Bitfarms Ltd. (NASDAQ: BITF // TSX: BITF), a vertically integrated

Bitcoin mining company, reported its financial results for the

third quarter ended September 30, 2023, with revenue of $35

million, net loss of $19 million, and Adjusted EBITDA* of $7

million. All financial references are in U.S. dollars.

“During the third quarter of 2023, we increased

operating capacity by 27 MW to 234 MW and by another 6 MW to 240 MW

in October 2023. We executed plans to opportunistically expand

farms with low-cost hydro power in Québec and Latin America, while

we continued to prudently strengthen balance sheet liquidity

preparing for the next BTC Halving,” said Geoff Morphy, CEO of

Bitfarms. “We remain committed to investing in new facilities and

miner upgrades at pricing with attractive returns. Now, with the

introduction of higher efficiency, lower-priced miners, we plan to

move aggressively to capitalize on more competitive pricing for

equipment upgrades.

“Our geographic diversification continues to

deliver competitive advantages. In Québec, where we utilize 100%

renewable power, we purchased, energized, and then increased our

Baie-Comeau farm to 11 MW. In LATAM, we’ve achieved operational

success and are benefitting from exceptionally low-cost energy in

the region. In Rio Cuarto, Argentina, we employed creative miner

racking to extend beyond our original design of 50 MW to 54 MW. In

Paso Pe, Paraguay, we acquired power purchase agreements as the

foundation of a transformative expansion and began construction at

our 50 MW facility. With the Paso Pe addition, we are on track to

increase our Q3 2023 operating capacity by 24% to 290 MW in Q1

2024. With our international development experience spanning four

countries in two continents, we are well-positioned to continue our

expansion and reduce production costs as we approach the Halving

and capture market share consolidation opportunities that will

likely arise after-Halving,” Morphy concluded.

Financial Highlights for the Quarter ended

September 30, 2023

- Total revenue of $35 million,

compared to $35 million in Q2 2023.

- Gross mining profit* and gross

mining margin* of $13 million and 38%, respectively, compared to

$14 million and 42% in Q2 2023, respectively.

- General and administrative

(“G&A”) expenses of $8 million, including non-cash share-based

compensation of $2 million, down 9% from Q2 2023.

- Operating loss of $19 million,

including $1 million of revaluation loss on digital assets,

compared to an operating loss of $25 million in Q2 2023, which

included $10 million of impairment charges.

- Net loss of $19 million, or $(0.07)

per basic and diluted share, compared to $25 million, or $(0.10)

per basic and diluted share, in Q2 2023.

- Non-IFRS Adjusted EBITDA* of $7

million, or 20% of revenue, compared to $8 million, or 22% of

revenue, in Q2 2023.

- Earned 1,172 BTC at an average

direct cost per BTC* of $16,900, compared to $15,700 in Q2

2023.

- Total cash cost, including G&A

expenses, per BTC* were $22,700 in Q3 2023, up from $21,800 in Q2

2023.

Liquidity**The Company held $47

million in cash and 703 BTC valued at approximately $19 million

based upon a BTC price of approximately $27,000 as of

September 30, 2023.

“In October, we initiated our Synthetic HODL™

strategy to increase our upside exposure to the price of BTC with

the purchase of 35 long-dated BTC call options,” commented Jeff

Lucas, CFO of Bitfarms. "This augments our October month-end BTC

holdings in treasury, which increased by 57 BTC to 760 BTC valued

at $26 million at October 31, 2023, based on a BTC price of

$34,200.”

Q3 2023 Financing

Activities

- Sold 1,018 BTC at an average price

of $27,900 per BTC for total proceeds of $28 million, a portion of

which was used to repay equipment-related indebtedness.

- Paid down $6 million in

equipment-related indebtedness, reducing the total outstanding

balance to $10 million as of September 30, 2023.

- Fully utilized remaining Miner

manufacturer credits of $19 million with the purchase of hydro

containers and Miners.

- Raised $31 million in net proceeds

through the Company’s at-the-market equity offering program, which

expired on September 12, 2023.

