Northland Power Inc. (

“Northland” or the

“Company”) (TSX:

NPI) reported

today financial results for the three and nine months ended

September 30, 2023. All dollar amounts set out herein are in

thousands of Canadian dollars, unless otherwise stated.

“Our third quarter financial results were solid

and in line with our expectations. We are maintaining the low end

of our Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow

guidance for 2023. Despite the regulatory changes in Spain last

quarter and the challenges in the economy more broadly, we expect

to deliver solid financial and operating results this year, as a

result of positive offsets from other planned activities, including

sell-downs. Notwithstanding recent challenges experienced in the

offshore wind sector, we delivered on two very significant

milestones this quarter for the Company, having achieved financial

close on our two offshore wind projects, Hai Long and Baltic Power.

Through achieving these milestones, our global team demonstrated

again that we have the capability and expertise to develop and

finance complex, large-scale projects in multiple jurisdictions.

Having achieved financial close of Hai Long, our team is now

working on closing the final element of the funding plan, being the

49% sell down transaction to Gentari,” Mike Crawley, Northland’s

President and Chief Executive Officer noted.

Third Quarter Highlights

Financial results for the three months ended

September 30, 2023 were lower compared to the same quarter of 2022,

primarily due to the non-recurrence of the unprecedented spike in

market prices in Europe realized in 2022, partially offset by

higher band adjustment revenue generated from Northland’s Spanish

portfolio.

Financial Results

-

Sales decreased to $513 million from $556 million

in 2022.

- Gross

Profit decreased to $458 million from $484 million in

2022.

- Adjusted

EBITDA (a non-IFRS measure) decreased to $267 million from

$290 million in 2022.

- Adjusted

Free Cash Flow per share (a non-IFRS measure) decreased to

$0.25 from $0.28 in 2022.

- Free

Cash Flow per share (a non-IFRS measure) decreased to

$0.14 from $0.19 in 2022.

- Net

income decreased to $43 million from $76 million in

2022.

Sales, gross profit, operating income and net

income, as reported under IFRS, include consolidated results of

entities not wholly owned by Northland, whereas Northland’s

non-IFRS financial measures include only Northland’s proportionate

ownership interest.

|

Summary of Consolidated Results |

|

|

|

|

|

|

| (in thousands of

dollars, except per share amounts) |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

