false

0001703079

82-2305867

0001703079

2024-02-01

2024-02-01

0001703079

XFLT:CommonSharesOfBeneficialInterestMember

2024-02-01

2024-02-01

0001703079

XFLT:Sec6.50Series2026Member

2024-02-01

2024-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 2, 2024 (February 1, 2024)

XAI

Octagon Floating Rate & Alternative Income Trust

(Exact name of registrant as specified in its

charter)

| Delaware |

|

811-23247 |

|

82-235867 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 321 North Clark Street, Suite 2430, Chicago, Illinois |

|

60654 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrants telephone number, including area

code (312) 374-6930

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares of Beneficial Interest |

|

XFLT |

|

New York Stock Exchange |

6.50% Series 2026

Term Preferred Shares

(Liquidation Preference $25.00) |

|

XFLTPRA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging

growth company

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry

into a Material Definitive Agreement. |

Registered Direct Placement of Common Shares

On February 1, 2024, the XAI Octagon Floating Rate

& Alternative Income Trust (formerly, XAI Octagon Floating Rate & Alternative Income Term Trust (NYSE: XFLT) (the “Trust”)

entered into a purchase agreement (the “Purchase Agreement”) between the Trust and the purchasers named therein (the “Purchasers”)

in connection with the purchase and sale of common shares of beneficial interest, par value $0.01 per share, of the Trust (the “Common

Shares”) in a registered direct placement (the “Offering”) pursuant to the Trust’s effective shelf registration

statement filed with the SEC. The Trust has agreed to sell 3,546,854 Common Shares at a price of $7.0485 per Common Share. The offering

is expected to close on or about February 5, 2024, subject to the satisfaction of customary closing conditions. The Trust expects to receive

net proceeds (before expenses) from the sale of Common Shares of approximately $25.0 million.

The Offering has been made pursuant a prospectus

supplement, dated February 1, 2024, and the accompanying prospectus, dated January 24, 2022, each of which constitutes part of the Trust’s

effective shelf registration statement on Form N-2 (File No. 333-261521) previously filed with the SEC (the “Registration Statement”).

The Trust has not retained a placement agent, underwriter,

broker or dealer with respect to the Offering.

The foregoing description of the Purchase Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Common Share Purchase Agreement

filed herewith as Exhibit 10.1 and incorporated herein by reference.

Common Share Voting Arrangements

Pursuant to the Purchase Agreement and a

letter agreement by and among the Trust, Eagle Point Credit Management LLC (“Eagle Point”) and the Purchasers, the

Purchasers and Eagle Point have granted the Trust an irrevocable proxy to vote at any annual meeting or special meeting of

shareholders of the Trust all Common Shares held by the Purchasers, Eagle Point, any other person controlled by Eagle Point’s

direct parent company (“Eagle Point Parent”), or any other investment vehicles or accounts sponsored or managed by Eagle

Point or any person controlled by Eagle Point Parent, or which Eagle Point or any person controlled by Eagle Point Parent otherwise

has or shares the power to vote, or to direct the voting of, as of the record date for the applicable annual or special meeting of

shareholders of the Trust in the same proportion as the vote of all other holders. The letter agreement provides that it shall

terminate automatically at such time as the Purchasers, Eagle Point, any other person controlled by Eagle Point Parent, any other

investment vehicles or accounts sponsored or managed by Eagle Point or any person controlled by Eagle Point Parent, or which Eagle

Point or any person controlled by Eagle Point Parent otherwise has or shares the power to vote, or direct the voting of, hold in the

aggregate less than 4.9% of the outstanding Common Shares of the Trust. The foregoing is qualified in its entirety by reference to

the full text of the Purchase Agreement filed herewith as Exhibit 10.1 and incorporated herein by reference and the letter agreement

filed herewith as Exhibit 10.2 and incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure |

On February 1, 2024, the Trust issued a press release,

furnished as Exhibit 99.1 to this Current Report and incorporated herein by reference.

The information disclosed under this Item 7.01,

including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as

expressly set forth by specific refence in such filing.

On February 1, 2024, the Trust conducted the Offering

pursuant to the Trust’s Registration Statement. A copy of the opinion of Skadden, Arps, Slate, Meagher & Flom LLP relating to

the legality of the Common Shares is filed herewith as Exhibit 5.1 and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

| 5.1 |

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP |

| |

|

|

| 10.1 |

|

Purchase Agreement, dated February 1, 2024, between the Trust and the Purchasers |

| |

|

|

| 10.2 |

|

Letter Agreement, dated February 1, 2024, between the Trust, Eagle Point and the Purchasers |

| |

|

|

| 23.1 |

|

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (included in Exhibit 5.1) |

| |

|

|

| 99.1 |

|

Press Release, dated February 1, 2024 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

XAI OCTAGON FLOATING RATE & ALTERNATIVE INCOME TRUST |

| |

|

|

| Date: February 2, 2024 |

By: |

/s/ Benjamin D. McCulloch |

| |

Name: |

Benjamin D. McCulloch |

| |

Title: |

Secretary and Chief Legal Officer |

2

Exhibit 5.1

| |

Skadden,

Arps, Slate, Meagher & Flom llp

155 North

Wacker Drive

Chicago,

Illinois 60606-1720

________

TEL: (312) 407-0700

FAX: (312) 407-0411

www.skadden.com |

FIRM/AFFILIATE

OFFICES

BOSTON

HOUSTON

LOS ANGELES

NEW YORK

PALO ALTO

WASHINGTON, D.C.

