Wesdome Announces 2021 Second Quarter Production of 30,375 Ounces of Gold Produced at the Eagle River Complex

July 13 2021 - 3:30PM

Wesdome Gold Mines Ltd. (TSX:WDO) (“Wesdome” or the “Company”)

today announces its gold production results for the second quarter

of 2021 (“Q2”).

Mr. Duncan Middlemiss, President and CEO commented, “Q2

production at the Eagle River underground mine of 29,836 ounces was

39% higher than Q1 (21,396 ounces) driven by an 18% increase in

both recovered gold grades and in Eagle River tonnes milled. Higher

production rates from the 311 Zone stope allowed production

throughput to reach over 693 tonnes per day ('tpd') during the

quarter. Total H1 2021 production at the Eagle River Complex is

52,939 ounces, leaving us very well positioned to deliver on our

guidance of 92,000 – 105,000 ounces.

“At Kiena, development is proceeding on track to produce our

first commercial ounces of gold from this asset in Q3 2021, where

guidance is 15,000 – 25,000 for H2 2021. This is a transformational

time for Wesdome as we begin to realize our vision of becoming

Canada’s next mid-tier gold producer.”

|

Amounts are denominated in Canadian dollars |

Second Quarter |

Year-to-Date |

|

|

|

2021 |

|

2020 |

Variance |

|

% +/(-) |

|

|

2021 |

|

2020 |

Variance |

|

% +/(-) |

|

|

|

|

|

|

|

|

|

|

|

| Ore

milled (tonnes) |

|

|

|

|

|

|

|

|

|

Eagle River |

|

63,057 |

|

42,349 |

|

20,708 |

|

49% |

|

|

116,596 |

|

98,223 |

|

18,373 |

|

19% |

|

|

Mishi |

|

9,347 |

|

13,721 |

|

-4,374 |

|

(32%) |

|

|

26,567 |

|

24,768 |

|

1,799 |

|

7% |

|

|

|

|

72,404 |

|

56,070 |

|

16,334 |

|

29% |

|

|

143,163 |

|

122,991 |

|

20,172 |

|

16% |

|

|

|

|

|

|

|

|

|

|

|

| Head

grade (grams per tonne, “g/t”) |

|

|

|

|

|

|

|

|

|

Eagle River |

|

15.1 |

|

18.1 |

|

(3.0) |

|

(17%) |

|

|

14.1 |

|

15.8 |

|

(1.7) |

|

(11%) |

|

|

Mishi |

|

2.4 |

|

2.9 |

|

(0.5) |

|

(17%) |

|

|

2.4 |

|

2.7 |

|

(0.3) |

|

(11%) |

|

|

|

|

|

|

|

|

|

|

|

| Gold

production (ounces) |

|

|

|

|

|

|

|

|

|

Eagle River |

|

29,836 |

|

24,117 |

|

5,719 |

|

24% |

|

|

51,232 |

|

48,574 |

|

2,658 |

|

5% |

|

|

Mishi |

|

539 |

|

1,026 |

|

-487 |

|

(47%) |

|

|

1,707 |

|

1,690 |

|

17 |

|

1% |

|

| Total

Gold Production |

|

30,375 |

|

25,142 |

|

5,233 |

|

21% |

|

|

52,939 |

|

50,264 |

|

2,675 |

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

Production sold (ounces) 3 |

|

28,500 |

|

23,140 |

|

5,360 |

|

23% |

|

|

50,957 |

|

49,640 |

|

1,317 |

|

3% |

|

|

|

|

|

|

|

|

|

|

|

| Revenue

from gold sales ($ millions) 4 |

$63.8 |

$54.7 |

$9.1 |

|

17% |

|

$109.7 |

$112.0 |

($2.3) |

|

(2%) |

|

|

|

|

|

|

|

|

|

|

|

| Average

realized price per ounce 2 |

$2,239 |

$2,365 |

|

-126 |

|

(5%) |

|

$2,232 |

$2,257 |

|

-25 |

|

(1%) |

|

|

|

|

|

|

|

|

|

|

|

Notes:

- Operating numbers may not add due to

rounding.

- Average realized price per ounce is a

non-IFRS performance measure and is calculated by dividing the

revenue from gold sales by the number of ounces sold for a given

period.

- YTD 2021 production sold includes

1,793 ounces of gold sold from the Kiena bulk sample which was

processed in Q4 2020 and sold in Q1 2021.

