Century Global Commodities Corporation (“Century” or the

“Corporation”) (TSX: CNT) and its 91.6% owned subsidiary Joyce

Direct Iron Inc. (“JDI”), or collectively (the “Company”), are

pleased to announce the Feasibility Study (“FS”) results for the

Joyce Lake Direct Shipping Iron Ore (“DSO”) Project (the “Project”)

of the Attikamagen Property, Labrador. JDI is 100% owner of the

Joyce Lake DSO Project.

The FS was completed by BBA Inc. (“BBA”), with

input from Stantec Consulting Ltd., Goldminds Geoservices Inc.,

Pinchin Ltd., and LVM, a division of Englobe Corporation. The NI

43-101 Technical Report of the FS will be filed on SEDAR and

Century’s website within 45 days of this news release. The FS

results disclosed in this news release is in Canadian dollars

unless otherwise stated. Please note estimates of total values in

tables may differ slightly from total values in the text, due to

rounding.

Project Summary

The Joyce Lake DSO Project is located in the

province of Newfoundland and Labrador in proximity to

Schefferville, Quebec. The Project comprises the following main

sectors:

- Open pit mine

which delivers run of mine high iron grade material to the crushing

and screening plant, while stockpiling lower grade material for

crushing and screening at the end of the open pit mine life.

- Dry crushing

and screening of ore generating a split of 65% sinter fines and 35%

lump products with an average annual production of 2.5 million dmt

of DSO products at an average grade of 59.94% Fe.

- Approximately 7

years production including transporting to market fines products in

the summer and dried lump products in the winter.

- Transportation

of products over a 43km dedicated haul road from the mine site to a

new rail siding near Astray Lake, which connects to existing rail

infrastructure for product transport to the Port of Sept-Îles (POS)

Multi-User port at Pointe Noire, for shipment to China and other

world markets.

Economic Results

The economic results in Table 1 are based upon quotations

with an effective date of March 31, 2022, and commodity pricing

averaged over a three-year look-back from March 31, 2022.

Table 1: Key Project Economic

Results

|

|

Before Tax |

After Tax |

|

NPV at 8% discount rate |

$357.2 M |

$184.6 M |

|

IRR |

27.72 |

% |

20.01 |

% |

|

Years to Payback (from start of operations) |

3.2 |

|

3.7 |

|

|

Initial Capital Costs |

$270.4 M |

|

Pre-production capital |

$80.4 M |

|

Life of Mine Sustaining Capital |

$18.3 M |

|

Average Operating Costs (loaded rail car at site rail siding) |

$36.26/dot |

|

Average Rail Transportation Costs |

$25.06/dot |

|

Average FOB Sept-Iles operating cost |

$61.32/dot |

|

Average Ocean Shipping Costs |

$33.93/dmt |

|

Average Operating Cost Landed (China) |

$95.26/dmt |

Mineral Resources

The Mineral Resource reporting was completed in

GENESIS and the current pit constrained Mineral Resources (“Current

MRE”) were estimated in conformity with generally accepted CIM

Estimation of Mineral Resources and Mineral Reserves Best Practices

Guidelines of 2019.

The Current MRE was based on results from the

2011-2013 drilling program and are at a cut-off grade of 50%Fe

generating 23.97 million tonnes of Measured and Indicated

Mineral Resources at an average grade of 58.63% total Iron (Fe) and

0.83 million tonnes of Inferred Mineral Resources. The pit

constrained Mineral Resources at a 55% cut-off grade was also

calculated for sensitivity purposes and also shown in Table 2.

The Current MRE shown in Table 2 is constrained

within an optimized pit shell with a 50%Fe cut off grade applied as

per CIM 2019 guidelines. The cut-off grade was applied within an

optimized pit shell, selected to achieve an overall resource iron

content that would, in the author’s opinion, meet typical DSO grade

market specifications and have a reasonable prospect for economic

extraction.

