- Revenues for Q2 2023: €658.2m, +3.6% (+3.3%

like-for-like)

- International (68% of revenues): €446.9m, +7.2% (+6.9%

like-for-like)

- France (32% of revenues): €211.3 million, -3.4%

- Revenues for H1 2023: €1,288.6m, +10.3% (+4.3%

like-for-like)

Regulatory News:

ID Logistics (ISIN: FR0010929125, Mnemo: IDL) (Paris:IDL), a

European leader in contract logistics, today announced its revenues

for the first half of 2023.

Eric Hémar, Chairman and CEO of ID Logistics, comments: "Against

a backdrop of declining consumer volumes in Europe, our company

recorded organic growth thanks to its dynamic revenue strategy and

excellent international positioning. In addition, we have signed

new contracts with international customers, which we will now

support in their deployment. Today, we are particularly confident

in our ability to maintain the dynamism of our growth model.”

Revenues, in €m

2023

2022

Change

Change on a like-for-like

basis

2nd quarter

International

446.9

416.8

+7.2%

+6.9%

France

211.3

218.7

-3.4%

-3.4%

Total

658.2

635.5

+3.6%

+3.3%

1st semester

International

877.3

745.5

+17.7%

+8.3%

France

411.3

422.9

-2.7%

-2.7%

Total

1,288.6

1,168.4

+10.3%

+4.3%

*see definition in appendices

REVENUE GROWTH FOR Q2 2023: +3.6% (+3.3% ON A LIKE-FOR-LIKE

BASIS)

ID Logistics recorded revenues of €658.2 million in the 2nd

quarter of 2023, up +3.6% and +3.3% like-for-like compared with the

2nd quarter of 2022, which had already seen strong growth of +15.5%

like-for-like.

- In international markets, revenue growth continued in

the 2nd quarter of 2023, reaching €446.9m, or +7.2%. This increase

includes the revenues of Spedimex, a company acquired in Poland and

consolidated from June, 1st 2023. Adjusted for this perimeter

effect and a generally unfavorable exchange rate effect over the

past quarter, growth stands at +6.9% compared with the 2nd quarter

of 2022, which had already recorded a significant increase of

+23.6%.

- In France, revenues came to €211.3 million (-3.4%), due

to lower consumer volumes, particularly in the DIY and home

furnishings sectors, and to the company's rigorous and selective

risk management policy.

In the 2nd quarter of 2023, the Group launched 7 new

projects.

ID Logistics thus ended the 1st half of 2023 with revenues of

€1,288.6 million, up +10.3%, of which +4.3% on a like-for-like

basis. Since the beginning of the year, ID Logistics has started up

12 new projects, and despite the postponement of some projects to

the second half of 2023, the Group is on track with its roadmap for

2023.

NEW CONTRACTS

ID Logistics continued to respond to a sustained number of

tenders during the 2nd quarter of 2023.

For example, the Group won or started up the following new

contracts during the quarter:

- In France, ID Logistics is continuing its partnership with

Intermarché, and will open a new 57,000 sq.m. site in the south of

France before the end of 2023. This activity will manage

Intermarché's food and non-food goods but will also call on the

Group's expertise in the management of alcoholic beverages and will

employ over 160 people.

- In Spain, ID Logistics started up a new business for a major

retailer, already a Group customer, on a 22,000 sq.m. site in the

Valladolid region.

- A year after setting up in Italy, ID Logistics opened a new

site for an international fashion company during the quarter and is

preparing to start up a new activity for a major retailer in

Milan.

- In the United States, ID Logistics completes its geographical

coverage with its first 12,000 sq.m. facility in Texas for its

long-standing customer in the United States. With this latest

opening, the Group now covers the entire Sun Belt, a region with

strong economic potential stretching from the West Coast to

Florida.

