IntelGenx Reminds Shareholders to Vote at Upcoming Special Meeting

November 13 2023 - 7:00AM

IntelGenx Technologies Corp. (TSX:IGX) (OTCQB:IGXT)

(“

IntelGenx” or the “

Company”)

wishes to remind its shareholders of record as of October 2, 2023

(the “

Shareholders”) of the importance of a

vote FOR the various proposals detailed below at the upcoming

special meeting of Shareholders to be held on November 28, 2023

(the “

Special Meeting”) as a virtual meeting

only.

At the Special Meeting, Shareholders will be

asked to vote:

- to amend the

certificate of incorporation of the Company to increase the

authorized common stock from 450,000,000 shares of common stock

(the “Shares”) to 580,000,000 Shares;

- to approve

(the “Pricing Shareholder Approval”) for

purposes of complying with Sections 607(e) and 607(i) of the

Toronto Stock Exchange (“TSX”) Company Manual, the

issuance of Shares at prices which may be less than the minimum

price permitted under the rules of the TSX in connection with

certain financing transactions involving atai Life Sciences AG

(“atai”) previously disclosed by the Company on

August 31, 2023 (the “Financing

Transactions”), as further described in the proxy

statement of the Company dated October 16, 2023

(the “Proxy Statement”);

- to approve

(the “General Shareholder Approval”) for

purposes of complying with Section 607(g)(i) of the TSX

Company Manual the issuance of Shares in excess of 24.99% of the

issued and outstanding Shares in connection with the Financing

Transactions, as further described in the Proxy Statement;

- to approve

(the “Insider Shareholder Approval”) for

purposes of complying with Section 607(g)(ii) of the TSX

Company Manual, the issuance of Shares to “insiders” of the Company

(as such term is defined in the policies of the TSX) in excess of

9.99% of the issued and outstanding Shares in connection with the

Financing Transactions, as further described in the Proxy

Statement; and

- to approve the

adjournment of the Special Meeting, if necessary, to continue to

solicit votes in favor of the foregoing proposals.

IntelGenx wishes to inform that the

Company has been advised that the Autorité des marchés financiers

(“AMF”) considers the Financing Transactions are subject to the

minority vote prescribed by Regulation 61-101

respecting Protection of Minority Security Holders in Special

Transactions. Therefore, the affirmative vote of a

majority of the votes cast at the Special Meeting, excluding the

votes attached to the Shares beneficially owned, directly or

indirectly, by atai will effectively be required to approve the

Financing Transactions. As explained in the Proxy

Statement, the Financing Transactions are, by their terms,

cross-conditional and require that the Company obtain each of the

Pricing Shareholder Approval, the General Shareholder Approval and

the Insider Shareholder Approval.

Should the Company fail to obtain any of

these approvals, (i) at the request of the AMF, atai has

undertaken not to exercise its rights to conversion of the

principal outstanding under the Loan Agreement into Shares and to

payment of Interest accrued and outstanding under the Second Loan

Agreement in Shares, (ii) the Company would be proscribed to

proceed with the portions of the Financing Transactions which have

not already been completed, namely the Call Option and the

Subsequent atai Subscription (each defined in the Proxy Statement),

and (iii) the Company would be deemed in default of its obligations

under the Loan Amendment, the Second Loan Agreement, the Notes, the

Subscription Agreement Amendment and the Warrants (each as defined

in the Proxy Statement).

As set out in the Proxy Statement, the

board of directors of IntelGenx believes the Financing Transactions

are in the best interest of the Company and unanimously recommends

that the Shareholders vote “FOR” all matters put to a vote at the

Special Meeting.

Copies of the Proxy Statement and related

documents are available at

https://annualgeneralmeetings.com/igxtsp2023, on SEDAR+ under the

Company's profile at www.sedarplus.ca and under the Company’s

profile on EDGAR at sec.gov. The Proxy Statement contains important

information, including a description of the Financing Transactions

and of the matters put to a vote with respect to such Financing

Transactions. IntelGenx strongly encourages all Shareholders who

would like to attend, participate and/or vote virtually online to

carefully follow the procedures outlined in the Proxy

Statement.

Shareholders who have questions regarding the

Financing Transactions or require assistance with voting may

contact the Company’s proxy solicitation agent, Innisfree M&A

Incorporated toll free at (877) 800-5194.

About IntelGenx

IntelGenx is a leading drug delivery company

focused on the development and manufacturing of pharmaceutical

films. IntelGenx’s superior film technologies, including

VersaFilm®, DisinteQ™, VetaFilm® and transdermal VevaDerm™, allow

for next generation pharmaceutical products that address unmet

medical needs. IntelGenx’s innovative product pipeline offers

significant benefits to patients and physicians for many

therapeutic conditions. IntelGenx's highly skilled team provides

comprehensive pharmaceuticals services to pharmaceutical partners,

including R&D, analytical method development, clinical

monitoring, IP and regulatory services. IntelGenx's

state-of-the-art manufacturing facility offers full service by

providing lab-scale to pilot- and commercial-scale production. For

more information, visit www.intelgenx.com.

Forward-Looking Information

This document may contain forward-looking

information which involve substantial risks and uncertainties.

Statements that are not purely historical are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. All statements, other than statements of

historical fact, contained in this press release including, but not

limited to, statements regarding, generally, the “About IntelGenx”

paragraph which essentially describe the Corporation’s outlook and

objectives, constitute “forward-looking information” or

“forward-looking statements” and are based on necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by the Corporation as the time of such statements, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. All forward-looking

statements are expressly qualified in their entirety by this

cautionary statement. Because these forward-looking statements are

subject to a number of risks and uncertainties, IntelGenx’ actual

results, objectives and plans could differ materially from those

expressed or implied by these forward-looking statements. Factors

that could cause or contribute to such differences include, but are

not limited to, those discussed under the heading “Risk Factors” in

IntelGenx’ annual report on Form 10-K, filed with the United States

Securities and Exchange Commission and available at www.sec.gov,

and also filed with Canadian securities regulatory authorities at

www.sedarplus.ca. IntelGenx assumes no obligation to update any

such forward-looking statements. Moreover, all forward-looking

information contained herein is subject to certain assumptions.

There can be no assurance that such approvals will be obtained.

For more information, please contact:

Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

Or

Andre Godin, CPA, CAPresident and CFOIntelGenx Technologies

Corp.(514) 331-7440 ext 203andre@intelgenx.com

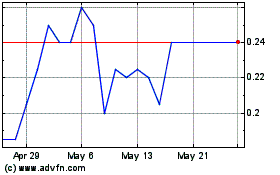

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

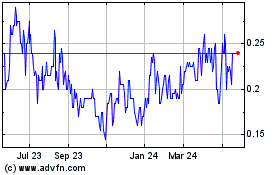

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Nov 2023 to Nov 2024