Financing Activities Subsequent

to Q3 2023

- Sold 341 BTC of the 398 BTC earned

during October 2023, generating proceeds of $10 million.

- Added 57 BTC to treasury in October

2023, increasing BTC in custody to 760 BTC, representing a total

value of $26 million based on a BTC price of $34,200, on

October 31, 2023.

Q3 2023 and Recent

Operating Highlights

- Operations

- Reached 6.1 EH/s corporate hashrate

as of September 30, 2023.

- Averaged 12.7 BTC per day in daily

production for Q3 2023.

- Earned 398 BTC in October

2023.

- Powered additional 6 MW at Baie-Comeau in October 2023, fully

energizing its initial 11 MW phase.

- Miners

- Fully utilized remaining Miner

manufacturer credits of $19 million for the purchase of nine

MicroBT hydro containers, with a total capacity of 20 MW, and

approximately 2,000 MicroBT M53S+ hydro Miners to be deployed in

Paraguay and Quebec.

- Imported and installed

approximately 1,300 new M50 Whatsminer Miners, 700 new S19j Pro

Antminer Miners and 5,500 new S19j Pro+ Antminer Miners, which

increased capacity to 51 MW and added approximately 0.8 EH/s to the

Rio Cuarto facility, bringing its total hashrate to approximately

1.5 EH/s.

- Imported and installed

approximately 2,900 new Antminer S19j Pro+ Miners in Magog, Quebec,

which added a net 110 PH/s after replacing the older generation

Miners, and bringing its total hashrate to approximately 330

PH/s.

- Installed approximately 2,500

Miners in Baie-Comeau, Quebec that were redeployed from Magog,

Quebec.

- Expansion Strategy

- Purchased Baie-Comeau facility and

initiated production.

- Acquired two power purchase

agreements for up to 150 MW of hydro power capacity in Paraguay and

initiated deployment plan in August for a new 50 MW facility at

Paso Pe. The Paso Pe location is comprised of 20 MW of next

generation hydro miners and related containers, which are ordered

and planned to energize and contribute 700 PH in Q1 2024, and a 30

MW air-cooled warehouse slated for next generation miners.

Quarterly Operating Performance

|

|

Q3 2023 |

Q2 2023 |

Q3 2022 |

|

Total BTC earned |

1,172 |

1,223 |

1,515 |

| Average Watts/average TH

efficiency*** |

36 |

37 |

38 |

| BTC

sold |

1,018 |

1,109 |

2,595 |

|

|

At September 30, |

At June 30, |

At September 30, |

|

|

2023 |

2023 |

2022 |

|

Period-end operating EH/s |

6.1 |

5.3 |

4.2 |

| Period-end operating capacity

(MW) |

234 |

207 |

176 |

| Hydro

power (MW) |

183 |

178 |

166 |

Quarterly Average Revenue**** and Cost

per BTC*

|

|

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

|

Average revenue/BTC**** |

$ |

28,100 |

|

$ |

28,000 |

|

$ |

22,500 |

|

$ |

18,100 |

|

$ |

21,300 |

| Direct cost/BTC* |

$ |

16,900 |

|

$ |

15,700 |

|

$ |

12,500 |

|

$ |

11,100 |

|

$ |

9,700 |

| Total

cash cost/BTC* |

$ |

22,700 |

|

$ |

21,800 |

|

$ |

17,600 |

|

$ |

16,800 |

|

$ |

14,600 |

Conference CallManagement will

host a conference call and live webcast with an accompanying

presentation today, Tuesday, November 7, 2023, at 11 a.m. ET

to review the Company's financial results and quarterly activity.

Following management’s formal remarks there will be a live

question-and-answer session, which may include pre-submitted

questions.

Participants are asked to preregister for the call through the

following link:

Q3 2023 Conference Call

Please note that registered participants will

receive their dial in number upon registration and will dial

directly into the call without delay. Those without internet access

or who are unable to preregister may dial in by calling:

1-866-777-2509 (domestic), 1-412-317-5413 (international). All

callers should dial in approximately 10 minutes prior to the

scheduled start time and ask to be joined into the Bitfarms

call.