- Lastly, a year after the acquisition of Kane Logistics, the

Group is realizing its first commercial synergies by supporting

European customers in their expansion in the United States. In the

2nd half-year 2023, ID Logistics will be starting up a new business

on an 86,000 sq.m. site in Pennsylvania for one of its main

customers, a global e-commerce giant.

INAUGURATION OF ID LOGISTICS' 1ST UK SITE, DEDICATED TO

RETURN FLOW MANAGEMENT

Following the acquisition of Spedimex, a specialist in fashion

logistics in Poland last May, a major fashion customer decided to

entrust ID Logistics with the management of e-commerce and store

returns for the UK zone. This new activity, based in an 18,000

sq.m. warehouse and employing 250 people in Northampton, has

benefited from the expertise of the group's Polish teams and

e-commerce support for its start-up in June.

This move into the UK, the 18th country for ID Logistics, gives

the Group an additional opportunity to realize future commercial

synergies, in particular with Anglo-Saxon customers currently based

in the U.S.

OUTLOOK

Against a backdrop of low consumption in the 1st half of 2023,

ID Logistics is focusing on implementing its variable cost model to

further increase its operating profitability.

The end of the inflation peak should be accompanied in the 2nd

half of 2023 by a recovery in consumption and promotional periods,

as the Group has already seen in several European countries where

it operates.

ID Logistics is preparing for the numerous start-ups mentioned

above, which will contribute to the acceleration of revenue growth

from the 2nd half of 2023 onwards.

NEXT PUBLICATION

Half-year results of 2023: August 30, 2023, after market

close.

ABOUT ID LOGISTICS:

ID Logistics, headed by Eric Hémar, is an international contract

logistics group with revenues of €2.5 billion by 2022. ID Logistics

manages 375 sites in 18 countries, representing more than 8 million

m² of operated space in Europe, America, Asia and Africa, with

30,000 employees.

With a customer portfolio balanced between distribution,

e-commerce and consumer goods, ID Logistics is characterized by

offers involving a high level of technology. Since its creation in

2001, the Group has developed a social and environmental approach

through a number of original projects and is now firmly committed

to an ambitious CSR policy. ID Logistics shares are listed on the

Euronext regulated market in Paris, compartment A (ISIN code:

FR0010929125, Mnemo: IDL).

* * *

APPENDIX

CHANGE ON A LIKE-FOR-LIKE BASIS

Changes in revenues on a like-for-like basis reflect the organic

performance of the ID Logistics Group, excluding the impact of:

- changes in the scope of consolidation: the contribution to

revenues of companies acquired during the period is excluded from

this period, and the contribution to revenues of companies sold

during the previous period is excluded from this period;

- changes in applicable accounting principles;

- variations in exchange rates, by calculating revenues for

different periods on the basis of identical exchange rates: thus,

published data for the previous period are converted using the

exchange rate for the current period.

Change in revenues from reported to

comparable data

in €M

2022

Effect of changes in scope of

consolidation

Effect of variations in exchange

rates

Effect of the application IAS

29*

Variation on a like-for-like

basis

2023

1st quarter

532.9

+13.6%

-0.8%

+0.1%

+5.4%

630.4

2nd quarter

635.5

+1.4%

-1.2%

+0.1%

+3.3%

658.2

1st semester

1,168.4

+7.0%

-1.1%

+0.1%

+4.3%

1,288.6

* application of hyperinflation accounting treatment for

Argentina

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230724651932/en/

Yann Perot - CFO Tel: +33 (0)4 42 11 06 00

yperot@id-logistics.com

Investor Relations Contact NewCap Tel. 33 (0)1 44 71 94

94 idlogistics@newcap.eu

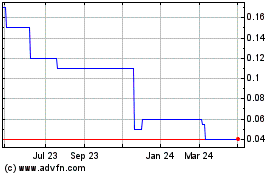

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

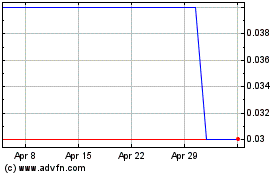

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Apr 2023 to Apr 2024