Flagship Communities Real Estate Investment Trust (“Flagship” or

the “REIT”) (TSX: MHC.U; MHC.UN) today announced that it has

entered into agreements to acquire (the “Acquisitions”) a total of

seven manufactured housing communities (“MHCs”), comprising 1,253

lots, for an aggregate purchase price of approximately US$93.0

million (the “Purchase Price”). The Acquisitions are expected to

close on or about May 15, 2024, subject to customary

closing conditions.

The Purchase Price, along with approximately

US$10 million of upfront capital expenditures, will be funded

with the net proceeds from the REIT’s US$60 million offering of

trust units (“Units”) (see “Equity Financing” below) and the

remainder funded with new debt financing. The Purchase Price

represents an attractive capitalization rate of 5.6% on Year 1

forecasted net operating income (“NOI”), and is expected to be

accretive to the REIT’s adjusted funds from operations per Unit

(diluted) (“AFFO”, see “Non-IFRS Financial Measures” below) on a

leverage neutral and stabilized basis.

“These acquisitions are the largest in the

REIT’s history to date and represent a milestone for our business

as we continue to execute on our stated growth strategy,” said Kurt

Keeney, President and CEO. “This is a generational opportunity to

strategically expand our footprint into the adjacent Nashville

market, as well as establish a presence in West Virginia, both

markets that enable us to maximize existing synergies and leverage

economies of scale.”

Transaction Highlights

- Increased Size and

Scale: Enhances Flagship’s scale, with the REIT’s pro

forma portfolio consisting of 82 communities comprising 15,033

lots

- Expansion into New

Markets: The Acquisitions strengthen the REIT’s presence

in Tennessee while entering the core Nashville market, which is one

of the fastest growing markets in the U.S. The Acquisitions also

expand the REIT’s operations into West Virginia, which represents

the REIT’s eighth contiguous U.S. state, and provide significant

growth opportunities to become a market leading owner in these

markets

- Organic Growth

Potential: Organic cash flow growth generated by the

REIT’s active lot leasing and home sales strategy, along with the

implementation of expense optimization initiatives, are expected to

generate stable, recurring and above market organic growth

- Attractive Cost

Basis: The Purchase Price represents a 5.6% capitalization

rate based on year 1 NOI and a price per lot of approximately

US$74,000

- Operating Platform

Synergies & Economies of Scale: The REIT continues to

expand its portfolio without material incremental corporate level

expenses and is well-positioned to further benefit from its

scalable platform going forward. The REIT intends to continue its

growth by sourcing acquisitions in existing and adjacent markets

which are expected to generate economies of scale and operational

synergies

- Accretion & Leverage

Profile: The completion of the Acquisitions is expected to

be accretive on a stabilized and leverage neutral basis to the

REIT’s long-term leverage target. Additionally, following the

completion of the Acquisitions and the Offering, the REIT’s Debt to

Gross Book Value Ratio (see “Other Real Estate Industry Metrics”

below) is expected to be 39.4% (prior to any exercise of the

over-allotment option) compared to 49.6% following completion of

the IPO.

“We are excited to have sourced more off-market

acquisitions through our long-standing industry relationships,

providing the ability to establish a presence in Nashville, as well

as West Virginia,” said Nathan Smith, Chief Investment Officer.

“The Acquisitions are comprised of high-quality properties that

adhere to our acquisition criteria and also provide the opportunity

to expand our presence into Nashville, one of the fastest growing

cities in the U.S., strategically located along the I-40 and I-65

Interstate corridors, within easy driving distance to employment

opportunities, hospitals, schools, shopping and recreational

facilities.”

Overview of Acquisitions

Nashville MSA

The Madison, Tennessee acquisition comprises 300

lots across approximately 38 acres and is located 13 miles north of

downtown Nashville. It is within close proximity to malls, sports

and medical facilities, golf courses, schools and entertainment,

and is situated along the Cumberland River. The community is 67%

occupied, including 6 rental homes. Community amenities include a

playground, basketball court, clubhouse, and a community center.