FINANCIALS |

|

|

|

|

|

|

|

| |

Sales |

$ |

513,290 |

|

$ |

555,854 |

|

$ |

1,606,558 |

|

$ |

1,807,700 |

| |

Gross profit |

|

458,316 |

|

|

484,103 |

|

|

1,454,687 |

|

|

1,604,818 |

| |

Operating income |

|

146,188 |

|

|

201,814 |

|

|

521,355 |

|

|

780,990 |

| |

Net income (loss) |

|

42,987 |

|

|

76,089 |

|

|

171,786 |

|

|

631,535 |

| |

Net income (loss) attributable

to common shareholders |

|

36,166 |

|

|

81,661 |

|

|

110,401 |

|

|

548,835 |

| |

Adjusted EBITDA (a non-IFRS

measure) (2) |

|

267,258 |

|

|

289,763 |

|

|

851,212 |

|

|

1,045,105 |

| |

|

|

|

|

|

|

|

|

| |

Cash provided by operating

activities |

|

148,005 |

|

|

523,338 |

|

|

649,345 |

|

|

1,282,294 |

| |

Adjusted Free Cash Flow (a

non-IFRS measure) (2) |

|

63,917 |

|

|

66,367 |

|

|

306,690 |

|

|

420,362 |

| |

Free Cash Flow (a non-IFRS

measure) (2) |

|

36,316 |

|

|

44,670 |

|

|

232,297 |

|

|

364,588 |

| |

Cash dividends paid |

|

52,137 |

|

|

49,673 |

|

|

153,332 |

|

|

145,508 |

| |

Total dividends declared

(1) |

$ |

76,036 |

|

$ |

71,957 |

|

$ |

227,101 |

|

$ |

210,410 |

| |

|

|

|

|

|

|

|

|

| Per

Share |

|

|

|

|

|

|

|

| |

Weighted average number of

shares — basic and diluted (000s) |

|

253,279 |

|

|

238,011 |

|

|

252,152 |

|

|

232,712 |

| |

Net income (loss) attributable

to common shareholders — basic and diluted |

$ |

0.14 |

|

$ |

0.33 |

|

$ |

0.42 |

|

$ |

2.32 |

| |

Adjusted Free Cash Flow —

basic (a non-IFRS measure) (2) |

$ |

0.25 |

|

$ |

0.28 |

|

$ |

1.22 |

|

$ |

1.81 |

| |

Free Cash Flow — basic (a

non-IFRS measure) |

$ |

0.14 |

|

$ |

0.19 |

|

$ |

0.92 |

|

$ |

1.57 |

| |

Total dividends declared |

$ |

0.30 |

|

$ |

0.30 |

|

$ |

0.90 |

|

$ |

0.90 |

| |

|

|

|

|

|

|

|

|

| ENERGY

VOLUMES |

|

|

|

|

|

|

|

|

|

Electricity production in gigawatt hours

(GWh) |

|

2,172 |

|

|

2,129 |

|

|

7,027 |

|

|

7,130 |

| (1) Represents

total dividends paid to common shareholders, including dividends in

cash or in shares under the DRIP. |

|

(2) See Forward-Looking Statements and Non-IFRS Financial Measures

below. Further, note that non-IFRS measures during the three and

nine months ended September 30, 2023, include the effect of changes

in the definition of non-IFRS measures. For a reconciliation of

these non-IFRS financial measures to the same measures before the

definition changes, please refer to Northland’s Management’s

Discussion and Analysis (“MD&A”) for the three

and nine months ended September 30, 2023. |

Third Quarter Results Summary

Offshore wind facilities

Electricity production for the three months

ended September 30, 2023, slightly increased by 2% or 14GWh

compared to the same quarter of 2022. This was primarily due to

higher wind resource at Gemini and higher turbine availability at

Nordsee One following the completion of the rotor shaft assembly

(“RSA”) replacement campaign in 2022, partially

offset by lower wind resource and higher unpaid curtailments

related to negative prices at German offshore wind facilities.

Sales of $232 million for the three months ended

September 30, 2023, decreased 16% or $46 million compared to the

same quarter of 2022, primarily due to the non-recurrence of the

unprecedented spike in market prices realized in 2022 of $75

million. This decline was partially offset by higher turbine

availability at Nordsee One following the completion of the RSA

replacement campaign in 2022, and the effect of foreign exchange

fluctuations due to the strengthening of the Euro and other items

by $30 million.

Adjusted EBITDA of $126 million for the three

months ended September 30, 2023, decreased 28% or $50 million

compared to the same quarter of 2022, due to the same factors as

noted above.

An important indicator for performance of

offshore wind facilities is the current and historical average

power production of the facility. The following tables summarize

actual electricity production and the historical average, high and

low, for the applicable operating periods of each offshore

facility:

|

Three months ended September 30, |

2023 (1) |

|

2022 (1) |

|

HistoricalAverage (2) |

|

Historical High

(2) |

|

Historical Low

(2) |

|

Electricity production (GWh) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Gemini |

467 |

|

436 |

|

449 |

|

524 |

|

397 |

| Nordsee One |

176 |

|

179 |

|

190 |

|

220 |

|

173 |

|

Deutsche Bucht |

172 |

|

185 |

|

173 |

|

185 |

|

164 |

|

Total |

815 |

|

800 |

|

|

|

|

|

|

| (1) Includes GWh

produced and attributed to paid curtailments. |

| (2) Represents the

historical power production for the period since the commencement

of commercial operation of the respective facility (2017 for Gemini

and Nordsee One and 2020 for Deutsche Bucht) and excludes unpaid

curtailments. |

Onshore renewable facilities

Electricity production was 12% or 59GWh lower

than the same quarter of 2022, primarily due to lower wind resource

across the Canadian and Spanish onshore wind facilities, partially

offset by higher solar resource at these facilities.

Sales of $118 million were 25% or $23 million

higher than the same quarter of 2022, primarily due to the increase

in band adjustments by $47 million as a result of the regulated

posted price being higher than the merchant pool price in 2023,

partially offset by the aggregate decrease in merchant revenue and

return on investment (“Ri”) by $24 million from the Spanish

portfolio. Please refer to the MD&A for further breakdown of

Spanish portfolio revenue by component.

Adjusted EBITDA of $88 million was 45% or $27

million higher than the same quarter of 2022, due to the same

factors as above.

Adjusted EBITDA from the Spanish portfolio of

$54 million for the three months ended September 30, 2023,

increased 116% or $29 million compared to the same quarter of 2022,

due to the same factors discussed above. Free Cash Flow from the

Spanish portfolio of $16 million for the three months ended

September 30, 2023, increased by $22 million compared to the same

quarter of 2022, due to the same factors discussed above.

Efficient natural gas facilities

Electricity production increased 10% or 88GWh

compared to the same quarter of 2022, mainly due to higher market

demand for dispatchable power.

Sales of $81 million decreased 27% or $31

million compared to the same quarter of 2022, primarily due to

lower natural gas prices resulting in lower energy rates affecting

revenue, and lower margins triggered by unplanned outages.

Adjusted EBITDA of $46 million for the three

months ended September 30, 2023, decreased 12% or $6 million,

compared to the same quarter of 2022, primarily due to lower

management fee income from Kirkland Lake, in addition to the same

factors as above.

Utility

Sales of $78 million for the three months ended

September 30, 2023, increased 12% or $8 million compared to the

same quarter of 2022, primarily due to the foreign exchange

fluctuations as a result of the strengthening of the Colombian

Peso.

Adjusted EBITDA of $30 million for the three

months ended September 30, 2023, remained in line with the same

quarter of 2022.