WILMINGTON

BEIJING

BRUSSELS

FRANKFURT

HONG KONG

LONDON

MUNICH

PARIS

SÃO PAULO

SEOUL

SHANGHAI

SINGAPORE

TOKYO

TORONTO |

February 1, 2024

XAI Octagon Floating Rate & Alternative Income Trust

321 North Clark Street, Suite 2430

Chicago, Illinois 60654

| Re: | XAI Octagon Floating Rate & Alternative Income Trust — Offering of Common

Shares |

Ladies and Gentlemen:

We have acted as special counsel

to XAI Octagon Floating Rate & Alternative Income Trust, a statutory trust (the “Trust”) created under the Delaware

Statutory Trust Act (the “DSTA”), in connection with the issuance and sale by the Trust of 3,546,854 shares (the “Shares”)

of the Trust’s common shares of beneficial interest, par value $0.01 per share (the “Common Shares”), pursuant

to the Purchase Agreement, dated February 1, 2024 (the “Purchase Agreement”), between the Trust and the purchasers

identified on Appendix A thereto (the “Purchasers”).

This opinion is being furnished in accordance with

the requirements of sub-paragraph (l) of item 25.2 of part C of Form N-2 under the Securities Act of 1933 (the “Securities Act”),

and the Investment Company Act of 1940, as amended (the “1940 Act”).

In rendering the opinions stated herein, we have

examined and relied upon the following:

(i) the

notification of registration on Form N-8A (File No. 811-23247) of the Trust filed with the Securities and Exchange Commission (the “Commission”)

under the 1940 Act on April 7, 2017;

(ii) the

registration statement on Form N-2 (File Nos. 333-261521 and 811-23247) of the Trust, filed with the Commission on December 7, 2021 under

the Securities Act and the 1940 Act, allowing for delayed offerings pursuant to Rule 415 of the General Rules and Regulations under the

Securities Act (the “Securities Act Rules and Regulations”), Pre-Effective Amendment No. 1 thereto, including information

deemed to be a part of the registration statement pursuant to Rule 430B of the Securities Act Rules and Regulations, and the Notice of

Effectiveness of the Commission posted on its website declaring such registration statement effective on January 24, 2022 (such registration

statement, as so amended, being hereinafter referred to as the “Registration Statement”);

XAI Octagon Floating Rate & Alternative Income Trust

February 1, 2024

Page 2

(iii) the

prospectus and Statement of Additional Information of the Trust, each dated January 24, 2022, in the form filed with the Commission on

June 28, 2022 pursuant to Rule 424(b) of the Securities Act Rules and Regulations (such prospectus and Statement of Additional Information

being hereinafter referred to collectively as the “Base Prospectus”);

(iv) the

preliminary prospectus supplement of the Trust, dated February 1, 2024, relating to the offering of the Shares, in the form filed with

the Commission on February 1, 2024 pursuant to Rule 424(b) of the Securities Act Rules and Regulations;

(v) the prospectus supplement of the Trust,

dated February 1, 2024 (together with the Base Prospectus, the “Prospectus”), relating to the offering of the

Shares, in the form to be filed with the Commission on February 2, 2024 pursuant to Rule 424(b) of the Securities Act Rules and

Regulations;

(vi) an

executed copy of the Purchase Agreement;

(vii) an

executed copy of a certificate of Benjamin D. McCulloch, Secretary of the Trust, dated the date hereof (the “Secretary’s

Certificate”);

(viii) a

copy of the Trust’s Certificate of Trust, dated April 4, 2017, as amended by Certificates of Amendment dated July 13, 2017, August

31, 2017 and January 25, 2024 (as so amended, the “Certificate of Trust”), certified by the Secretary of State of the

State of Delaware as of February 1, 2024 and certified pursuant to the Secretary’s Certificate;

(ix) a copy

of the Trust’s Second Amended and Restated Agreement and Declaration of Trust, by the trustees of the Trust, dated July 13, 2017,

as amended by the Certificate of Amendment to the Trust’s Second Amended and Restated Agreement and Declaration of Trust, dated

August 31, 2017, by the trustees of the Trust, and by the Second Amendment to the Trust’s Second Amended and Restated Agreement

and Declaration of Trust, dated February 1, 2024, by the trustees of the Trust and as supplemented by the Statement of Preferences, dated

March 23, 2021, as amended on September 8, 2021, June 28, 2022 and October 6, 2023, establishing and fixing the rights and preferences

of the Term Preferred Shares (as so amended and supplemented, the “Declaration of Trust”), certified pursuant to the

Secretary’s Certificate;

(x) a copy

of the Trust’s Amended and Restated By-Laws, as amended and in effect as of November 16, 2021 and as amended by the Second Amendment

to the Amended and Restated By-Laws of the Trust, effective as of February 1, 2024 (as so amended, the “By-Laws”),

certified pursuant to the Secretary’s Certificate;

(xi) copies

of certain resolutions of the Board of Trustees of the Trust, adopted on November 16, 2021 and February 1, 2024, and certain resolutions

of an offering committee of the Board of Trustees of the Trust, adopted on February 1, 2024, certified pursuant to the Secretary’s

Certificate; and

XAI Octagon Floating Rate & Alternative Income Trust

February 1, 2024

Page 3

(xii) a

copy of a certificate, dated the date hereof, from the Secretary of State of the State of Delaware with respect to the Trust’s existence

and good standing in the State of Delaware.

We have also examined originals or copies, certified

or otherwise identified to our satisfaction, of such records of the Trust and such agreements, certificates and receipts of public officials,

certificates of officers or other representatives of the Trust and others, and such other documents as we have deemed necessary or appropriate

as a basis for the opinions stated below.

In our examination, we have assumed the genuineness

of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all

documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic,

certified, or photocopied copies, and the authenticity of the originals of such copies. As to any facts relevant to the opinions stated

herein that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives

of the Trust and others and of public officials, including the facts and conclusions set forth in the Secretary’s Certificate and

the factual representations and warranties contained in the Purchase Agreement.

In making our

examination of documents, we have assumed that the parties thereto, other than the Trust, had or will have the power, corporate or other,

to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or

other, and execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties.

We do not express any opinion with respect to the

laws of any jurisdiction other than the DSTA.