Nearby employers include Epic Systems, American Family Insurance,

American Girl, Sub-Zero, Trek Bicycle, Lands’ End, Shopbop, Colony

Brands and John Deere. The community sits near the interchange of

Interstate 40 and 65 and is approximately a 20-minute drive to

downtown Nashville.

The Murfreesboro, Tennessee acquisition

comprises 173 lots across approximately 26 acres and is located 35

miles south of downtown Nashville. It is within close proximity to

local supermarkets, restaurants, the municipal airport,

universities and athletic centers. The community is approximately

99% occupied. Community amenities include a basketball court,

clubhouse and greenery surrounded gazebo. Major employers in the

community include Nissan Automotive, National Healthcare

Corporation, State Farm Insurance, Amazon and St. Thomas Rutherford

Hospital. The community sits near the interchange of Interstate 24

and is approximately a 30-minute drive to downtown Nashville.

Morgantown, West Virginia (2 Communities)

The Morgantown, West Virginia acquisitions

comprise 2 communities. The first community comprises 187 lots

across approximately 33 acres and is 88% occupied including 4

rental homes. The second community comprises 203 lots across

approximately 41 acres and is 81% occupied including 102 rental

homes. Both communities are centrally located in Morgantown along

the Monongahela River, near Morgantown Municipal Airport, as well

as nearby attractions including several golf courses, West Virginia

University campus and Art Museum, Hazel Ruby McQuain Riverfront

Park, Mountaineer Field, and West Virginia Coliseum. The

communities are located adjacent to Interstates 79 and 68,

providing excellent access to major transportation routes. Major

employers include West Virginia University, Target, WVU Medicine,

Mylan INC, IBM, Viatris, US Army, AT&T and Wipro.

Milton, West Virginia (Huntington MSA)

The Milton, West Virginia acquisition comprises 213 lots across

approximately 33 acres. It is located 15 miles east of Huntington,

West Virginia, within a quiet, well-maintained neighborhood near

schools, shopping centers, hospitals, entertainment and more. The

community is 66% occupied, including 21 rental homes. This

community offers residents many amenities including a new

playground, a clubhouse equipped with a full kitchen and billiards.

The community is located adjacent to Interstate 64, providing

excellent access to major transportation routes. Nearby employers

include Mountain Health Network, Marshall University, Cabell County

Board of Education, University Physicians & Surgeons, Walmart,

Huntington Alloys Corp., Alcon Research LLC and Steel of West

Virginia Inc.

Beckley, West Virginia (2 Communities)

The Beckley, West Virginia acquisitions comprise 2 communities.

The first community comprises 120 lots across approximately 15

acres and is 87% occupied including 12 rental homes. The second

community comprises 57 lots across approximately 14 acres and is

68% occupied including 7 rental homes. Both communities are

well-maintained offering residents well-lit, paved streets and are

centrally located, with easy access to schools, hospitals, post

offices, doctors’ offices, shopping malls, movie theaters,

restaurants and outdoor activities. The communities are located

adjacent to Interstates 64 and 77, providing excellent access to

major transportation routes. Nearby employers include Filter

Companies, Lowe’s Home Improvement, McDonald’s, US Army,

Enterprise, IBEX Global, AT&T and UPS.

Pro Forma Portfolio

The Acquisitions are a targeted and strategic expansion of the

REIT’s portfolio, increasing the number of Flagship’s MHCs to 82

from 75 and the number of manufactured housing lots to 15,033 from

13,780. The table below provides a summary of the pending

Acquisitions as of April 17, 2024.

|

|

|

Acquisitions Portfolio |

|

# of Communities |

(#) |

7 |

|

# of Lots |

(#) |

1,253 |

|

Average Lot Occupancy |

(%) |

78 |

Equity Financing

The REIT also announced today that it has entered into an

agreement with a syndicate of underwriters co-led by BMO Capital

Markets and Canaccord Genuity Corp. (together, the “Lead

Underwriters”) to sell, on a bought deal basis, 3,910,000 Units at

a price of US$15.35 per Unit for gross proceeds of approximately

US$60 million (the “Offering”). The REIT has also granted the

underwriters an over-allotment option to purchase up to an

additional 15% of the Offering on the same terms and conditions,

exercisable at any time, in whole or in part, up to 30 days after

the closing of the Offering. The Offering is expected to close on

or about April 24, 2024 and is subject to customary conditions,

including the approval of the Toronto Stock Exchange. The Offering

is not conditional upon closing of either of the Acquisitions.

