North American Construction Group Ltd. (“NACG”) (TSX:NOA/NYSE:NOA)

today announced results for the third quarter ended

September 30, 2021. Unless otherwise indicated, financial

figures are expressed in Canadian dollars and comparisons are to

the prior period ended September 30, 2020.

Third Quarter 2021

Highlights:

-

Adjusted EBITDA of $47.5 million was 28% higher than prior year

adjusted EBITDA of $37.1 million reflecting improved operating

conditions from the prior year, consistently increasing demand for

our heavy equipment fleet and a step change in scope being

completed by the Nuna Group of Companies ("Nuna").

- Gross profit of $21.7 million or 13.1%

continued to reflect the macro impacts of COVID-19 but was also

impacted by equipment maintenance completed in anticipation of a

busy winter season. The operational impacts of safety protocols and

workforce availability are estimated to have impacted gross profit

by approximately $3.0 million net of government assistance and wage

subsidy programs.

-

Free cash flow ("FCF") in the quarter of $10.0 million was

generated from strong adjusted EBITDA less sustaining capital

expenditures but was noticeably impacted by deferred timing of cash

receipts from our various joint ventures which we expect to receive

in the normal course.

-

Senior debt was $274.0 million as at September 30, 2021, a

decrease of $79.2 million from the December 31, 2020 balance

as proceeds from newly issued debentures were used to reduce senior

debt.

-

On July 21, 2021, we announced a contract amendment to a multiple

use agreement between the Mikisew North American Limited

Partnership and a major oil sands producer. We anticipate our share

to be approximately $175 million in additional revenue over the

remainder of the agreement.

-

On September 14, 2021, we announced a contract award to Mikisew

North American Limited Partnership ("MNALP") by a major oil sands

producer. The contract extends the existing master service

agreement between us and the producer to December 2023 but

transitions to MNALP as the contractor. We anticipate the contract

to generate approximately $275 million in revenue over the term of

the agreement.

-

On September 29, 2021, we announced amendment and extension of our

senior secured credit facility which extended the facility date by

one year with a new maturity date of October 8, 2024. In addition

to the extension of existing favourable terms, amendments have also

been incorporated that provide us a greater flexibility in

operating through joint ventures, including joint ventures related

to larger contracts under public-private-partnership financing

models.

NACG President and CEO, Joseph Lambert, commented:

“Thankfully, our Q3 financial performance was much more stable than

Q2 and the consistency in operating conditions allowed for

predictable results. Our operating margins continue to be impacted

by the necessary safety protocols in place at the various mine

sites, but the impacts were far less severe than last quarter. The

financial close of the Fargo-Moorhead project and the seamless

integration of DGI Trading are strong milestones in our strategy to

diversify our business. That said, the resumption of work at Fort

Hills and the contract amendments recently secured with oil sands

producers illustrates the strength of this region and we remain

committed to serving these customers.

Without taking our eye off of this critical Q4, we

look to 2022 and have provided our range of outcomes based on the

projects we currently have in place. I am, of course, keenly aware

of the exciting momentum we feel internally here at NACG but it

really shows up quantitatively when we look at the estimates for

next year. We see the goals ahead of us and are focused on

execution."

