Delta 9 Reports Year-end Financials for 2022

March 31 2023 - 6:00PM

DELTA 9 CANNABIS INC. (TSX: DN) (OTCQX: DLTNF) (“Delta 9” or the

“Company”) is pleased to announce financial and operating results

for the three-month and full year ending December 31, 2022.

Financial Highlights for the Year Ending December 31,

2022

-

Net revenues of $63.2 million in 2022, an increase of 2% compared

to $62.3 million in 2021, including the following revenue

segmentation highlights:

-

Retail revenues increased 26% to $52.2 million in 2022

-

Wholesale revenues decreased 35% to $12.1 million in 2022

- Business to

business revenues decreased 65% to $1.7 million in 2022

-

Gross profit1 of $12.9 million in 2022 compared to $18.3 million

last year.

-

Adjusted EBITDA2 (loss) of $(5.2) million in 2022 compared to

an Adjusted EBITDA2 of $2.0 million last year.

- Loss from

Operations of $(20.3) million in 2022 compared to Loss from

Operations of $(7.6) million last year.

Financial Highlights for the Three-Month Period Ending

December 31, 2022

-

Quarterly net revenues of $17.6 million for the fourth quarter of

2022, an increase of 3% compared to $17.1 million for the same

quarter last year.

- Sequentially net

revenues increased 12% for the fourth quarter of 2022 compared to

$15.7 million in the third quarter of 2022.

-

Gross profit1 of $3.4 million for the fourth quarter of 2022

compared to $4.9 million for the same quarter last year.

- Sequentially gross

profit increased 76% in the fourth quarter of 2022 compared to

$1.9 million in the third quarter of 2022.

- Sequentially

Adjusted EBITDA2 (loss) improved to $(1.5) million in the fourth

quarter of 2022 compared to and Adjusted EBITDA2 (loss) of $(1.7)

million in the third quarter of 2022.

“We are pleased to report record fourth quarter

and year end revenues for 2022 demonstrating the versatility of our

business model with measurable improvements versus the third

quarter of 2022,” said John Arbuthnot, CEO of Delta 9 Cannabis.

“Challenges persist in the Canadian cannabis industry, which

continues to struggle with intense competition resulting in margin

compression and affecting overall growth. We remain confident that

Delta 9 will be able to navigate the industry challenges and return

the Company to growth and profitability in the coming

quarters.”

4th Quarter

Operational and Subsequent Q1 2023 Highlights:

- Delta

9 installed a new fully-automated pre-roll machine that will

produce up to 4 million pre-rolls per year compared to the 1

million produced in 2022 that generated $2.3 million. The new

machine will significantly lower manufacturing costs and improve

contribution margin for pre-roll sales. We appreciated the

contribution from the Provincial Government that covered 25% of the

cost of the machine.

- Delta 9 shipped

bulk dried cannabis flower to a customer in Australia, marking the

Company’s first export of dried cannabis flower material to an

international market. The Company has also received seven

additional export permits from Health Canada and intends to

complete multiple shipments of dried cannabis flower and cannabis

extracts to the Australian market in the first and second quarter

of 2023. The shipments are anticipated to include approximately 100

Kg of dried cannabis flower material and 6 Kg of cannabis

distillate. This shipment marks a significant milestone for Delta 9

as it enters the global cannabis market.

- Delta 9 opened two

more retail cannabis stores in Western Canada in Q1 2023 quarter

that brings the total store count to 41. The companies retail

strategy continues to find the best available real estate in

high-traffic and high-population density areas. Delta 9’s retail

network has expanded by 25 stores in the past twelve months and is

expected to continue expansion of the retail portfolio across

Canada in 2023.

- Delta 9 announced

various cost cutting measures as a part of the Company’s 2023

strategic plan with the goal of producing positive cash flow from

operations. The Company plans to streamline its cultivation

operations and right-size capacity at its Winnipeg based

cultivation facilities, as well as various other cost cutting

measures including reducing public company and investor relations

costs. The Board of Directors and executive have also agreed to

reduce compensation as part of their commitment to achieving

positive cash flows from operations in the current fiscal year. The

cost savings are expected to reduce operating costs by $3 Million

to $4 Million in 2023. As a part of the plan, cultivation capacity

at the Company’s Winnipeg based cultivation facilities were cut by

approximately 40%, which included a temporary layoff of

approximately 40 staff.