Based upon the foregoing and subject to the qualifications

and assumptions stated herein, we are of the opinion that the Shares have been duly authorized by all requisite statutory trust action

on the part of the Trust under the DSTA and, when the Shares are duly registered into the share record books of the Trust and delivered

to and paid for by the Purchasers as contemplated by the Purchase Agreement, the Shares will be validly issued and fully paid, and under

the DSTA, the holders of the Shares will have no obligation to make further payments for the purchase of such Shares or contributions

to the Trust solely by reason of their ownership of such Shares except for their obligation to repay any funds wrongfully distributed

to them.

In rendering the foregoing opinions, we have assumed

that the Certificate of Trust, Declaration of Trust and the By-Laws constitute the only governing instruments, as defined in the DSTA,

of the Trust.

XAI Octagon Floating Rate & Alternative Income Trust

February 1, 2024

Page 4

We hereby consent to the filing of this opinion with

the Commission as an exhibit to the Current Report on Form 8-K being filed on the date hereof and incorporated by reference into the Registration

Statement. We also hereby consent to the reference to our firm under the heading “Legal Matters” in the Prospectus. In giving

this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the

Securities Act or the Securities Act Rules and Regulations. This opinion is expressed as of the date hereof unless otherwise expressly

stated, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent

changes in applicable laws.

| |

Very truly yours, |

| |

|

| |

/s/ Skadden, Arps, Slate, Meagher & Flom LLP |

|

|

Exhibit 10.1

PURCHASE AGREEMENT

THIS PURCHASE AGREEMENT (this

“Agreement”) is entered into as of February 1, 2024, by and between XAI Octagon Floating Rate & Alternative Income

Trust (formerly, XAI Octagon Floating Rate & Alternative Income Term Trust), a Delaware statutory trust (the “Trust”),

and each purchaser identified on Appendix A hereto (each, a “Purchaser” and collectively the “Purchasers”).

WHEREAS, subject to the terms

and conditions set forth in this Agreement and pursuant to an effective registration statement under the Securities Act of 1933, as amended

(the “Securities Act”), the Trust desires to issue, and each Purchaser, severally and not jointly, desires to purchase

shares of the Trust’s common shares of beneficial interest, par value $0.01 per share (the “Common Shares”),

upon the terms and conditions as more particularly provided herein; and

NOW, THEREFORE, in consideration

of the foregoing and of the mutual agreements hereinafter contained and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound, the Trust and each Purchaser hereby agree as follows:

ARTICLE I

PURCHASE AND SALE; CLOSING

1.1 Purchase

and Sale of the Shares. At the Closing (as defined in Section 1.2), the Trust shall sell to each Purchaser, and each Purchaser, severally

and not jointly, shall buy from the Trust, upon the terms and conditions hereinafter set forth, the number of Common Shares as specified

on Appendix A to this Agreement (all such Common Shares, the “Shares”), and at the purchase price of $7.0485

per Share.

1.2 The

Closing. The completion of the purchase and sale of the Shares (the “Closing”) shall occur at 10:00 A.M. (Eastern

time), on February 5, 2024 (the “Closing Date”) at the offices of the Trust, or at such other time, date and location

as the parties shall mutually agree. At the Closing, (a) the purchase price for the Shares being purchased by each Purchaser (the “Purchase

Price”) shall be delivered by or on behalf of such Purchaser to the Trust as more particularly provided in Section 1.3 and (b)

the Trust shall cause Equiniti Trust Company, LLC, the Trust’s transfer agent (the “Transfer Agent”), to deliver

to each Purchaser the number of Shares as specified on Appendix A to this Agreement and as more particularly provided in Section

1.4.

1.3. Delivery

of the Purchase Price. At the Closing, each Purchaser shall remit by wire transfer the amount of funds equal to the Purchase Price

with respect to the Shares being purchased by it to the account designated by the Trust on Appendix B hereto.

1.4 Delivery

of the Shares. On the Closing Date, each Purchaser shall direct the broker-dealer at which the account or accounts to be credited

with the Shares being purchased by such Purchaser are maintained (which broker/dealer shall be a Depository Trust Company participant)

to set up a Deposit/Withdrawal at Custodian (“DWAC”) instructing the Transfer Agent to credit such account or accounts

with the Shares purchased by such Purchaser by means of an electronic book-entry delivery. Such DWAC shall indicate the Closing Date as

the settlement date for the deposit of the Shares being purchased by such Purchaser. Immediately following the delivery to the Trust by

or on behalf of each Purchaser of the Purchase Price in accordance with and pursuant to Section 1.3, the Trust shall direct the Transfer

Agent to credit such Purchaser’s account or accounts with the Shares being purchased by such Purchaser pursuant to the information

contained in the DWAC.

1.5 Conditions

to the Trust’s Obligations. The Trust’s obligation to sell and issue the Shares to each Purchaser will be subject to the

receipt by the Trust of the respective Purchase Price from such Purchaser as set forth in Section 1.3 and the accuracy of the representations

and warranties made by such Purchaser and the fulfillment of those undertakings of such Purchaser to be fulfilled prior to the Closing

Date.

1.6 Conditions

to Purchaser’s Obligations. Each Purchaser’s obligation to purchase the respective Shares to be purchased by it hereunder

is subject to the fulfillment to each such Purchaser’s reasonable satisfaction, prior to or at the Closing, of the following conditions:

(a) The

representations and warranties of the Trust in this Agreement shall be correct when made and at the Closing.

(b) The

Trust shall have performed and complied with all agreements and conditions contained in this Agreement required to be performed or complied

with by it prior to or at the Closing.

(c) The

Trust shall have delivered to each such Purchaser an officer’s certificate from the Trust’s President, Vice President or other

senior officer, dated the Closing Date, certifying that the conditions specified in Sections 1.6(a) and 1.6(b) have been fulfilled.