Consolidated Financial

Highlights

| |

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

(dollars in thousands, except per share amounts) |

2021 |

|

|

|

2020(iii) |

|

|

2021 |

|

|

2020(iii) |

|

|

|

Revenue |

$ |

165,962 |

|

|

|

$ |

93,563 |

|

|

$ |

473,142 |

|

|

$ |

362,392 |

|

|

|

Project costs |

63,301 |

|

|

|

27,841 |

|

|

155,460 |

|

|

100,789 |

|

|

|

Equipment costs |

59,524 |

|

|

|

32,095 |

|

|

171,363 |

|

|

129,419 |

|

|

|

Depreciation |

21,426 |

|

|

|

18,845 |

|

|

78,966 |

|

|

62,534 |

|

|

|

Gross profit |

$ |

21,711 |

|

|

|

$ |

14,782 |

|

|

$ |

67,353 |

|

|

$ |

69,650 |

|

|

|

Gross profit margin(i) |

13.1 |

|

% |

|

15.8 |

% |

|

14.2 |

% |

|

19.2 |

|

% |

|

General and administrative expenses (excluding stock-based

compensation) |

7,136 |

|

|

|

3,698 |

|

|

20,074 |

|

|

16,225 |

|

|

|

Stock-based compensation expense (benefit) |

(62 |

) |

|

|

1,756 |

|

|

9,963 |

|

|

(2,895 |

) |

|

|

Interest expense, net |

4,845 |

|

|

|

4,428 |

|

|

13,782 |

|

|

14,221 |

|

|

|

Net income |

13,973 |

|

|

|

6,830 |

|

|

36,100 |

|

|

39,164 |

|

|

| |

|

|

|

|

|

|

|

|

Adjusted EBITDA(i) |

47,538 |

|

|

|

37,098 |

|

|

151,049 |

|

|

129,143 |

|

|

|

Adjusted EBITDA margin(i)(ii) |

22.7 |

|

% |

|

31.2 |

% |

|

26.2 |

% |

|

31.2 |

|

% |

| |

|

|

|

|

|

|

|

|

Per share information |

|

|

|

|

|

|

|

|

Basic net income per share |

$ |

0.49 |

|

|

|

$ |

0.23 |

|

|

$ |

1.28 |

|

|

$ |

1.41 |

|

|

|

Diluted net income per share |

$ |

0.44 |

|

|

|

$ |

0.22 |

|

|

$ |

1.16 |

|

|

$ |

1.28 |

|

|

|

Adjusted EPS(i) |

$ |

0.50 |

|

|

|

$ |

0.26 |

|

|

$ |

1.47 |

|

|

$ |

1.38 |

|

|

(i)See "Non-GAAP Financial Measures".(ii)Adjusted

EBITDA margin is calculated using adjusted EBITDA over total

combined revenue. (iii)The prior year amounts are adjusted to

reflect a change in accounting policy. See "Change in accounting

policy - Basis of presentation".

Free cash flow

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

2021 |

|

|

|

2020(ii) |

|

|

|

2021 |

|

|

|

2020(ii) |

|

|

|

Cash provided by operating activities |

|

$ |

32,185 |

|

|

|

$ |

1,612 |

|

|

|

$ |

99,285 |

|

|

|

$ |

84,057 |

|

|

|

Cash used in investing activities |

|

(31,762 |

) |

|

|

(21,913 |

) |

|

|

(74,968 |

) |

|

|

(87,669 |

) |

|

|

Capital additions financed by leases |

|

(4,175 |

) |

|

|

(886 |

) |

|

|

(19,198 |

) |

|

|

(27,882 |

) |

|

|

Add back: |

|

|

|

|

|

|

|

|

|

Growth capital additions |

|

13 |

|

|

|

4,235 |

|

|

|

60 |

|

|

|

34,487 |

|

|

|

Acquisition of DGI Trading Pty Limited |

|

13,724 |

|

|

|

— |

|

|

|

13,724 |

|

|

|

— |

|

|

|

Free cash flow(i) |

|

$ |

9,985 |

|

|

|

$ |

(16,952 |

) |

|

|

$ |

18,903 |

|

|

|

$ |

2,993 |

|

|

(i)See "Non-GAAP Financial Measures".(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in accounting policy - Basis of presentation".

Declaration of Quarterly

Dividend

On October 26th, 2021, the NACG Board of

Directors declared a regular quarterly dividend (the “Dividend”) of

four Canadian cents ($0.04) per common share, payable to common

shareholders of record at the close of business on November 30,

2021. The Dividend will be paid on January 7, 2022 and is an

eligible dividend for Canadian income tax purposes.

Financial Results for the Three Months

Ended September 30, 2021

Revenue was $166.0 million, up from $93.6 million

in the same period last year. revenue has increased as a result of

the continuation of previously delayed work, as well as an

increased demand for our services on new projects. In the quarter,

we re-mobilized equipment to the Fort Hills mine and began

completing earthwork, overburden, and heavy civil construction

activities, which is expected to continue for the remainder of the

year. The suspension of work at the Fort Hills mine caused a

reduction in year-over-year revenue which has returned to a more

normalized level in Q3. The demand for mine support work and

equipment rental support at the Kearl mine remained strong for the

quarter which was complemented by the completion of a haul truck

rebuild and a dozer repair through our external maintenance

program. Outside of our operations in the Fort McMurray region,

revenue was positively impacted by the acquisition of Australian

component supplier DGI Trading PTY Limited. Our share of Nuna's

revenue, which is consolidated in equity earnings, was $45.8

million in Q3 2021.

