NOVAGOLD RESOURCES INC. (TSX:NG)(NYSE MKT:NG) announced results for

its first quarter ended February 28, 2013 and gave an update on the

permitting process for its flagship Donlin Gold project in Alaska.

With approximately US$300 million in cash and cash equivalents at

the end of the first quarter, NOVAGOLD has a strong balance sheet

and more than sufficient cash to fulfill all of its current

financial obligations as well as fund the advancement of the Donlin

Gold project through the permitting process and support ongoing

activities at its Galore Creek project in British Columbia.

Details of the Company's financial results are described in the

Unaudited Interim Condensed Consolidated Financial Statements and

Management's Discussion and Analysis (MDA) which, together with

further details on each of the Company's projects, including

resource and reserve estimates, will be available on the Company's

website at www.novagold.com, on SEDAR at www.sedar.com, and on

EDGAR at www.sec.gov. All amounts are in Canadian dollars unless

otherwise stated and all resource and reserve estimates are shown

on a 100% project basis.

During the First Quarter in 2013, NOVAGOLD:

-- Transitioned from the public scoping period into the Preliminary Draft

Environmental Impact Statement (PDEIS) phase of permitting at Donlin

Gold, having received positive and constructive reviews in all the

public scoping meetings held in Alaska

-- Reported the discovery of the new Legacy zone at Galore Creek, a 700-

meter long mineralized zone, that remains open in all directions and is

located adjacent to the main Central Pit

-- Released significant intercepts from its 27,900-meter Galore Creek

drilling program, expected to result in an increased resource endowment

and improved future mine design

-- Received $54.0 million in cash proceeds from the exercise of all

remaining warrants

-- Strengthened the management team with the appointment of Richard

Williams to the position of Vice President Engineering and Development;

Mr. Williams came to NOVAGOLD from Barrick Gold where he most recently

led the successful design, construction and start-up of the Pueblo Viejo

mine in the Dominican Republic

President's Message

NOVAGOLD is off to a great start in 2013, with key deliverables

achieved to further de-risk our flagship Donlin Gold project in

Alaska and advance our Galore Creek project in British Columbia.

After the first quarter, Donlin Gold is on track with its

permitting activities with the recently completed public scoping

phase of the process as per the schedule issued by the Army Corps

of Engineers (the "Corps"), the lead permitting agency. The

permitting process, which is expected to take 3-4 years to

complete, is now well at hand and the Company can launch the PDEIS

process. Important meetings were held in 13 villages and in

Anchorage. During these well attended gatherings, local

constituents directed constructive comments towards the Corps as

part of the EIS process. This healthy atmosphere is a testament to

the excellent work combined with an extensive community outreach

that has been conducted by the Donlin Gold team over the last 16

years. Donlin Gold continues to enjoy the strong support of its

principal stakeholders, including the Alaska Native Corporations -

Calista Corporation and The Kuskokwim Corporation - the holders of

the mineral and surface rights. Having completed several projects

in the United States similar in size and scale to Donlin Gold, I am

very pleased with where we are in terms of permitting at this

stage.

During the last quarter, we reported excellent drill results

from our 2012 campaign at Galore Creek and announced the discovery

of the new Legacy zone, a 700-meter long zone adjacent to the main

Central Pit and which remains open in all directions. This

discovery should allow us to extend the known mineralization well

beyond the currently defined resources. With these positive drill

results, we are well positioned to update Galore Creek's resource

endowment and further improve the overall economics of this project

as we pursue the sale of our 50% share of this exceptional asset.

If developed as envisioned in the Pre-Feasibility Study, Galore

Creek is expected to become the largest and lowest-cost copper mine

in Canada. This factor is particularly important considering the

critical challenges copper miners face today in jurisdictions such

as the Democratic Republic of Congo, Indonesia, Argentina,

Mongolia, Chile and Peru.

During the quarter, we further strengthened the balance sheet

with the receipt of $54 million in proceeds from the exercise of

the remaining warrants. With approximately US$300 million in cash

and cash equivalents at the end of the first quarter, NOVAGOLD has

a strong balance sheet and more than sufficient cash to fulfill all

of its current financial obligations as well as fund the

advancement of the Donlin Gold project through the permitting

process and support ongoing activities at its Galore Creek project

in British Columbia.

Recently, we announced the appointment of Richard Williams as

Vice President Engineering and Development. Richard will be

responsible for all aspects related to the engineering and

technical advancement of Donlin Gold and Galore Creek. In his

30-year career with Barrick Gold, he has developed and operated

several major mines, with a particular focus on the design,

construction and implementation of autoclave technology planned to

be used to process ores at Donlin Gold. Most recently, he served as

Project Director of the Pueblo Viejo operation in the Dominican

Republic where he played a key role in designing and constructing

four of the largest state-of-the-art autoclaves in the world.

