IntelGenx Corp. (TSX:IGX) (OTCQB:IGXT) (the "Company" or

"IntelGenx") today announced the launch of a Regulation A offering

of up to 2,000,000 shares of Series A Convertible Cumulative

Preferred Stock (“Series A Preferred Stock”), par value $0.00001

per share, at an offering price of $10.00 per share (the

“Offering”), for a maximum Offering amount of $20,000,000.

Holders of the Series A Preferred Stock will be

entitled to receive cumulative dividends in the amount of $0.20 per

share each quarter, or 8% per year. Each share of Series A

Preferred Stock will be convertible into twenty (20) shares of our

common stock (“Common Stock) at the option of the holder, subject

to certain conditions in accordance with the requirements of the

Toronto Stock Exchange. Commencing on the fifth anniversary of the

initial closing of this offering and continuing indefinitely

thereafter, the Company shall have a right to call for redemption

the outstanding shares of the Series A Preferred Stock at a call

price equal to 150% of the original issue price of the Series A

Preferred Stock, and correspondingly, each holder of shares of the

Series A Preferred Stock shall have a right to sell the shares of

Series A Preferred Stock held by such holder back to the Company at

a price equal to 150% of the original issue purchase price of such

shares. The Series A Preferred Stock being offered will rank, as to

dividend rights and rights upon the Company’s liquidation,

dissolution, or winding up, senior to the Common Stock.

“We are excited to launch this Offering of

non-traded preferred shares to allow the Company to raise funds at

a valuation that we believe is more reflective of our assets and

business prospects,” stated Dwight Gorham, IntelGenx’s CEO. “With

the pending U.S. commercial launch of RizaFilm®, which we continue

to expect to occur in the second quarter, we will be entering into

a phase of anticipated rapid growth. This raise will allow us to

support that while we also continue to make strategic investments

in the advancement of the rest of our product pipeline and services

portfolio.”

In the United States, the Offering is being made

pursuant to Regulation A under the United States Securities Act of

1933, as amended (the “Securities Act”), and as a private placement

in all provinces and territories of Canada, except Quebec. An

Offering Statement on Form 1-A, as amended (the “Offering

Statement”), relating to these securities has been filed with the

U.S. Securities and Exchange Commission (“SEC”) and has been

qualified. A copy of the Preliminary Offering Circular that forms a

part of the Offering Statement is available on the Company’s EDGAR

profile at www.sec.gov/edgar.

The securities being offered have not been

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements

The Company intends to use the net proceeds of

the Offering for product launches, debt repayment and working

capital purposes. The Offering is subject to receipt of all

necessary approvals, including approval of the Toronto Stock

Exchange.This press release does not constitute an offer to sell

nor a solicitation of an offer to purchase any securities in any

jurisdiction in which such an offer or solicitation is not

authorized and does not constitute an offer within any jurisdiction

to any person to whom such offer would be unlawful.

About IntelGenx

IntelGenx is a leading drug delivery company

focused on the development and manufacturing of pharmaceutical

films.

IntelGenx’s superior film technologies,

including VersaFilm®, DisinteQ™, VetaFilm® and transdermal

VevaDerm™, allow for next generation pharmaceutical products that

address unmet medical needs. IntelGenx’s innovative product

pipeline offers significant benefits to patients and physicians for

many therapeutic conditions.

IntelGenx's highly skilled team provides

comprehensive pharmaceuticals services to pharmaceutical partners,

including R&D, analytical method development, clinical

monitoring, IP and regulatory services. IntelGenx's

state-of-the-art manufacturing facility offers full service by

providing lab-scale to pilot- and commercial-scale production. For

more information, visit www.intelgenx.com.

Forward-Looking Statements

This document may contain forward-looking

statements about IntelGenx's operating results and business

prospects that involve substantial risks and uncertainties.

Statements that are not purely historical are forward-looking

statements within the meaning of Section 21E of the United States

Securities Exchange Act of 1934, as amended, and Section 27A of the

Securities Act. These statements include, but are not limited to,

statements about IntelGenx's plans, objectives, expectations,

strategies, intentions or other characterizations of future events

or circumstances and are generally identified by the words "may,"

"expects," "anticipates," "intends," "plans," "believes," "seeks,"

"estimates," "could," "would," and similar expressions. All forward

looking statements are expressly qualified in their entirety by

this cautionary statement. Because these forward-looking statements

are subject to a number of risks and uncertainties, IntelGenx's

actual results could differ materially from those expressed or

implied by these forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the heading "Risk Factors" in

IntelGenx's annual report on Form 10-K, filed with the SEC and

available at www.sec.gov/edgar, and also filed with Canadian

securities regulatory authorities at www.sedarplus.com. IntelGenx

assumes no obligation to update any such forward-looking

statements.

The Offering will be made in the United States

only by means of the Offering Statement. The securities offered by

IntelGenx are highly speculative. Investing in shares of IntelGenx

involves significant risks. The investment is suitable only for

persons who can afford to lose their entire investment.

Furthermore, investors must understand that such investment could

be illiquid for an indefinite period of time. No public market

currently exists for the securities, and if a public market

develops following the offering, it may not continue.

For additional information on IntelGenx, the

Offering and any other related topics, please review the Offering

Statement that can be found by searching for IntelGenx Technologies

Corp. on www.sec.gov/edgar. Additional information concerning risk

factors related to the Offering, including those related to the

business, government regulations, intellectual property and the

offering in general, can be found in the section titled “Risk

Factors” of the Offering Statement.

Source: IntelGenx Technologies Corp.For

IntelGenx:

Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

Or

Andre Godin, CPA, CAPresident and CFOIntelGenx

Corp.(514) 331-7440 ext 203andre@intelgenx.com

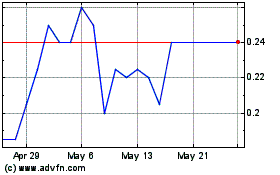

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

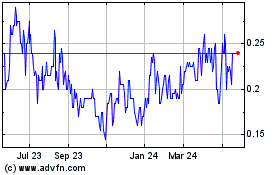

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Nov 2023 to Nov 2024