,737 shares

|

|

|

|

(31,628

|

)

|

|

|

|

(31,628

|

)

|

|

Total U. S. Physical Therapy, Inc. shareholders' equity

|

|

|

|

155,280

|

|

|

|

|

146,280

|

|

|

Non-controlling interests

|

|

|

|

26,734

|

|

|

|

|

20,934

|

|

|

Total equity

|

|

|

|

182,014

|

|

|

|

|

167,214

|

|

|

|

|

|

$

|

268,320

|

|

|

|

$

|

244,551

|

|

|

|

|

|

|

|

|

|

|

U.S. PHYSICAL THERAPY, INC. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(IN THOUSANDS, EXCEPT PER SHARE DATA)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2015

|

|

|

2014

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net income including non-controlling interests

|

|

|

$

|

15,268

|

|

|

|

$

|

15,743

|

|

|

Adjustments to reconcile net income including non-controlling

interests to net cash provided by operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

|

3,674

|

|

|

|

|

2,825

|

|

|

Provision for doubtful accounts

|

|

|

|

2,052

|

|

|

|

|

2,004

|

|

|

Equity-based awards compensation expense

|

|

|

|

2,206

|

|

|

|

|

1,593

|

|

|

Gain on sale or abandonment of assets, net

|

|

|

|

(13

|

)

|

|

|

|

34

|

|

|

Excess tax benefit from shared-based compensation

|

|

|

|

(430

|

)

|

|

|

|

(215

|

)

|

|

Deferred income tax

|

|

|

|

2,130

|

|

|

|

|

2,422

|

|

|

Write-off of goodwill - closed clinic

|

|

|

|

111

|

|

|

|

|

-

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

Increase in patient accounts receivable

|

|

|

|

(2,880

|

)

|

|

|

|

(4,442

|

)

|

|

Decrease (increase) in accounts receivable - other

|

|

|

|

165

|

|

|

|

|

(80

|

)

|

|

(Increase) decrease in other assets

|

|

|

|

(13

|

)

|

|

|

|

1,540

|

|

|

Decrease in accounts payable and accrued expenses

|

|

|

|

(3,958

|

)

|

|

|

|

(774

|

)

|

|

Increase in other Long term liabilities

|

|

|

|

927

|

|

|

|

|

404

|

|

|

Net cash provided by operating activities

|

|

|

|

19,239

|

|

|

|

|

21,054

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

Purchase of fixed assets

|

|

|

|

(2,873

|

)

|

|

|

|

(2,132

|

)

|

|

Purchase of businesses, net of cash acquired

|

|

|

|

(14,467

|

)

|

|

|

|

(10,750

|

)

|

|

Acquisitions of non-controlling interests

|

|

|

|

(968

|

)

|

|

|

|

(4,945

|

)

|

|

Proceeds on sale of business and fixed assets, net

|

|

|

|

72

|

|

|

|

|

38

|

|

|

Net cash used in investing activities

|

|

|

|

(18,236

|

)

|

|

|

|

(17,789

|

)

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Distributions to non-controlling interests (including redeemable

non-controlling interests)

|

|

|

|

(4,906

|

)

|

|

|

|

(4,982

|

)

|

|

Cash Dividends to shareholders

|

|

|

|

(3,723

|

)

|

|

|

|

(2,932

|

)

|

|

Proceeds from revolving line of credit

|

|

|

|

51,000

|

|

|

|

|

77,000

|

|

|

Payments on revolving line of credit

|

|

|

|

(44,500

|

)

|

|

|

|

(72,000

|

)

|

|

Payment of notes payable

|

|

|

|

(608

|

)

|

|

|

|

(575

|

)

|

|

Tax benefit from share-based compensation

|

|

|

|

430

|

|

|

|

|

215

|

|

|

Other

|

|

|

|

5

|

|

|

|

|

45

|

|

|

Net cash used in financing activities

|

|

|

|

(2,302

|

)

|

|

|

|

(3,229

|

)

|

|

Net (decrease) increase in cash and cash equivalents

|

|

|

|

(1,299

|

)

|

|

|

|

36

|

|

|

Cash and cash equivalents - beginning of period

|

|

|

|

14,271

|

|

|

|

|

12,898

|

|

|

Cash - end of period

|

|

|

$

|

12,972

|

|

|

|

$

|

12,934

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

Income taxes

|

|

|

$

|

3,835

|

|

|

|

$

|

3,235

|

|

|

Interest

|

|

|

$

|

460

|

|

|

|

$

|

657

|

|

|

Non-cash investing and financing transactions during the period:

|

|

|

|

|

|

|

|

Purchase of business - seller financing portion

|

|

|

$

|

1,350

|

|

|

|

$

|

400

|

|

|

Revaluation of redeemable non-controlling interests

|

|

|

$

|

627

|

|

|

|

$

|

1,841

|

|

|

|

|

|

|

|

|

U.S. PHYSICAL THERAPY, INC. AND SUBSIDIARIES

|

|

RECAP OF CLINIC COUNT

|

|

|

|

|

|

|

|

|

|

|

|

Number

|

|

|

|

|

|

of

|

|

Date

|

|

|

|

Clinics

|

|

|

|

|

|

|

|

March 31, 2014

|

|

|

|

472

|

|

June 30, 2014

|

|

|

|

486

|

|

September 30, 2014

|

|

|

|

489

|

|

December 31, 2014

|

|

|

|

489

|

|

|

|

|

|

|

|

March 31, 2015

|

|

|

|

494

|

|

June 30, 2015

|

|

|

|

501

|

CONTACT:

U.S. Physical Therapy, Inc.

Larry McAfee, (713) 297-7000

Chief

Financial Officer

or

Chris Reading, (713) 297-7000

Chief

Executive Officer

or

Westwicke Partners

Bob East, (443) 213-0502

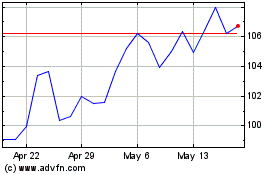

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Jun 2024 to Jul 2024

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Jul 2023 to Jul 2024