Our accomplishments in the first quarter of 2013 came against a

backdrop of tumultuous markets, especially among mining equities.

Companies in our space remain under siege in many mining

jurisdictions. In that context, NOVAGOLD is one of very few mine

developers with assets located in two of the safest geo-political

jurisdictions in the world. As investors become more focused on

jurisdictional safety and stability, we expect NOVAGOLD to be

recognized as an investment of choice among institutions seeking

"premium valuation" among gold equities with projects characterized

by superior grades of long-life ore bodies with substantial future

production profile and significant exploration potential.

NOVAGOLD's Donlin Gold project offers all of those qualities:

size, superior grades, exploration potential and jurisdictional

safety. With approximately 39 million ounces of gold in the

Measured and Indicated resource categories and with a grade of 2.2

grams per tonne, Donlin Gold is the world's largest known

high-grade undeveloped open-pit gold deposit. Once in operation, it

is expected to produce approximately 1,500,000 ounces of gold per

year in the first five full years of production. Assuming no future

expansions, it is expected to average well over 1,000,000 ounces

per year over its present 27-year life. With these statistics,

Donlin Gold is one of only six of the world's gold mines producing

or which have the potential to produce in excess of a million gold

ounces per year and it is located in North America. This is further

magnified by the fact that Donlin Gold's currently delineated ore

body covers only a three-kilometer portion of an eight-kilometer

ore-bearing strike length. Our project's exploration potential is

truly remarkable.

In conclusion, I would like to extend my sincere appreciation to

our shareholders and stakeholders for their incredible support and

trust; our Board of Directors for its guidance and its

shareholder-friendly and value-focused vision; our project teams

for their hard work, dedication and expertise in the excellent

management of our quality assets; the Governments and Native

Corporations of the jurisdictions where we operate, who give us the

foundation of support without which we could not develop our

projects; and finally, our employees whose dedication and hard work

help us deliver on our objectives laying out the foundation for

maximizing the value of our assets for the benefit of our

stakeholders.

Results of Operations

in thousands of Canadian dollars, except for per share amounts

---------------------------------------------------------------------------

Three months Three months

ended ended

February 28, February 29,

2013 2012

$ $

---------------------------------------------------------------------------

Expenses(1) 3,474 5,866

Share-based payments 5,526 10,088

Finance costs, net 3,911 3,176

Foreign exchange gain (loss) 7,883 1,411

Gain (loss) on embedded derivative (840) 27,778

Gain (loss) on derivative (2,455) 18,543

Income (loss) for the period (13,782) 16,769

Basic income (loss) per share (0.05) 0.07

Diluted income (loss) per share (0.05) (0.01)

Cash and cash equivalents 309,345 342,576

---------------------------------------------------------------------------

(1)General and administrative, salaries and severance, professional fees,

and corporate and development expenses.

Financial Results

For the first quarter ended February 28, 2013, the Company

reported a net loss of $13.8 million (or $0.05 basic and diluted

loss per share), compared to net income of $16.8 million (or $0.07

per share, basic and a loss of $0.01 per share, diluted) for the

corresponding period in 2012. The variance in the first quarter was

primarily due to the non-cash losses on embedded derivative and

derivative liabilities related to U.S. dollar denominated

convertible notes and common share warrants totaling $3.3 million

compared to non-cash gains of $46.3 million in the first quarter

2012. The fair value of the embedded derivative and derivative

liabilities vary with changes in the Company's share price and

changes in the U.S. dollar exchange rate. The Company's operating

loss decreased to $6.6 million in the first quarter of 2013 from

$27.4 million in the first quarter of 2012 due to significantly

lower expenses related to salaries, severance, share-based payments

and administrative costs as a result of the corporate

reorganization completed in 2012. Project maintenance, mineral

property and decommissioning expenses were eliminated in the first

quarter of 2013 compared to expenses of $5.1 million in the first

quarter last year as a result of the 2012 spin-out of NovaCopper

Inc. and the Ambler project, as well as the sale of the Rock Creek

project. The Company's combined share of project expenses at Donlin

Gold and Galore Creek decreased to $5.5 million in the first

quarter of 2013 from $7.7 million in the first quarter of 2012.

Foreign exchange gains increased by $6.5 million in the first

quarter of 2013 as the Company's U.S. dollar holdings increased on

a Canadian dollar basis. Net financing costs increased $0.7 million

due to lower accretion from notes receivable and higher accretion

on the convertible notes.

