Vortex Announces Private Placement of C$400,000 of Unsecured Convertible Debentures

January 09 2025 - 7:00AM

Vortex Energy Corp. (CSE: VRTX | OTC: VTECF | FRA: AA3)

("

Vortex” or the "

Company") is

pleased to announce that it intends to complete a non-brokered

private placement of unsecured convertible debentures of the

Company (the “

Convertible Debentures”) in an

aggregate amount of C$400,000 (the “

Offering”).

The Convertible Debentures will be sold in

principal amounts of C$1,000 and will mature 12 months from the

date of issuance (the “Maturity Date”). The

Convertible Debentures will bear interest at a rate of 10% per

annum, calculated quarterly in arrears and payable on the Maturity

Date (as defined below).

The principal amount of each Convertible

Debenture, plus any accrued interest thereon, will be convertible

into units of the Company (“Units”) at the

election of the holder on, or at any time prior to, the Maturity

Date at a conversion price equal to the most recent closing price

of the common shares of the Company (“Common

Shares”) on the Canadian Securities Exchange prior to the

time at which the holder delivers notice of conversion to the

Company (the “Market Price”). Each Unit shall be

comprised of one Common Share and one Common Share purchase warrant

(each, a “Warrant”), with each Warrant entitling

the holder to acquire one Common Share at an exercise price equal

to 110% of the Market Price for a period of 24 months from the date

of issuance.

The Company intends to use the net proceeds

raised from the Offering for general and administrative

expenditures and general working capital purposes. The Offering is

expected to close on or about January 24, 2025.

All securities issued pursuant to the Offering

will be subject to a statutory four month and one day hold period.

Closing of the Offering is subject to the Company’s receipt of all

necessary regulatory approvals, including approval of the Canadian

Securities Exchange.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any securities in the

United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

About Vortex Energy Corp.

Vortex Energy Corp. is an exploration stage

company engaged principally in the acquisition, exploration, and

development of mineral properties in North America. The Company is

currently advancing its Robinsons River Salt Project comprised of a

total of 942 claims covering 23,500 hectares located approximately

35 linear kms south of the town of Stephenville in the Province of

Newfoundland & Labrador. The Robinsons River Salt Project is

prospective for both salt and hydrogen salt cavern storage. The

Company is also evaluating technologies to efficiently store

hydrogen or energy in salt caverns. The Company is also currently

advancing its Fire Eye Uranium Property in the Athabasca Basin, a

region globally renowned for its uranium deposits.

On Behalf of the Board of

DirectorsPaul Sparkes Chief Executive Officer, Director +1

(778) 819-0164info@vortexenergycorp.com

Cautionary Note Regarding

Forward-Looking Statements

Certain statements contained in this press

release constitute forward-looking information. These statements

relate to future events or future performance. The use of any of

the words “could”, “intend”, “expect”, “believe”, “will”,

“projected”, “estimated” and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on the Company’s

current belief or assumptions as to the outcome and timing of such

future events.

In particular, this press release contains

forward-looking information relating to, among other things, the

Offering, including the total anticipated proceeds, the expected

use of proceeds and the closing (including the proposed closing

date) of the Offering. Various assumptions or factors are typically

applied in drawing conclusions or making the forecasts or

projections set out in forward-looking information, including the

assumption that the Company will close the Offering on the timeline

anticipated, will raise the anticipated amount of gross proceeds

from the Offering and will use the proceeds of the Offering as

anticipated. Those assumptions and factors are based on information

currently available to the Company. Although such statements are

based on reasonable assumptions of the Company’s management, there

can be no assurance that any conclusions or forecasts will prove to

be accurate.

Forward-looking information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include: the risk that the Offering does not close on the

timeline expected, or at all; the risk that the Company raises less

than the anticipated amount of gross proceeds from the Offering;

the risk that the Company does not use the proceeds from the

Offering as currently expected; risks inherent in the exploration

and development of mineral deposits, including risks relating to

changes in project parameters as plans continue to be redefined and

the risk that exploration and development activities will cost more

than the amount budgeted for such activities by the Company; access

and supply risks; operational risks; regulatory risks, including

risks relating to the acquisition of the necessary licenses and

permits; and financing, capitalization and liquidity risks. The

forward-looking information contained in this release is made as of

the date hereof, and the Company is not obligated to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise, except as required by

applicable securities laws. Because of the risks, uncertainties and

assumptions contained herein, investors should not place undue

reliance on forward-looking information. The foregoing statements

expressly qualify any forward-looking information contained

herein.

The Canadian Securities Exchange has not

reviewed, approved, or disapproved the contents of this press

release.

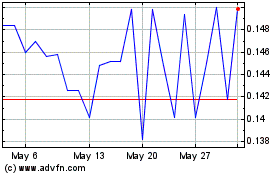

Vortex Energy (TG:AA3)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vortex Energy (TG:AA3)

Historical Stock Chart

From Jan 2024 to Jan 2025