The conference call will also be available

through a live webcast found here:

Live Webcast

A webcast replay of the call will be available

approximately one hour after the end of the call and will be

available for one year, at the above webcast link. A telephonic

replay of the call will be available through November 14, 2023

and may be accessed by calling 1-877-344-7529 (domestic) or

1-412-317-0088 (international) or Canada (toll free) 855-669-9658

and using access code 2148933. A presentation of the Q3 2023

results will be accessible on Tuesday, November 7, 2023, under

the “Investors” section of Bitfarms’ website.

* Gross mining profit, gross mining margin,

Adjusted EBITDA, Adjusted EBITDA margin, direct cost per BTC and

total cash cost per BTC are non-IFRS financial measures or ratios

and should be read in conjunction with and should not be viewed as

alternatives to or replacements of measures of operating results

and liquidity presented in accordance with IFRS. Readers are

referred to the reconciliations of non-IFRS measures included in

the Company’s MD&A and at the end of this press release.

** Liquidity represents cash and balance of

digital assets including digital assets pledged as collateral.

*** Average Watts represents the energy

consumption of Miners.

**** Average revenue per BTC is for mining

operations only and excludes Volta revenue.

About Bitfarms Ltd.Founded in

2017, Bitfarms is a global, publicly traded (NASDAQ/TSX: BITF)

Bitcoin mining company that contributes its computational power to

one or more mining pools from which it receives payment in Bitcoin.

Bitfarms develops, owns, and operates vertically integrated mining

farms with in-house management and company-owned electrical

engineering, installation service, and multiple onsite technical

repair centers. The Company’s proprietary data analytics system

delivers best-in-class operational performance and uptime.

Bitfarms currently has 11 farms, which are

located in four countries: Canada, the United States, Paraguay, and

Argentina. Powered by predominantly environmentally friendly

hydro-electric and long-term power contracts, Bitfarms is committed

to using sustainable, locally based, and often underutilized energy

infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

Website: www.bitfarms.com

https://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- BTC BTC/day = Bitcoin or Bitcoin per day

- EH or EH/s = Exahash or exahash per second

- MW or MWh = Megawatts or megawatt hour

- PH or PH/s = Petahash or petahash per second

- TH or TH/s = Terahash or terahash per second

- w/TH = Watts per Terahash

- KWh = Kilowatt per hour

- Synthetic HODL™ = the capital-efficient use of financial

instruments to create BTC-equivalent exposure

Cautionary StatementTrading in

the securities of the Company should be considered highly

speculative. No stock exchange, securities commission or other

regulatory authority has approved or disapproved the information

contained herein. Neither the Toronto Stock Exchange, Nasdaq, or

any other securities exchange or regulatory authority accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding projected growth, target hashrate, opportunities

relating to the Company’s geographical diversification and

expansion in Paraguay, Argentina, and Quebec, upgrading and

deployment of miners as well as the timing therefor, improved

financial performance and balance sheet liquidity, other growth

opportunities and prospects, and other statements regarding future

growth, plans and objectives of the Company are forward-looking

information. Other forward-looking information includes, but is not

limited to, information concerning: the intentions, plans and

future actions of the Company, as well as Bitfarms’ ability to

successfully earn digital currency, revenue increasing as currently

anticipated, the ability to profitably liquidate current and future

digital currency inventory, volatility of network difficulty and

digital currency prices and the potential resulting significant

negative impact on the Company’s operations, the construction and

operation of expanded blockchain infrastructure as currently

planned, and the regulatory environment for cryptocurrency in the

applicable jurisdictions.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could”, “should”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: the availability of financing

opportunities, risks associated with economic conditions,

dependence on management and conflicts of interest, the ability to

service debt obligations and maintain flexibility in respect of

debt covenants; economic dependence on regulated terms of service

and electricity rates; the speculative and competitive nature of

the technology sector; dependency on continued growth in blockchain

and cryptocurrency usage; lawsuits and other legal proceedings and

challenges; conflict of interests with directors and management;

government regulations and approvals; the global economic climate;