Liquidity and Capital Resource

Cash and cash equivalents was $309.3 million at February 28,

2013, an increase of $56.3 million from $253.0 million at November

30, 2012. The increase in cash during the first quarter of 2013 is

primarily related to the receipt of $54.0 million in net proceeds

from the exercise of all remaining warrants and foreign exchange

gains of $11.6 million resulting from the strengthening of the U.S.

dollar, partially offset by $9.3 million used in operating

activities during the period. The Company has sufficient cash and

cash equivalents available to repay US$95.0 million of outstanding

convertible notes due in 2015 and to advance Donlin Gold through

the expected three-to-four years of permitting. Holders of the

convertible notes have the option to require the Company to

repurchase the convertible notes on May 1, 2013. The Company

currently expects that it will be required to repurchase all

outstanding notes.

Cash used in operating activities was $9.3 million in the first

quarter of 2013, a decrease of $15.3 million from the $24.6 million

used in the first quarter of 2012. The decrease resulted from the

successful reorganization of the Company in 2012 encompassingthe

spin-out of NovaCopper Inc., the sale of Alaska Gold Corporation

which included Rock Creek, as well as a reduction in corporate

overhead and administrative costs. The Company used $3.2 million to

fund its share of expenditures at the Donlin Gold and Galore Creek

projects in the first quarter of 2013, compared to $5.0 million in

the first quarter of 2012.

Outlook

NOVAGOLD remains on target with the previously released 2013

total project budget of US$30 million (of which the Company is

responsible for 50%) to fund permitting, engineering, environmental

and community development activities, as well as general and

administrative expenses. Throughout the balance of the year, Donlin

Gold anticipates that the Corps will draft the PDEIS, receive

comments from the Federal and State agencies on the PDEIS in

preparation for issuance of the draft EIS in 2014. In addition,

Donlin Gold LLC will continue to optimize the project and evaluate

third-party owner-operator agreements to reduce the up-front

project capital costs. Sharing up-front costs with third-party

operators and further optimizing the project design and layout are

avenues that can significantly reduce initial capital costs. As the

anticipated operating margins of the project are already robust,

this emphasis could potentially have a significant impact on

project returns.

At the Galore Creek project, GCMC also remains on target with

the previously approved and released budget of $16 million (of

which the Company is responsible for 50%) to fund work in updating

the resource model with the latest 2012 drill results; test

additional targets on the Legacy zone with approximately 10,000

meters of planned drilling ; and potentially increase resources.

NOVAGOLD continues to evaluate opportunities to monetize the value

of Galore Creek.

Conference Call & Webcast Details

The conference call and webcast, to discuss these results, will

take place April 11, 2013 at 8:00 am PDT (11:00 am EDT). The

webcast and conference call-in details are provided below.

Webcast: http://www.novagold.com/

North American callers: 1-877-546-5021

International callers: 1-857-244-7553

Participant Passcode: 28327147

The webcast will be archived on NOVAGOLD's website for one year

and the conference call replay will be available for 14 days. To

access the conference call replay please dial 1-888-286-8010 (North

America), or 1-617-801-6888 (International), followed by your

Access PIN: 14294618. For a transcript of the call please email

info@novagold.com.

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company engaged in

the exploration and development of mineral properties in North

America. Its flagship asset is the 50%-owned Donlin Gold project in

Alaska, one of the safest jurisdictions in the world. With a total

of approximately 34 million ounces(1) of gold in the Proven and

Probable reserve categories (505 million tonnes at an average grade

of approximately 2.1 grams per tonne), Donlin Gold is regarded to

be one of the largest, and most prospective known gold deposits in

the world. According to the updated Feasibility Study, once in

production, Donlin Gold should average approximately 1.5 million

ounces of gold per year for the first five years, followed by

decades of more than one million ounces of gold per year on a 100%

basis. The Donlin Gold project has substantial exploration

potential beyond the designed footprint which currently covers only

three kilometers of an approximately eight-kilometer strike length

of the property. Permitting is underway for the Donlin Gold

project, a clearly defined process expected to take 3-4 years.

NOVAGOLD also owns 50% of the Galore Creek copper-gold-silver

project located in northern British Columbia. According to the 2011

Pre-Feasibility Study, Galore Creek is expected to be the largest

copper mine in Canada, a tier-one jurisdiction, when it is put into

production. NOVAGOLD is currently evaluating opportunities to sell

all or a portion of its interest in Galore Creek and would apply

the proceeds toward the development of Donlin Gold. NOVAGOLD has a

strong track record of forging collaborative partnerships, both

with local communities and with major mining companies.

