Double-digit, year-over-year growth across all key operating

metrics for the sixth consecutive quarter; counter-cyclical

business model continues to prove itself

In Q2 2023, Mainstreet Equity Corp. (“Mainstreet”, TSX:MEQ) once

again achieved double-digit, year-over-year growth across all key

operating metrics for the sixth consecutive quarter, extending a

period of high performance from Q1 as we continue to exhibit solid

results despite economic volatility. Funds from operations (“FFO”)

grew 25% in Q2, net operating income (“NOI”) increased 18%, and

revenues rose 16% (on a per-share basis, FFO grew 26% from $1.21 to

$1.52 in Q2 2023).

Bob Dhillon, Founder, President and CEO of Mainstreet, said,

“Despite the uncommon economic volatility of the last few years,

Mainstreet has continued to deliver results to its shareholders and

prove the viability of our 100% organic, non-dilutive growth

model.” He added, “This latest quarter is yet more evidence of the

resilient nature of the mid-market rental market, as favourable

macroeconomic trends continue to bolster our underlying

fundamentals and position Mainstreet as a key provider of

affordable living in Western Canada.”

We believe these positive Q2 results once again prove the

sustainability of Mainstreet’s non-dilutive business model, which

has allowed our management team to deliver value-added growth to

shareholders despite the uncommon turbulence of recent economic

cycles. Core to that success is Mainstreet’s long-term management

philosophy, anchored by a counter-cyclical strategy of leveraging

our ample liquidity position ($317 million estimated, or $34 per

share) and low-cost capital to acquire undervalued assets at

opportunistic prices. Once acquired, we rapidly reposition and

improve the condition of these assets through renovations to

bolster net operating income and margins (NOI is currently up 11%

year-over-year on a same-asset basis, while same-asset operating

margins have improved to 60%).

Mainstreet’s Q2 achievements also come as structural

supply-demand imbalances in the affordable rental market continue

to accelerate, underscoring the extraordinary resilience of this

particular asset class. Soaring immigration levels have pushed

Canada’s population to nearly 40 million, with the country gaining

a record-high one million people in 2022 alone largely due to

immigration, according to Statistics Canada data. That trend is

likely to continue as the federal government plans to accept

500,000 immigrants every year for the next three years—well higher

than previous averages—as a core piece of its economic policy. This

sharp influx has accelerated the supply gap that had already

persisted for years in the Canadian rental market, causing vacancy

rates to fall and rents to rise. According to CHMC estimates,

vacancy rates in the Calgary rental market are forecast to fall

from 2.2% to 1.2% between 2023 and 2025; in Edmonton they will fall

from 2.3% to 1.3%. The tightening trend is evident across

Mainstreet’s core markets, including Saskatoon (falling from 2.5%

to 1.8%) and Regina (from 2.8% down to 2.0%). Vancouver’s rental

vacancy is predicted to remain around the lowest in the country at

0.9% by 2025.

Mainstreet, with a tangible real estate portfolio that includes

nearly 17,000 rental units strategically located across western

Canadian urban centres, is well-positioned to remain a crucial

provider of affordable living in this current macroeconomic

context. Even amid high inflation and rising costs, Mainstreet has

managed to maintain highly affordable rental rates (our average

mid-market rental rate remains around $1,000), making us a

preferred option for young families, working Canadians, students

and immigrants that make up the core of Mainstreet’s customer

base.

As we continue fiscal 2023, Mainstreet is well positioned to

continue asserting our 100% organic, non-dilutive growth model and

extend our acquisition pipeline, despite economic uncertainty in

the remainder of the year. Already Mainstreet has strategically

acquired over $116 million (999 units) in new assets across five

diversified cities year-to-date, including subsequent acquisitions,

as we continue to aggressively expand and diversify our

portfolio.

CHALLENGES

Despite opportunities for growth in the coming year, inflation

and rising interest rates continue to pose a challenge. Canada’s

Consumer Price Index is increasing at a much lower rate than when

inflation was at its peak—the CPI increased 4.3% in March 2023—but

the Bank of Canada is warning it could be some time before it

returns to its 2% target. While the vast majority of Mainstreet’s

debt is locked in at low and fixed terms, higher interest rates

will raise the cost of any new refinancings (overall, debt is our

largest expense alongside acquisitions).

Mainstreet, however, has spent years establishing its long-term

debt position to fortify itself against such rate increases. By

securing early financing pre-matured debts and agreeing to pay

higher up-front borrowing costs on certain mortgages, we extended

our obligations over longer periods (10 years instead of the

typical five). Mainstreet has in turn locked in 99% of our debt

into fixed-term debt with an average maturity and interest rate of

6.0 years and 2.66%, respectively.