Gross profit margin of 13.1% was down from the

prior year driven manpower shortages from isolation and vaccination

requirements which increased overtime and other operating costs.

Additionally, the margin was impacted by increased equipment

maintenance activities as we performed services to ensure our fleet

is operating at full capacity for the large demand of work ahead of

us. Partially offsetting these decreases were the operating

performance related to the newly awarded scopes at the Fort Hills

mine and the profit generated from our acquisition of DGI

trading.

Direct general and administrative expenses

(excluding stock-based compensation benefit) were $7.1 million,

equivalent to 4.3% of revenue, higher than Q3 2020 of $3.7 million

and 4.0% driven by lower wage subsidies.

Cash related interest expense for the quarter of

$4.5 million represents an average interest rate of 4.3% as we

continue to benefit from both reductions in posted rates as well as

the competitive rates in equipment financing.

Free cash flow of $10.0 million in the quarter was

positively impacted by higher profitability and changes related to

working capital balances due to the acquisition of DGI. In

addition, positive cash flow of $23.8 million was generated by

adjusted EBITDA of $47.5 million detailed above offset by

sustaining capital additions of $19.8 million and cash interest

paid of $4.0 million. Sustaining maintenance expenditures remained

consistent with the expectations of the 2021 capital maintenance

plan reflecting necessary maintenance in anticipation of our busy

winter season.

BUSINESS UPDATES

Focus & Priorities for the Remainder of

2021

-

Safety - focus on people and relationships as we emerge from the

pandemic, maintain an uncompromising commitment to health and

safety while elevating the standard of excellence in the

field.

-

Sustainability - commitment to the continued development of

sustainability targets and consistent measurement of progress to

those targets.

-

Diversification - continue to pursue further diversification of

customer, resource and geography through strategic partnerships,

industry expertise and/or investment in Indigenous joint

ventures.

-

Execution - enhance our record of operational excellence with

respect to fleet maintenance, availability and utilization through

leverage of our reliability programs, technical improvements and

management systems.

Contract Award and

Extension

On September 14, 2021, we announced a contract

award to Mikisew North American Limited Partnership ("MNALP") by a

major oil sands producer. The contract effectively extends the

existing master service agreement between NACG and the producer to

December 2023 but transitions to MNALP as the contractor. NACG

anticipates the contract to generate approximately $275 million in

revenue for NACG over the term of the agreement.

Increase in Committed Scope from Contract

Amendment

On July 21, 2021, the Company announced a contract

amendment to a multiple use agreement between the Mikisew North

American Limited Partnership and a major oil sands producer. The

agreement has an expiration date of December 2023 and the Company

anticipates its share to be approximately $175 million in

additional revenue over the remainder of the agreement.

Issuance of $75 million of Convertible

Debentures

On June 1, 2021 we closed an offering of 5.50%

convertible unsecured debentures for gross proceeds of $65 million.

On June 4, 2021, underwriters exercised their over-allotment

option, in full, to purchase an additional $9.8 million for

aggregate gross proceeds of $74.8 million. The majority of proceeds

have been deployed to decrease senior debt through reducing the

balance on our credit facility.

Total liquidity of $189.7 million as at

September 30, 2021 represents an increase of $42.1 million

over the December 31, 2020 balance. Liquidity is primarily

provided by the terms of our $325.0 million credit facility which

allows for funds availability based on a trailing twelve-month

EBITDA and is scheduled to expire in October 2023.

Normal Course Issuer Bid

("NCIB")

On April 9, 2021, we commenced a normal course

issuer bid ("NCIB") under which a maximum number of 2,000,000

common shares were authorized to be purchased. During the nine

months ended September 30, 2021, we purchased and subsequently

cancelled 37,000 shares under this NCIB, which resulted in a

decrease of common shares of $0.3 million and a decrease to

additional paid-in capital of $0.2 million. To comply with

applicable securities laws, no more than 1,497,476 voting common

shares will be purchased on the New York Stock Exchange ("NYSE") or

alternative trading systems. This NCIB will be terminated no later

than April 8, 2022.

