Questerre Energy Corporation (“Questerre” or the “Company”)

(TSX,OSE:QEC) reported today on its financial and operating results

for the first quarter ended March 31, 2021.

Michael Binnion, President and Chief Executive

Officer, commented, “We started to add zero emissions hydrogen and

carbon capture and storage to our Clean Tech Energy project in the

quarter. We are also evaluating other carbon recycling technologies

that use carbon dioxide as a feedstock to make valuable products.

These are essential to the new circular economy where virtually all

the emissions from production and consumption are eliminated.

Recent commitments by the US and Canada to cut emissions by half in

the next decade need new technologies to achieve them. The success

of our net zero project could be the quickest path to contributing

to these climate goals and more importantly to acceptability in

Quebec.”

He added, “We also saw an increase in M&A

activity at Kakwa early this year. In March, the largest operator

merged with another Montney producer in a $8.1 billion transaction,

including net debt. In April, the operator of our Kakwa North

acreage was acquired by a mid-sized company for $300 million. We

are looking forward to their development plans for this

acreage.”

Highlights

- Commissioned CIRAIG to study zero emissions hydrogen production

from Clean Gas

- Executed Letter of Intent with ZEG Power to incorporate blue

hydrogen into Clean Tech Energy project

- Average daily production of 1,679 boe/d with adjusted funds

flow from operations of $2.9 million

Consistent with prior periods, Kakwa continued

to account for approximately 80% of corporate production. During

the first quarter of 2021, daily production averaged 1,679 boe/d

(2020: 2,078 boe/d)(1). Improving commodity prices offset the

production declines and petroleum and natural gas revenue totaled

$7.0 million in the period, unchanged from the same period last

year. The Company generated net income of $0.9 million for quarter

(2020: $113.9 million loss) and adjusted funds flow from operations

of $2.9 million (2020: $2.5 million).

With a focus on prioritizing financial

liquidity, the Company incurred capital expenditures of $0.5

million for the period (2020: $2.9 million) and reduced its net

debt from $7.7 million to $5.4 million as of March 31, 2021.

The term "adjusted funds flow from operations"

is a non-IFRS measure. Please see the reconciliation elsewhere in

this press release.

Questerre is an energy technology and innovation

company. It is leveraging its expertise gained through early

exposure to low permeability reservoirs to acquire significant

high-quality resources. We believe we can successfully transition

our energy portfolio. With new clean technologies and innovation to

responsibly produce and use energy, we can sustain both human

progress and our natural environment.

Questerre is a believer that the future success

of the oil and gas industry depends on a balance of economics,

environment, and society. We are committed to being transparent and

are respectful that the public must be part of making the important

choices for our energy future.

Advisory Regarding Forward-Looking

Statements

This news release contains certain statements

which constitute forward-looking statements or information

(“forward-looking statements”) including the Company’s views that

the success of its net zero project could be the quickest path to

contributing to climate goals and to social acceptability in

Quebec.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Questerre which

have been used to develop such statements and information, but

which may prove to be incorrect. Although Questerre believes that

the expectations reflected in these forward-looking statements are

reasonable, undue reliance should not be placed on them because

Questerre can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Further, events or circumstances may cause actual

results to differ materially from those predicted as a result of

numerous known and unknown risks, uncertainties, and other factors,

many of which are beyond the control of the Company, including,

without limitation: the effect of COVID-19 on the markets and the

demand for oil and natural gas; commitments to cut oil production

by OPEC and others; whether the Company's exploration and

development activities respecting its prospects will be successful

or that material volumes of petroleum and natural gas reserves will

be encountered, or if encountered can be produced on a commercial

basis; the ultimate size and scope of any hydrocarbon bearing

formations on its lands; that drilling operations on its lands will

be successful such that further development activities in these

areas are warranted; that Questerre will continue to conduct its

operations in a manner consistent with past operations; results

from drilling and development activities will be consistent with

past operations; the general stability of the economic and

political environment in which Questerre operates; drilling

results; field production rates and decline rates; the general

continuance of current industry conditions; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Questerre to secure adequate product transportation;

future commodity prices; currency, exchange and interest rates;

