European Residential Real Estate Investment Trust ("ERES" or the

"REIT") (TSX: ERE.UN) announced today its results for the year

ended December 31, 2021.

ERES’s audited consolidated annual financial

statements and management's discussion and analysis ("MD&A")

for the year ended December 31, 2021 can be found at

www.eresreit.com or under ERES's profile at www.sedar.com.

ACCELERATING INTO THE

FUTURE

- Exceptional growth in investment property portfolio value,

increasing by 26%

- Portfolio rental growth of 5.0% versus

prior year, including 3.8% on stabilized

assets

- Portfolio Net Operating Income increase of

12%, including 5% on stabilized

contribution

- FFO and AFFO per Unit increased significantly, up by

13% and 12%, respectively, versus

the prior year

- Distribution increase of 5% over 2021, with

additional 9% increase announced going forward in

2022

SIGNIFICANT EVENTS AND

HIGHLIGHTS

Business Update

- The REIT closed on five

acquisitions in the Netherlands for a combined purchase price of

€162.5 million (excluding transaction costs and fees), representing

an aggregate 499 residential units across 13 properties, increasing

its unit count by 8%.

- Mortgage financings were secured

for all the REIT's 2021 acquisition properties, combined with

refinancing of certain existing properties, in the total principal

amount of €156.6 million. The new mortgage financings mature on

October 1, 2027, and carry a weighted average interest rate of

1.16%, which lowered the REIT's overall weighted average mortgage

effective interest rate by 9 basis points to 1.52%.

- On February 23, 2021, the Board of

Trustees approved an increase of 5% to the REIT's monthly

distribution from its previous rate of €0.00875 per Unit

(equivalent to €0.105 per Unit annualized) to €0.00917 per Unit

(equivalent to €0.110 per Unit annualized).

Outperforming Operating Metrics

- Strong operating results

accelerated for the year ended December 31, 2021, fuelled by

accretive acquisitions, ongoing strong rental growth and margin

expansion. Stabilized portfolio Occupied Average Monthly Rent

("AMR") increased by 3.8%, from €896 as at December 31, 2020, to

€930 as at December 31, 2021, demonstrating the REIT's achievement

of rental growth at the higher end of its target range, despite

various developments in the regulatory regime.

- Turnover was 13.9% for the year

ended December 31, 2021, with rental uplift on turnover

accelerating to 16.3%, versus rental uplift of 9.9% on comparable

turnover of 14.2% in the prior year.

- Occupancy for the residential

properties increased to 98.6% as at December 31, 2021, compared to

98.3% as at December 31, 2020. A significant proportion (76%) of

residential vacancy in the current period is due to renovation,

which will provide further rental uplifts once the suites are

leased.

- Net Operating Income ("NOI")

increased by 11.7% for the year ended December 31, 2021, primarily

driven by contribution from accretive acquisitions as well as the

aforementioned higher monthly rents and lower property operating

costs as a percentage of revenues. In aggregate, this supported the

strong increase in NOI margin to 77.4% compared to 76.2% for the

year ended December 31, 2020, which the REIT anticipates will be

reflected in an increase to its normalized annual NOI margin.

Consistent Fair Value Appreciation on

Portfolio

- The fair value of the REIT's

property portfolio increased by 26% to €1.86 billion as at December

31, 2021, consisting of €1.76 billion in multi-residential

properties and €0.10 billion in commercial properties. The increase

was comprised of €19.5 million in capital investment, €172.6

million in property acquisitions and a significant fair value gain

of €194.6 million for the year ended December 31, 2021. The annual

increase in market value was driven by steady and strong portfolio

fundamentals resulting in a compression of capitalization rates,

down 28 basis points to 3.33% on its residential properties, as

well as the successful execution of the REIT's value-adding capital

expenditure program and the REIT's exceptional operating metrics,

including its continually increasing rental revenues, consistently

high occupancy and strong cost control.

Accretive Financial Performance

- Funds From Operations ("FFO") per

Unit increased significantly by 13.3% to €0.153 for the year ended

December 31, 2021, compared to €0.135 in the prior year, due to the

positive impact of accretive acquisitions as well as increased NOI

contribution.

