High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its third quarter financial and operating

results. The unaudited interim consolidated financial statements,

and management discussion & analysis (“MD&A”), for the

quarter ended September 30, 2023 will be available on SEDAR at

www.sedarplus.ca, and on High Arctic’s website at www.haes.ca. All

amounts are denominated in Canadian dollars (“CAD”), unless

otherwise indicated.

Mike Maguire, Chief Executive Officer

commented:

“High Arctic’s

businesses in both Canada and PNG have had a solid third quarter,

contributing to increased net cash balances. The closing of the

sale of our Nitrogen Pumping business in Canada progressed the

streamlining of our Canadian business. In Canada we have a low

operating cost high-margin rental business in addition to strategic

investments in the oilfield services industry.

Rig 103 continues

drilling operations in PNG which are expected to be completed by

the third quarter of 2024. In addition, the Ancillary Services

segment continues to perform at expectations and our manpower

solutions revenue stream has had a successful initiation during

2023. We continue to await a final investment decision on Papua LNG

and the project operators process, timetable and decision on

drilling rig selection. This decision is expected to clarify

development drilling specifications and sets the stage for insights

on exploration prospects where High Arctic’s owned assets carry

distinct advantage given their heli-portable design.

On the reorganization

and tax efficient return of capital, we continue to work to

addresses the concerns some shareholders have shared with us and

will revert with our intentions once that work is complete.”

Highlights

The following highlights the Corporations

results for Q3-2023:

- Full drilling utilization of PNG

Rig 103 during the Quarter, pursuant to a 3-year contract renewed

in August 2022.

- Generated positive Adjusted EBITDA

from continuing operations of $3.2 million on revenues of $17.8

million, funds flow from continuing operations of $3.1 million, and

incurred capital expenditures of $0.7 million.

- Recorded a non-cash impairment loss

of $20.5 million on PNG asset carrying values based on uncertainty

around future drilling activity levels.

- Incurred a net loss from continuing

operations of $15.0 million or ($0.31) per share in Q3-2023.

- After the Quarter, suspended the

monthly dividend to optimize capability to fund a pending

tax-efficient return of capital to shareholders, and

- Closed the sale of the

Corporation’s Canadian nitrogen transportation, hauling and pumping

services business for total cash consideration of $1.35 million

resulting in a gain on sale of $0.6 million.

2023 Strategic Objectives

High Arctic’s 2023 Strategic Objectives build on

the platform created in 2022, and include:

- Safety excellence and quality service delivery,

- Return idled assets in PNG to service,

- Scaling our Canadian business,

- Opportunities for growth and corporate transactions that

enhance shareholder value, and

- Examination of the Corporation’s optimal capital and overhead

structure.

RESULTS OVERVIEW

The following is a summary of select financial information of

the Corporation:

|

(unaudited) |

Three months ended Sept 30, |

|

Nine months ended Sept 30, |

|

|

(thousands of Canadian Dollars, except per share amounts) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Operating results from continuing operations: |

|

|

|

|

| Revenue(3) |

17,814 |

|

11,940 |

|

43,819 |

|

65,278 |

|

| Net loss from continuing

operations |

(15,039 |

) |

(4,368 |

) |

(15,580 |

) |

(26,895 |

) |

|

Per share – basic (1)(2) |

(0.31 |

) |

(0.09 |

) |

(0.32 |

) |

(0.56 |

) |

| Oilfield services operating

margin(2)(3) |

5,855 |

|

3,086 |

|

15,215 |

|

14,368 |

|

|

Oilfield services operating margin as a % of revenue(2) |

32.9 |

% |

25.9 |

% |

34.7 |

% |

22.0 |

% |

| EBITDA(2) |

(16,166 |

) |

(270 |

) |

(11,109 |

) |

(2,996 |

) |

| Adjusted EBITDA(2) |

3,202 |

|

598 |

|

8,556 |

|

6,686 |

|

|

Adjusted EBITDA as % of revenue(2) |

18.0 |

% |

5.0 |

% |

19.5 |

% |

10.2 |

% |

|

Operating income (loss) |

308 |

|

(2,582 |

) |

(373 |

) |

(8,107 |

) |

|

Cash flow from continuing operations: |

|

|

|

|

| Cash flow from operating

activities |

1,882 |

|

971 |

|

3,391 |

|

7,494 |

|

|

Per share – basic (1)(2) |

0.04 |

|

0.02 |

|

0.07 |

|

0.15 |

|

| Funds flow from (used in)

