Immunotec Inc. (TSX VENTURE:IMM), a Canadian based company and a leader in the

wellness industry (the "Company"), today released its 2012 second quarter

results for the period ended April 30, 2012.

Second Quarter 2012 Highlights:

(All amounts are in CAD dollars.)

-- Revenue growth of 7.1% in the quarter over the previous year to reach

$11.4 million and 6.8% year to date.

-- Revenues in Mexico, now the largest segment representing 37% of total

revenues were up 140% over previous year to reach $4.1 million.

-- Adjusted EBITDA of $457 thousand or 4% of revenues in Q2 and $672

thousand or 3% of total revenues, year to date. This represents an

improvement over negative adjusted EBITDA of ($32) thousand as compared

to prior year.

-- The acquisition of our subsidiary company in Mexico was completed during

the quarter end and we opened a new Immunotec corporate office in Mexico

City to support our growth plans.

"We are pleased with the result but we are determined to reenergize the Canadian

and US segments", said Bob Henry, Immunotec's Chairman and CEO.

Condensed financial results for the second Quarter ended April 30, 2012 are as

follows:

-- During the second quarter, Network sales reached $10.3M in 2012 compared

to $8.9M for the same quarter in 2011, an increase of 15.9% or $1.4M.

Other revenues which include revenues of products sold to licensees,

freight and shipping, charge backs and educational material purchased by

our network, amounted to $1.1M in Q2 of 2012, a decrease in $0.7M

compared to $1.8M for the same period in 2011.

-- Margins before expenses, as a percentage of net sales, decrease, in the

second quarter ending April 30, 2012 to 26.2% from 31.2% for the same

quarter in 2011. This decrease is primarily attributed to increase is

certain costs related to a growth in Mexico and the decrease of Export

sales to licenses which represent a higher margin contribution.

-- Selected expenses in the second quarter of 2012 were $2.8M and were the

same as the same period a year earlier. They now represent 24.6% of

sales compared to 26.7% a year earlier.

-- The adjusted EBITDA, a Non GAAP financial measure, was $457 thousand

which represent a decrease of $269 thousand over adjusted EBITDA for the

same period ended April 30, 2011.

-- Net loss for the quarter ended April 30, 2012 totalled $109 thousand,

compared to a net loss of $7 thousand for the same period a year

earlier. For the six-month ended April 30, 2012, net loss was $103

thousand compared to a net loss of $1.3M for the same period in 2011.

-- The total basic and fully diluted earnings per share for the three-month

period ended April 30, 2012 was $0.00 compared with fully a diluted loss

per share of $0.02 for the same period in 2011.

-- During the Quarter on April 30 The Company also announced today the

implementation of a Normal Course Issuer Bid (the "Bid") to purchase for

cancellation, from time to time, as it considers advisable, up to

1,000,000 of its issued and outstanding Common Shares. At the end of

June 15th, 2012, no shares had been purchase from this plan.

-- Subsequent to the quarter, on June 14th 2012, The Company granted 25,000

stock options to a recently named Director of the Company and 25,000

stock options to an executive of the Company. Both grants of options are

exercisable over 5 years at an exercise price of $0.35.

ABOUT IMMUNOTEC INC.

Immunotec is a world class business opportunity supported by unique

scientifically proven products that improve wellness. Headquartered with

manufacturing facilities near Montreal, Canada, the Company also has

distribution capacities to support its commercial activities in Canada and

internationally to the United States, Europe, Mexico and The Caribbean.

The Company files its consolidated financial statements, its management and

discussion analysis report, its press releases and such other required documents

on the SEDAR database at www.sedar.com and on the Company's website at

www.immunotec.com. The common shares of the Company are listed on the TSX

Venture Exchange under the ticker symbol IMM.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward-looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, which can be found at www.sedar.com.

Consequently, actual results may differ materially from the anticipated results

expressed in these forward-looking statements.