NACG’s Outlook for 2021-22

Given project visibility, management has decided

to provide stakeholders with guidance through 2022. This guidance

is predicated on projects currently in place and the heavy

equipment fleet that we own and operate.

|

Key measures |

|

2021 |

|

2022 |

|

Adjusted EBITDA |

|

$205 - $215M |

|

$215 - $245M |

|

Sustaining capital |

|

$95 - $105M |

|

$110 - $120M |

|

Adjusted EPS |

|

$1.95 - $2.15 |

|

$2.15 - $2.55 |

|

Free cash flow |

|

$65 - $85M |

|

$95 - $115M |

| |

|

|

|

|

|

Capital allocation measures |

|

|

|

|

|

Deleverage |

|

$15 - $35M |

|

|

|

Share purchases |

|

$17 - $35M |

|

|

|

Growth capital and acquisitions |

|

$25 - $35M |

|

|

| |

|

|

|

|

|

Leverage ratios |

|

|

|

|

|

Senior debt |

|

1.1x - 1.5x |

|

|

|

Net debt |

|

1.7x - 2.1x |

|

|

Conference Call and Webcast

Management will hold a conference call and

webcast to discuss our financial results for the quarter ended

September 30, 2021 tomorrow, Thursday, October 28, 2021 at

7:00 am Mountain Time (9:00 am Eastern Time).

| The call can be accessed by dialing: |

|

Toll free: 1-844-248-9143 |

|

International: 1-216-539-8612 |

|

Conference ID: 3877776 |

| |

| A replay will be available through November 28, 2021, by

dialing: |

|

Toll Free: 1-855-859-2056 |

|

International: 1-404-537-3406 |

|

Conference ID: 3877776 |

The Q3 2021 earnings presentation for the webcast

will be available for download on the company’s website at

www.nacg.ca/presentations/

The live presentation and webcast can be accessed

at:

https://onlinexperiences.com/Launch/QReg/ShowUUID=905E6D5A-D5F0-4582-81D8-BB2022992279

A replay will be available until November 28, 2021

using the link provided.

Basis of Presentation

We have prepared our consolidated financial

statements in conformity with accounting principles generally

accepted in the United States ("US GAAP"). Unless otherwise

specified, all dollar amounts discussed are in Canadian dollars.

Please see the Management’s Discussion and Analysis (“MD&A”)

for the quarter ended September 30, 2021 for further detail on

the matters discussed in this release. In addition to the MD&A,

please reference the dedicated Q3 2021 Results Presentation for

more information on our results and projections which can be found

on our website under Investors - Presentations.

Change in significant accounting policy

- Basis of presentation

Prior to July 1, 2021, we elected to apply the

provision available to entities operating within the construction

industry to apply proportionate consolidation to unincorporated

entities that would otherwise be accounted for using the equity

method. During the three months ended September 30, 2021, we

elected to change this policy to account for these unincorporated

entities using the equity method, resulting in a change to the

consolidation method for Dene North Site Services and Mikisew North

American Limited Partnership. This change allows for consistency in

the presentation of our investments in affiliates and joint

ventures. We have accounted for the change retrospectively

according to the requirements of US GAAP Accounting Standards

Codification ("ASC") 250 by restating the comparative periods. For

full disclosure, refer to note 14 in our Financial Statements for

September 30, 2021.

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

“anticipate”, “believe”, “expect”, “should” or similar

expressions.

The material factors or assumptions used to develop

the above forward-looking statements and the risks and

uncertainties to which such forward-looking statements are subject,

are highlighted in the MD&A for the three and nine months ended

September 30, 2021. Actual results could differ materially from

those contemplated by such forward-looking statements because of

any number of factors and uncertainties, many of which are beyond

NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

Non-GAAP Financial Measures

This press release presents certain non-GAAP

financial measures because management believes that they may be

useful to investors in analyzing our business performance, leverage

and liquidity. The non-GAAP financial measures we present include

"adjusted net earnings", "adjusted EBIT", "equity investment EBIT",

"adjusted EBITDA", "adjusted EBITDA margin", "total combined

revenue", "equity investment depreciation and amortization",

"adjusted EPS", "margin", "net debt", "senior debt", "sustaining

capital", "growth capital", "cash provided by operating activities

prior to change in working capital" and "free cash flow". A

non-GAAP financial measure is defined by relevant regulatory

authorities as a numerical measure of an issuer's historical or

future financial performance, financial position or cash flow that

is not specified, defined or determined under the issuer’s GAAP and

that is not presented in an issuer’s financial statements. These

non-GAAP measures do not have any standardized meaning and

therefore are unlikely to be comparable to similar measures

presented by other companies. They should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. Each non-GAAP financial measure used in

this press release is defined and reconciled to its most directly

comparable GAAP measure in the “Non-GAAP Financial Measures”

section of our Management’s Discussion and Analysis filed

concurrently with this press release.