operating activities(2) |

3,154 |

|

(620 |

) |

8,470 |

|

4,349 |

|

|

Per share – basic (1)(2) |

0.06 |

|

(0.01 |

) |

0.17 |

|

0.09 |

|

| Dividend payments |

730 |

|

731 |

|

2,190 |

|

1,218 |

|

|

Per share – basic (1)(2) |

0.01 |

|

0.01 |

|

0.05 |

|

0.02 |

|

| Capital

expenditures |

702 |

|

636 |

|

1,829 |

|

3,940 |

|

| |

|

|

|

|

|

|

|

|

|

(unaudited)(thousands of Canadian Dollars, except per share

amounts) |

As at Sept 30, 2023 |

|

As at Dec 31, 2022 |

|

|

Financial position: |

|

|

|

|

| Working

capital(2) |

63,452 |

|

59,461 |

|

|

Cash |

46,801 |

|

19,559 |

|

| Total

assets |

115,566 |

|

133,957 |

|

| Long

term debt |

3,394 |

|

4,028 |

|

| Long

term financial liabilities, excluding long term debt |

1,139 |

|

4,881 |

|

|

Shareholders’ equity |

97,302 |

|

115,231 |

|

|

Per share – basic(1)(2) |

2.00 |

|

2.37 |

|

|

Common shares outstanding (in thousands) |

48,674 |

|

48,691 |

|

(1) The number of common shares used in

calculating net loss from continuing operations per share, cash

flow from (used in) operating activities per share, funds flow from

continuing operations per share, dividends per share and

shareholders’ equity per share is determined as explained in Note

10 of the Financial Statements.(2) Readers are cautioned that

Oilfield services operating margin, EBITDA from continuing

operations (Earnings from continuing operations before interest,

tax, depreciation, and amortization), Adjusted EBITDA from

continuing operations, Funds flow from continuing operations,

oilfield services operating margin and working capital per share -

basic & diluted do not have standardized meanings prescribed by

IFRS – see “Non-IFRS Measures” for calculations of these

measures.(3) Revenue generated from the Canadian well services and

snubbing assets sold in the Sale Transactions, during the three and

nine months ended September 30, 2022 totaled $4,959 and $36,099

respectively. Oilfield services expenses, incurred from the

Canadian well services and snubbing assets sold in the Sale

Transactions, during the three months and nine months September 30,

2022 totaled $3,965 and $31,740 respectively. The Canadian snubbing

assets were sold for an equity interest in the purchaser, Team

Snubbing, on July 27, 2022. As a result, subsequent to this date,

revenue and expenses in connection with High Arctic’s 42% ownership

interest in Team Snubbing are being reflected in income from equity

investments.

Third Quarter 2023 Summary

- Revenue for the Quarter from

continuing operations was $17,814, an increase of $5,874 compared

to Q3-2022 at $11,940. The combined Drilling Services segment and

Ancillary Services segments increased revenue by an aggregate

$10,618 on the strength of increased revenues from PNG and Canadian

rentals. This increase was partially offset with the decline from

the Production Services segment that decreased by $4,959 as a

result of the sale of Canadian well servicing and snubbing assets

in 2022. Revenue generated from the assets sold in the Sale

Transactions during Q3-2022 totaled $4,959.

- High Arctic recorded an impairment

loss of $20,500 on its PNG Operations CGU as uncertainty around

future drilling activity levels in PNG negatively impact future

cashflows and asset carrying values.

- Reported Adjusted EBITDA from

continuing operations of $3,202 in Q3-2023, an increase of $2,603

over Q3-2022. The favourable variance was primarily due to the full

utilization of PNG Rig 103 in the Quarter, associated rentals, and

operational momentum with PNG drilling commencement in late

Q1-2023. Higher utilization rates experienced in the Canadian

rentals business also contributed to the increase in Adjusted

EBITDA in the quarter.

- Oilfield services operating margins

improved as a percent of revenue from 25.9% in Q3-2022 to 32.9% in

Q3-2023. This improvement was primarily a result of the elimination

of the lower margin Canadian well servicing and snubbing assets

that were sold in Q3-2022.