Interim Consolidated Statements of Financial Position

(Unaudited)

(Stated in Canadian dollars)

April 30, October 31,

2012 2011

$ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

ASSETS

Current assets

Cash 2,626,137 2,561,969

Trade and other receivables 1,091,669 659,004

Inventories 2,932,173 3,324,740

Prepaid expenses 475,227 393,119

----------------------------------------------------------------------------

7,125,206 6,938,832

Non-current assets

Property, plant and equipment 6,060,682 5,931,411

Intangible assets 1,803,682 2,000,217

Goodwill 833,559 833,559

Deferred income tax assets 2,749,283 2,725,367

Non-refundable research and

development tax credits 337,971 337,971

----------------------------------------------------------------------------

11,785,177 11,828,525

----------------------------------------------------------------------------

18,910,383 18,767,357

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES

Current liabilities

Payables 1,125,219 935,800

Accrued liabilities 2,702,543 2,464,967

Provisions 563,515 671,201

Customer deposits 497,620 288,192

Income taxes 65,711 58,576

Current portion of long- term debt 115,032 312,320

----------------------------------------------------------------------------

5,069,640 4,731,056

Long-term debt 2,019,753 2,077,787

----------------------------------------------------------------------------

7,089,393 6,808,843

----------------------------------------------------------------------------

EQUITY

Share capital 3,465,548 3,465,548

Other equity - Stock options 1,924,886 1,903,039

Contributed surplus 11,337,796 11,337,796

Accumulated other comprehensive income 249,742 306,595

Deficit (5,156,982) (5,054,464)

----------------------------------------------------------------------------

11,820,990 11,958,514

----------------------------------------------------------------------------

18,910,383 18,767,357

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interim Consolidated Statements of Changes in Equity

(Unaudited)

Six-month periods ended April 30,

(Stated in Canadian dollars except for number of shares)

Other

equity

- Stock Contributed

Share capital options surplus

----------------------------

Number $ $ $

----------------------------------------------------------------------------

Balance at November

1, 2010 69,994,300 3,465,548 1,894,040 11,337,796

Net loss for the

period - - - -

Foreign currency

translation

adjustments - - - -

----------------------------------------------------------------------------

Total comprehensive

loss of the period: - - - -

Share-based

compensation - - (11,448) -

----------------------------------------------------------------------------

Balance at April 30,

2011 69,994,300 3,465,548 1,882,592 11,337,796

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance at November

1, 2011 69,994,300 3,465,548 1,903,039 11,337,796

Net loss for the

period - - - -

Foreign currency

translation

adjustments - - - -

----------------------------------------------------------------------------

Total comprehensive

loss of the period: - - - -

Share-based

compensation - - 21,847 -

----------------------------------------------------------------------------

Balance at April 30,

2012 69,994,300 3,465,548 1,924,886 11,337,796

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Accumulated

other

comprehensive

income Deficit Total

$ $ $

----------------------------------------------------------------------------

Balance at November

1, 2010 - (3,650,834) 13,046,550

Net loss for the

period - (1,344,477) (1,344,477)

Foreign currency

translation

adjustments 187,407 - 187,407

----------------------------------------------------------------------------

Total comprehensive

loss of the period: 187,407 (1,344,477) (1,157,070)

Share-based

compensation - - (11,448)

----------------------------------------------------------------------------

Balance at April 30,

2011 187,407 (4,995,311) 11,878,032

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance at November

1, 2011 306,595 (5,054,464) 11,958,514

Net loss for the

period - (102,518) (102,518)

Foreign currency

translation

adjustments (56,853) - (56,853)

----------------------------------------------------------------------------

Total comprehensive

loss of the period: (56,853) (102,518) (159,371)

Share-based

compensation - - 21,847

----------------------------------------------------------------------------

Balance at April 30,

2012 249,742 (5,156,982) 11,820,990

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interim Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

Three-month and six-month periods ended April 30,

(Stated in Canadian dollars except for number of shares)

