Canadian General Investments: Investment Update-Unaudited

January 06 2014 - 2:47PM

Marketwired

Canadian General Investments: Investment Update-Unaudited

TORONTO, CANADA--(Marketwired - Jan 6, 2014) - Canadian General

Investments, Limited (TSX:CGI)(TSX:CGI.PR.C)(TSX:CGI.PR.D)(LSE:CGI)

(CGI) reports on an unaudited basis that its net asset value per

share (NAV) at December 31, 2013 was $25.64, resulting in a

one-year NAV return, with dividends reinvested, of 20.9%. This

compares with the 13.0% return of the benchmark S&P/TSX

Composite Index on a total return basis for the same period.

The closing price for CGI's common shares at December 31, 2013

was $18.40, resulting in an annual share price return, with

dividends reinvested, of 22.0%.

The sector weightings of CGI's investment portfolio at market as

of December 31, 2013 were as follows:

|

Financials |

21.9% |

|

Energy |

19.1% |

|

Consumer Discretionary |

15.1% |

|

Industrials |

13.7% |

|

Materials |

12.2% |

|

Information Technology |

6.4% |

|

Telecommunication Services |

3.7% |

|

Health Care |

3.2% |

|

Utilities |

1.8% |

|

Consumer Staples |

1.6% |

| Cash

& Cash Equivalents |

1.3% |

The top ten investments which comprised 30.1% of the investment

portfolio at market as of December 31, 2013 were as follows:

|

Dollarama Inc. |

4.7% |

|

Enbridge Inc. |

3.4% |

|

Catamaran Corporation |

3.2% |

|

Canadian Pacific Railway Limited |

3.1% |

|

Element Financial Corporation |

2.9% |

| Bank

of Montreal |

2.8% |

| Royal

Bank of Canada |

2.6% |

|

Rogers Communications Inc. |

2.5% |

|

Methanex Corporation |

2.5% |

|

Stantec Inc. |

2.4% |

Canadian General Investments, LimitedJonathan A. MorganPresident

and CEO(416) 366-2931(416)

366-2729cgifund@mmainvestments.comwww.mmainvestments.com

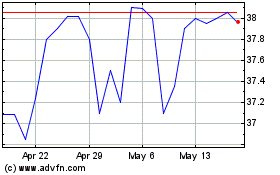

Canadian General Investm... (TSX:CGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

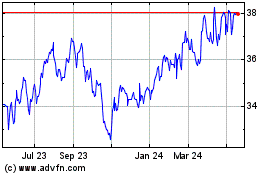

Canadian General Investm... (TSX:CGI)

Historical Stock Chart

From Jan 2024 to Jan 2025