(All $ figures reported in USD)

- Revenue from metals payable of $58.5 million in Q1 2023, a 27%

increase from Q4 2022.

- Adjusted EBITDA(1) of $15.2 million in Q1 2023, significantly

higher than the Adjusted EBITDA(1) of $(0.5) million in Q4

2022.

- Operating cash flows before movements in working capital(1) of

$12.9 million in Q1 2023, compared to $2.9 million Q4 2022.

- Net income attributable to shareholders in Q1 2023 was $2.1

millon versus a loss of $26.5 million in Q4 2022.

- Copper equivalent production of 18.0 million pounds; a 28%

increase from Q4 2022.

- Consolidated cash costs per copper equivalent payable pound(1)

in Q1 2023 of $2.12 and consolidated All-In Sustaining Costs per

equivalent payable pound (“AISC”)(1) of $3.28 were 13% and

22% lower, respectively, than the same recorded in Q4 2022.

Management will host a conference call and webcast to discuss

Q1 2023 Results on Monday, May 15, 2023, at 11:00 AM (EDT). Click

here to register.

Sierra Metals Inc. (TSX: SMT) ("Sierra Metals" or

"the Company") today reported financial results for the

three-month period ended March 31, 2023, including revenue of $58.5

million and adjusted EBITDA(1) of $15.2 million on throughput of

577,284 tonnes and metal production of 18.0 million copper

equivalent pounds.

Ernesto Balarezo, Interim CEO of Sierra Metals, commented, “Our

financial performance improved significantly in Q1 2023 compared to

Q4 2022, consistent with the operating gains we announced last

month. The scale of the turnaround is highlighted by sequential

improvements of $12.4 million in revenue, $10.0 million in

operating cash flows before movements in working capital (1), $15.7

million in adjusted EBITDA(1) and $11.5 million in adjusted net

income attributable to shareholders(1). While we still have work to

do, maintaining and improving upon these performance levels

throughout the year, as we anticipate, would position us very well

to move beyond the challenges of last year and build a platform for

long-term growth.

(1) This is a non-IFRS performance

measure. See the Non-IFRS Performance Measures section of the press

release

“We view the strong Q1 2023 production and financial results as

evidence that our plan is working. Our focus over the past six

months began with stabilizing our operations by making safety our

top priority, and investing in key infrastructure, such as pumping

and ventilation systems. We then shifted to optimizing operations,

and we are now seeing the initial results including increased

production.

“The next stage of our plan is growing our business. Our 2023

guidance calls for production levels to increase throughout the

year while we actively pursue the permit to mine below the 1120

level at Yauricocha, a major growth catalyst that should

significantly improve our throughput and profitability.”

Q1 2023 Consolidated Financial

Summary

The information provided below are excerpts from the Company’s

Q1 2023 financial statements and Management’s Discussion and

Analysis, which are available on the Company's website

(www.SierraMetals.com) and on SEDAR (www.sedar.com) under the

Company’s profile.

(In thousands of dollars, except per share and cash cost

amounts,consolidated figures unless noted otherwise)

Q1 2023

Q4 2022 Q1 2022 Operating Ore Processed /

Tonnes Milled

577,284

494,980

590,730

Silver Ounces Produced (000's)

622

570

734

Copper Pounds Produced (000's)

8,285

6,170

6,324

Lead Pounds Produced (000's)

3,060

2,071

4,216

Zinc Pounds Produced (000's)

10,579

6,367

10,492

Gold Ounces Produced

3,910

3,411

1,923

Copper Equivalent Pounds Produced (000's)1

18,009

14,073

15,896

Cash Cost per Tonne Processed

$

61.60

$

63.30

$

61.32

Cash Cost per CuEqLb2

$

2.12

$

2.44

$

2.73

AISC per CuEqLb2

$

3.28

$

4.19

$

4.48

Cash Cost per CuEqLb (Yauricocha)2

$

2.05

$

3.16

$

2.19

AISC per CuEqLb (Yauricocha)2

$

3.12

$

5.02

$

3.73

Cash Cost per CuEqLb (Bolivar)2

$

1.85

$

1.76

$

4.55

AISC per CuEqLb (Bolivar)2

$

3.10

$

3.69

$

7.33

Cash Cost per AgEqOz (Cusi)2

$

23.02

$

16.35

$

13.48

AISC per AgEqOz (Cusi)2

$

29.80

$

22.14

$

19.94

Financial Revenues

$

58,526

$

46,150

$

57,241

Adjusted EBITDA2

$

15,205

$

(537)

