IBEX Technologies Inc. (TSX VENTURE:IBT), today reported its financial results

for the second quarter ended January 31, 2010.

HIGHLIGHTS FOR THE QUARTER:

- Quarterly net earnings increased 47% vs. year ago;

- EPS double vs. year ago;

- Working capital increased 43% vs. year ago (and 17% vs. previous

quarter).

"Year to date results are in line with expectations, notwithstanding the quarter

to quarter variability", said Paul Baehr, IBEX CEO. "Second half results are

expected to be softer, given that certain customers are feathering back

inventories. Cash and working capital continue to increase significantly, as the

results from prior years hedges begin to flow in".

FINANCIAL RESULTS FOR THE SECOND QUARTER

In USD sales IBEX recorded its highest quarterly sales since going public, with

total sales for this quarter reaching USD$838,297, up from USD$790,428 in same

period a year ago, an increase of 6%.

Reported sales (CAD) for the quarter ended January 31, 2010 totaled $871,037 a

decrease of 13% as compared to $995,557 to the same period in the prior year,

but representing an increase of 35% vs. the previous quarter.

This decrease of 13% in CAD sales is due to the translation of current USD sales

into Canadian sales. A higher value of the Canadian dollar negatively impacts

the current USD sales by translating them into a lower Canadian amount. During

the second quarter of fiscal year 2009, the average USD currency rate reached

$1.2125 but dropped to an average of $1.0563 in the second quarter ended January

31, 2010.

Excluding the currency impact, sales of enzymes increased by 6% vs. the previous

year, and by 55% vs. the previous quarter, tracing to continued strong demand

for the point of care disposables sold by IBEX customers. Sales of arthritis

assays increased by 6% vs. year ago, and increased 27% vs. the previous quarter.

Net earnings for the quarter ended January 31, 2010 were $424,993 or $0.02 per

share, compared to net earnings of $289,110, or $0.01 per share, for the same

period year ago, representing an increase of 47%. This can be mainly

attributable to a gain of $129,673 in foreign exchange recorded in this quarter

versus a loss of $43,002 recorded in the previous fiscal year.

Expenses during the quarter decreased by 37% vs. year-ago and also decreased by

22% vs. the previous quarter. This reduction in expenses is mainly attributable

to foreign exchange impact, a higher inventory allocation and occupancy cost

reduction. Expenses excluding foreign exchange impact were $575,717 vs. $663,445

year ago.

Cash, cash equivalents, and marketable securities increased 9% during the

quarter to $2,904,889.

The Company's working capital was $3,433,285 as at the end of the second quarter

ended January 31, 2010 and up from $2,390,884 at the end of the prior year's

quarter ending January 31, 2009.

Financial Summary for the quarters ending

--------------------------------------------------------------------------

January 31, January 31,

2010 2009

Revenues $871,037 $995,557

Earning Before Interests, Tax, Depreciation &

Amortization $457,130 $300,698

Depreciation & Amortization $34,974 $16,818

Net Earnings $424,993 $289,110

Net Earnings per Share $0.02 $0.01

Cash, Cash Equivalents & Marketable Securities $2,904,889 $1,848,396

Net Working Capital $3,433,285 $2,390,884

Outstanding shares at report date (Common

Shares) 24,703,244 24,703,244

LOOKING FORWARD

IBEX has been successful in bringing its existing business to profitability and

is now turning its attention to pursuing growth opportunities, including further

growing its base business, and maximizing shareholder value through strategic

initiatives with companies where increased market strength and synergies might

be obtained.

ABOUT IBEX

The Company manufactures and markets a series of proprietary enzymes

(heparinases and chondroitinases) for use in pharmaceutical research by our

customers, as well Heparinase I, which is used in many leading hemostasis

monitoring devices.

IBEX also manufactures and markets a series of arthritis assays which are widely

used in pharmaceutical research by our customers. These assays are based on the

discovery and increasing role of a number of specific molecular biomarkers

associated with collagen synthesis and degradation.

For more information, please visit the Company's web site at www.ibex.ca.

Safe Harbor Statement

All of the statements contained in this news release, other than statements of

fact that are independently verifiable at the date hereof, are forward-looking

statements. Such statements, based as they are on the current expectations of

management, inherently involve numerous risks and uncertainties, known and

unknown. Some examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry, changes in the

regulatory environment in the jurisdictions in which IBEX does business, stock

market volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual future

results may differ materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or obligation to update

these statements.

--------------------------------------------------------------------------

CONSOLIDATED BALANCE SHEETS

--------------------------------------------------------------------------

January 31, July 31,

--------------------------------------------------------------------------

UNAUDITED 2010 2009

--------------------------------------------------------------------------

$ $

--------------------------------------------------------------------------

ASSETS

--------------------------------------------------------------------------

Current assets

--------------------------------------------------------------------------

Cash and cash equivalents 2,904,890 2,260,344

--------------------------------------------------------------------------

Accounts receivable 516,320 996,830

--------------------------------------------------------------------------

Inventories 364,373 321,922

--------------------------------------------------------------------------

Prepaid expenses 9,902 63,258

--------------------------------------------------------------------------

Sub-total current assets 3,795,485 3,642,354

--------------------------------------------------------------------------

Long term deposit 8,650 8,650

--------------------------------------------------------------------------

Property and equipment 544,705 530,544

--------------------------------------------------------------------------

Total assets 4,348,840 4,181,548

--------------------------------------------------------------------------

--------------------------------------------------------------------------

LIABILITIES

--------------------------------------------------------------------------

Current liabilities

--------------------------------------------------------------------------

Accounts payable and accrued liabilities 370,850 761,208

--------------------------------------------------------------------------

Total liabilities 370,850 761,208

--------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

--------------------------------------------------------------------------

Capital stock 52,660,078 52,660,078

--------------------------------------------------------------------------

Contributed surplus 462,333 401,553

--------------------------------------------------------------------------

Deficit (49,144,421) (49,641,291)