A reconciliation of total reported revenue

to total combined revenue is as follows:

|

|

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

2021 |

|

2020(ii) |

|

2021 |

|

2020(ii) |

|

Revenue from wholly-owned entities per financial statements |

165,962 |

|

|

93,563 |

|

|

473,142 |

|

|

362,392 |

|

|

Share of revenue from investments in affiliates and joint

ventures |

43,274 |

|

|

25,279 |

|

|

104,186 |

|

|

51,094 |

|

|

Total combined revenue(i) |

$ |

209,236 |

|

|

$ |

118,842 |

|

|

$ |

577,328 |

|

|

$ |

413,486 |

|

(i)See "Non-GAAP Financial Measures"(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in accounting policy - Basis of presentation".

A reconciliation of net income to adjusted

net earnings, adjusted EBIT and adjusted EBITDA is as

follows:

|

|

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

2021 |

|

|

|

2020(iii) |

|

|

|

2021 |

|

|

|

2020(iii) |

|

|

|

Net income |

$ |

13,973 |

|

|

|

$ |

6,830 |

|

|

|

$ |

36,100 |

|

|

|

$ |

39,164 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Loss (gain) on disposal of property, plant and equipment |

264 |

|

|

|

(193 |

) |

|

|

(348 |

) |

|

|

637 |

|

|

|

Stock-based compensation expense (benefit) |

(62 |

) |

|

|

1,756 |

|

|

|

9,963 |

|

|

|

(2,895 |

) |

|

|

Net realized gain on derivative financial instrument |

— |

|

|

|

(551 |

) |

|

|

(2,737 |

) |

|

|

(837 |

) |

|

|

Write-down on assets held for sale |

— |

|

|

|

— |

|

|

|

700 |

|

|

|

1,800 |

|

|

|

Tax effect of the above items |

(48 |

) |

|

|

(391 |

) |

|

|

(2,211 |

) |

|

|

565 |

|

|

|

Adjusted net earnings(i) |

14,127 |

|

|

|

7,451 |

|

|

|

41,467 |

|

|

|

38,434 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Tax effect of the above items |

48 |

|

|

|

391 |

|

|

|

2,211 |

|

|

|

(565 |

) |

|

|

Interest expense, net |

4,845 |

|

|

|

4,428 |

|

|

|

13,782 |

|

|

|

14,221 |

|

|

|

Income tax (benefit) expense |

2,388 |

|

|

|

3,959 |

|

|

|

6,798 |

|

|

|

10,945 |

|

|

|

Equity earnings in affiliates and joint ventures(i) |

(6,833 |

) |

|

|

(5,145 |

) |

|

|

(16,279 |

) |

|

|

(7,810 |

) |

|

|

Equity investment EBIT(i) |

9,489 |

|

|

|

5,345 |

|

|

|

19,544 |

|

|

|

8,609 |

|

|

|

Adjusted EBIT(i) |

24,064 |

|

|

|

16,429 |

|

|

|

67,523 |

|

|

|

63,834 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

21,617 |

|

|

|

19,068 |

|

|

|

79,092 |

|

|

|

63,016 |

|

|

|

Write-down on assets held for sale |

— |

|

|

|

— |

|

|

|

(700 |

) |

|

|

(1,800 |

) |

|

|

Equity investment depreciation and amortization(i) |

1,857 |

|

|

|

1,601 |

|

|

|

5,134 |

|

|

|

4,093 |

|

|

|

Adjusted EBITDA(i) |

47,538 |

|

|

|

37,098 |

|

|

|

151,049 |

|

|

|

129,143 |

|

|

|

Adjusted EBITDA

margin(i)(ii) |

22.7 |

|

% |

|

31.2 |

|

% |

|

26.2 |

|

% |

|

31.2 |

|

% |

(i)See "Non-GAAP Financial Measures". (ii)Adjusted

EBITDA margin is calculated using adjusted EBITDA over total

combined revenue.(iii)The prior year amounts are adjusted to

reflect a change in accounting policy. See "Change in accounting

policy - Basis of presentation".