$

15,988

Operating cash flows before movements in working capital

$

12,851

$

2,860

$

10,702

Adjusted net income (loss) attributable to shareholders2

$

4,746

$

(6,758)

$

5,945

Net income (loss) attributable to shareholders

$

2,053

$

(26,456)

$

369

Cash and cash equivalents

$

3,864

$

5,074

$

19,511

Working capital 3

$

(83,001)

$

(84,401)

$

12,433

(1) Copper equivalent pounds were

calculated using the following realized prices:

Q1 2023 - $22.57/oz Ag, $4.06/lb Cu,

$1.42/lb Zn, $0.97/lb Pb, $1,891/oz Au.

Q4 2022 - $21.21/oz Ag, $3.63/lb Cu,

$1.37/lb Zn, $0.95/lb Pb, $1,730/oz Au.

Q1 2022 - $23.95/oz Ag, $4.53/lb Cu,

$1.69/lb Zn, $1.06/lb Pb, $1,875/oz Au.

(2) This is a non-IFRS performance

measure, see Non-IFRS Performance Measures section of the press

release,

(3) The negative working capital is

largely the result of the reclassification of the long-term portion

of the corporate facility and term loan to current, as the Company

defaulted on its debt covenants. The Company has sought

accommodation from the banks for non-compliance of the corporate

facility as at March 31, 2023.

Revenue from metals payable of $58.5 million in Q1 2023

increased by 2% from $57.2 million in Q1 2022, as the 19% increase

in the copper equivalent payable pounds was partially offset by

lower metal prices as compared to Q1 2022. However, metal prices

were higher than Q4 2022 and combined with the 23% increase in the

copper equivalent payable pounds boosted revenues by 27% quarter

over quarter.

Yauricocha’s cash cost per copper equivalent payable pound(1)

was $2.05 (Q1 2022 - $2.19), and AISC per copper equivalent payable

pound(1) was $3.12 (Q1 2022 - $3.73). Despite a 6% decrease in

copper equivalent payable pounds, unit costs were lower due to the

reduction in cash cost and other elements of AISC such as treatment

and refining charges, selling costs and sustaining capital.

Bolivar’s cash cost per copper equivalent payable pound(1) was

$1.85 (Q1 2022 - $4.55), and AISC per copper equivalent payable

pound(1) was $3.10 (Q1 2022 - $7.33) for Q1 2023. The decrease in

unit costs at Bolivar was driven mainly by the 143% increase in

copper equivalent payable pounds.

Cusi’s cash cost per silver equivalent payable ounce(1) was

$23.02 (Q1 2022 - $13.48), and AISC per silver equivalent payable

ounce(1) was $29.80 (Q1 2022 - $19.94) for Q1 2023. Unit costs for

Q1 2023 increased at Cusi as the lower cost of sales and sustaining

costs could not offset the impact of a 45% decrease in the silver

equivalent payable ounces.

Adjusted EBITDA(1) of $15.2 million for Q1 2023 decreased 5%

compared to $16.0 million in Q1 2022, mainly due to lower metal

prices.

Net income attributable to shareholders for Q1 2023 was $2.1

million (Q1 2022: $0.4 million) or $0.01 per share (basic and

diluted) (Q1 2022: $0.00).

Adjusted net income attributable to shareholders (1) of $4.7

million, or $0.03 per share, for Q1 2023 as compared to the

adjusted net income attributable to shareholders(1) of $5.9

million, or $0.04 per share for Q1 2022.

Cash flow generated from operations before movements in working

capital(1) of $12.9 million for Q1 2023 increased compared to $10.7

million in Q1 2022.

Cash and cash equivalents of $3.9 million and working capital of

$(83.0)(2) million as at March 31, 2023 compared to $5.1 million

and $(84.4)(2) million, respectively, at the end of 2022. Cash and

cash equivalents decreased during Q1 2023 as cash used in investing

activities of $7.4 million and cash used in financing activities of

$0.5 million exceeded $6.7 million of cash generated from operating

activities.