(d) The

Trust shall have delivered to each such Purchaser a certificate of its Secretary, dated the Closing Date, certifying as to (i) the resolutions

attached thereto and other trust proceedings relating to the authorization, issuance and sale of the Shares and the authorization, execution

and delivery of this Agreement and (ii) the Trust’s organizational documents as then in effect.

ARTICLE II

REPRESENTATIONS AND WARRANTIES

2.1 Purchaser

Representations and Warranties. In connection with the purchase and sale of the Shares, each Purchaser represents and warrants, severally

and not jointly, to the Trust that:

(a) Such

Purchaser is acquiring the Shares for such Purchaser’s account and with no view to the distribution thereof. Such Purchaser has

no present intent, agreement, understanding or arrangement to sell, assign or transfer all or any part of the Shares, or any interest

therein, to any other person.

(b) Such

Purchaser in connection with its decision to purchase the Shares, relied only upon the Prospectus (as hereinafter defined) and the representations

and warranties of the Trust contained herein. Further, such Purchaser acknowledges that the Prospectus Supplement (as defined below) was

made available to Purchaser before this Agreement (or any contractual obligation of such Purchaser to purchase the Shares) will be deemed

to be effective.

(c) Such

Purchaser has full right, power, authority and capacity to enter into this Agreement and to consummate the transactions contemplated hereby

and has taken all necessary action to authorize the execution, delivery and performance of this Agreement. Eagle Point Credit Management,

LLC, in its capacity as agent and/or investment manager of each Purchaser is duly authorized and empowered to execute this Agreement on

behalf of each Purchaser. This Agreement has been duly and validly authorized, executed and delivered by or on behalf of each Purchaser

and this Agreement constitutes a valid and binding obligation of such Purchaser enforceable against such Purchaser in accordance with

its terms.

(d) Such

Purchaser understands that nothing in this Agreement or any other materials presented to Purchaser in connection with the purchase and

sale of the Shares constitutes legal, tax or investment advice. Such Purchaser has consulted such legal, tax and investment advisors as

it, in its sole discretion, has deemed necessary or appropriate in connection with its purchase of Shares.

2.2 Trust

Representations and Warranties. In connection with the purchase and sale of the Shares, the Trust represents and warrants to each

Purchaser that:

(a) The

Trust (i) has been duly formed and has legal existence as a statutory trust and is in good standing under the laws of the State of Delaware;

(ii) has full power and authority to own, lease and operate its properties and assets, and conduct its business as described in the Registration

Statement (as defined below) and the Prospectus; (iii) is duly licensed and qualified to transact business and is in good standing in

each jurisdiction where it owns or leases property or in which the conduct of its business or other activity requires such qualification,

except where the failure to so qualify or to be in good standing would not have a material adverse effect on the Trust.

(b) The

Trust has full power and authority to enter into this Agreement and to perform all of the terms and provisions hereof to be carried out

by it. This Agreement has been duly and validly authorized, executed and delivered by or on behalf of the Trust. Assuming due authorization,

execution and delivery by the other parties hereto, this Agreement constitutes a legal, valid and binding obligation of the Trust enforceable

in accordance with its terms, subject to the qualification that the enforceability of the Trust’s obligations thereunder may be

limited by U.S. bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance and similar laws affecting creditors’

rights generally, whether statutory or decisional, and to general equitable principles (regardless of whether enforcement is sought in

a proceeding in equity or at law), and except as enforcement of rights to indemnity or contribution thereunder may be limited by federal

or state securities laws.

(c) The

Shares to be issued and delivered to and paid for by the Purchasers in accordance with this Agreement have been duly authorized and when

issued and delivered to the Purchasers against payment therefor as provided by this Agreement will have been validly issued and will be

fully paid and nonassessable.

(d) The

offering and sale of the Shares hereunder are being made pursuant to an effective Registration Statement on Form N-2 (File No. 333-261521

and 811-23247), initially filed with the Securities and Exchange Commission (the “Commission”) on December 7, 2021,

as amended by Pre-Effective Amendment No. 1 thereto (the “Registration Statement”), and the Prospectus, dated January

24, 2022, including the statement of additional information and all documents incorporated by reference therein (the “Base Prospectus”),

as supplemented by the Prospectus Supplement, dated the date hereof (the “Prospectus Supplement”), that will be filed

with the Commission on or before the Closing Date. “Preliminary Prospectus,” as used herein means, the Base Prospectus

and the Preliminary Prospectus Supplement, dated February 1, 2024 (including the statement of additional information and all documents

incorporated therein by reference) that was used prior to the execution and delivery of this Agreement and filed with the Commission by

the Trust. “Prospectus,” as used herein, means the Base Prospectus and the Prospectus Supplement (including the statement

of additional information and all documents incorporated therein by reference). “Disclosure Package” means the Preliminary

Prospectus taken together with the information relating to (i) the number of Shares issued and (ii) the offering price of the Shares included

on the cover page of the Prospectus. No stop order or other order suspending the Registration Statement has been issued and, to the best

of the Trust’s knowledge, no proceedings for that purpose have been initiated or threatened by the Trust or any other governmental

authority.

(e) At

the time of execution of this Agreement, the Disclosure Package did not contain any untrue statement of a material fact or omit to state

any material fact necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

As of the Closing Date, the Prospectus will not contain any untrue statement of a material fact or omit to state any material fact necessary

in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. Since the date

as of which information is given in the Registration Statement, the Preliminary Prospectus and the Prospectus, except as otherwise stated

therein, (i) there has been no material adverse change in the condition (financial or otherwise), business prospects, management, net

assets or results of operations of the Trust, whether or not arising in the ordinary course of business (other than changes resulting

from changes in securities markets generally).

(f) The

financial statements, including the statement of assets and liabilities, together with any related notes or schedules thereto, included

or incorporated by reference in the Registration Statement, the Preliminary Prospectus and the Prospectus present fairly the financial

position of the Trust as of the dates and for the periods indicated and said statements were prepared in accordance with generally accepted

accounting principles in the United States applied on a consistent basis.

