Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX: CJ) is pleased to announce its

operating and financial results for the third quarter ended

September 30, 2020.

Selected financial and operating information is

shown below and should be read in conjunction with Cardinal's

unaudited condensed interim financial statements and related

Management's Discussion and Analysis for the three months ended

September 30, 2020 which are available at www.sedar.com and on our

website at www.cardinalenergy.ca.

FINANCIAL HIGHLIGHTS FROM THE THIRD

QUARTER OF 2020

- Reduced our bank indebtedness by $13.2 million while net

debt(1) decreased by $7.3 million compared to the second quarter of

2020;

- Increased adjusted funds flow(1) by $11.1 million over the

second quarter of 2020 to $13.2 million ($0.12 per

share);

- Reduced net operating costs(1) by $10.6 million leading to an

18% decrease in per boe net operating costs to $16.82/boe in the

third quarter of 2020 as compared to the same period in

2019;

- Reduced the Company's general and administrative ("G&A")

costs by $1.1 million leading to a 19% decrease in per boe G&A

costs to $1.64/boe in the third quarter of 2020 compared to the

same period in 2019;

- Reduced our capital program to $4.7 million for the third

quarter of 2020 demonstrating our cost control and debt reduction

strategy;

- Exchanged $28.2 million of our 5.5% maturing convertible

debentures to a new issuance of 8% convertible debentures with a

maturity date of December 31, 2022;

- Continued our risk management program hedging over 63% of our

remaining anticipated 2020 oil production and approximately 25% of

our first half 2021 oil production;

- Through our service providers, we received approximately $15

million in abandonment and reclamation expenditure government

subsidies to reduce our future asset retirement obligations;

| (1) |

See non-GAAP

measures |

The following table summarizes our third quarter

2020 operating and financial highlights:

