Sierra Metals Inc. (TSX: SMT) (“Sierra Metals” or

the “Company”) today issues a statement in response to

recent communications materials issued by its shareholder Arias

Resource Capital (“ARC”), including a news release ARC

issued on May 9, 2023 (the “ARC News Release”). The Company

acknowledges that it has also seen the circular issued by ARC on

May 12, 2023 (the “ARC Circular”) and plans to consider the

contents and respond in due course.

The Company places a high value on the integrity of public

disclosure, and as such, wishes to correct false or misleading

statements made by ARC so that the Company’s shareholders have

access to accurate information.

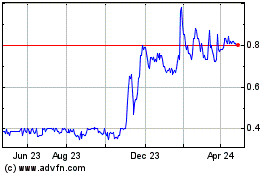

ARC continues to publish graphics of the Sierra Metals share

price with an arbitrary start date of March 2021. Had the share

price data started in January 2021, the timeline could have made

note of two additional events:

- The Company announced a strategic review on January 8, 2021 at

a time when ARC chairman Alberto Arias was chair of the Company’s

board of directors (the “Board”); this announcement

suggested that a sale of the Company would be considered, which

presumably created expectations of a potential sale, increasing the

share price. On January 11, 2021 (the following trading day), the

common shares of Sierra Metals (the “Shares”) closed at

CDN$4.87.

- On January 20, 2021, Arias Resource Capital Fund L.P. (a fund

over which Mr. Arias was the sole director of the general partner)

announced that it had distributed 52,721,964 Shares to its

underlying limited partners. By January 29, 2021, the Shares were

trading at CDN$4.00. The decline of the Share price started that

month as the limited partners presumably began to sell off a

portion of their Shares. At the time the Company announced Mr.

Arias ceasing to be on the Board in July 2021, the Shares were

trading at CDN$3.58. The strategic review concluded in October 2021

without having identified a buyer for the Company or other

strategic alternatives, even after the Company’s valuation had

fallen significantly from its peak at the start of the review

process.

The ARC News Release indicates that “ARC’s representatives left

the Board in mid-2021”. This statement insinuates that Mr. Arias

voluntarily resigned from the Board. Like many statements from ARC,

this is misleading.

At the Company’s 2021 annual shareholders meeting which took

place on June 10, 2021 (the “2021 Meeting”), Mr. Arias –

with minimal notice to or engagement with the Board – attempted to

unseat the then current Board by utilizing his significant voting

power against all members of the Board unaffiliated with the ARC

funds. Despite Mr. Arias having direction and/or control over

approximately 27% of the outstanding Shares, the shareholders

rallied against Mr. Arias’ efforts. Excluding votes cast by Mr.

Arias and the ARC funds (assuming all such Shares held by the

foregoing were voted at the 2021 Meeting in favour of Mr. Arias),

Mr. Arias received less than 18% support from the shareholders who

voted at the 2021 Meeting and was ultimately forced to resign from

the Board.

We believe that Mr. Arias’ tactics at the 2021 Meeting are

indicative of what Sierra shareholders may expect from Mr. Arias

going forward. He did not engage with the Company or the Board to

discuss his intention to vote off the non-ARC affiliated Board

members at the 2021 Meeting until his votes were received shortly

before such meeting. Had he been successful, Mr. Arias would have

been in a position to replace those unaffiliated Board members with

his own hand-picked nominees and to effectively take over the

Company without paying a premium to shareholders.

The self-motivation of these actions is only further exemplified

by Mr. Arias serving as chair of the Board’s nomination committee

at that time – a committee specifically responsible for reviewing

the appropriate experience, skills and characteristics required of

each existing and new board member. Mr. Arias did not communicate

to the nomination committee or the Board any reservations about the

qualifications of the proposed slate of directors that he intended

to vote against. Instead, he attempted to surprise the Board and

leave the Company without an appropriate slate of directors

following the 2021 Meeting. These efforts were short-sighted and

Mr. Arias was either in dereliction of his duty as chair of the

nomination committee or his desire to vote off the unaffiliated

directors was motivated by something other than acting in the best

interests of the Company (a theme that, despite recent news

releases from ARC to the contrary, we are continuing to see from

Mr. Arias).

