Arias Resource Capital Fund II L.P. and Arias Resource Capital Fund

II (Mexico) L.P. (the “Nominating Shareholders”), together with

other affiliates of Arias Resource Capital and its principal

(together with the Nominating Shareholders, “ARC”) holding

approximately 27% of the outstanding shares of Sierra Metals Inc.

(“Sierra” or the “Company”) (TSX: SMT), urges Sierra shareholders

to immediately vote to reconstitute the board of directors (the

“Board”) and to oust the entrenched incumbent members in advance of

the Company’s annual meeting of shareholders scheduled to be held

on at 2:00 p.m. (Eastern time) on June 28, 2023 (the “Meeting”).

Concerned shareholders should attend the Meeting, to be held

virtually via live audio webcast, online at:

meetnow.global/MFXH4US.

DON’T MISS YOUR LAST CHANCE. VOTE TODAY!

This is the final call to shareholders of Sierra Metals – who

are frustrated by the unprecedented -91% decline in shareholder

value – to elect a significantly reconstituted Board with ARC’s

five highly qualified and competent nominees: J. Alberto Arias,

Derek White, Daniel Tellechea, Ricardo Arrarte, and Alonso Checa

(collectively, the “ARC Nominees”). ARC has been a committed

long-term investor since 2008 and understands Sierra’s assets and

its long-term potential for all shareholders. ARC is the virtual

founder of the Company and when its representatives left the Board

in mid-2021, the value of your Company was US$500 million. This is

more than 10 times the Company’s current market value.

The ARC Nominees have in-country experience in the mining and

metals industry in Peru and Mexico, expertise in geological, mining

and metallurgical engineering, experience in permitting and

community engagement, and expertise in mining finance and M&A

transactions in the metals sector. ARC believes that there is no

better group of people to restore Sierra to its prior levels of

profitability. ARC Nominees will generate medium and long-term

solutions to Sierra’s current liquidity crisis while embarking on

an extensive marketing and capital markets engagement to help

Sierra regain its attractiveness to investors.

ARC’s 5-point plan to immediately start working on a turnaround

is available on www.ProtectYourSierraInvestment.com

FIVE REASONS TO BE WARY OF THE INCUMBENT

BOARD

- ARC is extremely concerned, and

other Sierra shareholders should be as well, that the incumbent

Board may provide a minority group of friendly shareholders that

vote in favour of them at the Meeting with the opportunity to

acquire Sierra shares at prices that are not reflective of Sierra’s

fundamental value. This would substantially dilute all

other shareholders while providing preferential treatment to select

shareholders. Please read ARC’s June 16, 2023 press

release for details.

- Under the incumbent Board, Sierra

Metals has mismanaged its highly lucrative mining assets in Peru

and Mexico. They have reversed more than a decade’s worth of value

and growth in just two years. The Board also consumed cash and

pushed the Company deep into debt by repeatedly

breaching debt covenants and refinancing a majority of its 2023

obligations without a clear path to paying off these

debts in 2025.

- The incumbent board rejected

an offer in excess of US$400 million and attempted to keep this

information from shareholders. The offer was worth more

than eight times Sierra’s current market value (see ARC’s press

release dated June 12, 2023 for details). The Company hid this

information and misled shareholders as recently as May 12, when it

publicly said, “[t]he strategic review concluded in October 2021

without having identified a buyer for the Company or other

strategic alternatives.” It was only after being publicly called

out by ARC that the Company later admitted on May 18, 2023 that

there was an offer in Fall 2021 that it did not accept.

- In May 2023, Sierra announced that

as part of its debt restructuring agreement, it had agreed to

covenants in a material credit facility that effectively entrench

management for the foreseeable future. In addition, the Board has

also agreed to new clauses in its credit facility that will

not let you change the Board in the future without risking

breach. This is shameful and extremely uncommon, and the details

were only disclosed following legal action by

ARC.

- An intentionally

misleading press release about support of a prominent

Peruvian bank to re-elect Sierra’s Board was issued on

June 15, 2023 by Alberto Gubbins. This was neither written nor

authorized by the bank and was corrected only after ARC brought to

light the deliberate misinformation.

YOUR VOTE COUNTS! ACT NOW!

The YELLOW proxy must be received prior to 5:00 p.m.

(Eastern time) on Friday, June 23, 2023 to make your vote count.

Don’t Wait, Vote Right Away.

If you voted on the green proxy and want to change your

vote to the YELLOW proxy, it’s easy! Only your last dated vote

counts.

Shareholders can call or text Kingsdale Advisors on

1.888.370.3955 (toll free in North America), email

contactus@kingsdaleadvisors.com, or chat with an advisor on

www.ProtectYourSierraInvestment.com for more information.

ADVISORS

ARC has retained Kingsdale Advisors as its strategic

shareholder, communications and proxy advisor and Stikeman Elliott

LLP as its legal advisor.

ABOUT ARC

Arias Resource Capital, founded in 2007, is a Miami-based

private equity firm in the metals sector that invests in critical

materials empowering the clean energy revolution.