|

|

Three months ended Sept 30, |

Nine months ended Sept 30, |

|

($000's except shares, per share and operating amounts) |

2020 |

2019 |

% Chg |

2020 |

2019 |

% Chg |

| |

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

61,982 |

95,483 |

(35) |

157,166 |

295,699 |

(47) |

|

Cash flow from operating activities |

18,950 |

24,836 |

(24) |

30,715 |

88,265 |

(65) |

|

Adjusted funds flow (1) |

13,206 |

27,571 |

(52) |

30,219 |

92,946 |

(67) |

|

per share basic and diluted |

$0.12 |

$0.24 |

(50) |

$ 0.27 |

$0.80 |

(66) |

|

Earnings / (Loss) |

(4,659) |

359 |

n/m |

(483,149) |

(19,246) |

n/m |

|

per share basic and diluted |

$(0.04) |

- |

n/m |

$(4.26) |

$(0.17) |

n/m |

|

Development capital expenditures (1) |

4,510 |

15,789 |

(71) |

27,068 |

43,982 |

(38) |

|

Other capital expenditures |

232 |

495 |

(53) |

871 |

1,552 |

(44) |

|

Total capital expenditures |

4,742 |

16,284 |

(71) |

27,939 |

45,534 |

(39) |

|

|

|

|

|

|

|

|

|

Common shares, net of treasury shares (000s) |

113,496 |

114,333 |

(1) |

113,496 |

114,333 |

(1) |

|

Dividends declared |

- |

5,372 |

n/m |

3,511 |

12,597 |

(72) |

|

per share |

- |

$0.045 |

n/m |

0.03 |

0.105 |

(71) |

|

|

|

|

|

|

|

|

|

Bank debt |

204,018 |

192,435 |

6 |

204,018 |

192,435 |

6 |

|

Working capital deficiency |

10,898 |

10,325 |

6 |

10,898 |

10,325 |

6 |

|

Net bank debt (1) |

214,916 |

202,760 |

6 |

214,916 |

202,760 |

6 |

|

Net debt (1) |

259,367 |

247,760 |

5 |

259,367 |

247,760 |

5 |

|

Net debt to adjusted funds flow ratio (1) |

4.4 |

2.5 |

76 |

4.4 |

2.5 |

76 |

|

Total payout ratio (1) |

34 |

77 |

(56) |

101 |

61 |

66 |

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

Average daily production |

|

|

|

|

|

|

|

Light oil (bbl/d) |

6,860 |

7,890 |

(13) |

7,255 |

8,058 |

(10) |

|

Medium/heavy oil (bbl/d) |

7,721 |

8,733 |

(12) |

8,051 |

8,744 |

(8) |

|

NGL (bbl/d) |

834 |

932 |

(10) |

814 |

945 |

(14) |

|

Natural gas (mcf/d) |

13,448 |

15,022 |

(10) |

13,562 |

15,616 |

(13) |

|

Total (boe/d) |

17,657 |

20,059 |

(12) |

18,380 |

20,350 |

(10) |

|

Netback ($/boe) (1) |

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

$38.16 |

$51.74 |

(26) |

$31.21 |

$53.23 |

(41) |

|

Royalties |

5.42 |

9.76 |

(44) |

4.59 |

8.70 |

(47) |

|

Net operating expenses(1) |

16.82 |

20.57 |

(18) |

17.58 |

21.15 |

(17) |

|

Transportation expenses |

0.34 |

0.36 |

(6) |

0.30 |

0.35 |

(14) |

|

Netback(1) |

$15.58 |

$21.05 |

(26) |

$8.74 |

$23.03 |

(62) |

|

Realized gain (loss) on commodity contracts |

(3.63) |

(2.27) |

60 |

1.12 |

(2.37) |

n/m |

|

Netback after risk management contracts (1) |

$11.95 |

$18.78 |

(36) |

$9.86 |

$20.66 |

(52) |

|

Interest and other |

2.18 |

1.82 |

20 |

1.78 |

1.82 |

2 |

|

G&A |

1.64 |

2.02 |

(19) |

2.08 |

2.10 |

(1) |

|

Adjusted funds flow netback (1) |

$ 8.13 |

$14.94 |

(46) |

$6.00 |

$16.74 |

(64) |

|

|

|

|

|

|

|

|

| (1) |

See non-GAAP

measures |

THIRD QUARTER OVERVIEW

In spite of the ongoing COVID-19 pandemic's

impact, the third quarter of 2020 brought some stability in oil

prices as compared to the volatility experienced in the second

quarter. This price stability combined with tighter Canadian oil

differential pricing supported Cardinal's debt reduction strategy

which continued through the third quarter reducing our net bank

debt by $7.3 million over the prior quarter. The Company continued

to focus on cost control spending $4.7 million of capital

expenditures while increasing our daily production by 3% over the

prior quarter. Approximately 10% to 15% of the Company's production

remains shut-in awaiting a sustainable recovery in oil prices

justifying the economics of reactivating the production.

Adjusted funds flow increased from $2.1 million

in the second quarter of 2020 to $13.2 million ($0.12/share) in the

third quarter, despite a $5.9 million realized hedging loss. The

increase was supported by an 18% reduction in net operating costs

per boe and a 19% reduction in G&A costs per boe when compared

to our levels in the third quarter of 2019. In comparison with the

third quarter of 2019, lower operating costs were the result of

reduced workover and reactivation activity, reduced Company labor

costs combined with lower environmental costs due to our proactive

pipeline monitoring and upgrading program. Lower G&A costs were

due to reduced salaries and bonus program contributions combined

with decreased staff levels across the Company and Cardinal

receiving the Canadian Emergency Wage Subsidy ("CEWS") during the

third quarter of 2020.

Cardinal's $4.7 million capital program included

one land earning well completion in Southern Alberta, required CO2

injection expenditures for the Company's enhanced oil recovery

project at Midale, Saskatchewan and miscellaneous expenditures on

recompletions and facility and pipeline integrity projects

throughout the Company's operations.

During the third quarter of 2020, a disciplined

capital program and reduced cost structure assisted Cardinal in

decreasing our bank indebtedness by $13.2 million and lowered our

net debt by $7.3 million. In addition, during the third quarter,

Cardinal exchanged $28.2 million of our 5.5% convertible debentures

maturing on December 31, 2020 for new 8% convertible debentures

maturing on December 31, 2022.

During the third quarter, in coordination with

our service company partners, Cardinal continued to benefit from

government subsidy programs. On our behalf, service companies

submitted a significant number of applications for abandonment and

reclamation work on Cardinal’s wells and leases within the Alberta

Site Rehabilitation Program ("SRP") and the Saskatchewan

Accelerated Site Closure Program ("ASCP"). Cardinal has received

approximately $15 million of approvals to date with more subsidy

application approvals expected in the future. These funds will be

utilized to reduce our abandonment and reclamation liabilities of

inactive wells and sites of which the majority is forecasted to be

spent within the next year. It is expected that this initial round

of government funding will cover the majority of expenditures to

abandon approximately 17% of Cardinal's inactive wells. Cardinal

will continue to be an active participant in available government

programs.

From a risk management perspective, for the

remainder of 2020, Cardinal has hedged an average of 9,000 bbl/d of

West Texas Intermediate ("WTI") oil production at an average price

of CAD$52.52/bbl. In addition, we have WTI collars locking in a

floor of CAD$50/bbl on 1,000 bbl/d for the remainder of 2020.

Cardinal continues to work through its credit

facility renewal process with our syndicate of banks. The reduction

in commodity prices has impacted our projected future cash flow

from operating activities and has emphasized our goal of reducing

our overall debt level. We have received approval from the

syndicate to further extend the revolving period and

re-determination date to November 30, 2020 and continue to work

through the application process for federal liquidity support

programs. Currently, Cardinal is drawn approximately $204 million

on its credit facility, a decrease of approximately 6% from the

amount drawn at the end of the second quarter.