- High Arctic generated a net loss of

$15,039 from continuing operations in Q3-2023 compared to a net

loss from continuing operations of $4,368 for Q3-2022. The increase

in net loss of $10,671 in Q3-2023 over Q3-2022 was due to the

impairment loss of $20,500 on its PNG Operations CGU. Mitigating

the impact of the impairment was the stronger operational

performance mentioned above, a $3,865 deferred tax recovery

recorded as a result of the impairment and $470 in higher Q3-2023

interest income.

Year-to-date September 30, 2023 Summary

- Revenue from continuing operations

for the nine months of 2023 was $43,819, a decrease of $21,459

compared to the corresponding period of 2022 at $65,278. This

decrease was due to the sale of Canadian well servicing and

snubbing assets in 2022 which accounted for revenues of $36,099 for

the nine months ended September 30, 2022. Partially offsetting this

decline was increased revenue from the Drilling Services segment of

$13,108 as a result of steady drilling activity in PNG since

Q1-2023. Revenue generated from the assets sold in the Sale

Transactions during first half of 2022 totaled $36,099.

- Despite lower revenue for the nine

months of 2023 Adjusted EBITDA from continuing operations increased

$1,870 to $8,556 when compared to the corresponding period of 2022.

The increase is primarily attributable to the contribution coming

from High Arctic’s higher margin businesses being Drilling and

Ancillary Services when compared to 2022 which had a greater

contribution from the Production Services segment which contained

the Canadian well servicing and snubbing assets that were sold on

July 27, 2022.

- Oilfield services operating margins

improved as a percent of revenue from 22.0% in Q3-2022 to 34.7% in

the nine months of 2023. This improvement is primarily a result of

the strength in Drilling Services and Ancillary Services operating

segments and the results of the Canadian well servicing and

snubbing assets impact on the 2022 Production Services segment

results.

- High Arctic generated a net loss of

$15,580 from continuing operations in YTD-2023 compared to a net

loss of $26,895 in the corresponding period of 2022. The lower net

loss recorded in YTD-2023 was primarily attributable to improved

income from operations, the gain on sale of the nitrogen business,

higher interest income and lower interest and finance expenses. The

YTD-2022 deferred tax expense of $7,116 recorded that related to

the reversal of the Corporation’s deferred tax asset and the

YTD-2023 deferred tax recovery of $3,892 recorded as a result of

the impairment recorded in Q3-2023, offset the $10,942 year over

year asset impairment expenses increase.

Operating Results

Drilling Services segment

|

(unaudited) |

Three months ended Sept 30, |

|

Nine months ended Sept 30, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Revenue |

13,940 |

|

4,870 |

|

33,653 |

|

20,545 |

|

|

Oilfield services expense |

(10,731 |

) |

(3,718 |

) |

(25,475 |

) |

(15,832 |

) |

|

Oilfield services operating margin(1) |

3,209 |

|

1,152 |

|

8,178 |

|

4,713 |

|

|

Operating margin (%) |

23.0 |

% |

23.7 |

% |

24.3 |

% |

22.9 |

% |

(1) See “Non-IFRS Measures”

Ancillary Services segment

|

(unaudited) |

Three months ended Sept 30, |

|

Nine months ended Sept 30, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Revenue |

3,874 |

|

2,326 |

|

10,166 |

|

10,235 |

|

|

Oilfield services expense |

(1,190 |

) |

(882 |

) |

(3,091 |

) |

(3,460 |

) |

|

Oilfield services operating margin(1) |

2,684 |

|

1,444 |

|

7,075 |

|

6,775 |

|

|

Operating margin (%) |

69.3 |

% |

62.1 |

% |

69.6 |

% |

66.2 |

% |

(1) See “Non-IFRS Measures”

Production Services segment

|

(unaudited) |

Three months ended Sept 30, |

|

Nine months ended Sept 30, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Revenue |

- |

|

4,959 |

|

- |

|

36,099 |

|

|

Oilfield services expense |

(38 |

) |

(4,469 |

) |

(38 |

) |

(33,219 |

) |

|

Oilfield services operating margin(1) |

(38 |

) |

490 |

|

(38 |

) |

2,880 |

|

|

Operating margin (%) |

nm |

|

9.9 |

% |

nm |

|

8.0 |

% |

(1) See “Non-IFRS Measures”

