Stantec Inc. (the “

Corporation” or

“

Stantec”) (TSX, NYSE: STN), a global leader in

sustainable design and engineering, has entered into an agreement

with National Bank Financial Inc. and CIBC Capital Markets, acting

as co-bookrunners, on behalf of a syndicate of underwriters

(collectively, the “

Underwriters”), pursuant to

which the Corporation will issue from treasury, and the

Underwriters shall purchase on a “bought deal” basis, 2,703,000

common shares (the “

Shares”) at a price of $92.50

(the “

Offer Price”) for gross proceeds to the

Corporation of approximately $250 million (the

“

Offering”).

Stantec intends to use the net proceeds of the

Offering to repay balances outstanding on its revolving credit

facility with the intention of creating additional capacity to fund

future acquisition opportunities and growth initiatives, as well as

for general corporate purposes.

On December 5, 2023, Stantec will release its

2024-2026 Strategic Plan laying out its overall objectives for the

next three years. The Offering will be an integral part of the

2024-2026 Strategic Plan, positioning Stantec to achieve its new

growth objectives. Stantec continues to see significant acquisition

opportunities in all its sectors and remains committed to executing

on its expansion plans by capitalizing on accretive opportunities

that enhance its operational profile.

“We continue to believe that deploying capital

towards strategic, accretive growth creates the best long-term

value for our stakeholders,” said Gord Johnston, Stantec’s

President and CEO. “This Offering signals our confidence in the

robustness of the acquisition landscape and, when combined with our

strong balance sheet, positions us to be opportunistic for

continued growth.”

The Underwriters have been granted an

over-allotment option (the “Over-Allotment

Option”), exercisable in whole or in part on the same

terms as the Offering for a period of 30 days from the closing of

the Offering, to purchase additional Shares, representing up to 15%

of the size of Offering, for additional gross proceeds of up to

$37,504,125.

The Shares to be issued pursuant to the Offering

and Over-Allotment Option will be offered in all provinces and

territories of Canada by way of a prospectus supplement (the

“Prospectus Supplement”) to the short form base

shelf prospectus (the “Shelf Prospectus”) of the

Corporation dated November 18, 2022. The Shares will also be

offered in the United States by way of private placement. The

Offering is made only under the Shelf Prospectus and the Prospectus

Supplement, which contain important detailed information about the

Shares. Before investing, prospective purchasers should read the

Shelf Prospectus, the Prospectus Supplement and the documents

incorporated by reference therein for more complete information

about Stantec and the Offering.

The issuance of the Shares is subject to

customary approvals of applicable securities regulatory

authorities, including the Toronto Stock Exchange (the

“TSX”) and the New York Stock Exchange

(“NYSE”). Closing of the Offering is expected to

occur on or about November 29, 2023.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Shares have not been, and will not be, registered under the U.S.

Securities Act, or any state securities laws. Accordingly, the

Shares may not be offered or sold within the United States unless

registered under the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions from the registration

requirements of the U.S. Securities Act and applicable state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the Shares in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Stantec

Communities are fundamental. Whether around the

corner or across the globe, they provide a foundation, a sense of

place and of belonging. That’s why at Stantec, we always design

with community in mind.

We care about the communities we serve—because

they’re our communities too. This allows us to assess what’s needed

and connect our expertise, to appreciate nuances and envision

what’s never been considered, to bring together diverse

perspectives so we can collaborate toward a shared success.

We’re designers, engineers, scientists, and

project managers, innovating together at the intersection of

community, creativity, and client relationships. Balancing these

priorities results in projects that advance the quality of life in

communities across the globe.

Stantec trades on the TSX and the NYSE under the

symbol STN.

Cautionary Note Regarding Forward Looking

Statements

Certain statements contained in this news

release constitute forward-looking statements. These statements

include, without limitation, comments about the size and terms of

the proposed Offering, the Over-Allotment Option, the timing and

completion of the Offering, the expected use of the net proceeds of

the Offering and the Corporation's ability to capture future growth

opportunities. Readers of this news release are cautioned not to

place undue reliance on forward-looking statements since a number

of factors could cause actual future results to differ materially

from the expectations expressed in these forward-looking

statements. These factors include, but are not limited to, the risk

of economic downturn, cash flow projections, project cancellations,

access and retention of skilled labor, decreased infrastructure

spending levels, decrease or end to stimulus programs, changing

market conditions for Stantec’s services, and the risk that Stantec

fails to capitalize on its strategic initiatives. Investors and the

public should carefully consider these factors, other

uncertainties, and potential events, as well as the inherent

uncertainty of forward-looking statements, when relying on these

statements to make decisions with respect to the Corporation.

Future outcomes relating to forward-looking

statements may be influenced by many factors and material risks.

For the three and nine month periods ended September 30, 2023,

there has been no significant change in the risk factors from those

described in Stantec's 2022 Annual Report. This report is

accessible online by visiting EDGAR on the SEC website at sec.gov

or by visiting the CSA website at sedarplus.ca or Stantec’s

website, Stantec.com. You may obtain a hard copy of the 2022 annual

report free of charge from the investor contact noted below.

Investor Contact Jess Nieukerk Stantec Investor

RelationsPh: 403-569-5389 jess.nieukerk@stantec.com

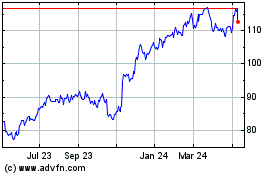

Stantec (TSX:STN)

Historical Stock Chart

From Mar 2024 to Apr 2024

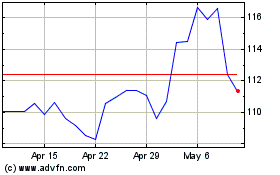

Stantec (TSX:STN)

Historical Stock Chart

From Apr 2023 to Apr 2024