Immunotec Inc. (TSX VENTURE:IMM), a Canadian based company and a leader in the

wellness industry (the "Company"), today is pleased to provide the following

update.

"This past fiscal year has seen Immunotec undergo significant changes and the

Company continues to make progress in meeting its planned objectives.

Immunotec's new sales and marketing team is moving quickly to aggressively

expand our presence in Mexico while recovering from lost market share in both

Canada and US during the recession" said Bob Henry, Immunotec's Chairman and

CEO.

In May 2010, we announced that Immunotec had completed the acquisition of

certain assets of a licensee of the Company in Mexico, in connection with the

distribution of the Company's products in the Mexican territory. During Fiscal

2011, we recorded sales from Mexico of $8.9M compared to $1.6M representing an

increase of $7.3 in twelve months. As a result, we are adding offices and

infrastructure to support this growth directly in Mexico City.

Financial results for its year ended October 31, 2011 are as follows: Network

sales reached $37.4M in 2011 compared to $34.5M for the same period in 2010, an

increase of 8.5% or $2.9M. Other revenues which include revenues of products

sold to licensees, freight and shipping, charge backs and educational material

purchased by our network, reached $5.5M in 2011, a small decrease of $0.4M

compared to $5.9M for the same period in 2010.

Margins before expenses, as a percentage of net sales, decreased in 2011 to 29%

compared to 31% for year 2010 and primarily attributed to increases in Sales

incentives paid which average a payout rate of 51.0%, compared to the 47.7%

level in 2010.The increase in sales incentives is predominantly caused by strong

recruitment in the Mexican territory.

Operating expenses reached $11.9M and remained very similar to the prior year at

$12.0M and saw an improvement in terms of percentage of revenues representing

28% in 2011 compared with 30% in 2010.

Sales and marketing expenses were $4.6M compared to $4.4M in the prior year.

Over the past year management made substantial changes to the sales and

marketing organizational structure. We have developed new marketing initiatives

by increasing the numbers of weekly meetings across North America and providing

additional field training and support programs for the Network. This effort is

focused toward increasing the company's customer and distributors' base in all

key markets.

For the year ended October 31, 2011, adjusted EBITDA was almost the same has the

year before reaching $724 thousand, compared to $774 thousand for Fiscal 2010.

Net loss and comprehensive loss totalled $1,1M for the year ending October 31,

2011, compared to a loss of $1.4M for 2010. The total basic and fully diluted

loss per share for Fiscal 2011 was $0.016 compared with fully a diluted loss

$0.020 for the same period in Fiscal 2010. This variation for the 2011 period

resulted primarily from:

i. Strong revenue growth in Mexico, mitigating decrease in both Canada and

the US.

ii. Increase in sales incentives payout during the year, reducing margins as

a result of strong recruitment in Mexico.

iii.The reorganization of its overhead structure in the first quarter.

The Company's Board of Directors announced today that Immunotec has entered into

a 3 year employment agreement with Mr. Henry whereby he will continue to lead

the Company as Chairman and CEO.

"I am looking forward to spending the next few years working with the field

associates and the corporate team in taking this business to the next level"

said Bob Henry. "I am excited about this opportunity and believe all of us have

a great future together"

About Immunotec Inc.

Immunotec is a world class business opportunity supported by unique

scientifically proven products that improve wellness. Headquartered with

manufacturing facilities near Montreal, Canada, the Company also has

distribution capacities to support its commercial activities in Canada and

internationally to the United States, Europe, Mexico and The Caribbean.

The Company files its consolidated financial statements, its management and

discussion analysis report, its press releases and such other required documents

on the SEDAR database at www.sedar.com and on the Company's website at

www.immunotec.com. The common shares of the Company are listed on the TSX

Venture Exchange under the ticker symbol IMM. The TSX Venture does not accept

responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward-looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, which can be found at www.sedar.com.

Consequently, actual results may differ materially from the anticipated results

expressed in these forward-looking statements.

Consolidated Balance Sheets

As at October 31, 2011 2010

$ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

ASSETS

Current assets

Cash 2,561,969 2,936,456

Accounts receivable 659,004 782,557

Inventories 3,326,349 2,605,371

Prepaid expenses 401,170 382,794

Future income taxes 270,592 103,099

----------------------------------------------------------------------------

7,219,084 6,810,277

Non-current assets

Property, plant and equipment 5,304,796 5,674,090

Intangible assets 2,008,000 2,456,651

Goodwill 833,559 833,559

Future income taxes 2,694,604 2,382,148

Other asset 337,971 484,349

----------------------------------------------------------------------------

18,398,014 18,641,074

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Demand loan - 1,000,000

Accounts payable 935,800 1,593,697

Accrued liabilities 3,136,168 2,707,076

Customer deposits 288,192 274,051

Income taxes payable 58,576 2,041

Current portion of long-term debt 312,320 147,218

----------------------------------------------------------------------------

4,731,056 5,724,083

Long-term debt 2,077,787 239,622

----------------------------------------------------------------------------

6,808,843 5,963,705

----------------------------------------------------------------------------

Shareholders ' equity

Share capital 3,465,548 3,465,548

Other equity - Stock options 1,921,288 1,907,584

Contributed surplus 11,337,796 11,337,796

Deficit (5,135,461) (4,033,559)