The REIT intends to use the net proceeds from the Offering to

fund (i) the Purchase Price (ii) capital expenditures, which are

expected to be approximately US$10 million, in connection with the

Acquisitions and (iii) for general business purposes. In the event

the REIT is unable to consummate one or both of the Acquisitions

and the Offering is completed, the REIT intends to use the net

proceeds of the Offering to fund future acquisitions and for

general business purposes.

The Offering is being made pursuant to the REIT’s base shelf

prospectus dated June 7, 2023. The terms of the Offering will be

described in a prospectus supplement to be filed with Canadian

securities regulators.

The Units have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, (the “1933 Act”)

and may not be offered, sold or delivered, directly or indirectly,

in the United States, except pursuant to an exemption from the

registration requirements of the 1933 Act. This press release does

not constitute an offer to sell or a solicitation of an offer to

buy any Units in the United States.

Forward-Looking Statements

This press release contains statements that include

forward-looking information (within the meaning of applicable

Canadian securities laws). Forward-looking statements are

identified by words such as “believe”, “anticipate”, “project”,

“expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”,

“must”, “estimate”, “target”, “objective”, and other similar

expressions, or negative versions thereof, and include statements

herein concerning: the terms of, timing for completion of and

source of funding for the Acquisitions, the expected synergies from

the Acquisitions, the expected impact of the Acquisitions and the

Offering on the REIT’s Debt-to-Gross Book Value Ratio, the expected

impact of the Acquisitions on the REIT’s AFFO per Unit (diluted),

the expected impact of the Acquisitions on the REIT’s long-term

leverage target, the REIT’s pro forma portfolio, the REIT’s growth

opportunities (including organic growth potential), the scalability

of the REIT’s platform, the REIT’s acquisitions strategy and

expectations regarding economies of scale and operational

synergies, the terms of and timing for completion of the Offering

and the intended use of the net proceeds of the Offering.

These statements are based on the REIT’s expectations,

estimates, forecasts, and projections, as well as assumptions that

are inherently subject to significant business, economic and

competitive uncertainties and contingencies that could cause actual

results to differ materially from those that are disclosed in such

forward-looking statements. While considered reasonable by

management of the REIT as at the date of this news release, any of

these expectations, estimates, forecasts, projections, or

assumptions could prove to be inaccurate, and as a result, the

forward-looking statements based on those expectations, estimates,

forecasts, projections, or assumptions could be incorrect. Material

factors and assumptions used by management of the REIT to develop

the forward-looking information in this news release include, but

are not limited to, that the conditions to closing of the

Acquisitions will be met or waived in a timely manner and that both

of the Acquisitions will be completed on the current agreed upon

terms. When relying on forward-looking statements

to make decisions, the REIT cautions readers not to place undue

reliance on these statements, as they are not guarantees of future

performance and involve risks and uncertainties that are difficult

to control or predict. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements, such as the risks identified in the

REIT’s management’s discussion and analysis for the year ended

December 31, 2023 available on the REIT’s profile on SEDAR+ at

www.sedarplus.com, including, but not limited to, the factors

discussed under the heading “Risks and Uncertainties” therein and

the risk of the REIT’s plans with respect to debt bridge financing

for the Acquisitions not being achieved as anticipated. There can

be no assurance that forward-looking statements will prove to be

accurate as actual outcomes and results may differ materially from

those expressed in these forward-looking statements. Readers,

therefore, should not place undue reliance on any such

forward-looking statements. Forward-looking statements are made as

of the date of this press release and, except as expressly required

by applicable Canadian securities laws, the REIT assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Non-IFRS Financial Measures

In this press release, the REIT uses certain financial measures

that are not defined under International Financial Reporting

Standards (“IFRS”) including certain non-IFRS ratios. These

measures are commonly used by entities in the real estate industry

as useful metrics for measuring performance. However, they do not

have any standardized meaning prescribed by IFRS and are not

necessarily comparable to similar measures presented by other

publicly traded entities. These measures should be considered as

supplemental in nature and not as a substitute for related

financial information prepared in accordance with IFRS. The REIT

believes these non-IFRS financial measures and ratios provide

useful supplemental information to both management and investors in

measuring the operating performance, financial performance and

financial condition of the REIT.