- YTD 2021 revenue excludes $3.9 million

of revenue from the Kiena bulk sample, which was processed in Q4

2020 and sold in Q1 2021. The incidental revenue was credited

against the cost of the Kiena exploration asset.

Technical Disclosure

The technical content of this release has been

compiled, reviewed and approved by Marc-Andre Pelletier, P. Eng,

Chief Operating Officer, a "Qualified Person" as defined in

National Instrument 43-101 -Standards of Disclosure for Mineral

Projects.

COVID-19

The health and safety of our employees,

contractors, vendors, and consultants is the Company’s top

priority. In response to the COVID-19 outbreak, Wesdome has adopted

all public health guidelines regarding safety measures and

protocols at all of its mine operations and corporate offices. In

addition, our internal COVID-19 Taskforce continues to monitor

developments and implement policies and programs intended to

protect those who are engaged in business with the Company.

Through care and planning, to date the Company has

successfully maintained operations, however there can be no

assurance that this will continue despite our best efforts. Future

conditions may warrant reduced or suspended production activities

which could negatively impact our ability to maintain projected

timelines and objectives. Consequently, the Company’s actual future

production and production guidance is subject to higher levels of

risk than usual. We are continuing to closely monitor the situation

and will provide updates as they become available.

ABOUT WESDOMEWesdome has had over

30 years of continuous gold mining operations in Canada. The

Company is 100% Canadian focused with a pipeline of projects in

various stages of development. The Company’s strategy is to

build Canada’s next intermediate gold producer, producing 200,000+

ounces from two mines in Ontario and Québec. The Eagle River

Underground Mine in Wawa, Ontario is currently producing gold at a

rate of 92,000 – 105,000 ounces per year. Wesdome is actively

exploring its brownfields asset, the Kiena Complex in Val d’Or,

Québec. The Kiena Complex is a fully permitted former mine

with a 930-metre shaft and 2,000 tonne-per-day mill, and a restart

of operations was announced on May 26, 2021. The Company has

completed a PFS in support of the production restart decision. The

Company also retains meaningful exposure to the Moss Lake gold

deposit, located 100 kilometres west of Thunder Bay, Ontario

through its equity position in Goldshore Resources Inc. The Company

has approximately 139.7 million shares issued and outstanding and

trades on the Toronto Stock Exchange under the symbol “WDO”.

| For

further information, please contact: |

|

|

| |

|

|

| Duncan Middlemiss |

or |

Lindsay Carpenter Dunlop |

| President and CEO |

|

VP Investor Relations |

| 416-360-3743 ext. 2029 |

|

416-360-3743 ext. 2025 |

| duncan.middlemiss@wesdome.com |

|

lindsay.dunlop@wesdome.com |

| |

|

|

| |

|

|

| 220 Bay St. Suite 1200 |

|

|

| Toronto, ON, M5J 2W4 |

|

|

| Toll Free: 1-866-4-WDO-TSX |

|

|

| Phone: 416-360-3743, Fax: 416-360-7620 |

|

|

| Website: www.wesdome.com |

This news release contains “forward-looking information” which

may include, but is not limited to, statements with respect to the

future financial or operating performance of the Company and its

projects. Often, but not always, forward-looking statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will” be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Forward-looking statements

contained herein are made as of the date of this press release and

the Company disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events

or results or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The Company undertakes no

obligation to update forward-looking statements if circumstances,

management’s estimates or opinions should change, except as

required by securities legislation. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements. The Company has included in this news release certain

non-IFRS performance measures, including, but not limited to, mine

operating profit, mining and processing costs and cash costs. Cash

costs per ounce reflect actual mine operating costs incurred during

the fiscal period divided by the number of ounces produced. These

measures are not defined under IFRS and therefore should not be

considered in isolation or as an alternative to or more meaningful

than, net income (loss) or cash flow from operating activities as

determined in accordance with IFRS as an indicator of our financial

performance or liquidity. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate the Company's

performance and ability to generate cash flow.

PDF

available: http://ml.globenewswire.com/Resource/Download/978d3c2a-800f-4a3d-92c9-e43305ddcd15

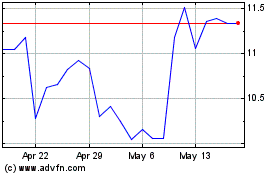

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Jun 2024 to Jul 2024

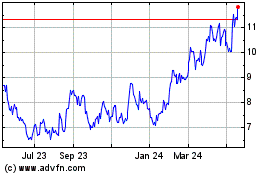

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Jul 2023 to Jul 2024