Management believes that inflationary periods are ultimately

transitory in nature. In recognition of this, we have strategically

opted for shorter, two-year maturities on our latest debts in order

to reduce our exposure to higher interest rates. When and if

interest rates fall, Mainstreet will benefit not only from more

competitive acquisition costs, but also lower interest expenses

(resulting in higher FFO) on refinancing after stabilization.

Inflationary pressures, meanwhile, also increase the cost of

everything, from labour to materials, raising our operating costs.

Renovation and maintenance costs have increased in line with supply

shortages for materials.

Canadian job vacancies have come down from their peak in Q2

2022, according to StatCan data, but competition for talent remains

fierce amid persistent labour shortages. This has raised

Mainstreet’s labour costs and made hiring more challenging. That

said, Mainstreet has managed to limit its exposure to such

shortages through various avenues including foreign worker

programs.

Major fixed expenses like property taxes, insurance, and

utilities also remain high. Carbon taxes, which place the financial

burden on property owners, are scheduled to rise annually. We have

addressed higher energy costs by securing various longer-term

natural gas contracts, pursuant to which Mainstreet currently pays

well below current spot prices. We also managed to reduce our

insurance costs more than 13% for fiscal 2023 by obtaining improved

premium rates and coverage.

Regardless of our efforts to counteract inflation and rising

interest rates, higher costs erode our operating margins and

negatively impact our bottom line. Some of the financial burden

will ultimately be passed onto tenants through soft rent increases.

However, we are confident Mainstreet will remain the leading

provider of quality, affordable housing in Western Canada, given

our track record of operational efficiencies, value creation and

sound management.

OUTLOOK

The ‘first inning’ of rental market tightening

As we continue into 2023, we expect high immigration rates, lack

of new rental supply and subsequent supply-demand imbalance to

persist in Canada. We believe immigration rates are unlikely to

taper off in the near term as labour markets remain tight, and as

the federal government indicates that immigration will remain a

bedrock of its plan to grow the Canadian economy. With that, we

expect average rental rates across Canada to grow in line with

rising inflation rates and supply shortages, which could also lead

to fewer home buyers (as for Mainstreet, we will continue to occupy

our position as Canada’s most competitive provider of affordable

living).

Accelerated acquisitions

Mainstreet believes the acquisition environment has entered a

period of transition. Our team continues to see risk-adjusted

opportunities for growth supported by our sizeable liquidity

position, as higher interest rates could force more distressed

sellers onto the market and create more renters. Such dynamics

create growth potential through opportunistic acquisitions. As

ever, we will maintain our strategy of counter-cyclical growth by

acquiring assets only when it prioritizes true value creation. In

particular, these efforts will include targeted acquisitions

outside of Alberta and Saskatchewan as we continue to diversify and

expand our portfolio.

BC remains a standout

We expect Vancouver/Lower Mainland will continue to drive growth

and performance, as vacancies remain among the lowest in the

country and rental rates among the highest. British Columbia has

become central to Mainstreet’s portfolio, accounting for

approximately 42% of our estimated net asset value (“NAV”) based on

IFRS value.

With an average monthly mark-to-market gap of $580 per suite per

month, 95% of our customers in the region are below the average

market rent. According to our estimates, that translates into

approximately $23 million in NOI growth potential after accounting

for tenancy turnover and gradual rent increases.

Western bound

Alberta had an in-migration rate of 41,210 in Q4 2022, as

improved economic prospects and relatively affordable living drew a

near record number of newcomers to the province. The figure is

comparable to the previous quarter, when Alberta had the largest

influx of international and interprovincial migrants in its

history. Alberta’s population grew 1.0% in Q4 2022, well above the

national average of 0.7%, according to provincial government

data.

Saskatchewan’s provincial in-migration also grew sharply, with

8,650 people coming to the province in Q4, compared with 1,950 the

year prior.

Manitoba diversification

Given the abundance of opportunity we’ve seen across Western

Canada, Mainstreet has continued to diversify our asset base. We

first entered the Manitoba market in 2021, and in Q2 2023,

Mainstreet acquired another 291-suite high-rise property in

Winnipeg (expanding our total city-wide portfolio to four

properties with 405 units).

Closing the NOI gap

Current market conditions create a rare opportunity for

Mainstreet. Our stabilization rates are higher than average due to

our high rate of counter-cyclical acquisitions in recent quarters,

while our vacancy rates are lower than average (4.5%, including

newly acquired un-stabilized properties). This discrepancy provides

substantial opportunity for Mainstreet to continue extracting value

from existing assets by aggressively repositioning units.

The MEQ intangibles

While Mainstreet’s many tangible assets are central to our

strategic position amid rising rental demand, we also boast several

less obvious upsides that speak to our inherent underlying value.

