Growth in all financial metrics for the 1st half of

2023:

- Revenues: +10.3% to €1,289 million

- Underlying EBITDA: +17.5% to €192.4m (+90bps)

- Underlying Operating income: +13.5% to €47.9m (+10bps)

- Cash flow from operating activities: +33.9% to €147.6m after

operating investments

- Debt leverage reduced to 1.8x pre-IFRS 16 EBITDA

Completion of the Spedimex acquisition in Poland, opening of

the UK, and acceleration of commercial synergies

Regulatory News:

ID Logistics (ISIN: FR0010929125, Mnemo: IDL), a European

leader in contract logistics, presents its results for the first

half of 2023, with revenues up +10.3% to €1,289 million and

underlying EBITDA up +17.5% to €192.4 million (+90bps).

Eric Hémar, Chairman and CEO of ID Logistics, comments: "ID

Logistics had a satisfactory first half of 2023, during which the

Group once again demonstrated its ability to pursue profitable

growth. The company completes the acquisition of Spedimex, an

operation already promising in terms of commercial synergies and

access to new customers: the Group becomes thus the first contract

logistic provider in Poland, a market with strong growth. ID

Logistics also opened its 18th country with the United Kingdom.

Finally, the company has achieved significant commercial

developments with blue-chip, particularly in e-commerce and

fashion, in the United States and Europe, which will enable it to

accelerate its growth from the 2nd half of 2023 onwards".

In €m

H1 2023

H1 2022(1)

Change

Revenues

1,288.6

1,168.4

+10.3%

Underlying EBITDA

192.4

163.7

+17.5%

As % of revenues

14.9%

14.0%

+90bps

Underlying operating income

47.9

42.2

+13.5%

As % of revenues

3.7%

3.6%

+10bps

Cash flow from operating activities after

capital expenditure

147.6

110.2

+33.9%

Net financial debt / underlying

EBITDA(2)

1.8x

2.4x

(1) In accordance with IFRS 5, ID Logistics' activities in

Russia have been accounted for as discontinued operations in 2022,

and the published data at June 30, 2022 have been restated to be

comparable. (2) pre-IFRS 16

REVENUES GROWTH OF +10.3% (+4.3% LIKE-FOR-LIKE)

ID Logistics recorded revenues of €1,288.6 million in the first

half of 2023, up +10.3% and +4.3% like-for-like compared to the

first half of 2022, which had already recorded strong growth of

+15.3% like-for-like compared to the previous six months.

- Outside France, revenues continued to grow, rising by +17.7% in

the first half of 2023 to €877.3m. This growth includes three

months' revenues from Kane Logistics, consolidated from April 1st

2022, and one month's revenues from Spedimex, acquired in Poland

and consolidated from June 1st 2023. Adjusted for these changes in

the scope of consolidation and a generally unfavorable currency

effect over the past half-year, growth was +8.3% compared with the

1st half of 2022, which had already recorded a significant increase

of +21.9%.

- In France, revenues for the 1st half of 2023 came to €411.3m

(-2.7%), marked by lower volumes in both food and non-food

consumption.

UNDERLYING EBITDA UP +17.5% (+90BPS) TO €192.4M

In the 1st half of 2023, the Group continued to improve its

operating profitability, with underlying EBITDA up +17.5% to €192.4

million. Underlying EBITDA margin rose by 90 basis points to

14.9%:

- Outside France, underlying EBITDA rose by €27.5m to €130.7m in

the first half of 2023. The underlying EBITDA margin rose by 120

basis points to 14.9%, thanks to the productivity gains achieved by

projects started up in 2021 and early 2022, and to cost control for

start-ups at the end of 2022 and 2023, including opening costs in

the United Kingdom.

- In France, underlying EBITDA was stable at €61.6 million in the

1st half of 2023. Good management of variable costs to adjust to

lower half-year revenues enabled to increase the underlying EBITDA

margin by 50 basis points to 15.0%.

UNDERLYING OPERATING INCOME UP +13.5% (+10BPS) TO

€47.9M

After taking into account depreciation and amortization related

to the resources deployed to manage increasingly technical

operations, underlying operating income rose by +13.5% to €47.9m.

Operating margin before non-recurring items thus rose by 10 basis

points to 3.7% in the first half of 2023, including a 10 basis

points decrease to 3.9% for operations in France and a 20 basis

points increase to 3.6% for international operations. The Group

recalls that its activities traditionally enjoy more favorable

profitability in the second half of the year.

GROUP SHARE OF NET INCOME AT €16.4 M

Group share of net income, stood at €16.4 million for the 1st

half of 2023, down slightly by €1.9 million on the 1st half of

2022. This performance includes net financing costs of €11.9m, up

€7.6m on the 1st half of 2022, due in particular to the scope

effect linked to Kane Logistics (financing of the acquisition and

activities over 6 months in 2023 instead of 3 months in 2022).

Other financial expenses of €9.7m correspond mainly to the

discounting of IFRS 16 rental debts, which are rising in line with

the Group's growth.

CASH GENERATION UP +33.9% FROM OPERATIONS

The Group's activities generated €147.6m in cash in the first 6

months of 2023, up +33.9% vs. 2022 after taking operating

investments into account. These investments of €31.8m are higher

than in the first half of 2022, and 80% of them concern start-ups

of new sites.

