Century Global Commodities Corporation (TSX: CNT)

(the “

Company” or “

Century”), is

pleased to announce it is undertaking a rights offering to raise

gross proceeds of $394,018. The Company will be offering 98,504,571

rights (the “

Rights”) to holders (the

“

Shareholders”) of its ordinary shares of the

Company (“

Shares”) at the close of business on the

record date of June 9, 2023 (the “

Record Date”) on

the basis of one (1) Right for each one (1) Share held (the

“

Rights Offering”). Five (5) Rights will entitle

the holder to subscribe for one Share upon payment of the

subscription price of CAD$0.02 per Share (the “

Basic

Subscription Privilege”). Shareholders who fully exercise

their Rights under the Basic Subscription Privilege will also be

entitled to subscribe for additional Shares, on a pro rata basis,

if available as a result of unexercised Rights prior to the expiry

time of the Rights Offering (the “

Additional Subscription

Privilege”).

The Rights will be listed and posted for trading

on the Toronto Stock Exchange (the “TSX”) under

the symbol “CNT.RT” on a “when issued” basis commencing on June 8,

2023 and will trade until 9:00 a.m. (Pacific time) on July 7, 2023.

The Rights will expire at 2:00 p.m. (Pacific Time) (the

“Expiry Time”) on July 7, 2023, after which time

unexercised Rights will be void and of no value.

The Rights will be offered to Shareholders

resident in (i) all provinces and territories of Canada and (ii) in

Hong Kong (collectively, the “Eligible

Jurisdictions”). Shareholders will be presumed to be

resident in the place shown on the securities register, unless the

contrary is shown to the Company’s satisfaction. Neither the Notice

(defined below), nor the Circular (defined below) is to be

construed as an offering of the Rights, and the Shares issuable

upon exercise of the Rights are not offered for sale in any

jurisdiction outside of the Eligible Jurisdictions, including in

the United States (the “Ineligible

Jurisdictions”), or to any shareholders who are resident

in any jurisdiction other than the Eligible Jurisdictions (the

“Ineligible Holders”). Details of the Rights

Offering are set out in the Rights Offering notice (the

“Notice”) and the Rights Offering circular dated

May 31, 2023 (the “Circular”), which are filed on

SEDAR under Century’s profile at www.sedar.com. The Company expects

to close the Rights Offering on or about July 14, 2023, but in any

event no later than July 28, 2023.

Pricing of the Rights Offering is mandated by

TSX rules which require the Company to offer all existing

Shareholders a significant discount to purchase new Shares in order

to provide a meaningful incentive to all Shareholders to

participate in the Rights Offering. The Company presently has

98,504,571 Shares issued and outstanding. Upon completion of the

Rights Offering and assuming all Rights are exercised, the Company

will have 118,205,485 Shares outstanding, of which the Shares

issued under the Rights Offering represent 16.67%.

The Notice, Rights direct registration advices

and subscription forms will be mailed to Shareholders resident in

the Eligible Jurisdictions. Registered Shareholders who wish to

exercise their Rights must forward the completed subscription form,

together with the applicable funds, to the Rights agent, TSX Trust

Company (the “Rights Agent”), on or before the

Expiry Time. Shareholders who own their Shares through an

intermediary, such as a bank, trust company, securities dealer or

broker, will receive materials and instructions from their

intermediary.

Each Ineligible Holder will be sent a letter

(the “Notice to Ineligible Shareholders”)

describing how Ineligible Holders may, in the Company’s discretion,

participate in the Rights Offering, provided such Ineligible Holder

satisfies the Company that, among other things, the distribution

to, and exercise by such Ineligible Holder of the Rights in the

Rights Offering: (i) is not unlawful; and (ii) is exempt from any

prospectus or similar filing requirement under the laws applicable

to such Ineligible Holder or the laws of such Ineligible Holder’s

place of residence and does not require obtaining any approvals of

a regulatory authority in such Ineligible Holder’s place of

residence. The Notice to Ineligible Shareholders will have attached

a form of exempt purchaser status certificate to this effect (the

“Exempt Purchaser Status Certificate”).

Brokers cannot exercise the Rights on behalf of

beneficial Ineligible Holders of Shares, unless the Ineligible

Holder has completed an Exempt Purchaser Status Certificate and has

provided same to the Company through the applicable broker.

After June 30, 2023 the Rights Agent will

attempt, on a commercially reasonable basis, to sell the Rights of

Ineligible Holders (other than those Shareholders from whom the

Company accepts subscriptions) over the facilities of the TSX. The

Rights Agent will mail cheques representing the net proceeds,

without interest, from such sales.

Sandy Chim and Thriving Century Limited, and

Ivan Wong, “insiders” and “related parties” (as such terms are

defined under applicable securities laws) of the Company, have

advised the Company that they intend to exercise, subject to

relevant restrictions, all of their Basic Subscription

Privileges.

The Company has also entered into a standby

guaranty agreement with Sandy Chim and Thriving Century Limited

(the “Standby Purchasers”), pursuant to which the

Standby Purchasers have agreed to purchase all of the Shares

issuable under the Rights Offering which remain unsubscribed under

the Basic Subscription Privilege and the Additional Subscription

Privilege (the “Standby Guaranty”). The Standby

Purchasers have allocated 8,051,963 Shares available under the

Standby Guaranty for purchase by Mr. Ivan Wong (the

“Management Allocation”). Currently, the Standby

Purchasers hold 18,025,317 Shares representing 18.30% of the

Company’s total issued and outstanding Shares. If the Standby

Purchasers acquire all of the Shares under the Standby Guaranty,

other than the Management Allocation, and their Basic Subscription

Privilege, the Standby Purchasers will hold 29,539,550 Shares

representing 24.99% of the Company’s total issued and outstanding

Shares after the completion of the Rights Offering.