(g) None

of (i) the execution and delivery by the Trust of this Agreement, (ii) the issuance and sale by the Trust of the Shares as contemplated

by this Agreement, the Registration Statement, the Preliminary Prospectus and the Prospectus and (iii) the performance by the Trust of

its obligations under this Agreement (A) conflicts with or will conflict with, or results in or will result in a breach or violation of

the declaration of trust (as amended and restated from time to time), bylaws or similar organizational documents of the Trust, (B) conflicts

with or will conflict with, results in or will result in a breach or violation of, or constitutes or will constitute a default or an event

of default under, or results in or will result in the creation or imposition of any lien, charge or encumbrance upon any properties or

assets of the Trust under the terms and provisions of any agreement, indenture, mortgage, loan agreement, note, insurance or surety agreement,

lease or other instrument to which the Trust is a party or by which it may be bound or to which any of the property or assets of the Trust

is subject, except which breach, violation, default, lien, charge or encumbrance would not have a material adverse effect on the Trust,

or (C) results in or will result in any violation of any order, law, rule or regulation of any court, governmental instrumentality, securities

exchange or association or arbitrator, whether foreign or domestic, applicable to the Trust or having jurisdiction over the Trust’s

properties, except which violation would not have a material adverse effect on the Trust.

(h) No

consent, approval, authorization, notification or order of, or filing with, or the issuance of any license or permit by, any federal,

state, local or foreign court or governmental or regulatory agency, commission, board, authority or body or with any self-regulatory organization,

other non-governmental regulatory authority, securities exchange or association, whether foreign or domestic, is required by the Trust

for the consummation by the Trust of the transactions to be performed by the Trust or the performance by the Trust of all the terms and

provisions to be performed by or on behalf of it in each case as contemplated in this Agreement, the Registration Statement, the Preliminary

Prospectus and the Prospectus, except such as (i) may be required and have been obtained under the Securities Act, the Securities Exchange

Act of 1934, the Investment Company Act of 1940 (the “Investment Company Act”) or the Investment Advisors Act of 1940

or (ii) which failure to obtain would not have a material adverse effect on the Trust.

(i) Except as otherwise

set forth in the Registration Statement or the Prospectus, there is no action, suit, claim, inquiry, investigation or proceeding affecting

the Trust or to which the Trust is a party before or by any court, commission, regulatory body, administrative agency or other governmental

agency or body, whether foreign or domestic, now pending or, to the knowledge of the Trust, threatened against the Trust, except which

would not have a material adverse effect on the Trust.

(j) The

operations of the Trust are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements

of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the Money Laundering Control Act of 1986, as amended, the

Bank Secrecy Act, as amended, the United and Strengthening of America by Providing Appropriate tools Required to Intercept and Obstruct

Terrorism Act (USA PATRIOT Act) of 2011, the money laundering statutes of all applicable jurisdictions, the rules and regulations thereunder

and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively,

the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority

or body or any arbitrator involving the Trust with respect to the Money Laundering Laws is pending or, to the knowledge of the Trust after

reasonable inquiry, threatened.

(k)

The Trust intends to direct the investment of the proceeds of the offering of the Shares in such a manner as to comply with the requirements

of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and has qualified and intends to continue

to operate in compliance with the requirements to maintain its qualification as a regulated investment company under Subchapter M of the

Code.

(l) Neither

the Trust, nor to the knowledge of the Trust, after reasonable inquiry, any trustee, officer, agent, employee or affiliate of the Trust

is (i) currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”)

or any other relevant sanctions authority or (ii) located, organized or resident in a country or territory that is subject to sanctions

by OFAC or any other relevant sanctions authority; and the Trust will not directly or indirectly use the proceeds of the offering, or

lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity, for the

purpose of financing the activities of any person currently subject to any U.S. sanctions administered by OFAC or any other relevant sanctions

authority.

(m) The

Trust is duly registered with the Commission under the Investment Company Act as a non-diversified, closed-end management investment company;

the provisions of the Trust’s declaration of trust (as amended and restated from time to time) and bylaws comply in all material

respects with the requirements of the Investment Company Act.

(n) The

Trust shall, by 5:30 p.m. Eastern time on the second trading day immediately following the date of this Agreement, issue a Current Report

on Form 8-K including the form of this Agreement and an opinion of legal counsel as to the validity of the Shares as exhibits thereto.

ARTICLE III

OTHER AGREEMENT OF THE PARTIES

3.1 Absence

of Control. It is the intent of the parties to this Agreement that in no event shall Purchasers, by reason of this Agreement or the

transactions contemplated thereby, be deemed to control, directly or indirectly, the Trust, and Purchasers shall not exercise, or be deemed

to exercise, directly or indirectly, a controlling influence over the management or policies of the Trust.

3.2 Tax

Information. On the Closing Date, each Purchaser shall deliver to the Trust a properly completed and executed IRS Form W-9, dated

as of the Closing Date, and shall update or replace such form from time to time upon any subsequent obsolescence, inaccuracy, or other

invalidity thereof.

ARTICLE IV

GENERAL PROVISIONS

4.1

Survival of Representations, Warranties and Agreements. Notwithstanding any investigation made by any party to this Agreement,

all covenants, agreements, representations and warranties made by the Trust and each Purchaser hereby will survive the execution of this

Agreement, the delivery to such Purchaser of the Shares and the payment by such Purchaser of the Purchase Price therefor for a period

of one year.

4.2 Entire

Agreement. This Agreement represents the entire agreement among the parties with respect to the transactions contemplated herein and

supersedes all prior agreements, written or oral, with respect thereto.

4.3 Amendment

and Waiver. The provisions of this Agreement may be amended only with the prior written consent of the Trust and each Purchaser. The

failure of any party to insist upon strict adherence to any one or more of the covenants and restrictions in this Agreement, on one or

more occasion, shall not be construed as a waiver, nor deprive such party of the right to require strict compliance thereafter with the

same. All waivers must be in writing and signed by the waiving party.