- Adjusted Funds From Operations

("AFFO") per Unit similarly increased significantly by 12.4% to

€0.136 for the year ended December 31, 2021, compared to €0.121 in

the year ended December 31, 2020.

- AFFO Payout Ratio was 80.4% for the

year ended December 31, 2021, at the lower end of the REIT's

long-term target range and down from 87.0% in the prior year.

Strong Financial Position with Ample

Liquidity

- On October 29, 2021, the REIT

amended and renewed its existing Revolving Credit Facility (defined

herein), providing up to €100.0 million for a three-year period

ending on October 29, 2024.

- On March 10, 2021, the REIT

extended its €165 million Pipeline Agreement with Canadian

Apartment Properties Real Estate Investment Trust ("CAPREIT") for

an additional two-year period ending on March 29, 2023, under the

same terms and conditions.

- Overall, liquidity and leverage

remain strong, supported by the REIT's staggered mortgage profile

with a four-year weighted average term to maturity and a weighted

average effective interest rate of 1.52%. The REIT has immediately

available liquidity of €39.4 million as at December 31, 2021, and

its total debt to gross book value is 46.8%.

Subsequent Events

- On December 29, 2021, the REIT

entered into a purchase agreement to acquire a multi-residential

property comprised of 201 suites located in Arnhem, the

Netherlands, for a purchase price of €45.0 million (excluding

transaction costs and fees), with estimated closing in early

2022.

- On January 31, 2022, the REIT

acquired a multi-residential property comprised of 45 suites

located in Rijswijk, the Netherlands, for a purchase price of €19.5

million (excluding transaction costs and fees).

- On February 17, 2022, the Board of

Trustees approved an increase of 9% to the REIT's monthly

distribution to €0.01 per Unit (equivalent to €0.120 per Unit

annualized), effective for the REIT's next monthly distribution in

respect of March 2022. Distributions will continue to be paid to

Unitholders of record on each record date, on or about the 15th

date of the month following the record date.

"Throughout the entirety of 2021, ERES has

out-performed on all of its operational and financial metrics. We

set ambitious targets, and we consistently exceeded those targets

in every capacity, every time," commented Phillip Burns, Chief

Executive Officer. "We will not only continue to enhance our

performance in the new year, but also accelerate the accretive

growth momentum established to date. We are excited to set the bar

even higher in 2022, and to that end, the best is yet to come."

OPERATING METRICS CONTINUE TO

STRENGTHEN

|

Total Portfolio |

Suite Count |

Net AMR/ABR |

Occupied AMR/ABR |

Occupancy % |

|

As at December 31, |

2021 |

2020 |

2021 |

2020 |

AMR |

2021 |

2020 |

AMR |

2021 |

2020 |

| |

|

|

€ |

€ |

% Change |

€ |

€ |

% Change |

|

|

|

Residential Properties |

6,545 |

6,047 |

927 |

882 |

5.1 |

941 |

896 |

5.0 |

98.6 |

98.3 |

|

Commercial Properties1 |

|

|

17.6 |

17.6 |

— |

17.6 |

17.6 |

— |

100.0 |

100.0 |

1 Represents 450,911 square feet of commercial

gross leasable area.

|

Stabilized Portfolio |

Suite Count1 |

Net AMR/ABR |

Occupied AMR/ABR |

Occupancy % |

|

As at December 31, |

|

2021 |

2020 |

AMR |

2021 |

2020 |

AMR |

2021 |

2020 |

| |

|

€ |

€ |

% Change |

€ |

€ |

% Change |

|

|

|

Residential Properties |

6,046 |

918 |

882 |

4.1 |

930 |

896 |

3.8 |

98.7 |

98.3 |

|

Commercial Properties2 |

|

17.6 |

17.6 |

— |

17.6 |

17.6 |

— |

100.0 |

100.0 |

1 Represents all properties owned by the REIT

continuously since December 31, 2020, and therefore excludes 13

residential properties (499 suites) acquired and 1 suite disposed

in the subsequent period to date. 2 Represents 450,911 square feet

of commercial gross leasable area.