A reconciliation of equity earnings in

affiliates and joint ventures to equity investment EBIT is as

follows:

| |

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

2021 |

|

|

|

2020(ii) |

|

|

|

2021 |

|

|

2020(ii) |

|

|

Equity earnings in affiliates and joint ventures |

$ |

6,833 |

|

|

|

$ |

5,145 |

|

|

|

$ |

16,279 |

|

|

$ |

7,810 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Interest (income) expense, net |

(94 |

) |

|

|

79 |

|

|

|

70 |

|

|

227 |

|

|

Income tax expense |

2,768 |

|

|

|

193 |

|

|

|

3,081 |

|

|

249 |

|

|

(Gain) loss on disposal of property, plant and equipment |

(18 |

) |

|

|

(72 |

) |

|

|

114 |

|

|

323 |

|

|

Equity investment EBIT(i) |

$ |

9,489 |

|

|

|

$ |

5,345 |

|

|

|

$ |

19,544 |

|

|

$ |

8,609 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in accounting policy - Basis of presentation".

About the Company

North American Construction Group Ltd.

(www.nacg.ca) is one of Canada’s largest providers of heavy

construction and mining services. For more than 65 years, NACG has

provided services to the mining, resource, and infrastructure

construction markets.

For further information contact:

Jason Veenstra, CPA, CAChief Financial OfficerNorth

American Construction Group Ltd.(780)

948-2009jveenstra@nacg.cawww.nacg.ca

Interim Consolidated Balance

Sheets

(Expressed in thousands of Canadian

Dollars)(Unaudited)