(1) This is a non-IFRS performance

measure. See the Non-IFRS Performance Measures section of the press

release

(2) The negative working capital is

largely the result of the reclassification of the long-term portion

of the corporate facility and term loan to current, as the Company

defaulted on its debt covenants. The Company has sought

accommodation from the banks for non-compliance of the corporate

facility as at March 31, 2023.

The following table displays average realized metal prices

information for Q1 2023 in comparison with Q4 2022 and Q1 2022:

Realized Metal Prices

Variance %

(In US dollars) Q1 2023 Q4 2022 Q1 2022

vs Q4 2022

vs Q1 2022

Silver (oz)

$

22.57

$

21.21

$

23.95

6%

-6%

Copper (lb)

$

4.06

$

3.63

$

4.53

12%

-10%

Zinc (lb)

$

1.42

$

1.37

$

1.69

4%

-16%

Lead (lb)

$

0.97

$

0.95

$

1.06

2%

-8%

Gold (oz)

$

1,891

$

1,730

$

1,875

9%

1%

Outlook 2023

Stabilizing operations with a focus on health and safety remains

the key short- to medium-term priority for management. The

Company’s long-term objective is to expand the resources at its

core operating mines. The Company is working on its revised Life of

Mines plans, which are expected to be released later during the

year.

As announced earlier, the Company has hired a VP of Health and

Safety, a newly created position, and has initiated plans to

continually improve safety of its employees and the communities in

which it operates. The Company is working closely with regulatory

bodies to expedite additional permitting at Yauricocha without

compromising on safety and environmental regulations.

The Company is streamlining operations, reducing costs and

deferring growth-related capital expenditure for cash preservation,

while continuing to advance on the refinancing of its debt

amortization payment obligations with its lenders. The refinancing

process for those amortization payments remains on track and is

expected to lead to a formal contract with the lenders in the

coming weeks.

The Company remains on track to achieve previously announced

production, cost and capital expenditure guidance for 2023. The

tables below summarize the previously announced 2023 production

guidance from the Yauricocha and the Bolivar mines. Management

considers the Cusi mine as 'non-core' and it has been excluded from

guidance.

Production (excluding Cusi)

2023 Guidance

2022

Low

High

Actual

Silver (000 oz)

1,500

1,700

1,218

Copper (000 lbs)

37,300

42,400

27,127

Lead (000 lbs)

14,000

15,400

12,216

Zinc (000 lbs)

46,000

50,500

38,100

Gold (oz)

13,500

15,400

9,361

Copper equivalent pounds (000's) (1)

74,300

83,300

56,108

(1) 2023 metal equivalent guidance was calculated using the

following prices: $21.03/oz Ag, $3.55/lb Cu, $1.35/lb Zn, $0.93/lb

Pb and $1,741/oz Au.

Cash costs and AISC:

Actual for 2022 Equivalent Production Cash costs

range AISC(2) range Cash costs AISC(2)

Mine Range (1) per CuEqLb per CuEqLb

per CuEqLb per CuEqLb Yauricocha Copper Eq Lbs ('000)

40,000 - 44,000 $1.81 - $1.88 $3.09 - $3.19

$2.23

$3.69

Bolivar Copper Eq Lbs ('000) 34,500 - 39,500 $1.92 - $2.05 $3.02 -

$3.25

$2.99

$5.07

(1) 2023 metal equivalent guidance was calculated using the

following prices: $21.03/oz Ag, $3.55/lb Cu, $1.35/lb Zn, $0.93/lb

Pb and $1,741/oz Au. (2) AISC includes treatment and refining

charges, selling costs, G&A costs and sustaining capital

expenditure

Capital Expenditure:

Amounts in $M

Sustaining

Growth

Total

Yauricocha

10

11

21

Bolivar

22

4

26

Total Capital Expenditure

32

15

47

Special Committee Update

The special committee of independent directors formed in October

2022 (the “Special Committee”) continues to evaluate opportunities

and improvements for the Company in accordance with its mandate.

That mandate included reviewing strategic transactions as well as

the development of initiatives and objectives to improve operations

and financial conditions of the Company.

Over the course of the strategic review process, the Special

Committee and the Company’s management team have identified and

implemented a number of operational and financial improvements

described in more detail in the Company’s news releases dated March

29, 2023 and May 2, 2023.