Net and Occupied AMR for the total

multi-residential portfolio increased by 5.1% and 5.0%,

respectively, while Net and Occupied AMR for the stabilized

portfolio increased by 4.1% and 3.8%, respectively, compared to the

prior year. The increases were driven by increased rents on annual

indexation, turnover and conversion of regulated suites to

liberalized suites. The REIT's achievement of growth in rental

revenues at the high end of its target range of 3% to 4%

demonstrates its ability to consistently and profitably operate in

a complex and fluid regulatory regime.

|

For the Three Months Ended December 31, |

2021 |

2020 |

| |

Change in Monthly Rent |

Turnovers |

Change in Monthly Rent |

Turnovers |

|

|

€ |

% |

% |

€ |

% |

% |

|

Regulated suites turnover |

16 |

2.8 |

0.4 |

10 |

1.5 |

0.6 |

|

Liberalized suites turnover |

155 |

16.4 |

2.3 |

113 |

11.6 |

2.6 |

|

Regulated suites converted to liberalized suites |

377 |

56.7 |

0.3 |

341 |

49.0 |

0.2 |

|

Weighted average turnovers |

162 |

19.1 |

3.0 |

110 |

12.3 |

3.4 |

|

For the Year Ended December 31, |

2021 |

2020 |

| |

Change in Monthly Rent |

Turnovers |

Change in Monthly Rent |

Turnovers |

|

|

€ |

% |

% |

€ |

% |

% |

|

Regulated suites turnover |

18 |

3.2 |

1.7 |

19 |

2.9 |

1.8 |

|

Liberalized suites turnover |

125 |

13.2 |

10.4 |

75 |

7.5 |

10.9 |

|

Regulated suites converted to liberalized suites |

304 |

45.2 |

1.9 |

261 |

36.8 |

1.4 |

|

Weighted average turnovers |

136 |

16.3 |

13.9 |

87 |

9.9 |

14.2 |

For the three months and year ended December 31,

2021, turnover was 3.0% and 13.9%, respectively, with average

rental uplift (including service charge income) of 19.1% and 16.3%.

This compares exceptionally well to average rental uplift

(including service charge income) of only 12.3% and 9.9% on fairly

stable turnover of 3.4% and 14.2% in the three months and year

ended December 31, 2020, respectively. Rental uplifts were

significantly higher on conversions, at 56.7% and 45.2% for the

current quarter and year, compared to 49.0% and 36.8% for the three

months and year ended December 31, 2020.

|

Total Portfolio Performance |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

|

|

2021 |

2020 |

2021 |

2020 |

|

Operating Revenues (000s) |

€ 20,029 |

€ 18,017 |

€ 76,872 |

€ 69,880 |

|

NOI (000s) |

€ 15,640 |

€ 13,891 |

€ 59,518 |

€ 53,269 |

|

NOI Margin |

78.1% |

77.1% |

77.4% |

76.2% |

|

Weighted Average Number of Suites |

6,276 |

5,897 |

6,140 |

5,708 |

Operating revenues increased by 11.2% and 10.0%

for the three months and year ended December 31, 2021,

respectively, primarily due to accretive acquisitions since the

prior year periods and an increase in monthly rents on the

stabilized portfolio, as described above.

NOI increased by 12.6% and 11.7% for the three

months and year ended December 31, 2021, respectively, likewise

driven by contribution from acquisitions since the prior year

periods, higher monthly rents on stabilized properties and strong

cost control. This was complemented by a decrease in property

operating costs as a percentage of operating revenues,

predominantly due to utilization of a rebate from the government

for landlord levies. In aggregate, total portfolio NOI margin

increased to 78.1% and 77.4% for the three months and year ended

December 31, 2021, respectively, compared to 77.1% and 76.2% in the

prior year periods.

Excluding the impact of the landlord levy

rebate, NOI margin on the total portfolio still increased to 77.3%

and 76.6% for the three months and year ended December 31, 2021,

respectively. However, the REIT notes that effective January 1,

2022, the landlord levy tax rate has been reduced, and there is

potential for its permanent abolishment in the medium term.

Therefore, the REIT considers that its actual NOI margin for the

year ended December 31, 2021 will be indicative of long-run

performance, with an expectation that it will achieve an annual NOI

margin in the increased range of 76% to 79% of operating revenues.