Adjusted Funds from Operations

Adjusted funds from operations (“AFFO”) is calculated in

accordance with the definition provided by the Real Property

Association of Canada (“REALPAC”). AFFO is defined as Funds From

Operations (being IFRS consolidated net income (loss) adjusted for

items such as distributions on redeemable or exchangeable units

(including distributions on class B units of the REIT’s subsidiary,

Flagship Operating, LLC (“Class B Units”)), unrealized fair value

adjustments to Class B Units, unrealized fair value adjustments to

investment properties, unrealized fair value adjustments to unit

based compensation, loss on extinguishment of acquired mortgages

payable, gain on disposition of investment properties, and

depreciation) adjusted for items such as maintenance capital

expenditures, and certain non-cash items such as amortization of

intangible assets, and premiums and discounts on debt and

investments. AFFO should not be construed as an alternative to

consolidated net income (loss) or consolidated cash flows provided

by (used in) operating activities determined in accordance with

IFRS. The REIT’s method of calculating AFFO is substantially in

accordance with REALPAC’s recommendations. The REIT uses a capital

expenditure reserve of $60 per lot per year and $1,000 per rental

home per year in the AFFO calculation. This reserve is based on

management’s best estimate of the cost that the REIT may incur,

related to maintaining the investment properties. This may differ

from other issuers ’methods and, accordingly, may not be comparable

to AFFO reported by other issuers. The REIT uses AFFO in assessing

its distribution paying capacity.

“AFFO per Unit (diluted)” is defined as AFFO for the applicable

period divided by the diluted weighted average Unit count

(including Class B Units, vested restricted units and vested

deferred trust units) during the period.

Please refer to the REIT’s management’s discussion and analysis

for the year ended December 31, 2023 at “Non-IFRS Financial

Measures – Funds from Operations and Adjusted Funds from

Operations” for further detail on this non-IFRS financial measure

and at “Reconciliation of FFO, FFO per Unit, AFFO and AFFO per

Unit” for a reconciliation of historical AFFO to consolidated net

income (loss), which disclosures are incorporated by reference into

this press release.

Other Real Estate Industry Metrics

Debt to Gross Book Value Ratio

Debt to Gross Book Value Ratio is calculated by dividing

indebtedness, which consists of the total principal amounts

outstanding under mortgages payable and credit facilities, by Gross

Book Value (being, at any time, the greater of: (a) the value of

the assets of the REIT and its consolidated subsidiaries, as shown

on its then most recent consolidated statement of financial

position prepared in accordance with IFRS, less the amount of any

receivable reflecting interest rate subsidies on any debt assumed

by the REIT; and (b) the historical cost of the investment

properties, plus (i) the carrying value of cash and cash

equivalents, (ii) the carrying value of mortgages receivable, and

(iii) the historical cost of other assets and investments used in

operations).

About Flagship Communities Real Estate Investment

Trust

Flagship Communities Real Estate Investment Trust is a leading

operator of affordable residential Manufactured Housing Communities

primarily serving working families seeking affordable home

ownership. The REIT owns and operates exceptional residential

living experiences and investment opportunities in family-oriented

communities in Kentucky, Indiana, Ohio, Tennessee, Arkansas,

Missouri, and Illinois. To learn more about Flagship, visit

www.flagshipcommunities.com.

For further information, please contact:

Eddie Carlisle, Chief Financial OfficerFlagship Communities Real

Estate Investment TrustTel: +1 (859) 568-3390

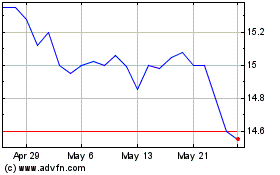

Flagship Communities Rea... (TSX:MHC.U)

Historical Stock Chart

From Nov 2024 to Dec 2024

Flagship Communities Rea... (TSX:MHC.U)

Historical Stock Chart

From Dec 2023 to Dec 2024