Consolidated statement of income (loss)

General and administrative

(“G&A”) costs of $22 million in the third

quarter increased $3 million compared to the same quarter of 2022,

primarily due to increased costs and resources to support

Northland’s projects and global platform and additional projects

entering operation during the period, including La Lucha.

Development costs of $35 million increased $13

million compared to the same quarter of 2022, primarily due to

timing of spending to advance development projects.

Net finance costs of $72 million in the third

quarter decreased $5 million compared to the same quarter of 2022,

primarily due to scheduled repayments on facility-level loans and

higher loan repayments related to loan restructurings that occurred

in 2022.

Fair value loss on derivative contracts was $46

million compared to a $43 million loss in the same quarter of 2022,

primarily due to net movement in the fair value of derivatives

related to commodity, interest rate and foreign exchange

contracts.

Foreign exchange gain of $12 million in the

third quarter was primarily due to unrealized gain from

fluctuations in the closing foreign exchange rates.

Other income of $20 million increased by $19

million compared to the same quarter of 2022, primarily due to the

gains associated with the partial sell-down of development assets

in the third quarter of 2023.

Net income of $43 million in the third quarter

decreased by $33 million compared to the same quarter of 2022,

primarily as a result of the factors described above.

Adjusted EBITDA

The following table reconciles net income (loss)

to Adjusted EBITDA:

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income (loss) |

$ |

42,987 |

|

|

$ |

76,089 |

|

|

$ |

171,786 |

|

|

$ |

631,535 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Finance costs, net |

|

72,421 |

|

|

|

77,814 |

|

|

|

210,699 |

|

|

|

237,054 |

|

|

Gemini interest income |

|

(150 |

) |

|

|

3,344 |

|

|

|

6,112 |

|

|

|

10,800 |

|

|

Provision for (recovery of) income taxes |

|

18,682 |

|

|

|

47,410 |

|

|

|

94,706 |

|

|

|

233,672 |

|

|

Depreciation of property, plant and equipment |

|

147,924 |

|

|

|

132,416 |

|

|

|

438,981 |

|

|

|

424,445 |

|

|

Amortization of contracts and intangible assets |

|

14,463 |

|

|

|

14,042 |

|

|

|

42,505 |

|

|

|

39,645 |

|

|

Fair value (gain) loss on derivative contracts |

|

43,711 |

|

|

|

38,238 |

|

|

|

106,714 |

|

|

|

(334,937 |

) |

|

Foreign exchange (gain) loss |

|

(11,514 |

) |

|

|

(39,668 |

) |

|

|

(36,162 |

) |

|

|

27,281 |

|

|

Elimination of non-controlling interests |

|

(53,380 |

) |

|

|

(56,897 |

) |

|

|

(186,389 |

) |

|

|

(198,715 |

) |

|

Finance lease (lessor) |

|

(1,349 |

) |

|

|

(1,563 |

) |

|

|

(4,318 |

) |

|

|

(4,841 |

) |

|

Others (1) |

|

(6,537 |

) |

|

|

(1,462 |

) |

|

|

6,578 |

|

|

|

(20,834 |

) |

|

Adjusted EBITDA (2) |

$ |

267,258 |

|

|

$ |

289,763 |

|

|

$ |

851,212 |

|

|

$ |

1,045,105 |

|

| (1) Others

primarily include Northland’s share of profit (loss) from equity

accounted investees, Northland’s share of Adjusted EBITDA from

equity accounted investees, gains from partial asset sell-downs,

acquisition costs and other expenses (income). |

| (2) See

Forward-Looking Statements and Non-IFRS Financial Measures below.

Further, note that non-IFRS measures during the three and nine

months ended September 30, 2023, include the effect of changes in

the definition of non-IFRS measures. For a reconciliation of these

non-IFRS financial measures to the same measures before the

definition changes, please refer to the MD&A. |

Adjusted EBITDA of $267 million for the three

months ended September 30, 2023, decreased 8% or $23 million

compared to the same quarter of 2022. The significant factors

decreasing Adjusted EBITDA include:

- $50 million

decrease in operating results at the offshore wind facilities

primarily due to the non-recurrence of the unprecedented spike in

market prices realized in 2022. This decline was partially offset

by higher turbine availability at Nordsee One following the

completion of the RSA replacement campaign in 2022 and the effect

of foreign exchange fluctuations due to the strengthening of the

Euro and other items; and

- $14 million

increase in G&A costs and development expenditures, primarily

due to higher administrative costs to support the sustainable

operations and the latter driven by timing of spend.

The factors partially offsetting the decrease in

the Adjusted EBITDA were:

- $29 million

increase in the contribution from the Spanish renewables portfolio,

as discussed above; and

- $19 million in

gains from partial sell-down of development assets.