This is further supported by the fact that the REIT's property

operating costs are largely insulated from inflation — tenants are

responsible for the majority of their own energy and other utility

costs, the REIT has no employees and therefore no wage costs, and

property management fees are a fixed percentage of operating

revenues.

|

Stabilized Portfolio Performance |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

|

For the Year Ended December 31, |

2021 |

2020 |

2021 |

2020 |

|

Operating Revenues (000s) |

€ 18,183 |

€ 17,344 |

€ 71,584 |

€ 68,992 |

|

NOI (000s) |

€ 14,235 |

€ 13,425 |

€ 55,436 |

€ 52,694 |

|

NOI Margin |

78.3% |

77.4% |

77.4% |

76.4% |

|

Stabilized Number of Suites1 |

5,631 |

5,631 |

5,631 |

5,631 |

1 Includes all properties owned by the REIT

continuously since December 31, 2019, and therefore does not take

into account the impact of acquisitions or dispositions completed

during 2020 or 2021.

The increase in stabilized NOI contribution by

6.0% and 5.2% for the three months and year ended December 31,

2021, respectively, compared to the prior year periods was

primarily driven by higher operating revenues from increased

monthly rents, as well as a reduction in operating expenses as a

percentage of operating revenues, predominantly due to the

recognition of the landlord levy rebate. Excluding the impact of

the landlord levy rebate, stabilized NOI margin still increased to

77.5% and 76.6% for the quarter and year ended December 31, 2021,

respectively.

The REIT remains focused on continuing to

further improve NOI and NOI margin in the long term through a

combination of accretive and value-enhancing acquisitions,

successful sales and marketing strategies to further improve

revenues, and investment in capital programs to further reduce

costs and enhance the quality and value of its portfolio. In

addition, the REIT notes that its property operating costs are

largely insulated from inflation, as tenants are responsible for

the majority of their own energy and other utility costs, the REIT

has no employees and therefore no wage costs, and property

management fees are a fixed percentage of operating revenues. This

further preserves the REIT's property operating costs and, combined

with its strong growth in rental revenues, improves its normalized

NOI margin.

|

Financial Performance |

|

|

|

|

|

|

|

A reconciliation of net income to FFO is as follows: |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