The review of strategic transactions is approaching completion.

Once the Special Committee work is completed and all

recommendations are received, the Company will provide an update on

any material developments and objectives. The Special Committee’s

evaluation of the proposed Kolpa transaction reached an impasse

when a recent request for material information from Kolpa regarding

the Kolpa operations and mine plans was substantively ignored by

Kolpa. Kolpa refused to provide this important information leaving

no reasonable way for the Company to advance discussions with

Kolpa. Those discussions are not continuing.

Q1 2023 Operating

Highlights

The Company reported Q1 2023 production results on April 25,

2023. A summary follows:

Yauricocha Mine, Peru

Throughput from the Yauricocha Mine during Q1 2023 was 219,145

tonnes, a 44% sequential increase over Q4 2022, and as anticipated,

a 30% decrease compared to Q1 2022, after the implementation of

measures to safeguard against similar occurrences to last year’s

mudslide incident. Mining activity at Yauricocha continues to focus

on smaller ore bodies located within the permitted mineable areas

above the 1120 level. These smaller ore bodies provided improved

head grades in all metals during Q1 2023 when compared to the

previous quarter, whereas, in Q1 2022, there was a greater

contribution to production from larger ore bodies with lower

grades. There was also a notable improvement in the recovery of

silver, copper and gold by 18%, 4% and 8%, respectively, when

compared to the previous quarter, while zinc and lead recoveries

remained in-line with Q4 2022.

Head grades in silver, lead and zinc, when compared to Q1 2022,

improved by 18%, 6%, and 39%, respectively. Copper grades were

in-line with Q1 2022 and gold grades decreased by 12%. Production

of all metals, except for zinc, declined, and copper equivalent

production at the mine decreased by 17% when compared to Q1 2022,

as the improved head grades and stronger recoveries during the

quarter could not compensate for the reduced throughput at

Yauricocha when compared to Q1 2022.

Bolivar Mine, Mexico

The Bolivar Mine processed 299,017 tonnes during Q1 2023, an 11%

increase over Q4 2022 and a 59% increase compared to Q1 2022, due

to improvements in ventilation and advancement in the mine’s

development and preparation which allowed for increased mining

activity during the quarter. As a result, the Bolivar mine saw

improved productivity and higher grades in copper and silver by 6%

and 31%, respectively, with a decrease of 10% in gold grades when

compared to Q4 2022. When comparing the quarter to Q1 2022, there

were significantly higher grades in copper, silver, and gold by

50%, 59% and 181%, respectively, as well as an 11% and 9%

improvement in copper and gold recovery rates. Bolivar generated

7.6 million pounds in copper equivalent production during Q1 2023,

an 18% increase over the previous quarter and a 192% increase when

compared to Q1 2022.

Cusi Mine, Mexico

The Cusi mine processed 59,122 tonnes of ore during Q1 2023, an

18% decrease when compared to Q4 2022 and a 33% decrease from Q1

2022. The decrease in throughput, combined with lower grades in

silver, gold and lead by 17%, 24%, and 4%, respectively, resulted

in a 31% decrease in silver equivalent production when compared to

Q4 2022. When compared to Q1 2022, decreases in grades for the same

metals of 18%, 32%, and 8% respectively, resulted in a 44% decrease

in silver equivalent production.

The decrease in throughput during Q1 2023, was attributed to a

general decline in mining activity, and a greater focus on recovery

of production sites from several issues that arose during the

quarter, including flooding at depth, contractor performance, and

the lack of availability of mining equipment. Head grades were also

impacted by the reduction in active mining sites during the

quarter.

Conference Call and

Webcast

Sierra Metals' senior management will host a conference call and

webcast to discuss the Company's financial and operating results

for the three months ended March 31, 2023. Details are as

follows:

Date: May 15, 2023 Time: 11:00 am (Eastern)

Webcast:

https://services.choruscall.ca/links/sierrametalsq12023.html

Telephone: Canada/USA (toll free): 1-800-319-4610 Other:

1-416-915-3239

The webcast, along with presentation slides, will be archived

for 180 days on www.sierrametals.com.

Non-IFRS Performance

Measures

The non-IFRS performance measures presented do not have any

standardized meaning prescribed by IFRS and are therefore unlikely

to be directly comparable to similar measures presented by other

issuers.