dilution; the Company’s limited operating history; future capital

needs and uncertainty of additional financing, including the

Company’s ability to utilize the Company’s at-the-market equity

offering program (the “ATM Program”) and the prices at which the

Company may sell Common Shares in the ATM Program, as well as

capital market conditions in general; risks relating to the

strategy of maintaining and increasing Bitcoin holdings and the

impact of depreciating Bitcoin prices on working capital; the

competitive nature of the industry; currency exchange risks; the

need for the Company to manage its planned growth and expansion;

the effects of product development and need for continued

technology change; the ability to maintain reliable and economical

sources of power to run its cryptocurrency mining assets; the

impact of energy curtailment or regulatory changes in the energy

regimes in the jurisdictions in which the Company operates;

protection of proprietary rights; the effect of government

regulation and compliance on the Company and the industry; network

security risks; the ability of the Company to maintain properly

working systems; reliance on key personnel; global economic and

financial market deterioration impeding access to capital or

increasing the cost of capital; share dilution resulting from the

ATM Program and from other equity issuances; and volatile

securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors that could

impact future results of the business of Bitfarms include, but are

not limited to: the construction and operation of facilities may

not occur as currently planned, or at all; expansion may not

materialize as currently anticipated, or at all; the digital

currency market; the ability to successfully earn digital currency;

revenue may not increase as currently anticipated, or at all; it

may not be possible to profitably liquidate the current digital

currency inventory, or at all; a decline in digital currency prices

may have a significant negative impact on operations; an increase

in network difficulty may have a significant negative impact on

operations; the volatility of digital currency prices; the

anticipated growth and sustainability of hydroelectricity for the

purposes of cryptocurrency mining in the applicable jurisdictions;

the inability to maintain reliable and economical sources of power

for the Company to operate cryptocurrency mining assets; the risks

of an increase in the Company’s electricity costs, cost of natural

gas, changes in currency exchange rates, energy curtailment or

regulatory changes in the energy regimes in the jurisdictions in

which the Company operates and the adverse impact on the Company’s

profitability; the ability to complete current and future

financings, any regulations or laws that will prevent Bitfarms from

operating its business; historical prices of digital currencies and

the ability to earn digital currencies that will be consistent with

historical prices; an inability to predict and counteract the

effects of COVID-19 on the business of the Company, including but

not limited to the effects of COVID-19 on the price of digital

currencies, capital market conditions, restriction on labour and

international travel and supply chains; and, the adoption or

expansion of any regulation or law that will prevent Bitfarms from

operating its business, or make it more costly to do so. For

further information concerning these and other risks and

uncertainties, refer to the Company’s filings on www.sedarplus.ca

(which are also available on the website of the U.S. Securities and

Exchange Commission at www.sec.gov), including the annual

information form for the year-ended December 31, 2022, filed on

March 21, 2023 and the MD&A for three-month period ended

September 30, 2023. The Company has also assumed that no

significant events occur outside of Bitfarms’ normal course of

business. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those expressed in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on any forward-looking

information. The Company undertakes no obligation to revise or

update any forward-looking information other than as required by

law.

Contacts:

LHA Investor RelationsDavid Barnard+1

415-433-3777Investors@bitfarms.com

Actual Agency Noor Dar + 1

516-270-4009mediarelations@bitfarms.com

Québec Media: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

|

Bitfarms Ltd. Consolidated Financial & Operational

Results |

| |

| |

Three months ended September 30, |

Nine months ended September 30, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