----------------------------------------------------------------------------

11,589,171 12,677,369

----------------------------------------------------------------------------

18,398,014 18,641,074

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Statements of Changes in Shareholders' Equity

For the years ended October 31, 2011 and 2010

Other

Number of equity

common Share - Stock Contributed

shares capital options surplus Deficit Total

$ $ $ $ $

------------------------------------------------------------------

Balance -

October

31, 2009 69,994,300 3,465,548 1,770,093 11,337,796 (2,646,399) 13,927,038

------------------------------------------------------------------

Net loss - - - - (1,387,160) (1,387,160)

Stock-

based

compensat

ion - - 137,491 - - 137,491

------------------------------------------------------------------

Balance -

October

31, 2010 69,994,300 3,465,548 1,907,584 11,337,796 (4,033,559) 12,677,369

------------------------------------------------------------------

Net loss - - - - (1,101,902) (1,101,902)

Stock-

based

compensat

ion - - 13,704 - - 13,704

------------------------------------------------------------------

Balance -

October

31, 2011 69,994,300 3,465,548 1,921,288 11,337,796 (5,135,461) 11,589,171

------------------------------------------------------------------

Consolidated Statements of Loss and Comprehensive Loss

For the years ended October 31, 2011 2010

$ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues

Network sales 37,396,889 34,453,216

Other revenue 5,523,390 5,888,000

----------------------------------------------------------------------------

42,920,279 40,341,216

Variable costs

Cost of goods sold 7,586,959 7,729,873

Sales incentives - Network 19,060,065 16,444,572

Other variable costs 3,810,679 3,654,375

----------------------------------------------------------------------------

Margin before expenses 12,462,576 12,512,396

----------------------------------------------------------------------------

Expenses

Administrative 6,403,079 6,403,627

Marketing and selling 4,551,532 4,400,073

Quality and development costs 905,113 1,182,394

Amortization 1,170,259 1,193,102

Other 836,523 828,270

Financing income (121,294) -

Financing expenses 155,610 -

----------------------------------------------------------------------------

13,900,822 14,007,466

----------------------------------------------------------------------------

Loss from continuing operations before

income taxes (1,438,246) (1,495,070)

Income taxes (recovery)

Current 93,605 98,180

Future (479,949) (425,711)

----------------------------------------------------------------------------

Loss from continuing operations (1,051,902) (1,167,539)

Loss from discontinued operations (50,000) (219,621)

----------------------------------------------------------------------------

Net loss and comprehensive loss (1,101,902) (1,387,160)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic and diluted net loss per share

Continuing operations (0.015) (0.017)

Discontinued operations (0.001) (0.003)

----------------------------------------------------------------------------

Total basic and diluted net loss per share (0.016) (0.020)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weighted average number of common shares

outstanding during the year

Basic and diluted 69,994,300 69,994,300

Consolidated Statement of Cash Flows

For the years ended October 31, 2011 2010

$ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating activities

Net loss (1,101,902) (1,387,160)

Loss from discontinued operations (50,000) (219,621)

----------------------------------------------------------------------------

Loss from continuing operations (1,051,902) (1,167,539)

Add (deduct) non-cash items:

Amortization of property, plant and

equipment 540,586 596,468

Amortization of intangible assets 629,673 596,634

Other receivables - 196,954

Gain on settlement of contingent

consideration liability (64,344) -

Gain on change in fair value of contingent

consideration liability (56,950) -

Unrealized foreign exchange (8,149) -

Accreted interest 51,720 -

Future income taxes (479,949) (425,711)

Stock-based compensation 13,704 137,491

----------------------------------------------------------------------------

Cash received prior to working capital

variation (425,611) (65,703)

Net change in non-cash working capital (note

20) (790,963) 932,870

----------------------------------------------------------------------------

Cash (used in) provided by operating

activities (1,216,574) 867,167

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Investing activities

Business acquisition - (570,664)

Additions to property, plant and equipment (171,292) (195,031)

Additions to intangible assets (163,989) (226,752)

Research and development tax credits 146,378 18,536

----------------------------------------------------------------------------

Cash used in investing activities (188,903) (973,911)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Financing activities

Long-term debt 2,200,000 -

Demand loan - 1,000,000

Reimbursement of long-term debt (9,233) -

Reimbursement of demand loan (1,000,000) -

Reimbursement of contingent consideration

liability (109,777) -

----------------------------------------------------------------------------

Cash provided by financing activities 1,080,990 1,000,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net (decrease) increase in cash from

continuing operations (324,487) 893,256

Net decrease in cash from discontinued

operations (50,000) (219,621)

----------------------------------------------------------------------------

Net (decrease) increase in cash during the

year (374,487) 673,635

Cash at the beginning of the year 2,936,456 2,262,821

----------------------------------------------------------------------------

Cash at the end of the year 2,561,969 2,936,456

----------------------------------------------------------------------------

----------------------------------------------------------------------------

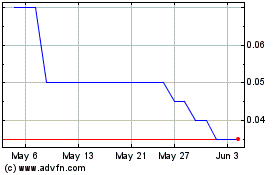

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Dec 2023 to Dec 2024