CAUTIONARY NOTES AND FORWARD-LOOKING

STATEMENTS

This news release contains forward-looking information within

the meaning of applicable securities laws (“forward-looking

statements”) and are prospective in nature. These forward-looking

statements are not based on historical facts, but rather on current

expectations and may include projections about future events and

estimates and their underlying assumptions, statements regarding

plans, objectives, intentions and expectations with respect to

future financial results, events, operations, services, product

development and potential, and statements regarding future

performance. Forward-looking statements are generally identified by

the words “expects”, “anticipates”, “believes”, “intends”,

“estimates”, “plans”, “will”, “may”, “should”, “could”, “believes”,

“potential” or “continue” and similar expressions, or the negative

thereof. Forward-looking statements in this news release include,

without limitation, statements regarding the potential benefits,

contributions and development of the ARC Nominees and the expected

impact and results of Sierra’s corporate governance practices, and

Sierra’s intentions regarding dilutive financings. There are

numerous risks and uncertainties that could cause actual results

and ARC’s plans and objectives to differ materially from those

expressed in, or implied or projected by, the forward-looking

information and statements in this news release, including, without

limitation, the risks described under the headings such as

“Cautionary Statement – Forward Looking Information” and “Risk

Factors” in Sierra’s annual information form dated March 28, 2023

for its fiscal year ended December 31, 2022, and other risks

identified in Sierra’s filings with Canadian securities regulatory

authorities which are available under Sierra’s profile on SEDAR at

www.sedar.com. The forward-looking statements speak only as of the

date hereof and, other than as required by applicable law, ARC

undertakes no duty or obligation to update or revise any

forward-looking information or statements contained in this news

release as a result of new information, future events, changes in

expectation or otherwise.

ADDITIONAL INFORMATION

In connection with the Nominating Shareholders’ solicitation of

proxies in respect of the Meeting, the Nominating Shareholders have

filed and mailed its dissident proxy circular (the “ARC Circular”)

and the YELLOW form of proxy to Sierra shareholders.

Any solicitation made by ARC will be made by it and not by or on

behalf of the management of Sierra. All costs incurred for any

solicitation will be borne by ARC, provided that, subject to

applicable law, ARC may seek reimbursement from Sierra of ARC’s

out-of-pocket expenses, including proxy solicitation expenses and

legal fees, incurred in connection with any successful result at a

meeting of Sierra shareholders. Proxies may be solicited by ARC

pursuant to the ARC Circular. Solicitations may be made by or on

behalf of ARC by mail, telephone, fax, email or other electronic

means as well as by newspaper or other media advertising, and in

person by directors, officers and employees of ARC, who will not be

specifically remunerated therefor. ARC may also solicit proxies in

reliance upon the public broadcast exemption to the solicitation

requirements under applicable Canadian corporate and securities

laws, including through press releases, speeches or publications,

and by any other manner permitted under applicable Canadian laws.

ARC may engage the services of one or more agents and authorize

other persons to assist in soliciting proxies on its behalf, which

agents would receive customary fees for such services. In

particular, ARC has engaged Kingsdale Advisors (“Kingsdale”) to act

as ARC’s shareholder and communications advisor and to act as its

strategic shareholder advisor and proxy solicitation agent to

solicit proxies in the United States and Canada. Pursuant to this

engagement, Kingsdale will receive an initial fee of C$150,000,

plus a customary fee for each call to and from shareholders.

Proxies may be revoked by instrument in writing by a shareholder

giving the proxy or by its duly authorized officer or attorney, or

in any other manner permitted by law and the articles or by-laws of

Sierra. None of ARC nor, to its knowledge, any of its associates or

affiliates, has any material interest, direct or indirect: (i) in

any transaction since the beginning of Sierra’s most recently

completed financial year or in any proposed transaction that has

materially affected or would materially affect Sierra or any of its

subsidiaries; or (ii) by way of beneficial ownership of securities

or otherwise, in any matter proposed to be acted on by Sierra at

the Meeting, other than the election of directors to the board of

Sierra or as disclosed in accordance with applicable law.

See the ARC Circular for further information regarding the

Nominating Shareholders, ARC and the ARC Nominees. A copy is

available under Sierra’s profile on SEDAR at www.sedar.com.

Sierra trades on the Toronto Stock Exchange under the symbol

“SMT”. Sierra’s head office is located at 77 King Street West,

Suite 400, Toronto, Ontario M5K 0A1.

CONTACT

Aquin GeorgeDirector, Special SituationsKingsdale

Advisors647-265-4528ageorge@kingsdaleadvisors.com

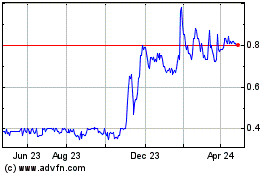

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

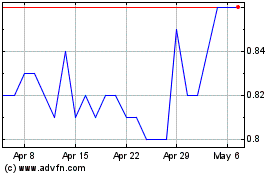

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024