For the three-month For the six-month

period period

ended April 30, ended April 30,

2012 2011 2012 2011

$ $ $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues

Network sales 10,277,123 8,869,108 20,238,165 17,933,127

Other revenue 1,142,964 1,790,657 2,225,090 3,102,285

----------------------------------------------------------------------------

11,420,087 10,659,765 22,463,255 21,035,412

Variable costs

Cost of goods sold 1,935,261 1,705,956 3,791,383 3,691,774

Sales incentives - Network 5,407,413 4,660,710 10,371,660 9,430,511

Other variable costs 1,088,149 966,101 2,037,160 1,907,905

----------------------------------------------------------------------------

Margin before expenses 2,989,264 3,326,998 6,263,052 6,005,222

----------------------------------------------------------------------------

Expenses

Administrative 1,378,453 1,492,271 2,999,778 3,231,700

Marketing and selling 1,248,505 1,126,524 2,405,769 2,568,282

Quality and development

costs 183,460 222,639 406,133 476,865

Depreciation and

amortization 223,658 274,913 463,262 538,402

Other expenses 11,706 (22,869) 21,847 657,625

----------------------------------------------------------------------------

Operating income (loss) (56,518) 233,520 (33,737) (1,467,652)

----------------------------------------------------------------------------

Net finance expenses 124,857 200,610 80,373 269,757

----------------------------------------------------------------------------

Profit (loss) before income

taxes (181,375) 32,910 (114,110) (1,737,409)

Income taxes (recovery)

Current 13,298 (19) 15,455 4,684

Future (85,747) 39,780 (27,047) (397,616)

----------------------------------------------------------------------------

Net loss (108,926) (6,851) (102,518) (1,344,477)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Other comprehensive income

(loss), net of income tax

Foreign currency translation

adjustments (57,461) (153,564) (56,853) (187,407)

----------------------------------------------------------------------------

Total comprehensive income

(loss) for the period (51,465) 146,713 (45,665) (1,157,070)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total basic and diluted net

profit (loss) per share (0.00) (0.00) (0.00) (0.02)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weighted average number of

common shares outstanding

during the period

Basic and diluted 69,994,300 69,994,300 69,994,300 69,994,300

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interim Consolidated Statements of Cash Flows

(Unaudited)

Six-month periods ended April 30,

(Stated in Canadian dollars)

2012 2011

$ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating activities

Net profit (loss) (102,518) (1,344,477)

Adjustments for:

Depreciation of property, plant and

equipment 185,685 231,047

Amortization of intangible assets 277,577 307,355

Unrealized foreign exchange (46,253) 203,706

Accreted interest - 35,068

Interest expense measured at amortized

cost 39,734 32,775

Future income taxes (27,047) (397,616)

Share- based compensation 21,847 (11,448)

Interest paid (42,129) (32,775)

Interest received 2,395 -

----------------------------------------------------------------------------

Cash received prior to working capital

variation 309,291 (976,365)

Net change in non- cash working capital 422,569 (421,965)

----------------------------------------------------------------------------

Net cash provided by (used in) operating

activities 731,860 (1,398,330)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Investing activities

Additions to property, plant and

equipment (314,823) (79,660)

Additions to intangible assets (83,057) (130,677)

----------------------------------------------------------------------------

Net cash used in investing activities (397,880) (210,337)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Financing activities

Reimbursement of long- term debt (55,982) -

Reimbursement of demand loan - (83,333)

Reimbursement of other liability (200,203) -

----------------------------------------------------------------------------

Net cash used in financing activities (256,185) (83,333)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net increase (decrease) in cash during

the period 77,795 (1,692,000)

Cash at the beginning of the period 2,561,969 2,936,456

Effect of foreign exchange rate

fluctuations on cash (13,627) (31,813)

----------------------------------------------------------------------------

Cash at the end of the period 2,626,137 1,212,643

----------------------------------------------------------------------------

----------------------------------------------------------------------------

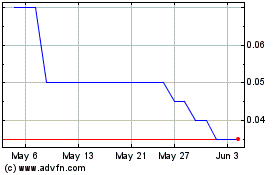

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Dec 2023 to Dec 2024