Table 2: Summary of current pit

constrained MRE at Joyce Lake DSO Project, May 6, 2022

|

Joyce Lake (DSO) Mineral Resource Estimate (1) |

|

50% Fe Cut-off (2) |

Tonnes (3) |

% Fe |

% SiO2 |

%

Al2O3 |

% Mn |

|

Measured ("M") |

18,530,000 |

58.71 |

12.97 |

0.55 |

0.81 |

|

Indicated ("I") |

5,440,000 |

58.35 |

14.09 |

0.51 |

0.53 |

|

M+I |

23,970,000 |

58.63 |

13.22 |

0.54 |

0.75 |

|

Inferred |

830,000 |

62.10 |

8.30 |

0.43 |

0.78 |

|

|

|

|

|

|

|

|

Joyce Lake (DSO) Mineral Resource Estimate Sensitivity (1) |

|

55% Fe Cut-off (2) |

Tonnes (3) |

% Fe |

% SiO2 |

%

Al2O3 |

% Mn |

|

Measured ("M") |

12,870,000 |

61.45 |

9.01 |

0.54 |

0.85 |

|

Indicated ("I") |

3,590,000 |

61.55 |

9.36 |

0.49 |

0.64 |

|

M+I |

16,460,000 |

61.47 |

9.09 |

0.53 |

0.81 |

|

Inferred |

790,000 |

62.50 |

7.68 |

0.43 |

0.81 |

Notes:

- Pit optimized using

approximately $68.97/t operating costs and $157/t FOB Sept-Îles for

material over 55% Fe (equivalent to approximately US$150/t

benchmark price at 0.76 C$:US$ exchange rate).

- Within mineralized

envelope and optimized pit shell, % Fe Cut-off on individual

blocks.

- Variable Density

(equation derived from core measurements), tonnes rounded to

nearest 10,000.

|

Mineral Reserves

The mineral reserves are reported in accordance

with CIM definition standards for Mineral Resources & Mineral

Reserves and their Guidelines and are compliant with NI43-101. The

mineral reserves estimated for Joyce Lake DSO Project during the FS

are set below.

Table 3: Joyce Lake Mineral Reserves

at 52% Fe cut-off grade

|

Mineral Reserves |

Tonnage |

Grade |

Grade |

Grade |

Grade |

|

Mineral Category |

(Mt) |

(%Fe) |

(%SiO2) |

(%Al2O3) |

(%Mn) |

|

High-grade Proven (Above 55% Fe) |

11.32 |

61.65 |

8.72 |

0.55 |

0.84 |

|

Low-grade Proven (52% - 55% Fe) |

2.84 |

53.49 |

20.42 |

0.62 |

0.69 |

|

Total Proven (Above 52% Fe) |

14.16 |

60.01 |

11.07 |

0.56 |

0.81 |

|

High-grade Probable (Above 55% Fe) |

2.49 |

61.51 |

9.46 |

0.50 |

0.61 |

|

Low-grade Probable (52% - 55% Fe) |

0.72 |

53.27 |

21.68 |

0.59 |

0.29 |

|

Total Probable (Above 52% Fe) |

3.21 |

59.65 |

12.21 |

0.52 |

0.54 |

|

Total Reserve (Above 52% Fe) |

17.37 |

59.94 |

11.28 |

0.55 |

0.76 |

Table Notes:

-

Mineral Reserves are based on Measured and Indicated Mineral

Resources with an effective date of May 6, 2022.

-

Mineral Reserves are reported based on open pit mining within

designed pits and incorporate estimates for mining dilution and

mining losses. As a result of regularization of the block model, an

estimated 2.4% mining dilution and 2.4% mining loss were

incorporated into the model.

-

Joyce Lake high-grade Mineral Reserves are reported at a diluted

cut-off grade of 55% Fe. The cut-off grades and pit designs are

considered appropriate for an iron ore price of $117.53/dot for

high-grade, a process recovery of 98% for crushing & screening,

and estimated mining, processing, and G&A unit costs during pit

operation.