They include:

- Residual lands and low-density portfolio: Many of Mainstreet’s

assets are ripe for further development and expansion, allowing new

capacity to be added at low cost

- Strong management: Mainstreet’s highly experienced team has

operated through countless cycles in the market, giving us the

ability to adapt as operating environments change

- Efficient operations: Mainstreet has invested resources over

the past decade building a strong operating platform, including our

adoption of Yardi’s IT operating system, to streamline operational

oversight

- Land aggregation and densification: Over Mainstreet’s 23-year

history, we have banked a considerable land portfolio (including

both residual land and low-density apartment buildings) that

translates into significant tangible value while also providing the

option to convert existing assets into higher density developments

should such opportunities emerge.

RUNWAY ON EXISTING PORTFOLIO

- Pursuing our 100% organic, non-dilutive growth model: Using our

strong potential liquidity position, estimated at $317 million, we

believe there is significant opportunity to continue acquiring

underperforming assets at attractive valuations.

- Boosting NOI: As of Q2 2023, 15% of Mainstreet’s portfolio was

going through the stabilization process. Once stabilized, we remain

confident same-asset revenue, vacancy rate, NOI and FFO will be

meaningfully improved. We are cautiously optimistic that we can

boost cash flow in coming quarters. In the BC market alone, we

estimate that the potential upside based on mark-to-market gaps for

NOI growth is approximately $23 million. The Calgary market also

has substantial room for rent-to-market catch up.

- Buying back shares at a discount: We believe MEQ shares

continue to trade below their true NAV, and ongoing macroeconomic

volatility could intensify that trend.

Forward-Looking Information

Certain statements contained herein constitute "forward-looking

statements" as such term is used in applicable Canadian securities

laws. These statements relate to analysis and other information

based on forecasts of future results, estimates of amounts not yet

determinable and assumptions of management. In particular,

statements concerning estimates related to future acquisitions,

dispositions and capital expenditures, increase or reduction of

vacancy rates, increase or decrease of rental rates and rental

revenue, future income and profitability, timing of refinancing of

debt and completion, timing and costs of renovations, increased or

decreased funds from operations and cash flow, the Corporation's

liquidity and financial capacity, improved rental conditions,

future environmental impact the Corporation's goals and the steps

it will take to achieve them the Corporation's anticipated funding

sources to meet various operating and capital obligations and other

factors and events described in this document should be viewed as

forward-looking statements to the extent that they involve

estimates thereof. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions of future events or

performance (often, but not always, using such words or phrases as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans", "estimates" or "intends", or

stating that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

forward-looking statements.

Such forward-looking statements are not guarantees of future

events or performance and by their nature involve known and unknown

risks, uncertainties and other factors, including those risks

described in this Annual Information Form under the heading "Risk

Factors", that may cause the actual results, performance or

achievements of the Corporation to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such risks and other factors

include, among others, costs and timing of the development of

existing properties, availability of capital to fund stabilization

programs, other issues associated with the real estate industry

including availability but without limitation of labour and costs

of renovations, fluctuations in vacancy rates, unoccupied units

during renovations, rent control, fluctuations in utility and

energy costs, credit risks of tenants, fluctuations in interest

rates and availability of capital, and other such business risks as

discussed herein. Material factors or assumptions that were applied

in drawing a conclusion or making an estimate set out in the

forward-looking statements include, among others, the rental

environment compared to several years ago, relatively stable

interest costs, access to equity and debt capital markets to fund

(at acceptable costs) and the availability of purchase

opportunities for growth in Canada. Although the Corporation has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, other factors may cause

actions, events or results to be different than anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could vary or differ materially from those anticipated in

such forward-looking statements. Accordingly, readers should not

place undue reliance on forward-looking statements contained

herein.

Forward-looking statements are based on Management's beliefs,

estimates and opinions on the date the statements are made, and the

Corporation undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions should change

except as required by applicable securities laws or as otherwise

described therein.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding the Corporations reasonable expectations

as to the anticipated results of its proposed business activities

for the periods indicated. Readers are cautioned that the financial

outlook may not be appropriate for other purposes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230509005503/en/

For further information: Bob Dhillon, Founder, President

& CEO D: +1 (403) 215-6063 Executive Assistant: +1 (403)

215-6070 100, 305 10 Avenue SE, Calgary, AB T2G 0W2 Canada TSX: MEQ

https://www.mainst.biz/ https://www.sedar.com

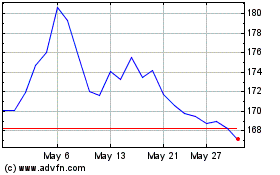

Mainstreet Equity (TSX:MEQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mainstreet Equity (TSX:MEQ)

Historical Stock Chart

From Jan 2024 to Jan 2025