Non-IFRS reconciliation of adjusted EBITDA

EBITDA is a non-IFRS measure that represents an indication of

the Company’s continuing capacity to generate earnings from

operations before taking into account management’s financing

decisions and costs of consuming capital assets, which vary

according to their vintage, technological currency, and

management’s estimate of their useful life. EBITDA comprises

revenue less operating expenses before interest expense (income),

property, plant and equipment amortization and depletion, and

income taxes. Adjusted EBITDA has been included in this document.

Under IFRS, entities must reflect in compensation expense the cost

of share-based payments. In the Company’s circumstances,

share-based payments involve a significant accrual of amounts that

will not be settled in cash but are settled by the issuance of

shares in exchange for cash. As such, the Company has made an

entity specific adjustment to EBITDA for these expenses. The

Company has also made an entity-specific adjustment to the foreign

currency exchange (gain)/loss. The Company considers cash flow

before movements in working capital to be the IFRS performance

measure that is most closely comparable to adjusted EBITDA.

The following table provides a reconciliation of adjusted EBITDA

to the condensed interim consolidated financial statements for the

three months ended March 31, 2023 and 2022:

Three months ended March

31,

2023

2022

Net income

$

2,139

$

2,130

Adjusted for: Depletion and depreciation

7,543

9,163

Interest expense and other finance costs

2,199

767

NRV adjustments on inventory

476

2,541

Share-based payments

102

195

Costs related to COVID

-

1,311

Foreign currency exchange and other provisions

1,372

1,863

Income taxes

1,374

(1,982)

Adjusted EBITDA

$

15,205

$

15,988

Non-IFRS reconciliation of adjusted net income

The Company has included the non-IFRS financial performance

measure of adjusted net income, defined by management as the net

income attributable to shareholders shown in the statement of

earnings plus the non-cash depletion charge due to the acquisition

of Corona and the corresponding deferred tax recovery and certain

non-recurring or non-cash items such as share-based compensation

and foreign currency exchange (gains) losses. The Company believes

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors may want to use this information to

evaluate the Company’s performance and ability to generate cash

flows. Accordingly, it is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance in accordance with IFRS.

The following table provides a reconciliation of adjusted net

income to the condensed interim consolidated financial statements

for the three months ended March 31, 2023 and 2022:

Three months ended March

31,

(In thousands of United States dollars)

2023

2022

Net income attributable to shareholders

$

2,053

$

369

Non-cash depletion charge on Corona's acquisition

1,070

1,404

Deferred tax recovery on Corona's acquisition depletion charge

(327)

(427)

NRV adjustments on inventory

476

2,541

Share-based compensation

102

195

Foreign currency exchange loss

1,372

1,863

Adjusted net income attributable to shareholders

$

4,746

$

5,945

Cash cost per silver equivalent payable ounce and copper

equivalent payable pound

The Company uses the non-IFRS measure of cash cost per silver

equivalent ounce and copper equivalent payable pound to manage and

evaluate operating performance. The Company believes that, in

addition to conventional measures prepared in accordance with IFRS,

certain investors use this information to evaluate the Company’s

performance and ability to generate cash flows. Accordingly, it is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS.

AISC per silver equivalent payable ounce and copper

equivalent payable pound

AISC is a non‐IFRS measure and was calculated based on guidance

provided by the World Gold Council (“WGC”) in June 2013. WGC is not

a regulatory industry organization and does not have the authority

to develop accounting standards for disclosure requirements. Other

mining companies may calculate AISC differently as a result of

differences in underlying accounting principles and policies

applied, as well as differences in definitions of sustaining versus

development capital expenditures.

AISC is a more comprehensive measure than cash cost per

ounce/pound for the Company’s consolidated operating performance by

providing greater visibility, comparability and representation of

the total costs associated with producing silver and copper from

its current operations.

The Company defines sustaining capital expenditures as, “costs

incurred to sustain and maintain existing assets at current

productive capacity and constant planned levels of productive

output without resulting in an increase in the life of assets,

future earnings, or improvements in recovery or grade. Sustaining

capital includes costs required to improve/enhance assets to

minimum standards for reliability, environmental or safety

requirements. Sustaining capital expenditures excludes all

expenditures at the Company’s new projects and certain expenditures

at current operations which are deemed expansionary in nature.”