Adjusted Free Cash Flow and Free Cash Flow

The following table reconciles cash flow from

operations to Adjusted Free Cash Flow and Free Cash Flow:

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash provided by operating activities |

$ |

148,005 |

|

|

$ |

523,338 |

|

|

$ |

649,345 |

|

|

$ |

1,282,294 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Net change in non-cash working capital balances related to

operations |

|

99,938 |

|

|

|

(189,623 |

) |

|

|

234,963 |

|

|

|

(148,631 |

) |

|

Non-expansionary capital expenditures |

|

(369 |

) |

|

|

(14,263 |

) |

|

|

(1,268 |

) |

|

|

(45,573 |

) |

|

Restricted funding for major maintenance, debt and decommissioning

reserves |

|

(582 |

) |

|

|

(228 |

) |

|

|

(3,235 |

) |

|

|

(11,326 |

) |

|

Interest |

|

(43,341 |

) |

|

|

(75,396 |

) |

|

|

(182,951 |

) |

|

|

(223,429 |

) |

|

Scheduled principal repayments on facility debt |

|

(55,677 |

) |

|

|

(52,044 |

) |

|

|

(381,319 |

) |

|

|

(400,429 |

) |

|

Funds set aside (utilized) for scheduled principal repayments |

|

(149,854 |

) |

|

|

(153,735 |

) |

|

|

(158,020 |

) |

|

|

(170,661 |

) |

|

Preferred share dividends |

|

(1,527 |

) |

|

|

(2,811 |

) |

|

|

(4,530 |

) |

|

|

(8,252 |

) |

|

Consolidation of non-controlling interests |

|

(3,533 |

) |

|

|

(1,707 |

) |

|

|

(65,186 |

) |

|

|

(43,513 |

) |

|

Investment income (1) |

|

5,041 |

|

|

|

4,268 |

|

|

|

22,311 |

|

|

|

12,666 |

|

|

Proceeds under NER300 and warranty settlement at Nordsee One |

|

— |

|

|

|

16,911 |

|

|

|

— |

|

|

|

55,787 |

|

|

Others (2) |

|

38,215 |

|

|

|

(10,040 |

) |

|

|

122,187 |

|

|

|

65,655 |

|

|

Free Cash Flow (3) |

$ |

36,316 |

|

|

$ |

44,670 |

|

|

$ |

232,297 |

|

|

$ |

364,588 |

|

|

Add back: Growth expenditures |

|

31,914 |

|

|

|

21,697 |

|

|

|

86,151 |

|

|

|

55,774 |

|

|

Less: Historical growth expenditures’ recovery due

to sell-down |

|

(4,313 |

) |

|

|

— |

|

|

|

(11,758 |

) |

|

|

— |

|

|

Adjusted Free Cash Flow (3) |

$ |

63,917 |

|

|

$ |

66,367 |

|

|

$ |

306,690 |

|

|

$ |

420,362 |

|

| (1) Investment

income includes Gemini interest income and repayment of Gemini

subordinated debt. |

| (2) Others mainly

include the effect of foreign exchange rates and hedges, interest

rate hedge, Nordsee One interest on shareholder loans, share of

joint venture project development costs, acquisition costs, lease

payments, interest income, Northland’s share of Adjusted Free Cash

Flow from equity accounted investees, gains from sales of

development assets, interest on corporate-level debt raised to

finance capitalized growth projects and other non-cash expenses

adjusted in working capital excluded from Free Cash Flow in the

period. |

| (3) See

Forward-Looking Statements and Non-IFRS Financial Measures below.

Further, note that non-IFRS measures during the three and nine

months ended September 30, 2023, include the effect of changes in

the definition of non-IFRS measures. For a reconciliation of these

non-IFRS financial measures to the same measures before the

definition changes, please refer to the MD&A. |

Adjusted Free Cash Flow of $64 million for the

three months ended September 30, 2023, was 4% or $2 million lower

than the same quarter of 2022.

The significant factors decreasing Adjusted Free

Cash Flow were:

- $23 million

decrease in contribution from the operating facilities leading to

lower Adjusted EBITDA primarily due to the factors described above;

and

- $10 million

decrease primarily as a result of higher net proceeds from the

Empresa de Energía de Boyacá S.A E.S.P (“EBSA”)

refinancing recognized in 2022.

The factors partially offsetting the decrease in

Adjusted Free Cash Flow were:

- $16 million

gains from partial asset sales of offshore wind development assets

and foreign exchange hedge settlements; and

- $18 million

decrease in net finance costs primarily due to scheduled repayments

on facility-level loans and higher loan repayments related to loan

restructurings in 2022.

Free Cash Flow, which is reduced by growth

expenditures, totaled $36 million for the three months ended

September 30, 2023, and was 19% or $8 million lower than the same

quarter of 2022, due to the same factors as Adjusted Free Cash

Flow.

The following table reconciles Adjusted EBITDA

to Adjusted Free Cash Flow.