Liquidity and capital resources

|

|

Three months ended |

|

Nine months ended |

|

|

(thousands of Canadian Dollars) |

Sept 30, 2023 |

|

Sept 30, 2022 |

|

Sept 30, 2023 |

|

Sept 30, 2022 |

|

|

Cash provided by (used in) continued operations: |

|

|

|

|

|

Operating activities |

1,882 |

|

971 |

|

3,391 |

|

7,494 |

|

|

Investing activities |

1,146 |

|

8,690 |

|

28,005 |

|

6,745 |

|

|

Financing activities |

(1,540 |

) |

(905 |

) |

(4,009 |

) |

(2,214 |

) |

|

Effect of exchange rate changes on cash |

- |

|

(419 |

) |

4 |

|

(512 |

) |

|

Increase in cash from continued operations |

1,488 |

|

8,337 |

|

27,391 |

|

11,513 |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

|

|

|

|

As at Sept 30, 2023 |

|

As at Dec 31, 2022 |

|

|

Current assets |

|

|

|

|

77,183 |

|

69,278 |

|

| Working

capital(1) |

|

|

|

|

63,452 |

|

59,461 |

|

| Working

capital ratio(1) |

|

|

|

|

5.6:1 |

|

7.1:1 |

|

| Cash and

cash equivalents |

|

|

|

|

46,801 |

|

19,559 |

|

|

Net cash(1) |

|

|

|

|

43,230 |

|

15,345 |

|

(1) See “Non-IFRS Measures”

The Bank of PNG continues to encourage the use

of the local market currency, Kina, or PGK. Due to High Arctic’s

requirement to transact with international suppliers and customers,

High Arctic has received approval from the Bank of PNG to maintain

its USD account within the conditions of the Bank of PNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the Bank of PNG’s

conditions is for PNG contracts to be settled in PGK, unless

otherwise approved by the Bank of PNG for the contracts to be

settled in USD. The Corporation has historically received such

approval for its contracts with its key customers in PNG. The

Corporation will continue to seek Bank of PNG approval for our

contracts to be settled in USD on a contract-by-contract basis,

however, there is no assurance the Bank of PNG will grant these

approvals.

If such approvals are not received, the

Corporation’s PNG contracts will be settled in PGK which would

expose the Corporation to exchange rate fluctuations related to the

PGK. In addition, this may delay the Corporation’s ability to

receive USD which may impact the Corporation’s ability to settle

USD denominated liabilities and repatriate funds from PNG on a

timely basis. The Corporation also requires the approval from the

PNG Internal Revenue Commission (“IRC”) to repatriate funds from

PNG and make payments to non-resident PNG suppliers and service

providers. While delays can be experienced for the IRC approvals,

all such approvals have eventually been received in the past.

Operating ActivitiesIn Q3-2023,

cash generated from operating activities from continuing operations

was $1,882, up from the Q3-2022 cash generated from operating

activities of $971. Funds flow from continuing operations totaled

$3,154 in the Quarter versus funds flow used in continuing

operations for Q3-2022 of $620, see “Non-IFRS Measures”, and a

$1,272 cash outflow from working capital changes (Q3-2022: $1,591

inflow).

In the nine months ended September 30, 2023,

cash generated from operating activities from continuing operations

was $3,391, down from $7,494 in the corresponding period of 2022.

Funds flow from continuing operations totaled $8,470 in the nine

months ended September 30, 2023, (YTD-2022: $4,349), see “Non-IFRS

Measures”, and a $5,079 cash outflow from working capital changes

(YTD-2022: $3,145 inflow).

Investing ActivitiesDuring

Q3-2023, the Corporation’s cash from investing activities from

continuing operations was $1,146 compared to Q3-2022 that saw

positive cash from investing activities from continuing operations

of $8,690. 2022 was favorably impacted with initial $10,000 cash

receipts from the sale of the Canadian well servicing assets that

exceeded the $1,350 received in the Quarter for the sale of the

Canadian nitrogen business assets.