OUTLOOK

As the effects of the COVID-19 pandemic continue

to impact global economies and our industry, Cardinal's focus

continues to be on the health and safety of our employees and

service providers and managing our liquidity through disciplined

efficient operation of our assets. Our corporate debt reduction

strategy continued through the third quarter and with our strong

hedging position, is forecasted to continue through the fourth

quarter.

To date in 2020, we have spent $27.9 million of

capital expenditures which were heavily weighted to the first

quarter prior to the COVID pandemic. For the remainder of 2020, we

expect to be on target with our annual $31 million capital

expenditure forecast for the year. We anticipate that despite a

minimal $3.1 million fourth quarter capital program, our top tier

low decline rate should allow us to maintain our current production

levels through the fourth quarter.

We will continue to navigate through these

challenging times and despite the volatility, look forward to a

recovery as we move into 2021.

Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to: our business strategies,

plans and objectives, 2020 anticipated production , our risk

management program, our abandonment and reclamation plans, plans to

continue to reduce debt, our focus and plans during the pandemic

and economic crisis, the Company's 2020 capital budget and

plans, decline rates, plans to participate in government

programs and future approvals, plans to reduce overall debt levels,

expectations that future adjusted funds flow will be sufficient to

support our capital program and debt reduction plan, the renewal of

our credit facility and terms thereof, our level of liquidity,

plans to retain long-term stability, our Environmental, Safety and

Governance mandate and plans to operate our assets in a responsible

and environmentally sensitive manner.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, future production, the impact

(and the duration thereof) that the COVID-19 pandemic will have on

(i) the demand for crude oil, NGLs and natural gas, (ii) our supply

chain, including our ability to obtain the equipment and services

we require, and (iii) our ability to produce, transport and/or sell

our crude oil, NGLs and natural gas; the ability of OPEC+ nations

and other major producers of crude oil to reduce crude oil

production and thereby arrest and reverse the steep decline in

world crude oil prices; future production rates, current and future

commodity prices and exchange rates, applicable royalty rates, tax

laws, future well production rates and reserve volumes, future

operating costs, the performance of existing and future wells, the

success of our exploration and development activities, the

sufficiency and timing of budgeted capital expenditures in carrying

out planned activities, the timing and success of our cost cutting

initiatives, the availability and cost of labor and services, the

impact of competition, conditions in general economic and financial

markets, availability of drilling and related equipment, effects of

regulation by governmental agencies, the renewal of our credit

facility and level of liquidity and our ability to obtain financing

on acceptable terms which are subject to change based on commodity

prices, market conditions and drilling success and potential timing

delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of the COVID-19 pandemic, general economic

conditions; volatility in market prices for crude oil and natural

gas; industry conditions; our and ability to access sufficient

capital from internal and external sources, currency fluctuations;

imprecision of reserve estimates; liabilities inherent in crude oil

and natural gas operations; environmental risks; incorrect

assessments of the value of acquisitions and exploration and

development programs; competition from other producers; the lack of

availability of qualified personnel, drilling rigs or other

services; changes in income tax laws or changes in royalty rates

and incentive programs relating to the oil and gas industry; and

hazards such as fire, explosion, blowouts, and spills, each of

which could result in substantial damage to wells, production

facilities, other property and the environment or in personal

injury.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this press release and Cardinal disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Supplemental Information Regarding Product

Types

This press release includes references to 2019

and 2020 production. The Company discloses crude oil production

based on the pricing index that the oil is priced off of. The

following table is intended to provide the product type composition

as defined by NI 51-101.

|

|

Light/MediumCrude Oil |

Heavy Oil |

NGL |

ConventionalNatural Gas |

Total (boe/d) |

|

Q3/20 |

56% |

27% |

5% |

12% |

17,657 |

|

Q3/19 |

54% |

29% |

5% |

12% |

20,059 |

|

3Q/20 |

56% |

27% |

4% |

12% |

18,380 |

|

3Q/19 |

54% |

28% |

5% |

13% |

20,350 |

Advisory Regarding Oil and Gas

Information

Where applicable, oil equivalent amounts

have been calculated using a conversion rate of six thousand cubic

feet of natural gas to one barrel of oil. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

