Goldsource Mines and Eagle Mountain Complete Business Combination;

Goldsource Mines Completes $2.4 Million Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 3, 2014) -

Goldsource Mines Inc. (TSX-VENTURE:GXS)(FRANKFURT:G5M)

("Goldsource") and Eagle Mountain Gold Corp.

(TSX-VENTURE:Z)(FRANKFURT:E9X1)(OTCQX:EMGCF) ("Eagle Mountain") are

pleased to announce that they have successfully completed their

previously announced business combination.

J. Scott Drever, Chief Executive Officer stated: "We are pleased

that the transaction has come to a successful conclusion. The new

Goldsource Mines brings together a powerful combination of

well-defined gold resources and dynamic, successful people with

strong financial capabilities. We are convinced that these

attributes will set the stage for accelerated development of the

Eagle Mountain Gold Project and enable us to commence gold

production in Guyana on a 'phased' production basis prior to year

end."

Ioannis (Yannis) Tsitos, President stated: "We are pleased to

announce the successful completion of the merger. The overwhelming

support received from our shareholders and the common vision and

strategy for the development of the Eagle Mountain Gold Project in

Guyana have been crucial in making this combination a success. As

President of the new Goldsource Mines, I look forward to working

with such a dynamic and experienced management team. I believe this

new era will drive significant growth and sustainable value for the

company and its shareholders."

Completion of Business

Combination

On February 28, 2014, Goldsource and Eagle Mountain completed

their business combination (the "Transaction") as jointly announced

on November 26, 2013. As a result, all of the shareholders of Eagle

Mountain have become shareholders of Goldsource and a corporation

into which Eagle Mountain was amalgamated has become a wholly owned

subsidiary of Goldsource. Pursuant to the Transaction, each common

share of Eagle Mountain has been exchanged for 0.52763 of a common

share of Goldsource.

The transfer agent for the common shares of Goldsource is

Computershare Trust Company of Canada ("Computershare"). A letter

of transmittal will be sent to the former Eagle Mountain registered

shareholders with instructions for the exchange through

Computershare of their existing Eagle Mountain share certificates

for certificates representing the common shares of Goldsource to

which they are entitled under the Transaction. Beneficial

shareholders whose shares are registered in the name of their

broker or an agent of that broker will receive the common shares of

Goldsource to which they are entitled under the Transaction

directly in their brokerage account.

As a result of the Transaction, Eagle Mountain's common shares

will be delisted from the TSX Venture Exchange on the date

announced in a TSX Venture Exchange Bulletin and from other public

trading markets in due course.

Goldsource's Completion

of $2.4 Million Private Placement

Goldsource also concurrently completed on February 28, 2014 the

private placement ("Private Placement") of 17,142,858 units at a

price of $0.14 per unit for gross proceeds of $2.4 million. Each

unit consisted of one common share of Goldsource and one-half of a

warrant of Goldsource, with each whole warrant being exercisable

for one common share of Goldsource at a price of $0.20 per share

for a term of three years until February 28, 2017.

Goldsource will have the right to accelerate the expiry date of

the warrants if the Volume Weighted Average Price of the common

shares of Goldsource on the TSX Venture Exchange is greater than

$0.65 per share for any 20 consecutive trading days after the first

18 months of the term. In such case, upon notice by Goldsource, any

warrants which remain unexercised will expire 30 days after such

notice.

Proceeds from the Private Placement will be used to advance the

Eagle Mountain Gold Project and for general working capital

purposes. No commission or finder's fee was payable on the Private

Placement. The shares and warrants issued under the Private

Placement and the shares issuable upon exercise of the warrants are

all subject to a hold period that expires on June 29, 2014.

Goldsource Share

Capital

As a result of the Transaction and the Private Placement,

Goldsource has 75,490,316 common shares outstanding and has an

aggregate of 29,212,629 common shares reserved for issuance upon

exercise of outstanding options and warrants.

As a condition of Goldsource's completion of the Transaction, an

amendment of Eagle Mountain's joint venture agreement on the Eagle

Mountain Gold Project was completed with OMAI Gold Mines Ltd.

("OMAI"), a subsidiary of IAMGOLD Corporation. Goldsource has

agreed to issue to or to the order of OMAI a total of 3,389,279

Goldsource common shares subject to the terms of the amendment and

TSX Venture Exchange approval. Further details of this transaction

are forthcoming.