4.4 Expenses.

Each Purchaser and the Trust will pay its own respective expenses, including attorneys’ fees, in connection with the negotiation

of this Agreement, the performance of its obligations hereunder, and the consummation of the transactions contemplated by this Agreement;

provided, however, that the Purchasers will pay the Trust’s reasonable and documented expenses of external legal counsel in connection

with drafting the documentation relating to the transactions contemplated by this Agreement in an amount not to exceed $50,000.

4.5 Successors

and Assigns. This Agreement and all of the provisions hereof will be binding upon and inure to the benefit of the parties hereto and

their respective successors and permitted assigns; provided, however, that neither this Agreement nor any of the rights, interests or

obligations hereunder may be assigned by any party without the prior written consent of each other party, except that the Shares may be

transferred by each Purchaser without the consent of the Trust.

4.6 Governing

Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect

to the choice of law principles thereof.

4.7 Counterparts.

This Agreement may be executed in counterparts, each of which shall be an original and all of which shall constitute a single agreement.

Delivery of an executed signature page of this Agreement by facsimile or other electronic transmission shall be effective as delivery

of a manually executed counterpart hereof.

4.8 Severability.

The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the

validity or enforceability of the other provisions hereof. If any provision of this Agreement, or the application thereof to any person

or entity or any circumstance, is invalid or unenforceable, (a) a suitable and equitable provision shall be substituted therefor in order

to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid or unenforceable provision and (b) the remainder

of this Agreement and the application of such provision to other persons, entities or circumstances shall not be affected by such invalidity

or unenforceability, nor shall such invalidity or unenforceability affect the validity or enforceability of such provision, or the application

thereof, in any other jurisdiction.

4.9 Construction.

Each covenant contained herein shall be construed (absent express provision to the contrary) as being independent of each other covenant

contained herein, so that compliance with any one covenant shall not (absent such an express contrary provision) be deemed to excuse compliance

with any other covenant. Where any provision herein refers to action to be taken by any person, or which such person is prohibited from

taking, such provision shall be applicable whether such action is taken directly or indirectly by such person, whether or not expressly

specified in such provision. The construction of this Agreement shall not be affected by which party drafted this Agreement.

4.10 Headings.

The headings of the sections and subsections hereof are provided for convenience only and shall not in any way affect the meaning or construction

of any provision of this Agreement.

4.11 Further

Assurances. In connection with this Agreement and the transactions contemplated herein, the parties to this Agreement shall execute

and deliver any additional documents and instruments and perform any additional acts that may be necessary or appropriate to effectuate

and perform the provisions of this Agreement and such transactions.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have executed

this Purchase Agreement on the date first written above.

| |

XAI OCTAGON FLOATING RATE & ALTERNATIVE INCOME TRUST |

| |

|

|

| |

/s/ Benjamin D. McCulloch |

| |

Name: |

Benjamin D. McCulloch |

| |

Title: |

Secretary and Chief Legal Officer |

| |

|

|

| |

PURCHASERS: |

| |

|

|

| |

By: |

EAGLE POINT CREDIT MANAGEMENT, LLC |

| |

|

|

| |

|

On behalf of each Purchaser listed on Appendix A hereto |

| |

|

|

| |

|

/s/ Taylor Pine |

| |

|

Name: |

Taylor Pine |

| |

|

Title: |

Director |

Exhibit 10.2

XAI Octagon Floating Rate & Alternative

Income Trust

321 North Clark Street, Suite 2430

Chicago, Illinois 60654

February 1, 2024

Eagle Point Credit Management LLC

600 Steamboat Road, Suite 202

Greenwich, CT 06830

Ladies and Gentlemen:

Whereas, the parties desire to enter into this letter agreement (the

“Letter Agreement”) in connection with the Purchase Agreement, dated as of February 1, 2024 (the “Purchase

Agreement”), between XAI Octagon Floating Rate & Alternative Income Trust (formerly, XAI Octagon Floating Rate & Alternative

Income Term Trust) (the “Trust”) and each purchaser party thereto (each, a “Purchaser”) relating

to the purchase of common shares of beneficial interest, par value $0.01 per share, of the Trust (the “Common Shares”).

Eagle Point Credit Management LLC (“Eagle Point”) is the investment manager of each Purchaser.

The parties do hereby agree:

1. (a) Each Purchaser hereby grants to the Trust an irrevocable

proxy to vote at any annual or special meeting of shareholders of the Trust all of the Common Shares which the Purchaser is entitled to

vote as of the record date for the applicable annual or special meeting of shareholders of the Trust in the same proportion as the vote

of all other holders of Common Shares of the Trust.

(b) Eagle

Point hereby grants to the Trust an irrevocable proxy to vote at any annual or special meeting of shareholders of the Trust all other

Common Shares held by Eagle Point, any person controlled by Eagle Point Holdings LP, Eagle Point’s immediate parent company (“Eagle

Point Parent”), or any other investment vehicles or accounts sponsored or managed by Eagle Point or any person controlled by Eagle

Point Parent, or which Eagle Point or any person controlled by Eagle Point Parent otherwise has or shares the power to vote, or to direct

the voting of, as of the record date for the applicable annual or special meeting of shareholders of the Trust (together with the Common

Shares which any Purchaser is entitled to vote, the “Eagle Point Shares”), in the same proportion as the vote of all other

holders of Common Shares of the Trust.

2. Upon the request of the

Trust, Eagle Point shall promptly provide to the Trust a written certification listing the number of Eagle Point Shares as of the record

date of such meeting and identifying the intermediary(s), if any, through which such Eagle Point Shares are held. The Trust (or its agent)

shall cooperate with Eagle Point in connection with Eagle Point’s compliance with its obligations hereunder.

3. All notices shall be in

writing and shall be delivered by registered or overnight mail, facsimile, or electronic mail to the address for each party specified

below or to such other person or address as such party may designate for receipt of such notice.