Year Ended |

|

(€ Thousands, except per Unit amounts) |

December 31, |

December 31, |

|

For the Year Ended December 31, |

2021 |

2020 |

2021 |

2020 |

|

Net income and comprehensive income for the year |

€ 45,204 |

€ 12,512 |

€ 96,138 |

€ 118,657 |

|

Adjustments: |

|

|

|

|

|

Fair value adjustments of investment properties |

(86,748) |

(4,387) |

(194,579) |

(46,006) |

|

Fair value adjustments of Class B LP Units |

22,352 |

(9,437) |

65,116 |

(73,455) |

|

Fair value adjustments of Unit Option liabilities |

129 |

(293) |

180 |

(576) |

|

Interest expense on Class B LP Units |

3,907 |

3,728 |

15,510 |

14,914 |

|

Deferred income taxes |

24,627 |

6,041 |

52,744 |

16,383 |

|

Foreign exchange loss1 |

285 |

(1,726) |

3,243 |

1,666 |

|

Net movement in derivative financial instruments |

(987) |

1,656 |

(3,861) |

(1,370) |

|

Acquisition research costs |

10 |

43 |

10 |

123 |

|

General and administrative expenses related to structuring2 |

— |

— |

34 |

392 |

|

Current income tax related expenses pursuant to the Initial

Acquisition3 |

727 |

— |

727 |

— |

|

Mortgage refinancing costs4 |

— |

— |

187 |

— |

|

Loss on disposition of investment properties |

— |

— |

— |

513 |

|

FFO |

€ 9,506 |

€ 8,137 |

€ 35,449 |

€ 31,241 |

|

FFO per Unit – basic5 |

€ 0.041 |

€ 0.035 |

€ 0.153 |

€ 0.135 |

|

FFO per Unit – diluted5 |

€ 0.041 |

€ 0.035 |

€ 0.153 |

€ 0.135 |

|

|

|

|

|

|

|

Total distributions declared |

€ 6,363 |

€ 6,055 |

€ 25,231 |

€ 24,218 |

|

FFO payout ratio |

66.9% |

74.4% |

71.2% |

77.5% |

1 Relates to foreign exchange movements

recognized on remeasurement on Unit Option liabilities as well as

on remeasurement of the REIT's US Dollar draw on the Revolving

Credit Facility as part of effective hedge. 2 Adjustments to

general and administrative expenses for structuring expenses in

2021 relate to tax restructuring with respect to the REIT's

commercial properties acquired pursuant to the Initial Acquisition

(defined herein).3 Adjustments to current income tax related

expenses pertain to finalization of the current income tax

triggered by the Initial Acquisition in 2019, of which the majority

will be reimbursed by CAPREIT.4 Includes break fees and accelerated

amortization of remaining deferred financing costs associated with

the early prepayment and refinancing component of the REIT's

mortgage which closed on September 29, 2021.5 Includes Class B LP

Units.

|

The table below illustrates a reconciliation of the REIT's FFO and

AFFO: |

|

|

|

|

|

|

| |

Three Months Ended |

Year Ended |

|

(€ Thousands, except per Unit amounts) |

December 31, |

December 31, |

|

For the Year Ended December 31, |

2021 |

2020 |

2021 |

2020 |

|

FFO |

€ 9,506 |

€ 8,137 |

€ 35,449 |

€ 31,241 |

|

Adjustments: |

|

|

|

|

|

Non-discretionary capital expenditure reserve1 |

(928) |

(789) |

(3,712) |

(3,041) |

|

Leasing cost reserve2 |

(93) |

(89) |

(374) |

(358) |

|

AFFO |

€ 8,485 |

€ 7,259 |

€ 31,363 |

€ 27,842 |

|

AFFO per Unit – basic3 |

€ 0.037 |

€ 0.031 |

€ 0.136 |

€ 0.121 |

|

AFFO per Unit – diluted3 |

€ 0.037 |

€ 0.031 |

€ 0.136 |

€ 0.121 |

|

|

|

|

|

|

|

Total distributions declared |

€ 6,363 |

€ 6,055 |

€ 25,231 |

€ 24,218 |

|

AFFO payout ratio |

75.0% |

83.4% |

80.4% |

87.0% |

1 Non-discretionary capital expenditure

reserve has been calculated based on the normalized annual 2021

forecast of €607 per weighted average number of residential suites

during the period (2020 — annual 2020 budget of €533 per weighted

average number of residential suites). The adjustments are based on

the normalized forecast amount as the REIT considers this to be

more normalized on a long-term basis and therefore more relevant

(the prior year adjustments were based on the budget amount due to

the REIT's deferral of certain non-discretionary capital

expenditures for 2020 as a result of the COVID-19 pandemic). 2

Leasing cost reserve is based on annualized 10-year forecast of

external leasing costs on the commercial properties.3 Includes

Class B LP Units.

The increases in FFO and AFFO were driven by the

positive impact of increased stabilized NOI and accretive

acquisitions since the prior year, in addition to the REIT's

recognition of a rebate from the government for landlord levies

payable.

FFO is a measure of operating performance based

on the funds generated by the business before reinvestment or

provision for other capital needs. AFFO is a supplemental measure

which adjusts FFO for costs associated with capital expenditures,

leasing costs, and tenant improvements. FFO and AFFO as presented

are in accordance with the recommendations of the Real Property

Association of Canada ("REALpac") as published in January

2022, with the exception of certain adjustments made to the REALpac

defined FFO, which are: (i) acquisition research costs, (ii)

general and administrative expenses related to structuring, (iii)

current income tax related expenses pursuant to the Initial

Acquisition (defined herein), and (iv) mortgage refinancing costs.

FFO and AFFO may not, however, be comparable to similar measures

presented by other real estate investment trusts or companies in

similar or different industries. Management considers FFO and AFFO

to be important measures of the REIT’s operating performance.

|

Other Financial Highlights |

|

| |

|

|

For the Year Ended December 31, |

2021 |

2020 |

|

Weighted Average Number of Units - Basic1 (000s) |

231,032 |

230,646 |

|

Closing Price of REIT Units2, 3 |

€3.13 |

€2.67 |

|

Closing Price of REIT Units (in C$)2 |

$4.51 |

$4.17 |

|

Market Capitalization (millions)1, 2, 3 |

€725 |

€617 |

|

Market Capitalization (millions in C$)1, 2 |

$1,043 |

$962 |

1 Includes Class B LP Units.2 As at December

31.3 Based on the foreign exchange rate of 1.4391 on December 31,

2021 (foreign exchange rate of 1.5608 on December 31, 2020).