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Adjusted EBITDA (2) |

$ |

267,258 |

|

|

$ |

289,763 |

|

|

$ |

851,212 |

|

|

$ |

1,045,105 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Scheduled debt repayments |

|

(166,900 |

) |

|

|

(163,945 |

) |

|

|

(450,443 |

) |

|

|

(459,499 |

) |

|

Interest expense |

|

(43,859 |

) |

|

|

(61,808 |

) |

|

|

(143,019 |

) |

|

|

(183,112 |

) |

|

Current taxes |

|

(26,212 |

) |

|

|

(33,535 |

) |

|

|

(90,902 |

) |

|

|

(122,644 |

) |

|

Non-expansionary capital expenditure |

|

(358 |

) |

|

|

(12,160 |

) |

|

|

(1,078 |

) |

|

|

(38,828 |

) |

|

Utilization (funding) of maintenance and decommissioning

reserves |

|

(583 |

) |

|

|

(228 |

) |

|

|

(3,228 |

) |

|

|

(10,458 |

) |

|

Lease payments, including principal and interest |

|

(1,783 |

) |

|

|

(4,234 |

) |

|

|

(6,312 |

) |

|

|

(7,357 |

) |

|

Preferred dividends |

|

(1,526 |

) |

|

|

(2,811 |

) |

|

|

(4,529 |

) |

|

|

(8,252 |

) |

|

Foreign exchange hedge gain (loss) |

|

747 |

|

|

|

8,125 |

|

|

|

31,035 |

|

|

|

56,216 |

|

|

Proceeds under NER300 and warranty settlement at Nordsee One |

|

— |

|

|

|

14,376 |

|

|

|

— |

|

|

|

47,420 |

|

|

EBSA Refinancing proceeds, net of growth capital expenditures |

|

— |

|

|

|

10,119 |

|

|

|

— |

|

|

|

26,896 |

|

|

Others (1) |

|

9,532 |

|

|

|

1,008 |

|

|

|

49,561 |

|

|

|

19,101 |

|

|

Free Cash Flow (2) |

$ |

36,316 |

|

|

$ |

44,670 |

|

|

$ |

232,297 |

|

|

$ |

364,588 |

|

|

Add Back: Growth expenditures |

|

31,914 |

|

|

|

21,697 |

|

|

|

86,151 |

|

|

|

55,774 |

|

|

Less: Historical growth expenditures’ recovery due

to sell-down |

|

(4,313 |

) |

|

|

— |

|

|

|

(11,758 |

) |

|

|

— |

|

|

Adjusted Free Cash Flow (2) |

$ |

63,917 |

|

|

$ |

66,367 |

|

|

$ |

306,690 |

|

|

$ |

420,362 |

|

| (1) Others mainly

include Gemini interest income, repayment of Gemini subordinated

debt, interest rate hedge settlement, gains from sales of

development assets, and interest received on third-party loans to

partners. |

| (2) See

Forward-Looking Statements and Non-IFRS Financial Measures below.

Further, note that non-IFRS measures during the three and nine

months ended September 30, 2023, include the effect of changes in

the definition of non-IFRS measures. For a reconciliation of these

non-IFRS financial measures to the same measures before the

definition changes, please refer to the MD&A. |

Significant Events and Updates

Balance Sheet:

-

At-The-Market Equity Program – The Company’s

“at-the-market” equity program (“ATM program”) was

terminated in accordance with its terms upon the expiry of the

Company’s short form base shelf prospectus on July 16, 2023. During

the third quarter of 2023, there was no activity under the ATM

program.

Renewables Growth:

- Hai Long

Offshore Wind Project – During the third quarter,

Northland successfully closed its NTD117 billion (equivalent to $5

billion) long term, over 20-year non-recourse green financing,

which will be provided by international and local lenders with

support from multiple Export Credit Agencies

(“ECAs”). The Hai Long project’s total cost is

projected to be approximately $9 billion, with funding from $5

billion of non-recourse debt by the project lenders, approximately

$1 billion of pre-completion revenues and the remaining equity

investment contributed by the project’s partners. Northland’s

interest (post targeted sell-down to Gentari International

Renewables Pte. Ltd. (“Gentari”)) in Hai Long is

expected to generate a five-year average of approximately $230 to

$250 million of Adjusted EBITDA and $75 to $85 million of Free Cash

Flow per year once operational, delivering significant long-term

value for Northland’s shareholders. The weighted average all-in

interest cost for the term of the financing is approximately 5% per

annum. Northland’s equity investment has and will be funded through

proceeds raised under its ATM program in 2022 and the anticipated

sale of its 49% interest to Gentari, which is discussed below, and

in the Outlook sections of this press release.On December 14, 2022,

Northland signed an agreement with Gentari to sell 49% of its

current 60% ownership stake in Hai Long (the “Gentari

Sell-Down”). Northland is targeting to close Gentari

Sell-Down in the fourth quarter of 2023, subject to the

satisfaction of certain closing conditions, which also include

meeting requirements under the existing multi-party project finance

agreements. Subject to closing, the transaction will result in

Gentari holding a 29.4% indirect equity interest in Hai Long. The

proposed sell-down is consistent with Northland’s long-term

financing strategy and will allow Northland to share development

costs for Hai Long with its joint venture partners. Northland will

hold a 30.6% interest in the project upon closing of the

transaction and will continue to take the lead role in the

construction and operation phases of the project.The Hai Long

project continues to advance its construction activities.

