Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX: CJ) announces that it has entered

into subscription agreements for a non-brokered private placement

of approximately $16,920,833 principal amount of 2nd lien secured

notes (the "

Notes") issued at a 4% discount for

gross proceeds of $16,244,000. As part of the Note offering, each

subscriber is also required to subscribe for a pro rata number of

units (the "

Units") totaling 8,122,000 Units, at a

subscription price of $0.50 per Unit for gross proceeds of

$4,061,000.

The Notes will bear interest at 12% per annum (all

interest will accrue semi-annually and be added to the principal

amount outstanding and will be payable on maturity) and will be due

on June 30, 2022, subject to extension to November 30, 2022 by

either Cardinal or the holders on 30 days' prior written notice.

Each Unit will consist of one common share of Cardinal (a

"Common Share") and one common share purchase

warrant (a "Warrant"). Each Warrant will entitle

the holder to purchase one Common Share at an exercise price of

$0.55 per Common Share for a period of three years from the closing

date of the Private Placement.

The closing of the private placement of Notes and

Units (the "Private Placement") is expected to

occur on or about December 29, 2020, and is subject to the approval

of the TSX, certain other funding conditions and satisfactory

completion of the finalization of the terms of Cardinal's new

credit facility. The proceeds of the Private Placement will be used

to repay Cardinal's outstanding 5.50% subordinated convertible

debentures (the "5.50%

Debentures"), which are maturing on December 31,

2020 and for general corporate purposes.

N. Murray Edwards has agreed to participate in the

Private Placement, either directly, or through a company

wholly-owned by Mr. Edwards, for $13,014,582 principal amount of

the Notes and 6,247,000 Units for an aggregate purchase price of

approximately $15,617,500. Mr. Scott Ratushny, CEO of Cardinal

states, "We welcome Mr. Edwards' investment in Cardinal and his

confidence in our assets and business plan and look forward to

working with him as we build our Company's future."

Mr. Edwards has indicated that his acquisition of

the Notes and Units will be for investment purposes and that he may

acquire, directly or indirectly, additional Common Shares or other

securities of the Company from time to time, depending on market

conditions. Mr. Edwards has advised that he currently owns, or

exercises control or direction over, 11,040,000 Common Shares

(representing approximately 9.6% of the issued and outstanding

Common Shares), $1,258,000 principal amount of 5.5% Debentures

(which are currently convertible into 119,810 Common Shares) and

$26,000 principal amount of Cardinal's outstanding 8.0% convertible

debentures (the "8.0%

Debentures") (which are currently convertible into 20,800

Common Shares).

After giving effect to the Private Placement and

assuming the exercise of the Warrants acquired pursuant to the

Private Placement, Mr. Edwards will hold approximately 23,534,000

Common Shares or 18% of the issued and outstanding Common Shares

(also assuming exercise of the Warrants acquired by the other

subscribers pursuant to the Private Placement) and 18.3% of the

issued and outstanding Common Shares (without assuming exercise of

the Warrants acquired by the other subscribers pursuant to the

Private Placement). In addition, assuming full conversion of Mr.

Edwards' 5.5% Debentures and 8.0% Debentures, Mr. Edwards will hold

approximately 23,674,610 Common Shares or 18.1% of the issued and

outstanding Common Shares (also assuming exercise of the Warrants

acquired by the other subscribers pursuant to the Private

Placement) and 18.3% of the issued and outstanding Common Shares

also (without assuming exercise of the Warrants acquired by the

other subscribers pursuant to the Private Placement).

It was a condition to the financing that insiders

of Cardinal also participate in the Private Placement. As a result,

certain directors of Cardinal are participating in the Private

Placement and will subscribe for approximately $3,906,250 principal

amount of the Notes and 1,875,000 Units, representing approximately

23% of the total Notes and Units to be issued pursuant to the

Private Placement. Insider participation in the Private Placement

will be "related party transactions" within the meaning of

Multilateral Instrument 61-101 - Protection of Minority Security

Holders in a Special Transaction ("MI

61-101"). The Units to be acquired by the

directors are exempt from the formal valuation and minority

approval requirements of MI 61-101 pursuant to section 5.5(a) and

5.7(1)(a). The material change report in relation to this

transaction will be filed less than 21 days before closing as the

Private Placement was required to be completed earlier due to the

December 31 maturity date of the 5.50% Debentures.

Forward Looking Information

Certain statements contained in this press release

constitute forward-looking information including, without

limitation, anticipated completion of the Private Placement on the

terms and timing contemplated, the anticipated use of proceeds and

our future plans. The use of any of the words "anticipate",

"continue", "expect", "intend", "may", "will", "project", "should",

"believe" and "confident" and similar expressions are intended to

identify forward-looking information. These statements involve

known and unknown risks, uncertainties and other factors including

the risk that the conditions to closing will not be satisfied and

that that closing will not occur which may cause actual results or

events to differ materially from those anticipated in such

forward-looking information.

Cardinal believes that the expectations reflected

in such forward-looking information are reasonable but no assurance

can be given that these expectations will prove to be correct and

such forward-looking information included in this press release

should not be unduly relied upon. These statements speak only as of

the date of this press release. Cardinal undertakes no obligation

to publicly update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities laws.

About Cardinal Energy

Ltd.

One of Cardinal's goals is to continually improve

our Environmental, Safety and Governance mandate and operate our

assets in a responsible and environmentally sensitive manner. As

part of this mandate, Cardinal injects and conserves more carbon

than it directly emits making us one of the few Canadian energy

companies to have a negative carbon footprint.

Cardinal is a Canadian oil focused company with

operations focused on low decline light, medium and heavy quality

oil in Western Canada.

For further information: M. Scott

Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos, VP

Finance Email: info@cardinalenergy.caPhone: (403) 234-8681 Website:

www.cardinalenergy.ca

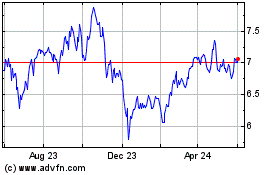

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

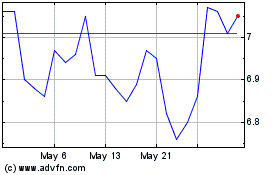

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jan 2024 to Jan 2025