FINANCIAL POSITION REMAINS ROBUST AND

CONSERVATIVE

|

As at December 31, |

2021 |

2020 |

|

Total Debt to Gross Book Value1,2 |

46.8% |

47.2% |

|

Weighted Average Mortgage Effective Interest Rate |

1.52% |

1.61% |

|

Weighted Average Mortgage Term (years) |

3.93 |

4.40 |

|

Debt Service Coverage Ratio (times)3,4 |

3.55 |

3.52 |

|

Interest Coverage Ratio (times)3,5 |

4.20 |

3.97 |

|

Available Liquidity6 |

€ 39,437 |

€ 101,917 |

1 Represents mortgage principal net of deferred

financing costs (excluding the fair value adjustment on assumed

mortgages) and bank indebtedness. 2 The REIT's Declaration of Trust

limits the maximum amount of total debt to 65% of the gross book

value ("GBV") of the REIT's total assets. GBV is defined as the

gross book value of the REIT's assets as per the REIT's financial

statements, determined on a fair value basis for investment

properties. 3 For the rolling 12 months ended.4 The debt service

coverage ratio is defined in the REIT's Revolving Credit Facility

as EBITDA less cash taxes, divided by the sum of principal

repayment and interest expense (including on mortgages, the

Revolving Credit Facility and the promissory note).5 The interest

coverage ratio is defined in the REIT's Revolving Credit Facility

as EBITDA divided by interest expense (including on mortgages, the

Revolving Credit Facility and the promissory note). 6 Includes cash

and cash equivalents of €10.3 million and unused credit facility

capacity of €29.1 million as at December 31, 2021 (cash and cash

equivalents of €10.7 million and unused credit facility capacity of

€91.2 million as at December 31, 2020).

ERES's liquidity and leverage remain strong,

supported by the REIT's staggered mortgage profile with a four-year

weighted average term to maturity and a weighted average effective

interest rate of 1.52%. The majority of the REIT's mortgages are

non-amortizing, and mature between 2022 and 2027. The REIT has

immediately available liquidity of €39 million as at December 31,

2021, and its total debt to gross book value is 46.8%.

Management aims to maintain an optimal degree of

debt to GBV of the REIT's assets depending on a number of factors

at any given time. Capital adequacy is monitored against investment

and debt restrictions contained in the REIT's fourth amended and

restated declaration of trust dated April 28, 2020, and the amended

and renewed credit agreement dated October 29, 2021, between the

REIT and two Canadian chartered banks, providing access to up to

€100.0 million (the "Revolving Credit Facility"). The REIT manages

its overall liquidity risk by maintaining sufficient available

credit facilities and available cash on hand to fund its ongoing

operational and capital commitments and distributions to

Unitholders, and to provide future growth in its business.

"Our financial position and liquidity remain

strong, demonstrating the REIT's ability to continuously acquire

and finance assets accretively," commented Stephen Co, Chief

Financial Officer. "Since last year, our debt to gross book value

ratio has decreased by four basis points to 46.8%, and our weighted

average mortgage effective interest rate has also decreased by nine

basis points to 1.52% as at December 31, 2021. In addition to this,

including the Pipeline Agreement, the REIT currently has immediate

access to over €200 million in liquidity, providing acquisition

capacity in excess of €400 million that will fuel our growth as we

forge ahead into 2022."

DISTRIBUTIONSDuring the year

ended December 31, 2021, the REIT declared monthly distributions of

€0.00875 per Unit (equivalent to €0.105 per Unit annualized) in

respect of January and February, and €0.00917 per Unit (equivalent

to €0.110 per Unit annualized) thereafter, following an increase of

5% in the REIT's monthly distribution rate. Such distributions are

paid to Unitholders of record on each record date, on or about the

15th day of the month following the record date. The REIT intends

to continue to make regular monthly distributions, subject to the

discretion of its Board of Trustees.