34,596 |

|

33,247 |

|

1,349 |

|

4 |

% |

100,125 |

|

115,391 |

|

(15,266 |

) |

(13) |

% |

|

Cost of revenues |

43,462 |

|

37,186 |

|

6,276 |

|

17 |

% |

123,384 |

|

92,789 |

|

30,595 |

|

33 |

% |

|

Gross (loss) profit |

(8,866 |

) |

(3,939 |

) |

(4,927 |

) |

125 |

% |

(23,259 |

) |

22,602 |

|

(45,861 |

) |

(203) |

% |

| Gross

margin(1) |

(26) |

% |

(12) |

% |

— |

|

— |

|

(23) |

% |

20 |

% |

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

General and administrative expenses |

8,372 |

|

10,299 |

|

(1,927 |

) |

(19) |

% |

25,887 |

|

39,534 |

|

(13,647 |

) |

(35) |

% |

|

Realized loss on disposition of digital assets |

— |

|

44,329 |

|

(44,329 |

) |

(100) |

% |

— |

|

122,243 |

|

(122,243 |

) |

(100) |

% |

|

(Reversal of) revaluation loss on digital assets |

1,183 |

|

(45,655 |

) |

46,838 |

|

103 |

% |

(1,512 |

) |

21,118 |

|

(22,630 |

) |

(107) |

% |

|

Loss on disposition of property, plant and equipment |

217 |

|

756 |

|

(539 |

) |

(71) |

% |

1,776 |

|

1,692 |

|

84 |

|

5 |

% |

|

Impairment on short-term prepaid deposits, equipment and

construction prepayments, property, plant and equipment and

right-of-use assets |

— |

|

84,116 |

|

(84,116 |

) |

(100) |

% |

9,982 |

|

84,116 |

|

(74,134 |

) |

(88) |

% |

|

Impairment on goodwill |

— |

|

— |

|

— |

|

— |

% |

— |

|

17,900 |

|

(17,900 |

) |

(100) |

% |

|

Operating loss |

(18,638 |

) |

(97,784 |

) |

79,146 |

|

(81) |

% |

(59,392 |

) |

(264,001 |

) |

204,609 |

|

(78) |

% |

|

Operating margin(1) |

(54) |

% |

(294) |

% |

— |

|

— |

|

(59) |

% |

(229) |

% |

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Net

financial income |

(336 |

) |

(8,251 |

) |

7,915 |

|

(96) |

% |

(12,706 |

) |

(24,191 |

) |

11,485 |

|

(47) |

% |

|

Net loss before income taxes |

(18,302 |

) |

(89,533 |

) |

71,231 |

|

(80) |

% |

(46,686 |

) |

(239,810 |

) |

193,124 |

|

(81) |

% |

|

|

|

|

|

|

|

|

|

|

| Income

tax expense (recovery) |

401 |

|

(4,725 |

) |

5,126 |

|

108 |

% |

(23 |

) |

(17,603 |

) |

17,580 |

|

(100) |

% |

|

Net loss |

(18,703 |

) |

(84,808 |

) |

66,105 |

|

(78) |

% |

(46,663 |

) |

(222,207 |

) |

175,544 |

|

(79) |

% |

|

|

|

|

|

|

|

|

|

|

| Basic

and diluted loss per share (in U.S. dollars) |

(0.07 |

) |

(0.40 |

) |

— |

|

— |

|

(0.19 |

) |

(1.09 |

) |

— |

|

— |

|

|

Change in revaluation surplus - digital assets, net of tax |

(824 |

) |

— |

|

(824 |

) |

(100) |

% |

1,567 |

|

— |

|

1,567 |

|

100 |

% |

|

Total comprehensive loss, net of tax |

(19,527 |

) |

(84,808 |

) |

65,281 |

|

(77) |

% |

(45,096 |

) |

(222,207 |

) |

177,111 |

|

(80) |

% |

|

|

|

|

|

|

|

|

|

|

| Gross Mining profit(2) |

12,505 |

|

16,789 |

|

(4,284 |

) |

(26) |

% |

39,017 |

|

74,089 |

|

(35,072 |

) |

(47) |

% |

| Gross Mining margin(2) |

38 |

% |

52 |

% |

— |

|

— |

|

40 |

% |

66 |

% |

— |

|

— |

|

| EBITDA(2) |

4,280 |

|

(65,419 |

) |

69,699 |

|

107 |

% |

19,767 |

|

(177,217 |

) |

196,984 |

|

111 |

% |

| EBITDA margin(2) |

12 |

% |

(197) |

% |

— |

|

— |

|

20 |

% |

(154) |

% |

— |

|

— |

|

| Adjusted EBITDA(2) |

6,866 |

|

10,325 |

|

(3,459 |

) |

(34) |

% |

21,107 |

|

52,326 |

|

(31,219 |

) |

(60) |

% |

| Adjusted EBITDA margin(2) |

20 |

% |

31 |

% |

— |

|

— |

|

21 |

% |

45 |

% |

— |

|

— |

|

nm: not meaningful(1) Gross margin and Operating

margin are supplemental financial ratios; refer to section 9 -

Non-IFRS and Other Financial Measures and Ratios of the Company's

MD&A.(2) Gross Mining profit, Gross Mining margin, EBITDA,

EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin are

non-IFRS measures or ratios; refer to section 9 - Non-IFRS and

Other Financial Measures and Ratios of the Company's MD&A.

