Pembina Agrees to Acquire Enbridge's Interests in Joint Ventures

December 13 2023 - 5:03PM

Dow Jones News

By Stephen Nakrosis

Pembina Pipeline on Wednesday said it agreed to acquire

Enbridge's interests in three joint ventures operated by the

companies.

Pembina said the deal would see it acquire all Enbridge's

interests in the Alliance, Aux Sable and NRGreen joint ventures for

an aggregate purchase price of about C$3.1 billion ($2.3 billion),

which includes approximately C$327 million of assumed debt. Pembina

said it will finance the cash portion of the deal with net proceeds

of a C$1.1 billion bought deal offering of subscription receipts,

as well as funds drawn from existing credit facilities and cash on

hand.

Once the deal closes, Pembina said, it will hold 100% of the

equity interests in Alliance, Aux Sable's Canadian operations and

NRGreen and about 85.4% of Aux Sable's U.S. operations. Pembina

will also become the operator of all Alliance, Aux Sable and

NRGreen businesses.

Enbridge said proceeds from the sale will be used to fund

"strategic U.S. gas utilities acquisitions," and for debt

reduction.

The Alliance JV transports natural gas sourced in Canada and the

U.S. to Chicago, while Aux Sable operates NGL extraction and

fractionation facilities in both countries, Enbridge said. NRGreen

operates waste heat recovery facilities along the Alliance

Pipeline, according to Enbridge.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

December 13, 2023 17:48 ET (22:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

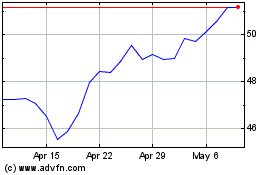

Enbridge (TSX:ENB)

Historical Stock Chart

From Mar 2024 to Apr 2024

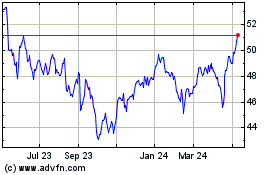

Enbridge (TSX:ENB)

Historical Stock Chart

From Apr 2023 to Apr 2024