The proceeds of the Rights Offering are expected

to be used for preliminary costs for exploring/preparing for

additional stock exchange listing in connection with the

advancement of the development of the Company’s Joyce Lake Iron Ore

Project.

The Rights and the underlying Shares have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “U.S. Securities

Act”), or the securities laws of any state of the United

States. This news release does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities within the

United States, and the Rights (a) may not be offered or sold in the

United States or to any U.S. person, and (b) may not be exercised

within the United States or for the account or benefit of any U.S.

person or any person in the United States. “United

States” and “U.S. person” are as defined

in Regulation S under the U.S. Securities Act.

ABOUT CENTURY

Century Global Commodities Corporation (TSX:CNT)

is primarily a resource exploration and development company with a

large portfolio of multi-billion tonne iron ore projects in Canada,

mostly discovered by its own exploration team. It has other

non-ferrous metals properties under exploration as well as a

well-established food distribution business (Century Food) in Hong

Kong.

The Joyce Lake Direct Shipping Iron Ore

Project

Joyce Lake, our most advanced project, is an

open pit direct shipping iron ore project in Newfoundland and

Labrador, close to the town of Schefferville, Québec which is

serviced by a rail link directly to ocean shipping iron ore ports

at Sept-Îles. The Project has completed an updated feasibility

study in 2022 and is undergoing environmental assessment. Joyce

Lake is held in a special purpose vehicle, Joyce Direct Iron Inc.

(“JDI”), in which Century owns 91.6%.

Century Food

Century Food is a subsidiary operation of the

Company which started a few years ago and is a value-adding

marketing and distribution business of quality food products

sourced from such regions as Europe and Australia and sold in the

Hong Kong and Macau markets.

For further information please

contact:

Sandy Chim, President & CEO Century Global Commodities

Corporation 416-977-3188 IR@centuryglobal.ca

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, THE COMPLETION OF THE RIGHTS OFFERING AND USE

OF PROCEEDS OF THE RIGHTS OFFERING, CENTURY’S OWNERSHIP AND PLANS

FOR THE SPIN-0UT, INCLUDING LISTING, FINANCING AND DEVELOPMENT OF

THE JOYCE LAKE DSO IRON ORE PROJECT, INCLUDING (I) ESTIMATES AS TO

RESOURCES AND RESERVES FOR THE PROJECT, (II) ESTIMATES AS TO THE

CAPITAL COSTS, OPERATING COSTS, PRODUCTION RATES, MINE LIFE, NET

PRESENT VALUE AND RATES OF RETURN FOR THE PROJECT, (III)

PROJECTIONS AS TO THE TIME FRAME FOR THE ADDITIONAL WORK REQUIRED

TO COMPLY WITH THE PROVINCIAL ENVIRONMENTAL IMPACT ASSESSMENT

GUIDELINES; (IV) THE ABILITY OF JDI TO CONCLUDE BENEFIT AGREEMENTS

WITH FIRST NATIONS AND THE GOVERNMENT OF NEWFOUNDLAND AND LABRADOR;

(V) THE TIMELINE FOR COMPLETION OF THE EIS PROCESS BY JDI; (VI) THE

ABILITY OF JDI TO MEET ALL FEDERAL AND PROVISIONAL EIS REQUIREMENTS

AND TO ULTIMATELY SECURE THE REQUIRED ENVIRONMENTAL PERMITTING; AND

(VII) THE ABILITY OF JDI TO LIST ITS COMMON SHARES ON THE NEO

AEQUITAS STOCK EXCHANGE, OF WHICH THERE IS NO ASSURANCE.

FORWARD-LOOKING INFORMATION IS BASED ON, AMONG OTHER THINGS,

OPINIONS, ASSUMPTIONS, ESTIMATES AND ANALYSES THAT, WHILE

CONSIDERED REASONABLE BY CENTURY AT THE DATE THE FORWARD-LOOKING

INFORMATION IS PROVIDED, ARE INHERENTLY SUBJECT TO SIGNIFICANT

RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS THAT MAY

CAUSE ACTUAL RESULTS AND EVENTS TO BE MATERIALLY DIFFERENT FROM

THOSE EXPRESSED OR IMPLIED BY THE FORWARD-LOOKING INFORMATION. THE

RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS THAT MAY

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR

IMPLIED BY THE FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT

LIMITED TO, RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS

DESCRIBED IN CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED

MARCH 31, 2022. INVESTOR SHOULD ALSO REVIEW THE FS IN DETAIL UPON

ITS PUBLICATION IN ORDER TO FULLY UNDERSTAND THE RISKS AFFECTING

THE PROJECT AND THE ESTIMATES INCLUDED IN THE PROJECT. READERS

SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION

AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE.

WHILE CENTURY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS

INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE

WITH APPLICABLE LAWS.

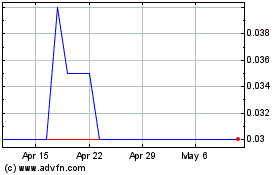

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Dec 2023 to Dec 2024