Provides Potential for Material Increase in

Shareholder Value Given Synergies That Exist With Sangdong Mine,

Currently Under Construction

Highlights

- Maiden Independent Inferred Molybdenum Mineral Resource

Estimate of 21.48Mt @ 0.26% MoS2 at the 0.19% MoS2 reporting

cut-off.

- Molybdenum Resource is located adjacent to the Tungsten

Resource at the Sangdong Tungsten project, on a fully permitted,

mining lease.

- Company will investigate integration into the Sangdong

Tungsten Mine which is currently under construction.

- Previous drilling has indicated that the deposit is open in

several directions and that higher grade zone may be delineated.

Both factors will be assessed with further drilling in the

future.

Almonty Industries Inc. (“Almonty” or the

“Company”) (TSX: AII / ASX: AII / OTCQX: ALMTF / Frankfurt:

ALI) is pleased to announce a maiden JORC 2012-compliant Inferred

Mineral Resource Estimate (MRE) of 21.48Mt @ 0.26% MoS2 at

the 0.19% MoS2 reporting cut-off for the Almonty Korea Moly Project

(AKM Project), which is located on the existing Sangdong

Tungsten Mine, which is currently under construction in South

Korea.

Almonty’s Chairman, President and CEO Lewis Black commented:

“The AKM Project is a major growth plank for Almonty and is

conveniently located immediately adjacent to the tungsten mine, on

our fully permitted, under construction Sangdong Tungsten Mine. We

are pleased to report our maiden Mineral Resource Estimate which

could be a globally relevant project in its own right.

We are pleased to note that based on a review of previous

exploration work, the MRE has significant upside, given the deposit

appears to be open in multiple directions and further that

potential exists to delineate a high grade zone within the current

orebody.

We are also excited to formulate a robust mining plan so that

this project will run alongside our tungsten mine simultaneously

given that both can share the same existing mining infrastructure

and the dramatic development cost savings it presents. Being LME

traded, it is also pleasing to note the hedging and pricing

transparency of molybdenum. We look forward continuing further

exploration works to integrating the AKM Project into the Sangdong

Tungsten Mine.”

The MRE has been independently estimated by Adam Wheeler, an

independent mining consultant, was prepared according to the

guidelines of the JORC Code dated 2012 and has also been prepared

in accordance with the 2015 edition of the Australasian Code for

Public Reporting of Technical Assessments and Valuations of Mineral

Assets (“VALMIN Code”).

The Resource estimate was based on a drillhole database stemming

from underground drilling, and some surface drilling, completed

prior to 1992 by the Korea Tungsten Mining Company Ltd.

(KTMC), as well by Oriental Minerals OTL during 2006-2008.

The KTMC drilling covers 14,300m over 27 holes.

Almonty notes that, based on a review of historical drilling,

the molybdenum zone may continue to the northeast and northwest,

where significant MoS2 was intersected in historical exploration

drilling.

The molybdenum deposit of the AKM Project is located adjacent to

the tungsten mine of Sangdong and appears to be hydrothermal and

with two different mineralisation stages.

Further, it was noted that sections with zones of higher grade

do occur, but insufficient drilling has been carried out to

properly assess the grade distribution. The company will further

assess both the full size and scale and higher-grade zones in

future exploration work.

Mineral Resource Estimate

The current evaluation work has been carried out and prepared

according to the guidelines of the JORC Code (2012). The current

resource estimation is shown below, for a cut-off of 0.19%MoS2.

This cut-off level was derived from a molybdenum price of 14.25$/lb

Mo. The resource model uses a maximum lateral extrapolation of

100m.

AKM Project – Inferred

Mineral Resource Estimate

Host Rock Type

Tonnes

Mt

MoS2

%

Slate

4.34

0.28

Quartzite

17.14

0.26

Total

21.48

0.26

Notes:

- As of 31st May, 2022

- Block Size 25m x25m x 5m

- Cut-off 0.19% MoS2

- All resources categorised as Inferred

Geology and geological interpretation

The Jangsan quartzite underlies the main tungsten skarn deposit

of the Sangdong mine. This formation contains the Sangdong

Molybdenum Stockwork (SMS), a zone of quartz veins hosting

predominantly molybdenum mineralisation (Kuehnbaum, 2006 and Le,

2001). The mineralisation appears to be hydrothermal in nature and

with two stages of mineral deposition; the first molybdenum-poor

scheelite mineralisation was related to skarn alteration, which was

followed by quartz-scheelite-molybdenite-bismuthenite vein

emplacement. It is currently considered that the deep molybdenum

mineralisation is likely to comprise a system of sheeted or

stockwork veins.