If to the Trust:

XAI Octagon Floating Rate & Alternative Income

Trust

c/o XA Investments LLC

321 North Clark Street, Suite 2430

Chicago, Illinois 60654

Attention: Secretary and Chief Legal Officer

E-mail: bmcculloch@xainvestments.com

If to Eagle Point:

Eagle Point Credit Management LLC

600 Steamboat Road, Suite 202

Greenwich, CT 06830

If to a Purchaser:

c/o Eagle Point Credit Management LLC

600 Steamboat Road, Suite 202

Greenwich, CT 06830

4. The execution and delivery

by each of the Trust, Eagle Point and each Purchaser of this Letter Agreement and the performance by each of the Trust, Eagle Point and

each Purchaser of its respective obligations hereunder have been duly authorized by all necessary action of the Trust, Eagle Point and

each Purchaser. Eagle Point, in its capacity as agent and/or investment manager of each Purchaser is duly authorized and empowered to

execute this Agreement on behalf of each Purchaser. Each of the Trust, Eagle Point and each Purchaser hereby represents and warrants that

this Letter Agreement is enforceable against it in accordance with its terms.

5. This Letter Agreement shall

terminate automatically at such time as the Eagle Point Shares, in the aggregate, represent less than 4.9% of the outstanding Common Shares

of the Trust.

6. Each party hereto hereby

acknowledges and agrees that irreparable harm will occur in the event any of the provisions of this Letter Agreement were not performed

in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties will be entitled to seek

specific performance hereunder, including, without limitation, an injunction or injunctions to prevent and enjoin breaches of the provisions

of this Letter Agreement and to enforce specifically the terms and provisions hereof, in addition to any other remedy to which they may

be entitled at law or in equity. Any requirements for the securing or posting of any bond with respect to any such remedy are hereby waived.

All rights and remedies under this Letter Agreement are cumulative, not exclusive, and will be in addition to all rights and remedies

available to any party at law or in equity.

7. The parties hereto hereby

irrevocably and unconditionally consent to and submit to the jurisdiction of the state or federal courts in the State of Delaware for

any actions, suits or proceedings arising out of or relating to this Letter Agreement or the transactions contemplated hereby. The parties

irrevocably and unconditionally waive any objection to the laying of venue of any action, suit or proceeding arising out of this Letter

Agreement, or the transactions contemplated hereby, in the state or federal courts in the State of Delaware, and hereby further irrevocably

and unconditionally waive and agree not to plead or claim in any such court that any such action, suit or proceeding brought in any such

court has been brought in an inconvenient forum. Each party waives all right to trial by jury in any action, proceeding or counterclaim

(whether based upon contract, tort or otherwise) in any way arising out of or relating to this Letter Agreement.

8. This Letter Agreement represents

the entire agreement among the parties with respect to the transactions contemplated herein and supersedes all prior agreements, written

or oral, with respect thereto.

9. The provisions of this

Letter Agreement may be amended or modified only with the prior written consent of the Trust and Eagle Point. The failure of any party

to insist upon strict adherence to any one or more of the covenants and restrictions in this Letter Agreement, on one or more occasion,

shall not be construed as a waiver, nor deprive such party of the right to require strict compliance thereafter with the same. All waivers

must be in writing and signed by the waiving party.

10. This Letter Agreement

and all of the provisions hereof will be binding upon and inure to the benefit of the parties hereto and their respective successors and

permitted assigns; provided, however, that neither this Letter Agreement nor any of the rights, interests or obligations hereunder may

be assigned by any party without the prior written consent of each other party.

11. This Letter Agreement

shall be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect to the choice of law

principles thereof.

12. This Letter Agreement

may be executed in counterparts, each of which shall be an original and all of which shall constitute a single agreement. Delivery of

an executed signature page of this Agreement by facsimile or other electronic transmission shall be effective as delivery of a manually

executed counterpart hereof.

13. The provisions of this

Letter Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability

of the other provisions hereof. If any provision of this Letter Agreement, or the application thereof to any person or entity or any circumstance,

is invalid or unenforceable, (a) a suitable and equitable provision shall be substituted therefor in order to carry out, so far as

may be valid and enforceable, the intent and purpose of such invalid or unenforceable provision and (b) the remainder of this Letter

Agreement and the application of such provision to other persons, entities or circumstances shall not be affected by such invalidity or

unenforceability, nor shall such invalidity or unenforceability affect the validity or enforceability of such provision, or the application

thereof, in any other jurisdiction.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties hereto have executed this Letter Agreement

as of the date first above written.

| |

XAI OCTAGON FLOATING RATE &

ALTERNATIVE INCOME TRUST |

| |

|

| |

By: |

/s/ Benjamin D. McCulloch |

| |

|

Name: |

Benjamin D. McCulloch |

| |

|

Title: |

Secretary and Chief Legal Officer |

| |

|

|

|

| |

EAGLE POINT CREDIT MANAGEMENT LLC |

| |

|

| |

By: |

/s/ Taylor Pine |

| |

|

Name: |

Taylor Pine |

| |

|

Title: |

Director |

| |

|

|

|

| |

PURCHASERS: |

| |

|

|

|

| |

By: |

EAGLE POINT CREDIT MANAGEMENT LLC |

| |

|

|

| |

|

On behalf of each Purchaser listed on Appendix A hereto |

| |

|

|

|

| |

|

/s/ Taylor Pine |

| |

|

Name: |

Taylor Pine |

| |

|

Title: |

Director |

[Voting Letter Agreement Signature Page]

4

Exhibit 99.1

XAI Octagon Floating

Rate & Alternative Income Trust Announces Registered Direct Placement of Common Shares

CHICAGO, Illinois - February 1,

2024 - XAI Octagon Floating Rate & Alternative Income Trust (the “Trust”)1

(NYSE: XFLT), a diversified, closed-end management investment company with an investment objective to seek attractive total return

with an emphasis on income generation across multiple stages of the credit cycle, has entered into a Purchase Agreement with certain

institutional investors for the purchase and sale of Common Shares in a registered direct placement pursuant to the Trust’s

effective shelf registration statement filed with the SEC. The Trust has agreed to sell 3,546,854 Common Shares at a price of

$7.0485 per Common Share. The offering is expected to close on or about February 5, 2024, subject

to the satisfaction of customary closing conditions. The Trust expects to receive net proceeds (before expenses) from the sale of

Common Shares of approximately $25 million.