-

Joyce Lake low-grade Mineral Reserves are reported at a diluted

cut-off grade of 52% Fe and below the higher cut-off grades

identified in Note 3. It is planned that low-grade Mineral Reserves

within the designed pits will be stockpiled during pit operation

and processed during pit closure. The low-grade cut-off is

considered appropriate for an iron ore price of $61.14/dot for

low-grade, a process recovery of 98% and estimated ore rehandle,

processing, and G&A unit costs during pit closure.

-

Proven Reserves are all blocks inside the engineered pit design in

the Measured Resource category.

-

Probable Reserves are all blocks inside the engineered pit design

in the Indicated Resource category.

-

Mineral Reserves were developed in accordance with CIM Definition

Standards on Mineral Resources and Mineral Reserves (May 2014) and

the CIM Estimation of Mineral Resources and Mineral Reserves Best

Practice Guidelines (2019).

-

Rounding may result in apparent summation differences between

tonnes and grade.

-

Mineral Reserves are reported with an effective date of May 6,

2022.

Financial Analysis

Table 4: Summary of key financial

results

|

Mineral Category |

Before Tax |

After Tax |

|

IRR |

27.72 |

% |

20.01 |

% |

|

Payback Years |

3.2 |

|

3.7 |

|

|

NPV @ 0% Discount Rate |

$660.2 M |

$394.7 M |

|

NPV @ 4% Discount Rate |

$489.4 M |

$276.4 M |

|

NPV @ 8% Discount Rate |

$357.2 M |

$184.6 M |

Analysis Assumptions

- Long term price, CFR

China of US$124.95 dot 62% Fe fines.

- The average FOB

Sept-Iles operating cost is C$61.32/dot (US$47.10/dot) before

royalties. Ocean freight to China is assumed to be C$33.93/dot

(US$26.06/dot). Total landed (China) cost is C$95.26/dot

(US$73.16/dot).

- Royalty payments

average C$1.86/dot.

- Exchange rate of

US$0.77 per C$1.00.

- Ore production of

approximately 7 years.

- Initial capital cost

estimate accuracy of -10% / +15%.

Table 5: Summary of Capital Costs and

Other Expenditures

|

Initial Capital Costs |

$M |

|

Mining (Capitalized Pre-Stripping) |

20.7 |

|

|

Mining Equipment (Initial Owner Fleet) |

26.3 |

|

|

Infrastructure Direct Costs |

143.1 |

|

|

Infrastructure Indirect and Owners Costs |

42.8 |

|

|

Railcars Lease Down Payment |

9.2 |

|

|

Other Mobile Equipment Lease Down Payment |

10.0 |

|

|

Contingency |

18.4 |

|

|

Total Project CAPEX |

270.4 |

|

|

Sustaining Capital |

$M |

|

Mining Equipment Sustaining |

18.3 |

|

|

Total Sustaining Capital |

18.3 |

|

|

Pre-production Capital |

$M |

|

Pre-payments for rail and port capacity buy-ins |

58.4 |

|

|

Leasing payments incurred in pre-production |

22.0 |

|

|

Total Pre-production Capital |

80.4 |

|

|

Other Expenditures |

$M |

|

Production Leasing Payments |

87.9 |

|

|

Closure and Rehab Assurance Payment |

6.4 |

|

|

Royalties |

32.3 |

|

|

Salvage Value |

(31.8 |

) |

The initial capital cost estimate is $270.4M

which excludes investment of $58.4M to acquire pre-production

capability for product handling at rail and ship-loading

facilities. This investment is reclaimed through agreements which

provide a credit per tonne of product transported or by selling

acquired capacity at the end of mine life. Mobile equipment such as

railcars, loaders and haul trucks will be leased thus incurring

pre-production leasing payments of $22.0M. Major equipment and

rolling stock sold at the end of mine life generates $31.8M of

salvage value.