Completion of construction activities and full commercial

operations are expected in 2026/2027.

- Baltic

Power Offshore Wind Project – During the third quarter,

Northland closed an equivalent of $5.2 billion, 20-year

non-recourse green financing, which will be supported by a

consortium of international and local commercial banks, and

multiple ECAs and multi-lateral agencies. The Baltic Power

project’s total cost is projected to be approximately $6.5 billion,

with funding from its $5.2 billion of non-recourse debt by the

project lenders and remaining capital to be contributed by the

project partners. Northland’s share of equity for the project was

fully funded through the $500 million of Fixed-to-Fixed Rate Green

Subordinated Notes, Series 2023-A, due June 30, 2083 (the

“Green Notes”)

issuance in June 2023 and existing corporate liquidity. Northland’s

interest in Baltic Power is expected to generate a high quality,

inflation-protected five-year average Adjusted EBITDA of

approximately $300 to $320 million and $95 to $105 million of Free

Cash Flow per year once operational, delivering significant

long-term cash flow for Northland’s shareholders.The weighted

average all-in interest cost for the term of the financing is

approximately 5% per annum. In addition, Northland has entered into

currency hedges to stabilize the Canadian dollar equivalent for the

majority of its projected distributions through 2038 and will enter

into additional hedges on an ongoing basis, in line with the

Northland’s risk management policies.

- New York

Onshore Wind Projects – On October 31, 2023, the 112MW

Bluestone and 108MW Ball Hill onshore wind projects have commenced

earning revenue under the 20-year PPA with the New York State

Energy Research and Development Authority

(“NYSERDA”). These projects are expected to

contribute an aggregate of $42 million and $15 million of Adjusted

EBITDA and Free Cash Flow, respectively, towards Northland’s 2024

financial results.

- NorthWind and CanWind

Offshore Wind Projects – During the third quarter of 2023,

Northland executed an investment partnership agreement with Gentari

resulting in the completion of a 49% stake sell-down in early-stage

offshore wind development projects in Taiwan: NorthWind and

CanWind. The partnership with Gentari is an extension of the

agreement formed in December 2022, as related to Hai Long, as

discussed above. The transaction resulted in Gentari holding a 49%

indirect equity interest in these projects, and Northland holding a

51% interest.

Outlook on 2023 Funding Plan

Northland’s focus is on successfully

constructing the Oneida energy storage project, and Baltic Power

and Hai Long offshore wind projects.

These projects represent an aggregate equity

investment by Northland of $1.75 billion, net of the Gentari

Sell-Down transaction. Northland had access to $563 million of

available liquidity at September 30, 2023, including $63 million of

cash on hand and approximately $500 million of capacity on its

corporate revolving credit facilities.

Northland also has a $500 million short-term

corporate credit facility (“Short Term Facility”)

to help fund its equity contribution in Hai Long, of which $344

million was utilized at September 30, 2023. This facility matures

at the end of November 2023 and is expected to be repaid upon

receipt of the proceeds from the Gentari Sell-Down transaction,

which management is targeting to close in the fourth quarter of

2023, upon certain closing conditions being met, as discussed

above. In the event that the Gentari Sell-Down is delayed due to

satisfying closing conditions taking more time than planned, the

facility may need to be extended or re-financed. In addition,

Northland has secured a $1.0 billion Hai Long related corporate LC

facility to support Hai Long credit requirements during

construction. Northland’s Hai Long related letter of credit

obligations and this facility would decrease by 49% upon closing of

the Gentari Sell-Down.

2023 and Long-term Outlook

As of November 9, 2023, management has

reiterated its 2023 financial outlook. Adjusted EBITDA in 2023 is

expected to be at the low end of original guidance of $1.2 billion

to $1.3 billion. Adjusted Free Cash Flow and Free Cash Flow per

share in 2023 are also expected to be at the low end of our

previously communicated ranges of $1.70 to $1.90 and $1.30 to

$1.50, respectively. The ranges for Adjusted EBITDA, Adjusted Free

Cash Flow and Free Cash Flow include sell-down gains.

Northland continues to implement a selective

partnership strategy to sell interests in certain development

projects on or before financial close. The Company will assess each

opportunity individually and intends to remain a long-term owner of

the renewable power assets it develops.

Over the longer term, Northland remains

positioned to achieve substantial growth in Adjusted EBITDA by

2027, upon achieving targeted commercial operations of Oneida,

Baltic Power and Hai Long, each with long-term contracted revenues

of between 20 to 30 years.

Once all three projects are fully operational,

anticipated by 2027, they are expected to collectively generate an

aggregate Adjusted EBITDA and Free Cash Flow of $570 to $615

million and $185 to $210 million, respectively, resulting in

significant value creation and accretion for Northland’s

shareholders.