The Common Shares were offered directly

to the purchasers without a placement agent, underwriter, broker or dealer.

The offering of Common Shares may be

made only by means of a prospectus.

Investors should consider the investment

objective and policies, risk considerations, charges and expenses of the Trust carefully before investing. The preliminary prospectus

supplement, dated February 1, 2024, and accompanying prospectus, dated January 24, 2022, each of which has been filed with the SEC, contain

a description of these matters and other important information about the Trust and should be read carefully before investing.

Copies of the preliminary prospectus

supplement and accompanying prospectus may be obtained from: XA Investments, Attn: Investor Relations, 321 N. Clark, Suite 2430, Chicago,

IL 60654, or by emailing info@xainvestments.com, or by calling 1-888-903-3358.

Investors may also obtain these documents

free of charge from the SEC’s website at www.sec.gov.

The information in the preliminary prospectus

supplement, the accompanying prospectus and this press release is not complete and may be changed. This press release shall not constitute

an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such

offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

The Trust intends to use the net proceeds

from the offering to invest in accordance with its investment objective and policies, to pay down outstanding borrowings under its credit

facility and/or for general working capital purposes.

| 1 | Effective February 1, 2024, the name of the Trust was changed

from “XAI Octagon Floating Rate & Alternative Income Term Trust” to “XAI Octagon Floating Rate & Alternative

Income Trust.” |

About XA Investments

XA Investments LLC (“XAI”) serves as the Trust’s

investment adviser. XAI is a Chicago-based firm founded by XMS Capital Partners in April, 2016. In addition to investment advisory services,

the firm also provides investment fund structuring and consulting services focused on registered closed-end funds to meet client needs.

XAI offers custom product build and consulting services, including development and market research, sales, marketing, fund management

and administration. XAI believes that the investing public can benefit from new vehicles to access a broad range of alternative investment

strategies and managers. XAI provides individual investors with access to institutional-caliber alternative managers. For more information,

please visit www.xainvestments.com.

About XMS Capital Partners

XMS Capital Partners, LLC, established in 2006, is a global, independent,

financial services firm providing M&A, corporate advisory and asset management services to clients. It has offices

in Chicago, Boston and London. For more information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the

Trust’s investment sub-adviser. Octagon is a 29 year-old, $35B below-investment grade corporate credit investment adviser focused

on leveraged loan, high yield bond and structured credit (CLO debt and equity) investments. Through fundamental credit analysis and active

portfolio management, Octagon’s investment team identifies attractive relative value opportunities across below-investment grade

asset classes, sectors, and issuers. Octagon’s investment philosophy and methodology encourage and rely upon dynamic internal communication

to manage portfolio risk. Over its history, the firm has applied a disciplined, repeatable, and scalable approach in its effort to generate

attractive risk-adjusted returns for its investors. For more information, please visit www.octagoncredit.com.

* * *

XAI does not provide tax advice; please consult a professional tax

advisor regarding your specific tax situation. Income may be subject to state and local taxes, as well as the federal alternative minimum

tax.

Investors should consider the investment objectives and policies, risk

considerations, charges and expenses of the Trust carefully before investing. For more information on the Trust, please visit the Trust’s

webpage at www.xainvestments.com.

This press release shall not constitute an offer to sell or a solicitation

to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would

be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

This press release contains certain statements that may include “forward-looking

statements.” Forward-looking statements can be identified by the words “may,” “will,” “intend,”

“expect,” “estimate,” “continue,” “plan,” “anticipate,” and similar terms

and the negatives of such terms. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could

differ materially from those contemplated by the forward-looking statements. Many factors that could materially affect the Trust’s

actual results are the performance of the portfolio of securities held by the Trust, the conditions in the U.S. and international financial

and other markets, the price at which the Trust’s shares trade in the public markets and other factors discussed in the Trust’s

annual and semi-annual reports filed with the SEC.

Although the Trust believes that the expectations

expressed in such forward-looking statements are reasonable, actual results could differ materially from those expressed or implied in

such forward-looking statements. The Trust’s future financial condition and results of operations, as well as any forward-looking

statements, are subject to change and are subject to inherent risks and uncertainties. You are cautioned not to place undue reliance on

these forward-looking statements, which are made as of the date of this press release. Except for the Trust’s ongoing obligations

under the federal securities laws, the Trust does not intend, and the Trust undertakes no obligation, to update any forward-looking statement.

| NOT FDIC INSURED |

|

NO BANK GUARANTEE |

|

MAY LOSE VALUE |

Contacts

Kimberly Flynn, Managing Director

XA Investments LLC

Phone: 1-888-903-3358

Email: info@xainvestments.com

www.xainvestments.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=XFLT_CommonSharesOfBeneficialInterestMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=XFLT_Sec6.50Series2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

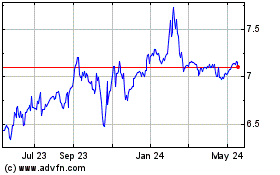

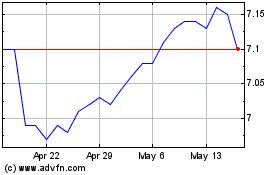

XAI Octagon Floating Rat... (NYSE:XFLT)

Historical Stock Chart

From Apr 2024 to May 2024

XAI Octagon Floating Rat... (NYSE:XFLT)

Historical Stock Chart

From May 2023 to May 2024