The Company believes today, as its shareholders affirmed in

2021, that control of 27% of the outstanding Shares does not

entitle any individual to control of the Board.

ARC has referred to a “revolving suite of executives and

directors” at Sierra Metals. However, since Mr. Arias was voted off

the Board in 2021, the Company has made a single change to the CEO

position with the appointment of Ernesto Balarezo as Interim CEO on

November 28, 2022. In contrast, the Company had five different CEOs

during the eight years Mr. Arias chaired the Board. We believe the

regular turnover at the CEO position prior to 2021, at times sudden

and unplanned, was disruptive to operations and the implementation

of an effective long-term vision.

The ARC News Release continues to misrepresent the Company’s

financial situation, including the use of such inflammatory terms

as “distress” and “bleeding”. ARC once again fails to make any

reference to the positive operational achievements and outlook

disclosed in the Company’s 2022 operating and financial results

announced on March 29, 2023, or the Q1 2023 production results

announced on April 25, 2023 – presumably because the favourable

news does not support ARC’s mischaracterizations. The Company looks

forward to reporting its Q1 2023 financial results on May 15,

2023.

The Company is now working diligently to remedy decisions made

and performance of the Company when it was under Mr. Arias’

guidance. It is those decisions that are largely responsible for

the current circumstances of the Company.

The only reference the ARC News Release makes to the recent

operational improvements is a suggestion that these should not be

considered an outcome of the ongoing strategic review, purportedly

because they have been achieved by the Company itself rather than

an outside financial advisor. To the contrary, operational

improvements are fully within the mandate of the special committee

of independent directors announced on October 18, 2022 (the

“Special Committee”). As disclosed at that time, the Special

Committee’s mandate included, among other things, “exploring,

reviewing and considering options to optimize the operations of the

Company”. As Mr. Arias knows or ought to know, optimizing

operations is a core responsibility of the management team and

board of any mining company.

ARC’s decision to pursue a proxy contest coincides with Mr.

Arias’ attempts to quickly realize value from ARC’s investment in

Compañia Minera Kolpa S.A. ("Kolpa") by having Sierra Metals

merge with Kolpa. Mr. Arias’ criticism of the Company’s requirement

to diligently and carefully consider the proposed Kolpa transaction

and not rush the transaction through without due consideration is a

clear indication of his desire to create value for ARC and Kolpa at

the expense of the Company’s due consideration of the

transaction.

About Sierra Metals Sierra

Metals is a diversified Canadian mining company with green metal

exposure including copper, zinc and lead production with precious

metals byproduct credits, focused on the production and development

of its Yauricocha Mine in Peru and its Bolivar Mine in Mexico. The

Company is focused on the safety and productivity of its producing

mines. The Company also has large land packages with several

prospective regional targets providing longer-term exploration

upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals |

Facebook: SierraMetalsInc | LinkedIn: Sierra Metals

Inc | Instagram: sierrametals

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation, including

information with respect to the Company’s intention to report its

Q1 2023 financial results on May 15, 2023. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230512005425/en/

Securityholder Communications Advisor Christine Carson

President & CEO Carson Proxy Advisors Tel: (416) 804-0825

Email: christine@carsonproxy.com

Media Relations John Vincic Principal Oakstrom Advisors

Tel: (647) 402-6375 Email: john@oakstrom.com

Investor Relations Raj Vyas Vice-President, Corporate

Controller and Corporate Secretary Sierra Metals Inc. Tel: (416)

366-7777 Email: info@sierrametals.com

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

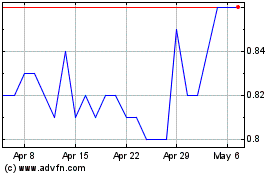

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024