|

|

|

Bitfarms Ltd.Reconciliation of

Consolidated Net Income (loss) to EBITDA and Adjusted

EBITDA |

| |

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

34,596 |

|

33,247 |

|

1,349 |

|

4 |

% |

100,125 |

|

115,391 |

|

(15,266 |

) |

(13) |

% |

|

|

|

|

|

|

|

|

|

|

|

Net loss before income taxes |

(18,302 |

) |

(89,533 |

) |

71,231 |

|

(80) |

% |

(46,686 |

) |

(239,810 |

) |

193,124 |

|

(81) |

% |

|

Interest expense |

815 |

|

3,394 |

|

(2,579 |

) |

(76) |

% |

3,458 |

|

10,950 |

|

(7,492 |

) |

(68) |

% |

|

Depreciation and amortization |

21,767 |

|

20,720 |

|

1,047 |

|

5 |

% |

62,995 |

|

51,643 |

|

11,352 |

|

22 |

% |

|

EBITDA |

4,280 |

|

(65,419 |

) |

69,699 |

|

107 |

% |

19,767 |

|

(177,217 |

) |

196,984 |

|

111 |

% |

|

EBITDA margin |

12 |

% |

(197) |

% |

— |

|

— |

|

20 |

% |

(154) |

% |

— |

|

— |

|

|

Share-based payment |

2,011 |

|

3,961 |

|

(1,950 |

) |

(49) |

% |

7,009 |

|

17,993 |

|

(10,984 |

) |

(61) |

% |

| Realized loss on disposition

of digital assets |

— |

|

44,329 |

|

(44,329 |

) |

(100) |

% |

— |

|

122,243 |

|

(122,243 |

) |

(100) |

% |

| Impairment on short-term

prepaid deposits, equipment and construction prepayments, property,

plant and equipment and right-of-use assets |

— |

|

84,116 |

|

(84,116 |

) |

(100) |

% |

9,982 |

|

84,116 |

|

(74,134 |

) |

(88) |

% |

| (Reversal of) revaluation loss

on digital assets |

1,183 |

|

(45,655 |

) |

46,838 |

|

103 |

% |

(1,512 |

) |

21,118 |

|

(22,630 |

) |

(107) |

% |

| Impairment on goodwill |

— |

|

— |

|

— |

|

— |

% |

— |

|

17,900 |

|

(17,900 |

) |

(100) |

% |

| Gain on extinguishment of

long-term debt and lease liabilities |

— |

|

— |

|

— |

|

— |

% |

(12,835 |

) |

— |

|

(12,835 |

) |

(100) |

% |

| Gain on disposition of

marketable securities |

(4,120 |

) |

(13,690 |

) |

9,570 |

|

(70) |

% |

(11,246 |

) |

(44,332 |

) |

33,086 |

|

(75) |

% |

| Net

financial expenses and other |

3,512 |

|

2,683 |

|

829 |

|

31 |

% |

9,942 |

|

10,505 |

|

(563 |

) |

(5) |

% |

|

Adjusted EBITDA |

6,866 |

|

10,325 |

|

(3,459 |

) |

(34) |

% |

21,107 |

|

52,326 |

|

(31,219 |

) |

(60) |

% |

|

Adjusted EBITDA margin |

20 |

% |

31 |

% |

— |

|

— |

% |

21 |

% |

45 |

% |

— |

|

— |

% |

nm: not meaningful

| |

|

Bitfarms Ltd.Calculation of Gross

Mining Profit and Gross Mining Margin |

| |

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

Gross (loss) profit |

(8,866 |

) |

(3,939 |

) |

(4,927 |

) |

125 |

% |

(23,259 |

) |

22,602 |

|

(45,861 |

) |

(203) |

% |