During the nine months ended September 30, 2023,

the Corporation’s cash from investing activities from continuing

operations was $28,005 (YTD-2022 $6,745) reflecting the receipt of

the final cash proceeds of $28,000 from the Well Servicing

Transaction in Q1-2023 (YTD-2022: $11,361) offset by lower capital

expenditures totaling $1,829 (YTD-2022: $3,940) and $1,350 in

proceeds received on the disposal of the Canadian nitrogen business

assets, and cash inflow of $383 relating to working capital balance

changes for capital items (YTD-2022: $676, cash outflow).

Financing ActivitiesIn Q3-2023,

the Corporation’s cash used in financing activities was $1,540

(Q3-2022: $905). During the Quarter, the Corporation paid $730 in

dividends (Q3-2022 $731), $544 (Q3-2022: $80) towards principal

payments on its mortgage financing and $266 against lease liability

payments (Q3-2022: $94).

During the nine months ended September 30, 2023,

the Corporation’s cash used in financing activities was $4,009

(YTD-2022: $2,214). During the period, the Corporation paid $2,190

in dividends (YTD-2022: $1,218), $643 (YTD-2022: $215) towards

principal payments on its mortgage financing, $1,151 against lease

liability payments (YTD-2022: $1,025), $25 towards purchase of

common shares for cancellation (YTD-2022: $nil) and cash inflow of

$nil relating to non-cash working capital balance changes

(YTD-2022: $244).

Intention to Return Capital and

Reorganize

On May 11, 2023, the Corporation announced that

the Board of Directors intends to recommend to shareholders a tax

efficient return of capital to a maximum of $38.2 million relating

to the Q3-2022 sale of High Arctic’s Canadian well servicing

assets, and a reorganization of the Corporation.

The reorganization was intended to separate the

international business of High Arctic, which is focussed on Papua

New Guinea, from the Canadian business. This addresses the

inefficiency of managing two small businesses on opposite sides of

the world, with few synergies and allowing senior management to

concentrate where they can have the most success.

The Corporation has received feedback from some

shareholders and is working with its advisors on the reorganization

plan to incorporate key elements of the shareholder feedback. The

High Arctic Board has reserved its final decision to proceed with

the reorganization until these matters and ongoing strategic review

have been addressed to their satisfaction. The

Corporation cautions readers of this MD&A that there is no

certainty that the reorganization will proceed in the format

previously announced, or at all.

Outlook

High Arctic’s Canadian rental business, while

small, continues to generate solid margins with a high level of

utilization and we anticipate this continuing through the winter

period. Opportunities to gain scale and underlying net

profitability are a priority. Our investment in Team Snubbing

performed well in Q3-2023 with Team recording its highest quarterly

revenue to date and we have expectations for increased activity to

drive Team’s revenues up further across the traditionally busy

winter period.

Coupling the nearing completion of the

long-awaited pipeline expansion to tidewater for both oil liquids

and natural gas production, with the evolving attitudes to carbon

sequestration, energy security and the longevity of Canada’s oil

and gas industry sets up a favorable backdrop for relatively

sustained upstream energy service demand in Canada. We continue to

seek to expand our rentals business capacity to service the energy

industry now and into the future.

High Arctic’s PNG business was highlighted by

Rig 103 operating continuously through the third quarter. Rig 103

has now completed two of the four approved wells on our customer’s

current drilling program which is expected to be completed by

Q3-2024. In addition, the Ancillary Services segment rental fleet

of equipment continues to generate strong utilization and pricing

and our manpower solutions continues to contribute a strong revenue

stream at appropriate margins.

The Corporation’s owned rig assets in PNG,

heli-portable drilling rigs 115 and 116 and hydraulic workover rig

102, have been idle throughout 2023. This equipment continues to be

actively marketed. However, we do not currently have outstanding

customer contract tenders or open bid submissions for this

equipment. That said, the appointment of Chris Fraser as a key

business development executive for High Arctic International has

led to opportunities to promote our services to new customers and

markets within the region. The Corporation is focussed upon our

specialist PNG know-how, drilling capability, fleet of rental

equipment and camps, and our worker development and manpower

solutions.