During the first half of 2023, ID Logistics completes the

acquisition of Spedimex in Poland, paid in part in cash for a net

amount of €15.6m, and made an earn-out payment of €6.7m to the

sellers of Colisweb. As a reminder, the acquisitions of Colisweb in

France and Kane Logistics in the United States were completed in

early 2022 for a total amount of €247.7m, including acquisition

costs. These various operations were financed by a €400 million

syndicated loan concluded in Q1 2022, the short-term portion of

which was refinanced in Q1 2023 by a new amortizable syndicated

loan, as the Group no longer has any significant repayment due date

before 2027.

Thanks to strict management and the good financial performance

achieved in the 1st half of 2023, the debt-to-equity ratio

continues to fall to 1.8x pre-IFRS 16 underlying EBITDA at June 30,

2023.

OUTLOOK

In the short term, the Group is focusing on the success of new

projects with blue-chip and on continuing to adapt its costs to

customer volumes.

Over the past two years, ID Logistics has significantly

diversified its operations, both in terms of geography and customer

sector, giving it a more global approach to its market. In

addition, the company's ability to support major global groups has

resulted in significant commercial developments, ensuring continued

business growth.

Additional note: the Board of Directors approved the interim

financial statements on August 30, 2023 and the review procedures

for the consolidated financial statements have been completed. The

limited review report will be issued once the procedures required

for publication of the interim financial report have been

completed.

NEXT RELEASE Revenues for 3rd quarter of 2023: October

24, 2023, after market close.

ABOUT ID LOGISTICS:

ID Logistics, headed by Eric Hémar, is an international contract

logistics group with revenues of €2.5 billion by 2022. ID Logistics

manages 375 sites in 18 countries, representing more than 8 million

m² of operated space in Europe, America, Asia and Africa, with

30,000 employees.

With a customer portfolio balanced between distribution,

e-commerce and consumer goods, ID Logistics is characterized by

offers involving a high level of technology. Since its creation in

2001, the Group has developed a social and environmental approach

through a number of original projects, and is now firmly committed

to an ambitious CSR policy. ID Logistics shares are listed on the

Euronext regulated market in Paris, compartment A (ISIN code:

FR0010929125, Mnemo: IDL).

APPENDIX

- Simplified income statement

In €m

H1 2023

H1 2022(1)

Revenues

International

France

1,288.6

877.3

411.3

1,168.4

745.5

422.9

Underlying EBITDA

International

France

192.4

130.7

61.6

163.7

102.5

61.2

Underlying operating income

International

France

47.9

31.7

16.2

42.2

25.3

16.9

Amortization of customer relationships

(2.3)

(1.7)

Non-current expenses

-

(2.2)

Net financial income

(21.6)

(10.2)

Taxes

(6.7)

(8.3)

Associated companies

0.6

0.7

Net income from continuing

operations

17.9

20.4

Net income from discontinued

operations

0.3

(0.2)

Consolidated net income

18.2

20.2

of which net income, Group share

16.4

18.3

In €m

H1 2023

H1 2022(1)

Underlying EBITDA

192.4

163.7

Change in WCR

5.4

(15.1)

Other net changes from operations

(18.4)

(15.1)

Net operating investments

(31.8)

(23.3)

Net cash generated by

operations

147.6

110.2

Acquisition of subsidiaries

(22.3)

(247.7)

Net financing expenses

(11.9)

(4.3)

Net debt issuance (repayment)

(99.3)

151.8

Other changes

(3.0)

(0.8)

Change in cash and cash

equivalents

+11.1

+9.2

Cash and cash equivalents at end of

year

194.7

166.0

(1) In accordance with IFRS 5, ID Logistics' activities in

Russia have been accounted for as discontinued operations. 2022,

and 2021 has been restated to be comparable.

DEFINITIONS

- Change on a like-for-like basis

Changes in revenues on a like-for-like basis reflect the organic

performance of the ID Logistics Group, excluding the impact of

:

- changes in the scope of consolidation: the

contribution to revenues of companies acquired during the period is

excluded from this period, and the contribution to revenues of

companies sold during the previous period is excluded from this

period; - changes in applicable accounting principles; - variations

in exchange rates, by calculating revenues for different periods on

the basis of identical exchange rates: thus, published data for the

previous period are converted using the exchange rate for the

current period.

Operating income recurring before depreciation, amortization and

impairment of property, plant and equipment and intangible

assets

Gross financial debt plus bank overdrafts minus cash and cash

equivalents

Net financial debt plus rental debt under IFRS 16

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230830262740/en/

ID Logistics Yann Perot - CFO Tel: +33 (0)4 42 11 06 00

yperot@id-logistics.com

Investor Relation NewCap Tel. +33 (0)1 44 71 94 94

idlogistics@newcap.eu

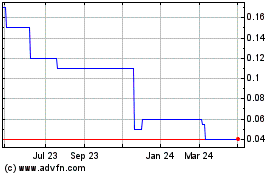

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

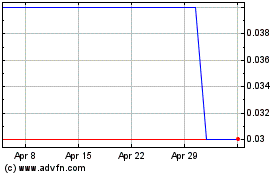

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Apr 2023 to Apr 2024