- Delta 9 received a

Cannabis Distributor License from the Liquor Gaming and Cannabis

Authority of Manitoba, making the Company the first licensed

distributor of cannabis products in the province. Under the

License, Delta 9 is authorized to acquire, store, sell and deliver

cannabis in accordance with The Liquor, Gaming and Cannabis Control

Act. The Company’s distribution services will allow out-of-province

suppliers to improve logistics efficiencies and reduce shipping

costs into the Manitoba market and will provide Delta 9 with

additional diversified revenue streams. Total retail cannabis sales

in Manitoba for the twelve months ending August 30, 2022, exceeded

$169 Million, according to data from Statistics Canada, with more

than 150 licensed retail stores in operation as of September 30,

2022.

- Delta 9 announced

that Mr. Stuart Starkey joined the Company's board of directors

following the previously announced resignation of Joanne

Duhoux-Defehr as a director of the Company. Over the past 15 years,

Mr. Starkey was an entrepreneur, para-athlete, and non-profit

founder. As President of Two Small Men Canada, Mr. Starkey grew a

national moving chain to achieve corporate and franchise revenues

of $35 Million per year with over 400 employees. As Co-founder of

Mighty Moving Mr. Starkey grew a cross-docking and logistics

business to service dozens of large chain retailers, with offices

across Alberta. He has since successfully exited both Two Small Men

Canada and Mighty Moving.

- Delta 9 established

an at-the-market equity program (the “ATM Program”) that allows the

Company to issue up to $5,000,000 of common shares in the capital

of the Company from treasury to the public from time to time, at

the Company’s discretion. Distributions of the Common Shares

through the ATM Program will be made between the Company and

Haywood Securities Inc.

Summary of Quarterly Results:

|

Consolidated Statement of Net Income (Loss) |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

|

Revenue |

$ |

12,479,577 |

|

$ |

17,495,078 |

|

$ |

15,693,969 |

|

$ |

17,559,647 |

|

|

Cost of Sales |

|

9,515,096 |

|

|

12,850,777 |

|

|

13,772,202 |

|

|

14,173,693 |

|

|

Gross Profit Before Unrealized Gain From Changes In Biological

Assets1 |

|

2,964,481 |

|

|

4,644,301 |

|

|

1,921,767 |

|

|

3,385,954 |

|

|

Unrealized gain from changes in fair value of biological assets

(Net) |

|

874,293 |

|

|

(542,188 |

) |

|

340,602 |

|

|

(2,710,521 |

) |

|

Gross Profit |

$ |

3,838,774 |

|

$ |

4,102,113 |

|

$ |

2,262,369 |

|

|

675,433 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

General and Administrative |

|

3,810,316 |

|

|

4,043,257 |

|

|

3,668,708 |

|

|

3,551,472 |

|

|

Sales and Marketing |

|

2,713,630 |

|

|

3,381,223 |

|

|

3,710,471 |

|

|

4,647,409 |

|

|

Share Based Compensation |

|

246,944 |

|

|

107,121 |

|

|

1,086,858 |

|

|

169,540 |

|

|

Total Operating Expenses |

$ |

6,770,890 |

|

$ |

7,531,601 |

|

$ |

8,466,037 |

|

$ |

8,368,421 |

|

|

|

|

|

|

|

|

Adjusted EBITDA (Loss) 2 |

|

(1,694,529 |

) |

|

(391,054 |

) |

|

(1,683,018 |

) |

|

(1,479,845 |

) |

|

Income (Loss) from Operations |

$ |

(2,932,116 |

) |

$ |

(3,429,488 |

) |

$ |

(6,203,668 |

) |

$ |

(7,692,988 |

) |

|

Other Income/ Expenses |

|

(1,189,730 |

) |

|

(1,402,588 |

) |

|

(1,470,942 |

) |

|

(3,515,430 |

) |

|

Net Income (Loss) |

$ |

(4,121,846 |

) |

$ |

(4,832,076 |

) |

$ |

(7,674,610 |

) |

$ |

(11,208,418 |

) |

|

Basic and Diluted Earnings (Loss) Per Share |

$ |

(0.04 |

) |

$ |

(0.04 |

) |

$ |

(0.06 |

) |

$ |

(0.09 |

) |

-

Gross Profit, before changes in the fair value of biological

assets.