--------------------------------------------------------------------------

Total shareholders' equity 3,977,990 3,420,340

--------------------------------------------------------------------------

Total liabilities and shareholders' equity 4,348,840 4,181,548

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT January 31, January 31,

--------------------------------------------------------------------------

2010 2009

--------------------------------------------------------------------------

$ $

--------------------------------------------------------------------------

Balance - Beginning of period (49 641 291) (50,985,029)

--------------------------------------------------------------------------

Net earnings for the period 496,870 626,525

--------------------------------------------------------------------------

Balance - End of period (49,144,421) (50,358,504)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF EARNING AND COMPREHENSIVE INCOME

--------------------------------------------------------------------------

UNAUDITED

--------------------------------------------------------------------------

Three months ended Six months ended

January 31st January 31st

--------------------------------------------------------------------------

2010 2009 2010 2009

--------------------------------------------------------------------------

$ $ $ $

--------------------------------------------------------------------------

Revenue 871,037 995,557 1,517,693 1,607,988

--------------------------------------------------------------------------

Operating expenses

--------------------------------------------------------------------------

Selling, general and

administrative expenses

and cost of goods sold (540,414) (648,009) (1,035,539) (1,136,919)

--------------------------------------------------------------------------

Amortization of property

and equipment (34,974) (16,818) (67,741) (32,018)

--------------------------------------------------------------------------

Other interest and bank

charges (3,166) (8,133) (6,635) (11,211)

--------------------------------------------------------------------------

Foreign exchange gain

(loss) 129,673 (43,002) 84,960 168,617

--------------------------------------------------------------------------

Gain on sale of assets - 4,285 - 10,389

--------------------------------------------------------------------------

Investment income 2,837 5,230 4,132 19,679

--------------------------------------------------------------------------

Total operating expenses (446,044) (706,447) (1,020,823) (981,463)

--------------------------------------------------------------------------

Net earnings and other

comprehensive income 424,993 289,110 496,870 626,525

--------------------------------------------------------------------------

Net earnings and other

comprehensive income per

share

--------------------------------------------------------------------------

Basic and diluted $0.02 $0.01 $0.02 $0.03

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying notes

--------------------------------------------------------------------------

CONSOLIDATED CASH FLOW Three months ended Six months ended

STATEMENTS January 31st January 31st

--------------------------------------------------------------------------

UNAUDITED 2010 2009 2010 2009

--------------------------------------------------------------------------

$ $ $ $

--------------------------------------------------------------------------

Cash flows provided by (used

in):

--------------------------------------------------------------------------

Operating activities

--------------------------------------------------------------------------

Net profit for the period 424,993 289,110 496,870 626,525

--------------------------------------------------------------------------

Items not affecting cash -

--------------------------------------------------------------------------

Amortization of property and

equipment 34,974 16,818 67,741 32,018

--------------------------------------------------------------------------

Stock-based compensation

costs 60,780 2,605 60,780 4,952

--------------------------------------------------------------------------

Gain on disposal of property

and equipment - (4,285) - (10,389)

--------------------------------------------------------------------------

Cash flow relating to

operating activities 520,747 304,248 625,391 653,106

--------------------------------------------------------------------------

Net changes in non-cash

working capital items -

--------------------------------------------------------------------------

Decrease (increase) in

accounts receivable 170,123 (174,022) 480,511 (448,049)

--------------------------------------------------------------------------

Increase in inventories (67,136) (60,837) (42,451) (35,954)

--------------------------------------------------------------------------

Decrease (increase) in

prepaid expenses 33,450 (16,430) 53,356 24,480

--------------------------------------------------------------------------

(Decrease) increase in

accounts payable and

accrued liabilities (395,446) 196,320 (390,360) 182,804

--------------------------------------------------------------------------

Net changes in non-cash

working capital balances

relating to operations (259,009) (54,969) 101,056 (276,719)

--------------------------------------------------------------------------

Cash flow relating to

operating activities 261,738 249,279 726,447 376,387

--------------------------------------------------------------------------

Investing activities

--------------------------------------------------------------------------

Additions to marketable

securities - - - (209,207)

--------------------------------------------------------------------------

Proceeds on disposal of

marketable securities - 1,199,912 - 1,404,375

--------------------------------------------------------------------------

Additions to property and

equipment (18,415) (80,663) (81,902) (105,104)

--------------------------------------------------------------------------

Proceeds on disposal of

property and equipment - 4,285 - 10,389

--------------------------------------------------------------------------

Cash flow relating to

financing activities (18,415) 1,123,534 (81,902) 1,100,453

--------------------------------------------------------------------------

Increase in cash and cash

equivalents during the quater 243,323 1,372,813 644,545 717,617

--------------------------------------------------------------------------

Cash and cash equivalents -

Beginning of period 2,661,567 476,123 2,260,345 348,752

--------------------------------------------------------------------------

Cash and cash equivalents -

End of period 2,904,890 1,848,936 2,904,890 1,066,369

--------------------------------------------------------------------------

--------------------------------------------------------------------------

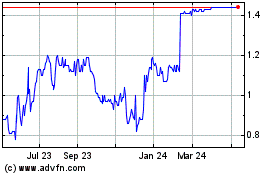

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

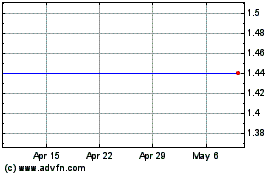

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025