Galane Gold Ltd. (“Galane Gold” or the Company”) (TSX-V: GG; OTCQB:

GGGOF) today announces that it has entered into definitive

agreements to sell its Mupane gold mine in Botswana (the “Mupane

Property”) to Hawks Mining Company Proprietary Limited (the

“Purchaser”), a company registered under the laws of Botswana and

owned by certain individuals forming part of the Company’s local

Botswana management team (the “Transaction”).

The board of directors (the “Board”) and

management of Galane, as part of its continuing review of the

strategy of the Company going forward, has concluded that the

Transaction aligns with its long-term goal to be a low-cost

producer that can generate positive cash flows through the various

cycles of the gold market. With the near completion of the mining

of the Tau ore body and the transition to the mining of Golden

Eagle, there is a need to restructure operations at the Mupane

Property both operationally and financially. Upon review by the

Board, it was decided that the Company’s resources will be better

utilised by increasing production at Galaxy, and restarting

operations at the Summit Mine. Based on the financial statements of

the Company as at September 30, 2021, Mupane represented

approximately 5% of the net value of the total assets less the

total liabilities of the Company.

The Transaction is structured as a sale of all

of the issued and outstanding shares of the Company’s Botswana

subsidiaries which own the Mupane Property and related claims

namely Mupane Gold Mining Proprietary Limited, Galane Gold Botswana

Proprietary Limited and Southern Cross Exploration and Development

Proprietary Limited. The aggregate consideration to be paid by the

Purchaser is a nominal amount. In addition, as part of the

Transaction, the Company has agreed to cede its rights, title and

interest in certain claims it has on loan accounts against the

Botswana subsidiaries through cession agreements entered into with

the Purchaser. On the closing of the Transaction, the Company will

have no further rights or financial obligations relating to

Mupane.

“Mupane has been the cornerstone of Galane since

we commenced operations in 2011, and the decision to sell it to the

local management team represents a sensible conclusion for both

parties. Mupane needs to transition into a smaller producer,

restructuring its operations and finances to match its projected

cash flows. We believe that the local management team has the

skills required and will have the support of the Botswana

Government to achieve this. For Galane Gold, the restructured

Mupane does not fit our long-term goals. Our current focus needs to

be on the expansion of Galaxy and the recommencement of operations

at the Summit Mine,” said Nick Brodie, Chief Executive Officer.

Ravi Sood, the Chairman of Galane Gold, said in

addition, “Our experience with Mupane in Botswana over the past 11

years has been outstanding in every respect. While we are sad to be

leaving such a constructive and progressive country, we are very

pleased to be part of a transaction that will result in one of the

largest businesses in the country becoming wholly-owned by the

local management team.”

Closing of the Transaction is expected towards

the end of the first quarter of 2022 and is subject to various

conditions, including, but not limited to, the execution of

transition services agreements with respect to certain obligations

of each party to the Transaction for the interim period prior to

the Closing and for 12 months following Closing, approval of

governmental and regulatory authorities, including the Botswana

Ministry of Mineral Resources, Green Technology and Energy Security

and the TSX Venture Exchange (the “TSXV”), and other customary

closing conditions.

About Galane Gold

Galane Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements in

Botswana, South Africa and New Mexico. Galane Gold is a public

company and its shares are quoted on the TSXV under the symbol “GG”

and the OTCQB under the symbol “GGGOF”. Galane Gold’s management

team is comprised of senior mining professionals with extensive

experience in managing mining and processing operations and

large-scale exploration programmes. Galane Gold is committed to

operating at world-class standards and is focused on the safety of

its employees, respecting the environment, and contributing to the

communities in which it operates.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, those regarding the closing

of the Transaction, satisfaction of the closing conditions to the

Transaction, obtaining customary governmental, regulatory and stock

exchange approvals including that of the TSXV for the Transaction,

the Company being a low-cost producer and generating positive cash

flows through the various cycles of the gold market, technical,

financial and business prospects of the Company, future financial

position and results of operations, strategy, proposed

acquisitions, plans, objectives, goals and targets, and any

statements preceded by, followed by or that include the words

“believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”,

“may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”,

“project”, “seek”, “should” or similar expressions or the negative

thereof, are forward-looking statements. These statements are not

historical facts but instead represent only the Company’s

expectations, estimates and projections regarding future events.

These statements are not guarantees of future performance and

involve assumptions, risks and uncertainties that are difficult to

predict. Therefore, actual results may differ materially from what

is expressed, implied or forecasted in such forward-looking

statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in Botswana and South Africa;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in Botswana and South Africa; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Neither the TSXV nor its regulation services

provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:Nick BrodieCEO, Galane Gold Ltd.+ 44 7905

089878Nick.Brodie@GalaneGold.comwww.GalaneGold.com

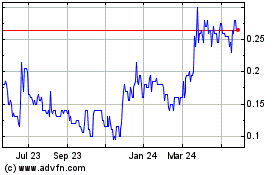

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Dec 2024 to Jan 2025

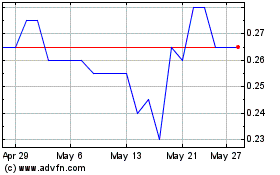

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Jan 2024 to Jan 2025