-

Adjusted EBITDA is a non-IFRS measure, and is calculated as

earnings before interest, tax, depreciation and amortization,

share-based compensation expense, fair value changes and other

non-cash items.

A comprehensive discussion of Delta 9’s financial position and

results of operations is provided in the Company’s Management

Discussion & Analysis for the three-month and year ending

period ending December 31, 2022 filed on SEDAR and can be found at

www.sedar.com.

2022 Forth Quarter Results Conference

Call

A conference call to discuss the above results

is scheduled for April 3, 2023. The conference call will be hosted

that day at 10:00 a.m. Eastern Time by John Arbuthnot, Chief

Executive Officer, and Jim Lawson, Chief Financial Officer,

followed by a question-and-answer period.

|

|

|

|

DATE: |

April 3, 2023 |

|

TIME: |

10:00 am Eastern Time |

|

Dial in # |

1-888-886-7786 |

|

REPLAY: |

1-877-674-6060Available until 12:00 midnight Eastern Time, December

15, 2023 |

|

Replay passcode: |

107180 # |

For more information contact:

Investor & Media Contact:Ian Chadsey VP Corporate

AffairsMobile: 204-898-7722E-mail: ian.chadsey@delta9.ca

About Delta 9 Cannabis Inc.

Delta 9 Cannabis Inc. is a vertically integrated

cannabis company focused on bringing the highest quality cannabis

products to market. The company sells cannabis products through its

wholesale and retail sales channels and sells its cannabis grow

pods to other businesses. Delta 9's wholly-owned subsidiary, Delta

9 Bio-Tech Inc., is a licensed producer of medical and recreational

cannabis and operates an 80,000 square foot production facility

in Winnipeg, Manitoba, Canada. Delta 9 owns and operates a

chain of retail stores under the Delta 9 Cannabis Store brand.

Delta 9's shares trade on the Toronto Stock Exchange under the

symbol "DN" and on the OTCQX under the symbol "DLTNF". For more

information, please visit www.delta9.ca.

Disclaimer for Forward-Looking Information

Certain statements in this release are

forward-looking statements, which reflect the expectations of

management regarding the Company’s future business plans and other

matters. Forward-looking statements consist of statements that are

not purely historical, including any statements regarding beliefs,

plans, expectations or intentions regarding the future. Forward

looking statements in this news release include statements relating

to: (i) the Company’s plans to establish cannabis distribution

operations in Manitoba; and (ii) the Company’s plans to continue to

expand its retail operations in Canada. Such statements are subject

to risks and uncertainties that may cause actual results,

performance or developments to differ materially from those

contained in the statements, including all risk factors set forth

in the annual information form of Delta 9 dated March 31,

2023 which has been filed on SEDAR. No assurance can be given

that any of the events anticipated by the forward-looking

statements will occur or, if they do occur, what benefits the

Company will obtain from them. Readers are urged to consider these

factors carefully in evaluating the forward-looking statements

contained in this news release and are cautioned not to place undue

reliance on such forward-looking statements, which are qualified in

their entirety by these cautionary statements. These

forward-looking statements are made as of the date hereof and the

Company disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, except as required by

applicable securities laws.

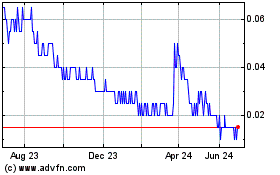

Delta 9 Cannabis (TSX:DN)

Historical Stock Chart

From Dec 2024 to Jan 2025

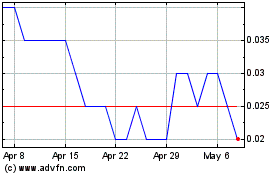

Delta 9 Cannabis (TSX:DN)

Historical Stock Chart

From Jan 2024 to Jan 2025