|

|

September 30,2021 |

|

December 30, 2021(i) |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash |

$ |

15,021 |

|

|

|

$ |

43,447 |

|

|

|

Accounts receivable |

66,427 |

|

|

|

36,231 |

|

|

|

Contract assets |

10,512 |

|

|

|

7,008 |

|

|

|

Inventories |

49,352 |

|

|

|

19,151 |

|

|

|

Prepaid expenses and deposits |

6,542 |

|

|

|

4,977 |

|

|

|

Assets held for sale |

723 |

|

|

|

4,129 |

|

|

|

Derivative financial instruments |

— |

|

|

|

4,334 |

|

|

|

|

148,577 |

|

|

|

119,277 |

|

|

|

Property, plant and equipment, net of accumulated depreciation of

$331,617 (December 31, 2020 – $302,682) |

646,256 |

|

|

|

632,210 |

|

|

|

Operating lease right-of-use assets |

15,820 |

|

|

|

18,192 |

|

|

|

Investments in affiliates and joint ventures |

52,936 |

|

|

|

46,263 |

|

|

|

Other assets |

7,355 |

|

|

|

6,336 |

|

|

|

Goodwill and intangible assets |

3,988 |

|

|

|

378 |

|

|

|

Deferred tax assets |

— |

|

|

|

16,407 |

|

|

|

Total assets |

$ |

874,932 |

|

|

|

$ |

839,063 |

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

70,787 |

|

|

|

$ |

41,428 |

|

|

|

Accrued liabilities |

23,833 |

|

|

|

19,382 |

|

|

|

Contract liabilities |

1,892 |

|

|

|

1,512 |

|

|

|

Current portion of long-term debt |

19,540 |

|

|

|

16,263 |

|

|

|

Current portion of finance lease obligations |

26,416 |

|

|

|

26,895 |

|

|

|

Current portion of operating lease liabilities |

3,333 |

|

|

|

4,004 |

|

|

|

|

145,801 |

|

|

|

109,484 |

|

|

|

Long-term debt |

337,609 |

|

|

|

341,396 |

|

|

|

Finance lease obligations |

35,584 |

|

|

|

42,577 |

|

|

|

Operating lease liabilities |

12,475 |

|

|

|

14,118 |

|

|

|

Other long-term obligations |

26,426 |

|

|

|

18,850 |

|

|

|

Deferred tax liabilities |

54,014 |

|

|

|

64,195 |

|

|

|

|

611,909 |

|

|

|

590,620 |

|

|

|

Shareholders' equity |

|

|

|

|

Common shares (authorized – unlimited number of voting common

shares; issued and outstanding – September 30, 2021 - 30,002,028

(December 31, 2020 – 31,011,831)) |

246,815 |

|

|

|

255,064 |

|

|

|

Treasury shares (September 30, 2021 - 1,561,696 (December 31, 2020

- 1,845,201)) |

(17,735 |

) |

|

|

(18,002 |

) |

|

|

Additional paid-in capital |

36,257 |

|

|

|

46,536 |

|

|

|

Deficit |

(2,308 |

) |

|

|

(35,155 |

) |

|

|

Accumulated other comprehensive loss |

(6 |

) |

|

|

— |

|

|

|

Shareholders' equity |

263,023 |

|

|

|

248,443 |

|

|

|

Total liabilities and shareholders’ equity |

$ |

874,932 |

|

|

|

$ |

839,063 |

|

|

(i)The prior year amounts are adjusted to reflect a

change in accounting policy. See "Change in accounting policy -

Basis of presentation".

Interim Consolidated Statements of

Operations and Comprehensive Income

(Expressed in thousands of Canadian Dollars, except

per share amounts)(Unaudited)

| |

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

|

2021 |

|

|

|

2020(i) |

|

|

|

2021 |

|

|

|

2020(i) |

|

|

|

Revenue |

$ |

165,962 |

|

|

|

$ |

93,563 |

|

|

|

$ |

473,142 |

|

|

|

$ |

362,392 |

|

|

|

Project costs |

63,301 |

|

|

|

27,841 |

|

|

|

155,460 |

|

|

|

100,789 |

|

|

|

Equipment costs |

59,524 |

|

|

|

32,095 |

|

|

|

171,363 |

|

|

|

129,419 |

|

|

|

Depreciation |

21,426 |

|

|

|

18,845 |

|

|

|

78,966 |

|

|

|

62,534 |

|

|

|

Gross profit |

21,711 |

|

|

|

14,782 |

|

|

|

67,353 |

|

|

|

69,650 |

|

|

|

General and administrative expenses |

7,074 |

|

|

|

5,454 |

|

|

|

30,037 |

|

|

|

13,330 |

|

|

|

Loss (gain) on disposal of property, plant and equipment |

264 |

|

|

|

(193 |

) |

|

|

(348 |

) |

|

|

637 |

|

|

|

Operating income |

14,373 |

|

|

|

9,521 |

|

|

|

37,664 |

|

|

|

55,683 |

|

|

|

Interest expense, net |

4,845 |

|

|

|

4,428 |

|

|

|

13,782 |

|

|

|

14,221 |

|

|

|

Equity earnings in affiliates and joint ventures |

(6,833 |

) |

|

|

(5,145 |

) |

|

|

(16,279 |

) |

|

|

(7,810 |

) |

|

|

Net realized gain on derivative financial instrument |

— |

|

|

|

(551 |

) |

|

|

(2,737 |

) |

|

|

(837 |

) |

|

|

Income before income taxes |

16,361 |

|

|

|

10,789 |

|

|

|

42,898 |

|

|

|

50,109 |

|

|

|

Current income tax expense |

572 |

|

|

|

470 |

|

|

|

572 |

|

|

|

487 |

|

|

|

Deferred income tax expense |

1,816 |

|

|

|

3,489 |

|

|

|

6,226 |

|

|

|

10,458 |

|

|

|

Net income |

13,973 |

|

|

|

6,830 |

|

|

|

36,100 |

|

|

|

39,164 |

|

|

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

Unrealized foreign currency translation loss |

6 |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

Comprehensive income |

$ |

13,967 |

|

|

|

$ |

6,830 |

|

|

|

$ |

36,094 |

|

|

|

$ |

39,164 |

|

|

|

Per share information |

|

|

|

|

|

|

|

|

Basic net income per share |

$ |

0.49 |

|

|

|

$ |

0.23 |

|

|

|

$ |

1.28 |

|

|

|

$ |

1.41 |

|

|

|

Diluted net income per share |

$ |

0.44 |

|

|

|

$ |

0.22 |

|

|

|

$ |

1.16 |

|

|

|

$ |

1.28 |

|

|

(i)The prior year amounts are adjusted to reflect a

change in accounting policy. See "Change in accounting policy -

Basis of presentation".

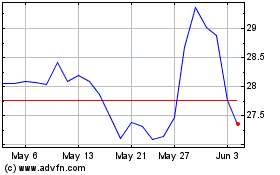

North American Construct... (TSX:NOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

North American Construct... (TSX:NOA)

Historical Stock Chart

From Dec 2023 to Dec 2024