|

Non-Mining revenues (1) |

(1,697 |

) |

(971 |

) |

(726 |

) |

75 |

% |

(3,775 |

) |

(2,342 |

) |

(1,433 |

) |

61 |

% |

| Depreciation and

amortization |

21,767 |

|

20,720 |

|

1,047 |

|

5 |

% |

62,995 |

|

51,643 |

|

11,352 |

|

22 |

% |

| Purchases of electrical

components and other |

892 |

|

690 |

|

202 |

|

29 |

% |

1,836 |

|

1,262 |

|

574 |

|

45 |

% |

|

Electrician salaries and payroll taxes |

409 |

|

289 |

|

120 |

|

42 |

% |

1,220 |

|

924 |

|

296 |

|

32 |

% |

|

Gross Mining profit |

12,505 |

|

16,789 |

|

(4,284 |

) |

(26) |

% |

39,017 |

|

74,089 |

|

(35,072 |

) |

(47) |

% |

|

Gross Mining margin |

38 |

% |

52 |

% |

— |

|

— |

|

40 |

% |

66 |

% |

— |

|

— |

|

| |

| (1) Non-Mining

revenues reconciliation: |

| |

| |

|

Three months ended September 30, |

Nine months ended September 30, |

| |

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

|

Revenues |

34,596 |

|

33,247 |

|

1,349 |

|

4 |

% |

100,125 |

|

115,391 |

|

(15,266 |

) |

(13) |

% |

| |

Less Mining related revenues for the purpose of calculating gross

Mining margin: |

|

|

|

|

|

|

|

|

|

|

Mining revenues |

(32,899 |

) |

(32,276 |

) |

(623 |

) |

2 |

% |

(96,350 |

) |

(113,049 |

) |

16,699 |

|

(15) |

% |

|

|

Non-Mining revenues |

1,697 |

|

971 |

|

726 |

|

75 |

% |

3,775 |

|

2,342 |

|

1,433 |

|

61 |

% |

| |

|

Bitfarms Ltd. Calculation of Direct Cost and Direct Cost

per BTC |

| |

|

|

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

Cost of revenues |

43,462 |

|

37,186 |

|

6,276 |

|

17 |

% |

123,384 |

|

92,789 |

|

30,595 |

|

33 |

% |

|

Depreciation and amortization |

(21,767 |

) |

(20,720 |

) |

(1,047 |

) |

5 |

% |

(62,995 |

) |

(51,643 |

) |

(11,352 |

) |

22 |

% |

| Purchases of electrical

components |

(890 |

) |

(688 |

) |

(202 |

) |

29 |

% |

(1,830 |

) |

(1,252 |

) |

(578 |

) |

46 |

% |

| Electrician salaries and

payroll taxes |

(409 |

) |

(289 |

) |

(120 |

) |

42 |

% |

(1,220 |

) |

(924 |

) |

(296 |

) |

32 |

% |

| Infrastructure |

(600 |

) |

(1,060 |

) |

460 |

|

(43) |

% |

(2,303 |

) |

(3,841 |

) |

1,538 |

|

(40) |

% |

|

Other |

— |

|

336 |

|

(336 |

) |

(100) |

% |

82 |

|

633 |

|

(551 |

) |

(87) |

% |

|

Direct Cost |

19,796 |

|

14,765 |

|

5,031 |

|

34 |

% |

55,118 |

|

35,762 |

|

19,356 |

|

54 |

% |

| Quantity of BTC earned |

1,172 |

|

1,515 |

|

(343 |

) |

(23) |

% |

3,692 |

|

3,733 |

|

(41 |

) |

(1) |

% |

|

Direct Cost per BTC (in U.S. dollars) |

16,900 |

|

9,700 |

|

7,200 |

|

74 |

% |

14,900 |

|

9,600 |