During operations, additional mining equipment

is required which incurs a sustaining capital of $18.3M. Additional

costs which are incurred during operations include: $32.3M in

royalty payments, leasing payments for mobile equipment such as

railcars, loaders and haul trucks which totals $87.9M and site

closure costs of $6.4M. These estimates are included in the FS

financial analysis.

Table 6: Site and Astray Lake Loading

Operating Cost Summary

|

Area |

($/dmt) |

|

Mining |

15.5 |

|

Perimeter Dewatering and Water Management |

0.7 |

|

Cushing and Screening and Product Handling |

3.0 |

|

Product Truck Haulage to Astray Lake Rail Loading |

6.7 |

|

Load-out and Rail Siding at Astray Lake |

1.8 |

|

Site Administration |

4.5 |

|

Site Services (Room & Board and FIFO Air Tickets) |

3.1 |

|

Lump Drying |

0.9 |

|

Total operating costs excluding Royalties |

36.3 |

Note: The project remains subject to permitting

and there is no assurance permitting will be obtained for the

project or that material modifications may not be required

Technical Report and Qualified Person

An NI 43-101 Technical Report (the “Report”) will be filed on

SEDAR and on Century’s website within 45 days of the date of this

news release. The Report will consist of a summary of the FS

prepared by BBA in respect of the FS. The technical information

contained in this news release has been reviewed and approved by

Mr. Derek Blais, P. Eng., of BBA with the exception of the Current

MRE’s which was reviewed and approved by Mr. Claude Duplessis,

P.Eng., of Goldmunds Ecoservices Inc. and the mine design and

mining plan which were prepared and approved by Ms. Joanne

Robinson, P. Eng. of BBA. These individuals are considered as

Qualified Persons (“QPs”) as defined by NI 43-101 and are

independent of the Corporation and Company. Additional FS QPs

include Guillaume Joyal, P.Eng., of Englobe Corp., Sheldon Smith,

P.Geo., of Stantec Consulting Ltd., and Byron O’Connor, P.Eng., of

Pinchin Ltd.

Comments by the Company

Sandy Chim, Century’s President and CEO added,

“I am pleased with the feasibility study results at an initial

capital cost of C$270.4M, generating after-tax

NPV8 of C$184.6M and after-tax IRR of 20.01%,

which provide the foundation for our further advancement of the

development of the Project.”

He went on to say, “The feasibility study adopted the

extraordinary innovation of transporting DSO fines in summer while

also drying and stockpiling DSO lump. The dried lump will be

transported in winter, avoiding the customary take-or-pay penalties

of a winter transportation shut-down. The transportation innovation

together with discrete equipment leasing and a reduction in

transportation equipment, has greatly enhanced the Projects

financial performance.”

He also said, “Supported by these excellent results, management

will work diligently to complete Indigenous Groups consultation and

environmental assessment and permitting to reach a production

decision as soon as possible.”

Peter Jones, Chair of Century’s Advisory Committee

said, “The cost of drying DSO lump product to 2% moisture

content, stockpiling and protecting it from additional moisture

gain before reclaiming and winter transport, is a fraction of the

cost of a normal winter transportation shutdown. Working with BBA

Inc. of Montreal, Century has developed this innovative concept,

which I believe is a first in Canada’s Labrador Trough iron ore

mines.”

ABOUT CENTURY

Century Global Commodities Corporation (TSX:CNT)

is primarily a resource exploration and development company with a

large portfolio of multi-billion tonne iron ore projects in Canada,

mostly discovered by its own exploration team. It has other

non-ferrous metals properties under exploration as well as a

well-established food distribution business (Century Food) in Hong

Kong.

The Joyce Lake DSO Iron Ore Project

Joyce Lake, our most advanced project, is a DSO project in

Newfoundland and Labrador, close to the town of Schefferville,

Québec which is serviced by a rail link directly to ocean shipping

iron ore ports at Sept-Îles. The Project has completed an updated

feasibility study in 2022 and is undergoing environmental

assessment. Joyce Lake is held in a special purpose vehicle, Joyce

Direct Iron Inc., to be spun out to be a separate listed

company.