With over 3 gigawatts (GW) of gross operating

capacity and a robust development pipeline of approximately 15GW,

with 2.4GW being under construction and expected to be operational

by 2026/2027, the Company is well positioned for an accelerating

global energy transition. Northland intends to be selective and

pursue only projects within its pipeline that meet its strategic

objectives and targeted returns and closely monitor macroeconomic

conditions surrounding renewables development globally.

Third-Quarter Earnings Conference Call

Northland will hold an earnings conference call

on November 10, 2023, to discuss its 2023 third quarter

results. The call will be hosted by Northland’s Senior Management,

who will discuss the Company’s financial results and developments

as well as answering questions from analysts.

Conference call details are as follows:

Friday, November 10, 2023, 10:00 a.m. ET

Participants wishing to join the call and ask

questions must register using the following URL below:

https://register.vevent.com/register/BIb14b87ba5135410fb9fed115bde5d406

For all other attendees, the call will be

broadcast live on the internet, in listen-only mode and can be

accessed using the following link:

Webcast URL:

https://edge.media-server.com/mmc/p/ysmaxpt8

For those unable to attend the live call, an

audio recording will be available on northlandpower.com on November

13, 2023.

Northland’s unaudited interim condensed

consolidated financial statements for the three and nine months

ended September 30, 2023, and related Management’s Discussion

and Analysis can be found on SEDAR+ at www.sedarplus.ca under

Northland’s profile and on northlandpower.com.

ABOUT NORTHLAND POWER

Northland Power is a global power producer

dedicated to helping the clean energy transition by producing

electricity from clean renewable resources. Founded in 1987,

Northland has a long history of developing, building, owning and

operating clean and green power infrastructure assets and is a

global leader in offshore wind. In addition, Northland owns and

manages a diversified generation mix including onshore renewables,

efficient natural gas energy, as well as supplying energy through a

regulated utility.

Headquartered in Toronto, Canada, with global

offices in eight countries, Northland owns or has an economic

interest in approximately 3.4GW (net 2.9GW) of operating capacity.

The Company also has a significant inventory of projects in

construction and in various stages of development encompassing

approximately 15GW of potential capacity.

Publicly traded since 1997, Northland's common

shares, Series 1 and Series 2 preferred shares trade on the Toronto

Stock Exchange under the symbols NPI, NPI.PR.A and NPI.PR.B,

respectively.

NON-IFRS FINANCIAL MEASURES

This press release includes references to the

Company’s adjusted earnings before interest, income taxes,

depreciation and amortization (“Adjusted EBITDA”),

Adjusted Free Cash Flow, Free Cash Flow and applicable payout

ratios and per share amounts, which are measures not prescribed by

International Financial Reporting Standards

(“IFRS”), and therefore do not have any

standardized meaning under IFRS and may not be comparable to

similar measures presented by other companies. Non-IFRS financial

measures are presented at Northland’s share of underlying

operations. These measures should not be considered alternatives to

net income (loss), cash flow from operating activities or other

measures of financial performance calculated in accordance with

IFRS. Rather, these measures are provided to complement IFRS

measures in the analysis of Northland’s results of operations from

management’s perspective. Management believes that Northland’s

non-IFRS financial measures and applicable payout ratio and per

share amounts are widely accepted and understood financial

indicators used by investors and securities analysts to assess the

performance of a company, including its ability to generate cash

through operations.

FORWARD-LOOKING STATEMENTS

This press release contains statements that

constitute forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”) that are

provided for the purpose of presenting information about

management’s current expectations and plans. Readers are cautioned

that such statements may not be appropriate for other purposes.

Northland’s actual results could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, the events anticipated by the forward-looking

statements may or may not transpire or occur. Forward-looking

statements include statements that are not historical facts and are

predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects,” “anticipates,”

“plans,” “predicts,” “believes,” “estimates,” “intends,” “targets,”

“projects,” “forecasts” or negative versions thereof and other

similar expressions or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could.” These statements may

include, without limitation, statements regarding future Adjusted

EBITDA, Adjusted Free Cash Flow and Free Cash Flow, including

respective per share amounts, dividend payments and dividend payout

ratios, the timing for and attainment of the Hai Long and Baltic

Power offshore wind, and Oneida energy storage projects’