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which Questerre operates; and the

ability of Questerre to successfully market its oil and natural gas

products; changes in commodity prices; changes in the demand for or

supply of the Company's products; unanticipated operating results

or production declines; changes in tax or environmental laws,

changes in development plans of Questerre or by third party

operators of Questerre's properties, increased debt levels or debt

service requirements; inaccurate estimation of Questerre's oil and

gas reserve and resource volumes; limited, unfavourable or a lack

of access to capital markets; increased costs; a lack of adequate

insurance coverage; the impact of competitors; and certain other

risks detailed from time-to-time in Questerre's public disclosure

documents. Additional information regarding some of these risks,

expectations or assumptions and other factors may be found under in

the Company's Annual Information Form for the year ended December

31, 2020 and other documents available on the Company’s profile at

www.sedar.com. The reader is cautioned not to place undue reliance

on these forward-looking statements. The forward-looking statements

contained in this news release are made as of the date hereof and

Questerre undertakes no obligations to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, unless so required by

applicable securities laws.

Certain information set out herein may be

considered as “financial outlook” within the meaning of applicable

securities laws. The purpose of this financial outlook is to

provide readers with disclosure regarding Questerre’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

(1) For the period ended March 31, 2021, liquids

production including light crude and natural gas liquids accounted

for 971 bbl/d (2020: 1,388 bbl/d) and natural gas including

conventional and shale gas accounted for 4,250 Mcf/d (2020: 4,141

Mcf/d).

Barrel of oil equivalent (“boe”) amounts may be

misleading, particularly if used in isolation. A boe conversion

ratio has been calculated using a conversion rate of six thousand

cubic feet of natural gas to one barrel of oil and the conversion

ratio of one barrel to six thousand cubic feet is based on an

energy equivalent conversion method application at the burner tip

and does not necessarily represent an economic value equivalent at

the wellhead. Given that the value ratio based on the current price

of crude oil as compared to natural gas is significantly different

from the energy equivalent of 6:1, utilizing a conversion on a 6:1

basis may be misleading as an indication of value.

This press release contains the terms “adjusted

funds flow from operations” and “working capital deficit” which are

non-GAAP terms. Questerre uses these measures to help evaluate its

performance.

As an indicator of Questerre’s performance,

adjusted funds flow from operations should not be considered as an

alternative to, or more meaningful than, cash flows from operating

activities as determined in accordance with GAAP. Questerre’s

determination of adjusted funds flow from operations may not be

comparable to that reported by other companies. Questerre considers

adjusted funds flow from operations to be a key measure as it

demonstrates the Company’s ability to generate the cash necessary

to fund operations and support activities related to its major

assets.

|

|

Three Months Ended

March 31, |

|

($ thousands) |

|

2021 |

|

|

2020 |

|

|

Net cash used in operating activities |

$ |

3,079 |

|

$ |

4,561 |

|

| Interest

received |

|

(50 |

) |

|

(138 |

) |

| Interest

paid |

|

133 |

|

|

187 |

|

|

Change in non-cash operating working capital |

|

(277 |

) |

|

(2,150 |

) |

|

Adjusted Funds Flow from Operations |

$ |

2,885 |

|

$ |

2,460 |

|

Working capital surplus is a non-GAAP measure

calculated as current assets less current liabilities excluding

risk management contracts and lease liabilities.

For further information, please contact:

Questerre Energy Corporation

Jason D’Silva, Chief Financial Officer

(403) 777-1185 | (403) 777-1578 (FAX) |Email: info@questerre.com

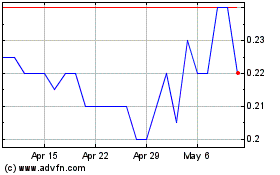

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Dec 2023 to Dec 2024