We continue to await the final investment

decision of the TotalEnergies led Papua-LNG project expected in

early 2024. That project is anticipated to stimulate other

exploration and appraisal activity and is expected to be followed

by the P’nyang gas field development in the Western Province of

PNG. State owned Kumul Petroleum continues to advance towards

appraisal of other gas discoveries in PNG and discussions continue

with other exploration companies towards future work.

In the immediate term, the current monetary

policy environment is delivering high yield fixed interest income

for investment of surplus cash. Additional cost discipline as well

as the recent suspension of the Corporation’s regular monthly

dividend, aim to optimize a tax-efficient return of capital to

shareholders.

Non – IFRS Measures

This News Release contains references to certain

financial measures that do not have a standardized meaning

prescribed by International Financial Reporting Standards (“IFRS”)

and may not be comparable to the same or similar measures used by

other companies High Arctic uses these financial measures to assess

performance and believes these measures provide useful supplemental

information to shareholders and investors. These financial measures

are computed on a consistent basis for each reporting period and

include Oilfield services operating margin, EBITDA (Earnings before

interest, tax, depreciation, and amortization), Adjusted EBITDA,

Operating loss, Funds flow from operating activities, Working

capital Shareholders’ equity per share and Long-term financial

liabilities. These do not have standardized meanings.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at

www.sedarplus.ca and through High Arctic’s website at www.haes.ca.

Forward-Looking Statements

This press release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties, and

assumptions. Many factors could cause the Corporation’s actual

results, performance, or achievements to vary from those described

in this press release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, among

others, statements pertaining to the following: general economic

and business conditions which will include, among other things, the

outlook for energy services; continued impact of Russia-Ukraine

conflict and other conflicts; sustained upstream energy service

demand in Canada; the expansion of Canada’s traditional and

emerging energy industries; opportunities for growth and

transactions that enhance shareholder value; the Corporation’s

ability to maintain a USD bank account and conduct its business in

USD in PNG; market fluctuations in interest rates, commodity

prices, and foreign currency exchange rates; restrictions to

repatriate funds held in PGK; expectations regarding the

Corporation’s ability to manage its liquidity risk, raise capital

and manage its debt finance agreements; projections of market

prices and costs; factors upon which the Corporation will decide

whether or not to undertake a specific course of operational action

or expansion; the Corporation’s ongoing relationship with its major

customers; the return of capital to the Corporation’s shareholders;

potential impacts regarding the Corporation’s reorganization plan;

the performance of the Corporation’s investment in Team Snubbing;

realizing opportunities to gain scale and underlying net

profitability in the Canadian business; expansion of the Canadian

rentals business; upswing in PNG energy sector activity and

opportunities for growth; the final investment decision on the

Papua-LNG project and development of the P’nyang gas field;

stimulation of other exploration and appraisal activity in PNG;

expectations of Rig 103 to operate beyond the current approved

wells on the customers drilling program; deploying idle

heli-portable drilling rigs 115 and 116; future work with other

exploration companies in PNG; executing on one or more corporate

transactions and estimated credit risks.

With respect to forward-looking statements

contained in this press release, the Corporation has made

assumptions regarding, among other things, its ability to: maintain

its ongoing relationship with major customers; successfully market

its services to current and new customers; devise methods for, and

achieve its primary objectives; source and obtain equipment from

suppliers; successfully manage, operate, and thrive in an

environment which is facing much uncertainty; remain competitive in

all its operations; attract and retain skilled employees; and

obtain equity and debt financing on satisfactory terms.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Annual Information Form filed on SEDAR at

www.sedarplus.ca.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

Services

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

pressure control equipment on a rental basis to exploration and

production companies.

For further information

contact:

Mike MaguireChief

Executive OfficerP: +1 (403) 988 4702P: +1 (800) 688 7143

High Arctic Energy Services Inc.Suite

2350, 330 – 5th Ave SWCalgary, Alberta, Canada T2P 0L4

website: www.haes.caEmail:

info@haes.ca

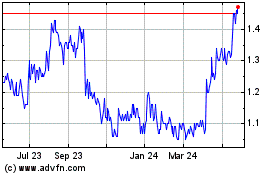

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

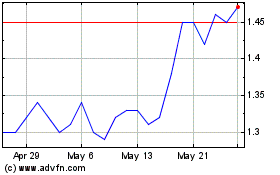

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Nov 2023 to Nov 2024