|

5,300 |

|

55 |

% |

| |

|

Bitfarms Ltd. Calculation of Total Cash Cost and Total Cash

Cost per BTC |

| |

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

% Change |

2023 |

|

2022 |

|

$ Change |

% Change |

|

Net loss before income taxes |

18,302 |

|

89,533 |

|

(71,231 |

) |

(80) |

% |

46,686 |

|

239,810 |

|

(193,124 |

) |

(81) |

% |

|

Revenues |

34,596 |

|

33,247 |

|

1,349 |

|

4 |

% |

100,125 |

|

115,391 |

|

(15,266 |

) |

(13) |

% |

| Depreciation and

amortization |

(21,767 |

) |

(20,720 |

) |

(1,047 |

) |

5 |

% |

(62,995 |

) |

(51,643 |

) |

(11,352 |

) |

22 |

% |

| Purchases of electrical

components |

(890 |

) |

(688 |

) |

(202 |

) |

29 |

% |

(1,830 |

) |

(1,252 |

) |

(578 |

) |

46 |

% |

| Electrician salaries and

payroll taxes |

(409 |

) |

(289 |

) |

(120 |

) |

42 |

% |

(1,220 |

) |

(924 |

) |

(296 |

) |

32 |

% |

| Share-based payment |

(2,011 |

) |

(3,961 |

) |

1,950 |

|

(49) |

% |

(7,009 |

) |

(17,993 |

) |

10,984 |

|

(61) |

% |

| Realized loss on disposition

of digital assets |

— |

|

(44,329 |

) |

44,329 |

|

100 |

% |

— |

|

(122,243 |

) |

122,243 |

|

100 |

% |

| (Reversal of) revaluation loss

on digital assets |

(1,183 |

) |

45,655 |

|

(46,838 |

) |

(103) |

% |

1,512 |

|

(21,118 |

) |

22,630 |

|

107 |

% |

| Loss on disposition of

property, plant and equipment |

(217 |

) |

(756 |

) |

539 |

|

(71) |

% |

(1,776 |

) |

(1,692 |

) |

(84 |

) |

5 |

% |

| Impairment on short-term

prepaid deposits, equipment and construction prepayments, property,

plant and equipment and right-of-use assets |

— |

|

(84,116 |

) |

84,116 |

|

100 |

% |

(9,982 |

) |

(84,116 |

) |

74,134 |

|

(88) |

% |

| Impairment on goodwill |

— |

|

— |

|

— |

|

— |

% |

— |

|

(17,900 |

) |

17,900 |

|

100 |

% |

| Net financial income |

336 |

|

8,251 |

|

(7,915 |

) |

(96) |

% |

12,706 |

|

24,191 |

|

(11,485 |

) |

(47) |

% |

|

Other |

(179 |

) |

336 |

|

(515 |

) |

(153) |

% |

(97 |

) |

633 |

|

(730 |

) |

(115) |

% |

|

Total Cash Cost |

26,578 |

|

22,163 |

|

4,415 |

|

20 |

% |

76,120 |

|

61,144 |

|

14,976 |

|

24 |

% |

|

Quantity of BTC earned |

1,172 |

|

1,515 |

|

(343 |

) |

(23) |

% |

3,692 |

|

3,733 |

|

(41 |

) |

(1) |

% |

|

Total Cash Cost per BTC (in U.S. dollars) |

22,700 |

|

14,600 |

|

8,100 |

|

55 |

% |

20,600 |

|

16,400 |

|

4,200 |

|

26 |

% |

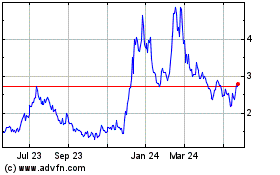

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

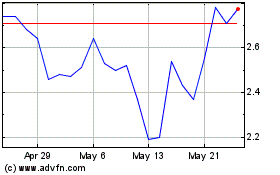

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025