(1) Proven and Probable reserves of 0.57 million ounces and

33.28 million ounces respectively (504.8 million tonnes at an

average grade of approximately 2.09 grams per tonne) which are

included in Measured and Indicated resources of 0.63 million ounces

and 38.38 million ounces respectively (541 million tonnes at an

average grade of approximately 2.2 grams per tonne).

Please note: As part of the rebranding, the company has

converted its primary domain to .com from .net, therefore, our

website can now be accessed at www.novagold.com and all email

formats within NOVAGOLD are now firstname.lastname@novagold.com.

Please update your contacts accordingly.

Scientific and Technical Information

Scientific and technical information contained herein with

respect to Donlin Gold is derived from the "Donlin Creek Gold

Project Alaska, USA NI 43-101 Technical Report on Second Updated

Feasibility Study" compiled by AMEC. Kirk Hanson, P.E., Technical

Director, Open Pit Mining, North America, (AMEC, Reno), Gordon

Seibel, R.M. SME, Principal Geologist, (AMEC, Reno), Tony Lipiec,

P.Eng. Manager Process Engineering (AMEC, Vancouver) are the

Qualified Persons responsible for the preparation of the

independent Feasibility Study, each of whom are independent

"qualified persons" as defined by NI 43-101.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain "forward-looking

information" and "forward-looking statements" (collectively

"forward-looking statements") within the meaning of applicable

securities legislation, including the United States Private

Securities Litigation Reform Act of 1995. All statements, other

than statements of historical fact, included herein including,

without limitation, the timing of permitting and potential

development of the project, statements relating to NOVAGOLD's

future operating and financial performance, outlook, and the

potential sale of all or part of NOVAGOLD's interest in Galore

Creek are forward-looking statements. Forward-looking statements

are frequently, but not always, identified by words such as

"expects", "anticipates", "believes", "intends", "estimates",

"potential", "possible", and similar expressions, or statements

that events, conditions, or results "will", "may", "could", or

"should" occur or be achieved. These forward-looking statements may

include statements regarding perceived merit of properties;

exploration results and budgets; mineral reserves and resource

estimates; work programs; capital expenditures; timelines;

strategic plans; completion of transactions; market prices for

precious and base metals; intended use of proceeds; or other

statements that are not statements of fact. Forward-looking

statements involve various risks and uncertainties.

There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ

materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from

NOVAGOLD's expectations include the uncertainties involving the

need for additional financing to explore and develop properties and

availability of financing in the debt and capital markets;

uncertainties involved in the interpretation of drilling results

and geological tests and the estimation of reserves and resources;

the need for continued cooperation with Barrick Gold Corporation

and Teck Resources Limited for the continued exploration and

development of the Donlin Gold and Galore Creek properties; the

need for cooperation of government agencies and native groups in

the development and operation of properties; the need to obtain

permits and governmental approvals; risks of construction and

mining projects such as accidents, equipment breakdowns, bad

weather, non-compliance with environmental and permit requirements,

unanticipated variation in geological structures, ore grades or

recovery rates; unexpected cost increases, which could include

significant increases in estimated capital and operating costs;

fluctuations in metal prices and currency exchange rates; and other

risk and uncertainties disclosed in NOVAGOLD's Annual Information

Form for the year-ended November 30, 2011, filed with the Canadian

securities regulatory authorities, and NOVAGOLD's annual report on

Form 40-F filed with the United States Securities and Exchange

Commission and in other NOVAGOLD reports and documents filed with

applicable securities regulatory authorities from time to time.

NOVAGOLD's forward-looking statements reflect the beliefs, opinions

and projections on the date the statements are made. NOVAGOLD

assumes no obligation to update the forward-looking statements of

beliefs, opinions, projections, or other factors, should they

change, except as required by law.

Contacts: NOVAGOLD RESOURCES INC. Melanie Hennessey Vice

President, Corporate Communications 604-669-6227 or 1-866-669-6227

NOVAGOLD RESOURCES INC. Erin O'Toole Analyst, Investor Relations

604-669-6227 or 1-866-669-6227 www.novagold.com

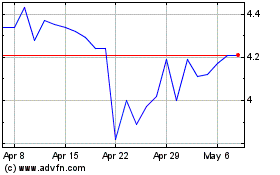

NovaGold Resources (TSX:NG)

Historical Stock Chart

From Apr 2024 to May 2024

NovaGold Resources (TSX:NG)

Historical Stock Chart

From May 2023 to May 2024