In previous evaluation work, a mineralised envelope had been

defined which terminated upwards at the top of the quartzite.

However, it is clear that the MoS2 mineralisation continues up into

the overlying slates. The upper part of the overall MoS2

mineralisation overlaps with the tungsten-bearing beds and

underground mine workings. The current interpretation has been

based on capturing the majority of the +0.1%MoS2 assays.

Drilling Database

The drillhole database stems from underground drilling, and some

surface drilling, completed prior to 1992 by the Korea Tungsten

Mining Company Ltd. (“KTMC”), as well by Oriental Minerals OTL

during 2006-2008. The KTMC drilling covers 14,300m over 27 holes.

The OTL drilling which intersected the area of molybdenum

mineralisation, covers 4,000m over 6 holes. The sample database is

in the form of an Excel spreadsheets.

The majority of the holes are vertical with an average lateral

spacing of approximately 100m. Once within the overall extents of

the molybdenum zone, most of the holes exhibit marked alternating

nature of high and low grade assays, consistent with an overall

stockwork interpretation. The nature and dip of the higher grade

intersections is not clear. The upper 25% of the overall MoS2

mineralisation continues is hosted in slates. The lower 75% of the

overall MoS2 mineralisation is hosted in quartzite.

Mineral Resource Estimation Methodology

An updated mineral resource estimation was completed by the

Competent Person. This estimation employed a three-dimensional

block modelling approach, using Datamine software. The block model

was set up with a 25m x 25m x 5m parent cell size and a cutoff

grade of 0.19% MoS2. Grade estimation was done using ordinary

kriging (OK) for the waste/mineralisation fractions, as well as low

and high MoS2 grade portions. These estimated values were combined

to give overall MoS2 grades for each parent block.

All of these modelled resources were classified with an Inferred

category, reflecting the spacing and quality of available data, as

well as the geological understanding of the deposit.

Drilling Techniques, Sampling and assaying

The following information was based on the Wardrop. “Sangdong

Project Scoping Study” published in April 2010.

Sample Preparation

Sample preparation from core to pulps for analysis was completed

on-site. Core was sawn in half, half placed in a plastic sample bag

and half replaced in the core box for archival storage. Sample tags

were placed in the core box and in the sample bag and the sample

number was written on the sample bag as well. Standards were placed

into the sample stream at this point in the sampling process, in

accordance with a sample list that had been drawn up by the

geologist responsible for logging the hole. Core samples were

dried, split, crushed and pulverized on-site by WMC personnel in a

preparation lab that was purchased as a modular unit. Equipment was

cleaned by brushing and the use of compressed air between each

sample. An approximately 50g split portion of the pulverized sample

was sent to Perth, Australia, for analysis. Blanks are inserted one

in every twenty samples to ensure there is no contamination.

Analyses

From 2006 to 2008 samples were analysed at an external

laboratory in Brisbane by inductively coupled plasma mass

spectrometry (ICP- MS) for 41 elements and for ore grade quantities

of specific elements by aqua regia or four-acid digestion followed

by ICP analysis. All quantities are reported in parts per million

(ppm).

Sample Security and Chain of

Custody

The sample preparation facility comprised a fenced area beside

the WMC accommodation facility. A split portion of the pulp from

each sample and coarse rejects were retained in a locked facility

at the project site. The pulps are placed in brown paper envelopes

and sent by courier to

Perth.

Quality Assurance/Quality

Control

The QA/QC protocol included the insertion of the following

control samples in the assay batches, as summarised below:

- Pulp duplicates (one in 50, or 2%), consisting of second splits

of the pulverized samples that are submitted to the primary

laboratory for analysis in the same batches as the original

samples, but with different numbers.

- Certified reference materials (CRMs, three in 50, or 6%).