anticipated contributions to Adjusted EBITDA, Adjusted Free Cash

Flow and Free Cash Flow, the expected generating capacity of

certain projects, guidance, the completion of construction,

acquisitions, dispositions, investments or financings and the

timing thereof, including the timing and final terms of the pending

sell-down of Hai Long to Gentari, the timing for and attainment of

financial close and commercial operations, for each project, the

potential for future production from project pipelines, cost and

output of development projects, the all-in interest cost for debt

financing, the impact of currency hedges, litigation claims,

anticipated results from the optimization of the Thorold

Co-Generation facility and the timing related thereto, plans for

raising capital and future funding requirements, the allocation of

the net proceeds from the Green Notes offering, and the future

operations, business, financial condition, financial results,

priorities, ongoing objectives, strategies and the outlook of

Northland, its subsidiaries and joint ventures. There is a risk

that delays in closing financings, assets sales or sell-downs,

failure to obtain the anticipated level of finance commitments and

failure to close one or more financings or sell-downs could affect

construction schedules and/or Northland’s cash or credit position

and capital funding needs. These statements are based upon certain

material factors or assumptions that were applied in developing the

forward-looking statements, including the design specifications of

development projects, the provisions of contracts to which

Northland or a subsidiary is a party, management’s current plans

and its perception of historical trends, current conditions and

expected future developments, the ability to obtain necessary

approvals, satisfy any closing conditions, satisfy any project

finance lender conditions to closing sell-downs or obtain adequate

financing regarding contemplated construction, acquisitions,

dispositions, investments or financings, as well as other factors,

estimates and assumptions that are believed to be appropriate in

the circumstances. Although these forward-looking statements are

based upon management’s current reasonable expectations and

assumptions, they are subject to numerous risks and uncertainties.

Some of the factors include, but are not limited to, risks

associated with further regulatory and policy changes in Spain

which could impair current guidance and expected returns, risks

associated with merchant pool pricing and revenues, risks

associated with sales contracts, the emergence of widespread health

emergencies or pandemics, Northland’s reliance on the performance

of its offshore wind facilities at Gemini, Nordsee One and Deutsche

Bucht for over 50% of its Adjusted EBITDA, counterparty and joint

venture risks, contractual operating performance, variability of

sales from generating facilities powered by intermittent renewable

resources, offshore wind concentration, natural gas and power

market risks, commodity price risks, operational risks, recovery of

utility operating costs, Northland’s ability to resolve

issues/delays with the relevant regulatory and/or government

authorities, permitting, construction risks, project development

risks, acquisition risks, procurement and supply chain risks,

financing risks, disposition and joint-venture risks, competition

risks, interest rate and refinancing risks, liquidity risk,

inflation risks, impacts of regional or global conflicts, credit

rating risk, currency fluctuation risk, variability of cash flow

and potential impact on dividends, taxation, natural events,

environmental risks, climate change, health and worker safety

risks, market compliance risk, government regulations and policy

risks, utility rate regulation risks, international activities,

cybersecurity, data protection and reliance on information

technology, labour relations, reputational risk, insurance risk,

risks relating to co-ownership, bribery and corruption risk,

terrorism and security, legal contingencies, and the other factors

described in the “Risks Factors” section of Northland’s

Management’s Discussion and Analysis and Annual Information Form

for the year ended December 31, 2022, which can be found at

www.sedarplus.ca under Northland’s profile and on Northland’s

website at northlandpower.com. Northland has attempted to identify

important factors that could cause actual results to materially

differ from current expectations, however, there may be other

factors that cause actual results to differ materially from such

expectations. Northland’s actual results could differ materially

from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, and Northland cautions you not to place undue

reliance upon any such forward-looking statements.

The forward-looking statements contained in this

release are, unless otherwise indicated, stated as of the date

hereof and are based on assumptions that were considered reasonable

as of the date hereof. Other than as specifically required by law,

Northland undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after such date or to

reflect the occurrence of unanticipated events, whether as a result

of new information, future events or results, or otherwise.

Certain forward-looking information in this

MD&A, including, but not limited to the information in Section

9: Outlook and our projected Adjusted EBITDA and Free Cash Flow

expected to be generated from Northland’s interest in Hai Long,

Baltic Power and Oneida may also constitute “financial outlooks”

within the meaning of applicable securities laws. Financial outlook

involves statements about Northland’s prospective financial

performance, financial position or cash flows and is based on and

subject to the assumptions about future economic conditions and

courses of action and the risk factors described above in respect

of forward-looking information generally, as well as any other

specific assumptions and risk factors in relation to such financial

outlook noted in this MD&A. Such assumptions are based on

management’s assessment of the relevant information currently

available and any financial outlook included in this MD&A is

provided for the purpose of helping readers understand Northland’s

current expectations and plans for the future. Readers are

cautioned that reliance on any financial outlook may not be

appropriate for other purposes or in other circumstances and that

the risk factors described above or other factors may cause actual

results to differ materially from any financial outlook. The actual

results of Northland’s operations will likely vary from the amounts

set forth in any financial outlook and such variances may be

material.

For further information, please

contact:

Adam Beaumont, Vice President

Dario Neimarlija, Vice President

647-288-1019

investorrelations@northlandpower.com

northlandpower.com

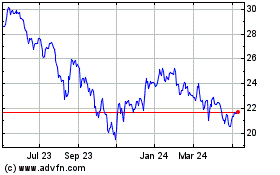

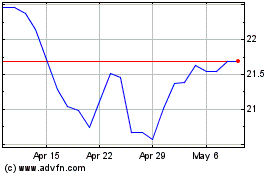

Northland Power (TSX:NPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Northland Power (TSX:NPI)

Historical Stock Chart

From Feb 2024 to Feb 2025