Non-GAAP measures

This press release contains the terms

"development capital expenditures", "adjusted funds flow",

"adjusted funds flow per basic share", "adjusted funds flow per

diluted share", "free cash flow", "net debt", "net debt to adjusted

funds flow ratio", "net operating expenses", "netback", "netback

after risk management contracts" and "adjusted funds flow netback"

which do not have a standardized meaning prescribed by

International Financial Reporting Standards ("IFRS" or,

alternatively, "GAAP") and therefore may not be comparable with the

calculation of similar measures by other companies. Cardinal uses

adjusted funds flow, adjusted funds flow per basic and diluted

share, free cash flow and net debt to adjusted funds flow ratio to

analyze operating performance and assess leverage. Cardinal feels

these benchmarks are a key measure of profitability and overall

sustainability for the Company. Adjusted funds flow is not intended

to represent operating profits nor should it be viewed as an

alternative to cash flow provided by operating activities, net

earnings or other measures of performance calculated in accordance

with GAAP. As shown below, adjusted funds flow is calculated as

cash flows from operating activities adjusted for changes in

non-cash working capital, decommissioning expenditures and

transaction costs. Development capital expenditures represents

expenditures on property, plant and equipment (excluding

capitalized G&A, other assets and acquisitions). Free cash flow

represents adjusted funds flow less dividends and development

capital. The term "net debt" is not recognized under GAAP and as

shown below, is calculated as bank debt plus the principal amount

of convertible unsecured subordinated debentures ("convertible

debentures") and current liabilities less current assets (adjusted

for the fair value of financial instruments, the current portion of

lease liabilities, the current portion of the decommissioning

obligation and the current portion of the liability component of

convertible debentures). Net debt is used by management to analyze

the financial position, liquidity and leverage of Cardinal. Net

debt is used by management to analyze the financial position,

liquidity and leverage of Cardinal. Net debt to adjusted funds flow

ratio is calculated as net debt divided by the trailing 12 months

adjusted funds flow. Net operating expenses is calculated as

operating expense less processing and other revenue primarily

generated by processing third party volumes at processing

facilities where the Company has an ownership interest, and can be

expressed on a per boe basis. As the Company’s principal business

is not that of a midstream entity, management believes this is a

useful supplemental measure to reflect the true cash outlay at its

processing facilities by utilizing spare capacity through

processing third party volumes. Netback is calculated on a boe

basis and is determined by deducting royalties, transportation

costs and net operating expenses from petroleum and natural gas

revenue. Netback after risk management contracts includes realized

gains or losses on commodity contracts in the period on a boe

basis. Adjusted funds flow netback is calculated as netback after

risk management and also includes interest and other costs and

G&A costs on a boe basis. Netback, netback after risk

management contracts and adjusted funds flow netback are utilized

by Cardinal to better analyze the operating performance of our

petroleum and natural gas assets taking into account our risk

management program, interest and G&A costs against prior

periods.

|

|

Three months ended |

Nine months ended |

|

|

Sept 30, 2020 |

Sept 30, 2019 |

Sept 30, 2020 |

Sept 30, 2019 |

|

Cash flow from operating activities |

18,950 |

24,836 |

30,715 |

88,265 |

|

Change in non-cash working capital |

(5,982) |

1,487 |

(2,749) |

1,044 |

|

Funds flow |

12,968 |

26,323 |

27,966 |

89,309 |

|

Decommissioning expenditures |

238 |

1,248 |

2,253 |

3,637 |

|

Adjusted funds flow |

13,206 |

27,571 |

30,219 |

92,946 |

|

|

As at |

|

|

Sept. 30, 2020 |

Sept. 30, 2019 |

|

Bank debt |

204,018 |

192,435 |

|

Principal amount of Convertible Debentures |

44,451 |

45,000 |

|

Working capital deficiency (1) |

10,898 |

10,325 |

|

Net debt |

259,367 |

247,760 |

|

(1) |

Includes current assets less current liabilities excluding the fair

value of financial instruments, current decommissioning obligation,

current lease liabilities, current bank debt and the current

portion of the liability component of convertible debentures. |

Oil and Gas Metrics The term

"boe" or barrels of oil equivalent may be misleading, particularly

if used in isolation. A boe conversion ratio of six thousand cubic

feet of natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl)

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Additionally, given that the value

ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

About Cardinal Energy Ltd.

One of Cardinal's goals is to continually

improve our Environmental, Safety and Governance mandate and

operate our assets in a responsible and environmentally sensitive

manner. As part of this mandate, Cardinal injects and conserves

more carbon than it directly emits making us one of the few

Canadian energy companies to have a negative carbon footprint.

Cardinal is a Canadian oil focused company with

operations focused on low decline light, medium and heavy quality

oil in Western Canada.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.caPhone: (403) 234-8681

Website: www.cardinalenergy.ca

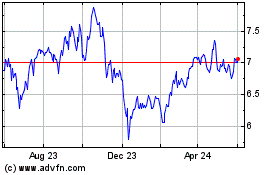

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

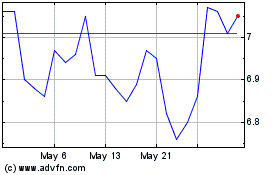

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jan 2024 to Jan 2025