- Coarse blanks (one in 50, or 2%) and fine blanks (one in 50, or

2%), consisting of coarse (approximately 1” diameter) and

pulverized material, respectively, whose blank character was

demonstrated by laboratory analysis. Initially ground glass was

used as blank for Phases #1 to #4 drilling, but was subsequently

changed to coarse crystalline feldspar for Phase #5 drilling.

- Check samples (two in 50, or 4%), collected from pulps that

were previously assayed at the primary laboratory, were resubmitted

to another laboratory in Perth Australia for external control. The

check sample batch included an appropriate proportion of control

samples (pulp duplicates, CRMs and fine blanks).

The Competent Person considers that the sample preparation,

security, analytical procedures and supporting QA/QC results,

relating to the 2006- 2008 drilling campaign, were collected in

line with industry good practice.

Data Verification

Data verification procedures were applied by at the Sangdong

Project since 2006. The Competent Person last visited the Sangdong

site in August 2015, and discussed with site geologists all aspects

of sample collection, preparation and storage, as well as visiting

the core storage and sample preparation areas. The sample database

was also reviewed and during the resource estimation update, many

aspects of the drillhole data were checked by communication with

the Sangdong geologists. The Competent Person, after also checking

the Phase 7 (2016 drilling) results, considers these new results to

be demonstrating the same accuracy as previously, which therefore

supports their use in Mineral Resource Estimation. In the Competent

Person’s opinion, the geological data stemming from drilling data

after 2006 were collected in line with good industry practice,

allowing the results to be reported according to the guidelines of

the JORC Code. It is not known what quality control procedures were

applied to data derived prior to 2006.

Bulk Density

In the current resource estimation work, global average density

values (t/m3) were applied, of 2.63 t/m3 for Quartzite and 2.7 t/m3

for Slate. It is considered that the density values applied do take

adequate account of void spaces. There is no basis for any

particular relationship between density and MoS2 grade values.

Classification

All of these modelled resources were classified with an Inferred

category, reflecting the spacing and quality of available data, as

well as the geological understanding of the deposit.

Mining factors or Assumptions

A minimum thickness of 5m was applied in the Mineral Resource

estimation, as being a realistic minimum height for underground

mining.

Metallurgical Testing

No metallurgical test work has been completed on the AKM Project

by Almonty to date.

Environmental Permitting

The AKM Project is located on the Sangdong Tungsten Mine which

is fully permitted, with all environmental requirements for the

current development of the Sangdong Tungsten Mine have been met.

There are no areas requiring special protection or significant

natural environmental resources or wildlife habitats in the area

surrounding the Project site.

About Almonty

The principal business of Toronto, Canada-based Almonty

Industries Inc. is the mining, processing and shipping of tungsten

concentrate from its Los Santos Mine in western Spain and its

Panasqueira mine in Portugal as well as the development of its

Sangdong tungsten mine in Gangwon Province, South Korea and the

development of the Valtreixal tin/tungsten project in north western

Spain. The Los Santos Mine was acquired by Almonty in September

2011 and is located approximately 50 kilometres from Salamanca in

western Spain and produces tungsten concentrate. The Panasqueira

mine, which has been in production since 1896, is located

approximately 260 kilometres northeast of Lisbon, Portugal, was

acquired in January 2016 and produces tungsten concentrate. The

Sangdong mine, which was historically one of the largest tungsten

mines in the world and one of the few long-life, high-grade

tungsten deposits outside of China, was acquired in September 2015

through the acquisition of a 100% interest in Woulfe Mining Corp.

Almonty owns 100% of the Valtreixal tin-tungsten project in north-

western Spain. Further information about Almonty’s activities may

be found at www.almonty.com and under Almonty’s profile at

www.sedar.com.

Legal Notice

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law and therefore

persons in such jurisdictions into which this announcement is

released, published or distributed should inform themselves about

and observe such restrictions.

Neither the TSX nor its Regulation Services Provider (as that

term is defined in the policies of the TSX) accepts responsibility

for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

When used in this press release, the words “estimate”,

“project”, “belief”, “anticipate”, “intend”, “expect”, “plan”,

“predict”, “may” or “should” and the negative of these words or

such variations thereon or comparable terminology are intended to

identify forward-looking statements and information. These

statements and information are based on management’s beliefs,

estimates and opinions on the date that statements are made and

reflect Almonty’s current expectations.

Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of Almonty

to be materially different from those expressed or implied by such

forward-looking statements, including but not limited to: any

specific risks relating to fluctuations in the price of ammonium

para tungstate (“APT”) from which the sale price of Almonty’s

tungsten concentrate is derived, actual results of mining and

exploration activities, environmental, economic and political risks

of the jurisdictions in which Almonty’s operations are located and

changes in project parameters as plans continue to be refined,

forecasts and assessments relating to Almonty’s business, credit

and liquidity risks, hedging risk, competition in the mining

industry, risks related to the market price of Almonty’s shares,

the ability of Almonty to retain key management employees or

procure the services of skilled and experienced personnel, risks

related to claims and legal proceedings against Almonty and any of

its operating mines, risks relating to unknown defects and

impairments, risks related to the adequacy of internal control over

financial reporting, risks related to governmental regulations,

including environmental regulations, risks related to international

operations of Almonty, risks relating to exploration, development

and operations at Almonty’s tungsten mines, the ability of Almonty

to obtain and maintain necessary permits, the ability of Almonty to

comply with applicable laws, regulations and permitting

requirements, lack of suitable infrastructure and employees to

support Almonty’s mining operations, uncertainty in the accuracy of

mineral reserves and mineral resources estimates, production

estimates from Almonty’s mining operations, inability to replace

and expand mineral reserves, uncertainties related to title and

indigenous rights with respect to mineral properties owned directly

or indirectly by Almonty, the ability of Almonty to obtain adequate

financing, the ability of Almonty to complete permitting,

construction, development and expansion, challenges related to

global financial conditions, risks related to future sales or

issuance of equity securities, differences in the interpretation or

application of tax laws and regulations or accounting policies and

rules and acceptance of the TSX of the listing of Almonty shares on

the TSX.

Forward-looking statements are based on assumptions management

believes to be reasonable, including but not limited to, no

material adverse change in the market price of ammonium para

tungstate (APT), the continuing ability to fund or obtain funding

for outstanding commitments, expectations regarding the resolution

of legal and tax matters, no negative change to applicable laws,

the ability to secure local contractors, employees and assistance

as and when required and on

reasonable terms, and such other assumptions and factors as are

set out herein. Although Almonty has attempted to identify

important factors that could cause actual results, level of

activity, performance or achievements to differ materially from

those contained in forward-looking statements, there may be other

factors that cause results, level of activity, performance or

achievements not to be as anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to

be accurate and even if events or results described in the

forward-looking statements are realized or substantially realized,

there can be no assurance that they will have the expected

consequences to, or effects on, Almonty. Accordingly, readers

should not place undue reliance on forward-looking statements and

are cautioned that actual outcomes may vary.

Investors are cautioned against attributing undue certainty to

forward-looking statements. Almonty cautions that the foregoing

list of material factors is not exhaustive. When relying on

Almonty’s forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Almonty has also assumed that material factors will not cause

any forward-looking statements and information to differ materially

from actual results or events. However, the list of these factors

is not exhaustive and is subject to change and there can be no

assurance that such assumptions will reflect the actual outcome of

such items or factors.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS

RELEASE REPRESENTS THE EXPECTATIONS OF ALMONTY AS OF THE DATE OF

THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER

SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-

LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF

ANY OTHER DATE. WHILE ALMONTY MAY ELECT TO, IT DOES NOT UNDERTAKE

TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS

REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220718005663/en/

Lewis Black Chairman, President and CEO Telephone: +1 647

438-9766 Email: info@almonty.com

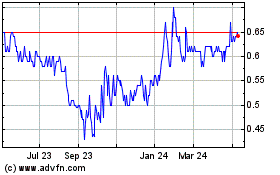

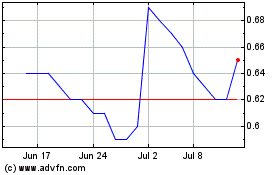

Almonty Industries (TSX:AII)

Historical Stock Chart

From Oct 2024 to Nov 2024

Almonty Industries (TSX:AII)

Historical Stock Chart

From Nov 2023 to Nov 2024