Consolidated AISC includes total production cash costs incurred

at the Company’s mining operations, including treatment and

refining charges and selling costs, which forms the basis of the

Company’s total cash costs. Additionally, the Company includes

sustaining capital expenditures and corporate general and

administrative expenses. AISC by mine does not include certain

corporate and non‐cash items such as general and administrative

expense and share-based payments. The Company believes that this

measure represents the total sustainable costs of producing silver

and copper from current operations and provides the Company and

other stakeholders of the Company with additional information of

the Company’s operational performance and ability to generate cash

flows. As the measure seeks to reflect the full cost of silver and

copper production from current operations, new project capital and

expansionary capital at current operations are not included.

Certain other cash expenditures, including tax payments, dividends

and financing costs are also not included.

The following table provides a reconciliation of cash costs to

cost of sales, as reported in the Company’s condensed interim

consolidated statement of income for the three months ended March

31, 2023 and 2022:

Three months ended Three months ended (In thousand of

US dollars, unless stated)

March 31, 2023 March 31,

2022 Yauricocha Bolivar Cusi

Consolidated Yauricocha Bolivar Cusi

Consolidated Cash Cost per

Tonne of Processed Ore Cost of Sales

21,892

14,932

5,812

42,636

23,930

15,995

6,674

46,599

Reverse: D&A/Other adjustments

(5,123)

(2,301)

(609)

(8,033)

(4,780)

(3,181)

(1,090)

(9,051)

Reverse: Variation in Inventory

408

524

25

957

(490)

(1,406)

570

(1,326)

Total Cash Cost

17,177

13,155

5,228

35,560

18,660

11,408

6,154

36,222

Tonnes Processed

219,145

299,017

59,122

577,284

315,250

187,556

87,924

590,730

Cash Cost per Tonne Processed US$

78.38

43.99

88.43

61.60

59.19

60.82

69.99

61.32

The following table provides detailed information on

Yauricocha’s cash cost and all-in sustaining cost per copper

equivalent payable pound for the three months ended March 31, 2023

and 2022:

YAURICOCHA Three months ended (In thousand of US

dollars, unless stated)

March 31, 2023 March 31, 2022

Cash Cost per zinc equivalent

payable pound Total Cash Cost

17,177

18,660

Variation in Finished inventory

(408)

490

Total Cash Cost of Sales

16,769

19,150

Treatment and Refining Charges

4,741

6,852

Selling Costs

616

719

G&A Costs

2,433

1,952

Sustaining Capital Expenditures

1,044

3,968

All-In Sustaining Cash Costs

25,603

32,641

Copper Equivalent Payable Pounds (000's)

8,197

8,740

Cash Cost per Copper Equivalent Payable Pound (US$)

2.05

2.19

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.12

3.73

The following table provides detailed information on Bolivar’s

cash cost, and all-in sustaining cost per copper equivalent payable

pound for the three months ended March 31, 2023 and 2022:

BOLIVAR Three months ended (In thousand of US

dollars, unless stated)

March 31, 2023 March 31, 2022

Cash Cost per copper equivalent

payable pound Total Cash Cost

13,155

11,408

Variation in Finished inventory

(524)

1,406

Total Cash Cost of Sales

12,631

12,814

Treatment and Refining Charges

2,165

2,048

Selling Costs

1,537

963

G&A Costs

1,317

815

Sustaining Capital Expenditures

3,548

4,012

All-In Sustaining Cash Costs

21,198

20,652

Copper Equivalent Payable Pounds (000's)

6,843

2,818

Cash Cost per Copper Equivalent Payable Pound (US$)

1.85

4.55

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.10

7.33

The following table provides detailed information on Cusi’s cash

cost, and all-in sustaining cost per silver equivalent payable

ounce for the three months ended March 31, 2023 and 2022:

CUSI Three months ended (In thousand of US dollars,

unless stated)

March 31, 2023 March 31, 2022

Cash Cost per silver equivalent payable

ounce Total Cash Cost

5,228

6,154

Variation in Finished inventory

(25)

(570)