Goldsource Directors

and Officers

Upon the completion of the Transaction, Goldsource's directors

and officers are as follows:

| J.

Scott Drever |

- |

Chief

Executive Officer and Director |

|

Ioannis (Yannis) Tsitos |

- |

President and Director |

|

Jonathan Dubois-Phillips |

- |

Director |

|

Steven B. Simpson |

- |

Director |

|

Graham C. Thody |

- |

Chairman and Director |

| N.

Eric Fier |

- |

Chief

Operating Officer |

|

Barney Magnusson |

- |

Chief

Financial Officer |

|

Bernard Poznanski |

- |

Corporate Secretary |

Further information

on Goldsource, its business and properties, and the Transaction is

contained in Eagle Mountain's Information Circular dated January

24, 2014 filed on SEDAR. Information on Goldsource directors and

officers is available on the Goldsource website:

www.goldsourcemines.com.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements"

within the meaning of Canadian securities legislation. Such

forward-looking statements concern Goldsource's anticipated

consolidated results and developments in Goldsource's consolidated

operations in future periods, planned exploration and development

of the Eagle Mountain Gold Project, plans related to its business

and other matters that may occur in the future. These statements

relate to analyses and other information that are based on

expectations of future performance, including gold production and

planned work programs. Statements derived from mineral resource

estimates may also constitute forward-looking statements to the

extent that they involve estimates of the mineralization that will

be encountered if the Eagle Mountain property is

developed.

Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors which could

cause actual events or results to differ from those expressed or

implied by the forward-looking statements, including, without

limitation: risks related to precious and base metal price

fluctuations; risks related to fluctuations in the currency markets

(particularly the Guyanese dollar, Canadian dollar and United

States dollar); risks related to the inherently dangerous activity

of mining, including conditions or events beyond control of

Goldsource, and operating or technical difficulties in mineral

exploration, development and mining activities; uncertainty in the

Goldsource's ability to raise financing and fund the development of

the Eagle Mountain Gold Project; uncertainty as to actual capital

costs, operating costs, production and economic returns, and

uncertainty that development activities will result in a profitable

mining operation at the Eagle Mountain Gold Project; risks related

to mineral resource figures being estimates based on

interpretations and assumptions; risks related to governmental

regulations and obtaining necessary licenses and permits; risks

related to the business being subject to environmental laws and

regulations; risks relating to inadequate insurance or inability to

obtain insurance; risks related to potential litigation; risks

related to the global economy; risks related to the Eagle Mountain

Gold Project being located in Guyana, including political,

economic, social and regulatory instability. Should one or more of

these risks and uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in the forward-looking statements. The

forward-looking statements are based on beliefs, expectations and

opinions of management on the date the statements are made. For the

reasons set forth above, investors should not place undue reliance

on forward-looking statements.

The information provided in this news release is not

intended to be a comprehensive review of all matters and

developments concerning Goldsource and its business combination

with Eagle Mountain. It should be read in conjunction with all

other disclosure documents of the two companies. The information

contained herein is not a substitute for detailed investigation or

analysis.

Neither the

TSX Venture Exchange nor its Regulation Service Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Goldsource Mines Inc.J. Scott DreverCEO+1 (604)

694-17601-866-691-1760 (Canada & USA)Goldsource Mines

Inc.Ioannis (Yannis) TsitosPresident+1 (604) 694-17601-866-691-1760

(Canada & USA)Goldsource Mines Inc.Fred CooperInvestor

Relations+1 (604) 694-1760 / 1-866-691-1760 (Canada & USA)+1

(604) 694-1761info@goldsourcemines.comwww.goldsourcemines.com

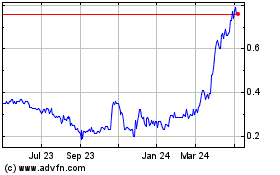

Goldsource Mines (TSXV:GXS)

Historical Stock Chart

From Dec 2024 to Jan 2025

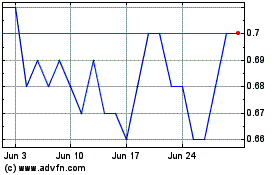

Goldsource Mines (TSXV:GXS)

Historical Stock Chart

From Jan 2024 to Jan 2025