Directorate changes - Appointment of new Chairman

August 08 2022 - 1:00AM

For immediate release8

August 2022

Serabi Gold

Plc (“Serabi” or the

“Company”)Directorate

Changes

Serabi Gold plc (AIM:SRB, TSX:SBI), the

Brazilian-focused gold mining and development company, is pleased

to announce the appointment of Mr Michael Lynch-Bell as a

Non-executive Director and Chairman with immediate effect. The

Company also announces that Mr Bañados, who has acted as

Non-executive Chairman since June 2020, will continue in office as

a Non-executive director.

Mr Lynch-Bell spent a 38-year career with Ernst

& Young (“EY”), having led its Global Oil and Gas, UK IPO and

Global Oil and Gas and Mining transaction advisory practices. He

was a member of EY’s assurance Practice from 1974 to 1996, when he

transferred to the Transaction Advisory Practice. He was also UK

Alumni sponsor and a member of the firm’s Europe, Middle East,

India, and Africa and Global Advisory Councils. He retired from EY

as a partner in 2012 and continued as a consultant to the firm

until November 2013. Mr Lynch-Bell is a non-executive director of

London-listed Gem Diamonds Limited, independent non-executive

chairman of ASX-listed Little Green Pharma and independent

non-executive director of JSE-listed Barloworld Limited.

Mr Lynch-Bell will be appointed as Chair of the

Audit Committee and also serve on the Remuneration Committee.

Mr Lynch-Bell (FCA) graduated with a BA Hons

Economics and Accountancy (University of Sheffield) and is a member

of the Institute of Chartered Accountants in England and Wales.

Mr Eduardo Rosselot, who has served as a

Director of Serabi since October 2012 is standing down from the

Board. Mr Rosselot was one of two representatives on the Board,

alongside Mr Bañados, appointed by Fratelli Investments Limited.

Fratelli are not seeking to replace Mr Rosselot and will only have

one representative appointed to the Board.

Mike Hodgson, CEO of Serabi commented:

“I am delighted to have Michael join the Board of Directors of

the Company as Non-executive Chairman. He brings a wealth of

international mining experience to Serabi and will provide

significant insight in his role as independent Chairman. . I would

also like to take this opportunity to thank Eduardo for his ten

years of service on the Board. He has visited the operations on

many occasions over this time and provided valuable technical

input. Whilst he is standing down from the Board, I am pleased that

we will be able to continue to call on his services and support in

the future”

Michael Lynch-Bell commented:

“I am very pleased to take on this role with Serabi as the

Company moves into the next exciting phase of its development with

the ongoing development of Coringa and advancing the many

opportunities that its exploration tenements present.”

Further AIM Disclosures

on Mr. Lynch-Bell

As required under Schedule Two, paragraph (g)

(i)-(viii) of the AIM Rules for Companies, further disclosures on

Mr. Lynch-Bell are as follows.

Michael David Lynch-Bell, aged 69, has held the

following directorships and/or partnerships in the past five

years:

|

Current directorships and/or partnerships |

Past directorships and/or partnerships |

|

Barloworld LimitedBarloworld Holdings LimitedGem Diamonds

LimitedLittle Green Pharma LtdPrivateLanka Ocean PartnershipLanka

Ocean Properties (Private) LimitedLGHH CorpRanjith Property

Developers (Private) LimitedSt Pancras Chambers Residents

Association LimitedThe Orchid Children’s Trust |

Kaz Minerals LimitedLenta IPJSC (f.k.a Lenta plc)PrivateActionAid

InternationalActionAid International AfricaExoro Energy

International Limited Lynch-Bell Resources LimitedSeven Energy

International LimitedTwenty First Century Legacy LimitedWhitfield

P18 LLP |

|

Mr. Lynch-Bell holds no ordinary shares in the

Company.

Mr. Lynch-Bell was formerly a non-executive

director of Seven Energy International Limited, a Mauritian

registered company with a UK establishment, Exoro Energy

International Limited (together “Seven”). Seven was a private,

Nigerian focused integrated oil and gas company. Seven agreed to

sell its principal assets and restructure its debts in November

2019. English and Mauritian administrators were appointed on 13

November 2019 to implement the transfer of Seven’s business and

assets to a purchaser and provide continuity of the business

operations. The appointment of administrators was part of an agreed

creditor restructuring of Seven’s debt facilities. The

administration ended on 12 May 2021. The net deficit to the secured

and unsecured creditors who were also members of the company

amounted in aggregate to approximately £518million.

There is no further information on Mr.

Lynch-Bell required to be disclosed under Schedule Two, paragraph

(g) of the AIM Rules for Companies.

Enquiries

|

Serabi Gold plc |

|

|

Michael Hodgson |

Tel: +44 (0)20 7246 6830 |

|

Chief Executive |

Mobile: +44 (0)7799 473621 |

|

|

|

|

Clive Line |

Tel: +44 (0)20 7246 6830 |

|

Finance Director |

Mobile: +44 (0)7710 151692 |

|

|

|

|

Email: contact@serabigold.com |

|

|

Website: www.serabigold.com |

|

|

|

|

|

Beaumont Cornish LimitedNominated Adviser and

Financial Adviser |

|

|

Roland Cornish / Michael Cornish |

Tel: +44 (0)20 7628 3396 |

|

|

|

|

Peel Hunt LLPJoint UK Broker |

|

|

Ross Allister / Alexander Allen |

Tel: +44 (0)20 7418 9000 |

|

|

|

|

Tamesis Partners LLPJoint UK Broker |

|

|

Charlie Bendon / Richard Greenfield |

Tel: +44 (0)20 3882 2868 |

|

|

|

|

Camarco Financial

PR |

|

|

Gordon Poole / Emily Hall |

Tel: +44(0) 20 3757 4980 |

A copy of this announcement is available from the Company’s

website at www.serabigold.com

Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this announcement.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

ENDS

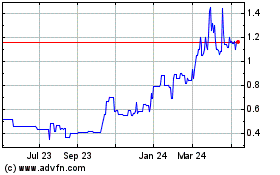

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

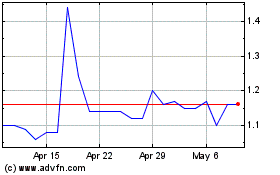

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025