Century Food

Century Food is a subsidiary operation of the Company which

started a few years ago and is a value-adding marketing and

distribution business of quality food products sourced from such

regions as Europe and Australia and sold in the Hong Kong and Macau

markets.

For further information please contact:

| Sandy Chim, President &

CEOCentury Global Commodities

Corporation416-977-3188IR@centuryglobal.ca |

|

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, CENTURY’S OWNERSHIP AND PLANS FOR THE SPIN-0UT,

INCLUDING LISTING, FINANCING AND DEVELOPMENT OF THE JOYCE LAKE DSO

IRON ORE PROJECT, INCLUDING (I) ESTIMATES AS TO RESOURCES AND

RESERVES FOR THE PROJECT, (II) ESTIMATES AS TO THE CAPITAL COSTS,

OPERATING COSTS, PRODUCTION RATES, MINE LIFE, NET PRESENT VALUE AND

RATES OF RETURN FOR THE PROJECT, (III) PROJECTIONS AS TO THE TIME

FRAME FOR THE ADDITIONAL WORK REQUIRED TO COMPLY WITH THE

PROVINCIAL ENVIRONMENTAL IMPACT ASSESSMENT GUIDELINES; (IV) THE

ABILITY OF JDI TO CONCLUDE BENEFIT AGREEMENTS WITH FIRST NATIONS

AND THE GOVERNMENT OF NEWFOUNDLAND AND LABRADOR; (V) THE TIMELINE

FOR COMPLETION OF THE EIS PROCESS BY JDI; (VI) THE ABILITY OF JDI

TO MEET ALL FEDERAL AND PROVISIONAL EIS REQUIREMENTS AND TO

ULTIMATELY SECURE THE REQUIRED ENVIRONMENTAL PERMITTING; AND (VII)

THE ABILITY OF JDI TO LIST ITS COMMON SHARES ON THE NEO AEQUITAS

STOCK EXCHANGE, OF WHICH THERE IS NO ASSURANCE. FORWARD-LOOKING

INFORMATION IS BASED ON, AMONG OTHER THINGS, OPINIONS, ASSUMPTIONS,

ESTIMATES AND ANALYSES THAT, WHILE CONSIDERED REASONABLE BY CENTURY

AT THE DATE THE FORWARD-LOOKING INFORMATION IS PROVIDED, ARE

INHERENTLY SUBJECT TO SIGNIFICANT RISKS, UNCERTAINTIES,

CONTINGENCIES AND OTHER FACTORS THAT MAY CAUSE ACTUAL RESULTS AND

EVENTS TO BE MATERIALLY DIFFERENT FROM THOSE EXPRESSED OR IMPLIED

BY THE FORWARD-LOOKING INFORMATION. THE RISKS, UNCERTAINTIES,

CONTINGENCIES AND OTHER FACTORS THAT MAY CAUSE ACTUAL RESULTS TO

DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY THE

FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT LIMITED TO,

RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS DESCRIBED IN

CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED MARCH 31,

2022. INVESTOR SHOULD ALSO REVIEW THE FS IN DETAIL UPON ITS

PUBLICATION IN ORDER TO FULLY UNDERSTAND THE RISKS AFFECTING THE

PROJECT AND THE ESTIMATES INCLUDED IN THE PROJECT.

READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING

INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY

OTHER DATE. WHILE CENTURY MAY ELECT TO, IT DOES NOT UNDERTAKE TO

UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED

IN ACCORDANCE WITH APPLICABLE LAWS.

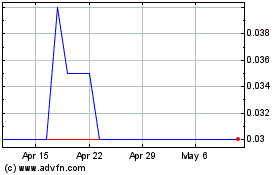

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Apr 2024 to May 2024

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From May 2023 to May 2024