Total Cash Cost of Sales

5,203

5,584

Treatment and Refining Charges

150

504

Selling Costs

243

371

G&A Costs

284

695

Sustaining Capital Expenditures

854

1,106

All-In Sustaining Cash Costs

6,734

8,260

Silver Equivalent Payable Ounces (000's)

226

414

Cash Cost per Silver Equivalent Payable Ounce (US$)

23.02

13.48

All-In Sustaining Cash Cost per Silver Equivalent Payable

Ounce (US$)

29.80

19.94

Consolidated:

CONSOLIDATED Three months ended (In thousand of US

dollars, unless stated)

March 31, 2023 March 31, 2022

Total Cash Cost of Sales

34,603

37,548

All-In Sustaining Cash Costs

53,535

61,553

Copper Equivalent Payable Pounds (000's)

16,299

13,748

Cash Cost per Copper Equivalent Payable Pound (US$)

2.12

2.73

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.28

4.48

Additional non-IFRS measures

The Company uses other financial measures, the presentation of

which is not meant to be a substitute for other subtotals or totals

presented in accordance with IFRS, but rather should be evaluated

in conjunction with such IFRS measures. This includes:

- Operating cash flows before movements in working capital -

excludes the movement from period-to-period in working capital

items including trade and other receivables, prepaid expenses,

deposits, inventories, trade and other payables and the effects of

foreign exchange rates on these items.

This term does not have a standardized meaning prescribed by

IFRS, and therefore the Company’s definition is unlikely to be

comparable to similar measures presented by other companies. The

Company’s management believes that their presentation provides

useful information to investors because cash flows generated from

operations before changes in working capital excludes the movement

in working capital items. This, in management’s view, provides

useful information of the Company’s cash flows from operations and

is considered to be meaningful in evaluating the Company’s past

financial performance or its future prospects. The most comparable

IFRS measure is cash flows from operating activities.

Qualified Persons

Ricardo Salazar Milla, Corporate Manager of Mineral Resources is

a member of the Australian Institute of Geoscientist and is a

Qualified Person under National Instrument 43-101 – Standards of

Disclosure for Mineral Projects.

About Sierra Metals

Sierra Metals is a diversified Canadian mining company with

green metal exposure including copper, zinc and lead production

with precious metals byproduct credits, focused on the production

and development of its Yauricocha Mine in Peru and its Bolivar Mine

in Mexico. The Company is focused on the safety and productivity of

its producing mines. The Company also has large land packages with

several prospective regional targets providing longer-term

exploration upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals

| Facebook: SierraMetalsInc | LinkedIn: Sierra Metals

Inc | Instagram: sierrametals

Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action,

including the accuracy of the Company’s current mineral resource

estimates; that the Company’s activities will be conducted in

accordance with the Company’s public statements and stated goals;

that there will be no material adverse change affecting the

Company, its properties or its production estimates (which assume

accuracy of projected ore grade, mining rates, recovery timing, and

recovery rate estimates and may be impacted by unscheduled

maintenance, labour and contractor availability and other operating

or geo-political uncertainties on the Company’s production,

workforce, business, operations and financial condition); the

expected trends in mineral prices, inflation and currency exchange

rates; that all required approvals will be obtained for the

Company’s business and operations on acceptable terms; that there

will be no significant disruptions affecting the Company's

operations. In certain cases, statements that contain

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", "believes" or

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might", or

"will be taken", "occur" or "be achieved" or the negative of these

words or comparable terminology. Forward-looking statements include

those relating to the Company’s guidance on the timing and amount

of future production and its expectations regarding the results of

operations; expected costs; permitting requirements and timelines;

anticipated market prices of metals; and formalizing the

refinancing contract and the timeline related thereto By its very

nature forward-looking information involves known and unknown

risks, uncertainties and other factors that may cause actual

performance of Sierra to be materially different from any

anticipated performance expressed or implied by such

forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's Annual Information Form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which filings are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230515005259/en/

Investor Relations Sierra Metals Inc. +1 (416) 366-7777

info@sierrametals.com

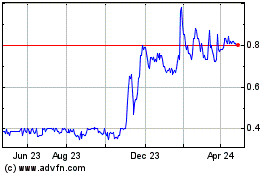

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

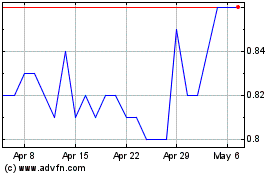

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024