On February 17, 2022, the Board of Trustees

approved an increase of 9% to the REIT's monthly distribution to

€0.01 per Unit (equivalent to €0.120 per Unit annualized),

effective for the REIT's next monthly distribution in respect of

March 2022. Distributions will continue to be paid to Unitholders

of record on each record date, on or about the 15th date of the

month following the record date.

CONFERENCE CALLA conference

call hosted by Phillip Burns, Chief Executive Officer and Stephen

Co, Chief Financial Officer, will be held on Friday, February 18,

2022 at 9:00 am EST. The telephone numbers for the conference call

are Canadian Toll Free: 1 (833) 950-0062 / International: +1 (929)

526-1599. The Passcode for the call is 100174.

A replay of the call will be available for 7

days after the call, until Friday, February 25, 2022. The telephone

numbers to access the replay are Canadian Toll Free: 1 (226)

828-7578 or International +44 (204) 525-0658. The Passcode for the

replay is 583913.

The call will also be webcast live and

accessible through the ERES website at www.eresreit.com — click on

"Investor Info" and follow the link at the top of the page. The

webcast will also be available by clicking on the link below:

https://events.q4inc.com/attendee/482805728

A replay of the webcast will be available for 1

year after the webcast at the same link.

The slide presentation to accompany management's

comments during the conference call will be available on the ERES

website an hour and a half prior to the conference call.

About European Residential Real Estate

Investment TrustERES is an unincorporated, open-ended real

estate investment trust. ERES's REIT Units are listed on the TSX

under the symbol ERE.UN. ERES is Canada’s only European-focused

multi-residential REIT, with a current initial focus on investing

in high-quality multi-residential real estate properties in the

Netherlands. ERES owns a portfolio of 152 multi-residential

properties, comprised of 6,590 suites and ancillary retail space

located in the Netherlands, and owns one office property in Germany

and one office property in Belgium.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information please visit our website at

www.eresreit.com.

For further information:

| Phillip Burns |

Stephen Co |

| Chief Executive Officer |

Chief Financial Officer |

| Email: p.burns@eresreit.com |

Email: s.co@eresreit.com |

Category: Earnings

The REIT was formed on March 29, 2019,

subsequent to a reverse acquisition by a previous subsidiary of

CAPREIT, that resulted in CAPREIT having a majority ownership and

control in the REIT (the "Initial Acquisition").

Certain statements contained in this press

release constitute forward-looking statements within the meaning of

applicable Canadian securities laws which reflect ERES’s current

expectations and projections about future results. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”,

“consider”, “should”, “plans”, “predict”, “estimate”, “forward”,

“potential”, “could”, “likely”, “approximately”, “scheduled”,

“forecast”, “variation” or “continue”, or similar expressions

suggesting future outcomes or events. The forward-looking

statements made in this press release relate only to events or

information as of the date on which the statements are made in this

press release. Actual results and developments are likely to

differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this press release.

Any number of factors could cause actual results to differ

materially from these forward-looking statements as well as future

results. Although ERES believes that the expectations reflected in

forward-looking statements are reasonable, it can give no

assurances that the expectations of any forward-looking statements

will prove to be correct. Such forward-looking statements are based

on a number of assumptions that may prove to be incorrect.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Except as specifically required by applicable

Canadian securities law, ERES does not undertake any obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise, after

the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing ERES’s views

as of any date subsequent to the date of this press release.

ERES uses financial measures regarding itself,

such as adjusted funds from operations, that do not have

standardized meaning under IFRS and may not be comparable to

similar measures presented by other entities (“non-IFRS measures”).

Further information relating to non-IFRS measures, is set out in

ERES’s annual information form dated March 30, 2021 under the

heading “Non-IFRS Measures” and in ERES’s MD&A under the

heading “Non-IFRS Financial Measures.”

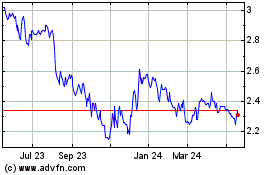

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

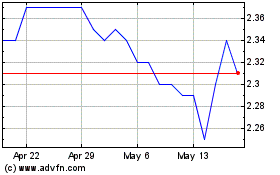

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025