Emgold Mining Corporation (EMR:

TSX-V) ("Emgold" or the "Company") is pleased to announce that the

2013 surface drilling program proposed for its Buckskin Rawhide

East Property (the "Property") has been approved by the U.S. Bureau

of Land Management (the "BLM"). The Property is located about 40

miles south of Fallon, Nevada in the Rawhide Mining District and is

adjacent to the active Denton Rawhide Mine owned by Rawhide Mining

LLC ("RMC"), a private company. The Company also announces the

resignation of one of its directors, reducing the number of

directors of the company from six to five, as described on page two

below.

Emgold recently acquired a 75

percent interest in the Buckskin Rawhide East Property and is in

the process of acquiring the remaining 25 percent interest from the

underlying property owners (see November 14, 19, and 26, 2012,

December 28, 2012, January 13, 2013, and February 13, 2013 press

releases). As part of these transactions, the Company has completed

two private placements to RMC to date, totaling CDN$750,000. The

Company will complete another CDN$250,000 private placement to RMC

once the remaining 25 percent interest in Buckskin Rawhide East

Property is transferred from the underlying property owners to

Emgold, as part of the title process. Upon acquiring 100 percent

ownership of the Property, the Property will be leased to RMC, who

will conduct the exploration as part of the lease agreement.

Reverse circulation drilling is

planned for the eastern half of the Buckskin Rawhide claim block in

the Chicago Mountain/Chicago Gulch and North Buckskin Mountain

Target areas. The purpose of the 2013 exploration program is to

extend areas of gold-silver mineralization discovered by Kennecott

Exploration ("Kennecott") in the 1990s and by Emgold since 2009.

The Chicago Mountain Target consists of a bulk disseminated gold

and silver exploration target approximately 4,000 feet long by 400

feet width that was identified from historic Kennecott and more

recent Emgold surface rock chip sampling and analysis, as well as

from historic Kennecott drilling (see Emgod's October 4, 2011 press

release). Kennecott drilled approximately 15 reverse circulation

holes in this target area in the 1990s, with 10 of the holes

encountering structurally controlled mineralization from surface to

depths of up to 165 feet. The North Buckskin Mountain Target is a

new target that has been identified by Emgold and RMC from historic

rock chip sampling and analysis of historic Kennecott drilling. It

consists of a bulk disseminated gold and silver exploration target

approximately 2,000 feet long by 400 feet wide. Kennecott drilled

21 reverse circulation holes in this target area in the 1990s with

10 encountering structurally controlled mineralization to depths up

to 500 feet.

The 2013 planned drilling program

includes 11 drill sites at Chicago Mountain/Chicago Gulch and seven

drill sites at North Buckskin Mountain. Planned drilling depths

range from 300-500 feet. Multiple holes may be drilled at any of

the drill sites. The estimated total cost of the 2013 drill program

is $250,000. If this initial program is successful, additional work

will be planned to conduct a larger drill program with the goal of

delineating a bulk disseminated gold and silver resource that could

potentially become a minable satellite deposit for the adjacent

Denton Rawhide Mine. The Chicago Mountain Target is situated about

one mile from RMC mine facilities and the North Buckskin Target is

about 1.5 miles from the mine facilities.

The Denton Rawhide Mine was owned

and operated by Kennecott Minerals Company from 1988 to 2010.

Operations at the mine were suspended in May 2003 due to low gold

prices but the mine continued to produce gold and silver from

existing heap leach pads. From 1990 through 2010, the Denton

Rawhide Mine produced 1.5 million ounces of gold and 12.4 million

ounces of silver (source: The Nevada Mineral Industry 2010, Nevada

Bureau of Mines and Geology Special Publication MI-2010, 2011). In

2010, the Denton Rawhide Mine was acquired by RMC who continued to

produce gold and silver from the heap leach pads. RMC advises that,

in 2012, it recommenced mining activities at the Denton Rawhide

Mine.

David Watkinson, President and CEO

of Emgold, stated: "We are pleased that exploration drilling will

commence on the Buckskin Rawhide East Property. Opportunity exists

to fast track exploration, permitting, and development of any

resources discovered at Buckskin Rawhide East by utilizing the

adjacent Denton Rawhide facilities. Emgold believes that advancing

the Buckskin Rawhide East Property with RMC as the operator is the

best opportunity for the Company to achieve cash flow in the near

term. Cash flow would come in the form of Bonus Payments related to

gold equivalent ounces produced from the Property."

As per a Letter Agreement with RMC

announced by press release on November 14, 2012, RMC has the option

of earning a 100% interest in the Buckskin Rawhide East Property by

bringing it into commercial production. Upon achieving commercial

production, RMC would make Bonus Payments to Emgold. Bonus Payments

would be US$15 per ounce when the price of gold ranges between

US$1,200 and US$1,799 per ounce. Payments would increase to US$20

per ounce when the price of gold exceeds $1,800 per ounce.

Management Update

Emgold announces that, effective

June 14, Mr. Stephen Wilkinson has resigned as a Director for

personal reasons. This reduces the number of directors of the

Company from six to five, including two independent directors.

Management would like to thank Mr. Wilkinson for his work over

these last few years and continued support of the Company.

About Emgold Mining Corporation

Emgold is a junior gold exploration

and project development company that has several exploration

properties located in the western U.S. and Canada. These include

the Buckskin Rawhide East and West and Koegel Rawhide gold

properties in Nevada, and the Stewart and Rozan poly-metallic

properties in British Columbia.

Qualified Person

Technical information in this press

release has been reviewed and approved by Mr. Robert Pease, P.Geo.,

a Qualified Person as defined in National Instrument 43-101. Mr.

Pease is responsible for supervising the technical work related to

Emgold's U.S. Properties.

On behalf of the Board of

Directors

David G. Watkinson, P.Eng.

President & CEO

For further information please contact:

Tel: 778-375-3106

Email: info@emgold.com

This release was

prepared by the Company's management. Neither TSX Venture Exchange

nor its Regulation Services Provider (as the term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release. For more information on

the Company, investors should review the Company's filings that are

available at www.sedar.com or the Company's

website at www.emgold.com.

This news release

includes certain statements that are "forward-looking statements"

within the meaning of applicable securities laws including

statements regarding planned drilling and potential future mining

of the Buckskin Rawhide East Property, exploration potential,

expected results, and other statements. Forward-looking statements

assume that actual results of permitting and exploration activities

by the Company on its various properties are consistent with

management's expectations, that assumptions relating to exploration

targets are accurate, and that necessary financing will be

available for Emgold and RMC to complete exploration work. They

include assumptions about production rates, production grades, and

gold recoveries. Although the Company believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in or that may be inferred from the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include the failure to obtain the required permits and approvals,

exploration results that are different than those anticipated,

inability to raise or otherwise secure capital to fund planned

permitting, exploration, mine construction and development, and

mine operations. Other risk factors include changes in metal

prices, the price of the Company's shares, the costs of labour, the

cost of equipment, the cost of supplies, actual development and

mining operation successes, exploitation and exploration successes,

approvals by federal, state, and local agencies, permitting delays,

legal challenges to permits, general economic, market or business

conditions, and other factors beyond the control of the Company.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

The Company does not intend to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by law.

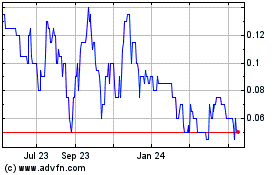

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

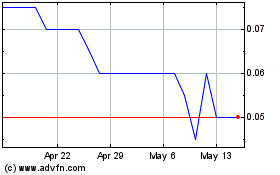

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Jan 2024 to Jan 2025