Kane Biotech Announces Fourth Quarter and Full Year 2023 Financial Results

March 26 2024 - 3:05PM

Kane Biotech Inc. (TSX- V:KNE; OTCQB:KNBIF) (the “Company” or “Kane

Biotech”) today announces its fourth quarter and full year 2023

financial results.

On December 20, 2023, Kane Biotech announced that it received a

non-binding offer for its interest in STEM Animal Health. The terms

of the offer remain confidential but specify that Kane will sell

its ownership of STEM. In addition, pursuant to the terms of the

offer, Kane received a US $625,000 deposit. The parties have agreed

to collaborate using their best efforts to enter into a binding

share purchase agreement with respect to the sale of STEM within 90

days.

On March 20, 2024, Kane announced that it has extended the

exclusivity period from March 19, 2024 until March 31, 2024 and

that it has received additional deposits totaling US $900,000. All

deposits will be applied towards the sale price of Kane’s interest

in STEM.

Fourth Quarter Financial Highlights:

- License and royalty income for the three months ended December

31, 2023 was $250,740, an increase of 66% compared to $151,173 in

the three months ended December 31, 2022. The increase is due

mainly to incremental license and royalty income associated with

Skout’s Honor’s launch of its oral care product line as well as

increased royalty revenue from Animalcare in the current

period.

- Product revenue for the three months ended December 31, 2023

was $490,829, an increase of 9% compared to $450,313 in the three

months ended December 31, 2022. The increase is due mainly to

higher online sales of bluestemTM products in the current

period.

- Total revenue for the three months ended December 31, 2023 was

$764,997, an increase of 11% compared to $691,655 in the three

months ended December 31, 2022.

- Gross profit for the fourth quarter of 2023 was $398,234, an

increase of 24% compared to $320,653 for the fourth quarter ended

December 31, 2022.

- Total operating expenses for the three months ended December

31, 2023 were $1,734,547, an increase of 96% compared to $884,298

for the three months ended December 31, 2022. The increase is

primarily due to short-term compensation expense adjustments in the

comparative period as well as higher non-cash long-term incentive

expense and higher contract research expenditures related to the

Company’s coactiv+TM Antimicrobial Wound Gel product development in

the current period.

- Loss for the fourth quarter of 2023 was ($1,611,894), an

increase of 92% compared to ($838,150) for the quarter ended

December 31, 2022.

2023 Full Year Financial Highlights:

- License and royalty income for the twelve months ended December

31, 2023 was $730,864, a decrease of 22% compared to $932,532 in

the twelve months ended December 31, 2022. Excluding the one-time

revenue recognition in the prior period associated with contractual

Veterinary Oral Health Council milestone payments received from

licensing partners, license and royalty income increased by 46% in

the current period over the comparative period. The increase is due

mainly to incremental license and royalty income associated with

Skout’s Honor’s launch of its oral care product line as well as

increased royalty revenue from Dechra and Animalcare in the current

period.

- Product revenue for the twelve months ended December 31, 2023

was $1,872,418, an increase of 25% compared to $1,496,548 in the

twelve months ended December 31, 2022. The increase is due mainly

to higher online and pet retail sales of bluestemTM products in the

current period.

- Total revenue for the twelve months ended December 31, 2023 was

$2,817,776 an increase of 6% compared to $2,668,352 in the twelve

months ended December 31, 2022.

- Gross profit for the twelve months ended December 31 2023 was

$1,389,051, a decrease of 2% compared to $1,413,229 for the twelve

months ended December 31, 2022.

- Total operating expenses for the twelve months ended December

31, 2023 were $5,474,723, an increase of 15% compared to $4,777,038

for the twelve months ended December 31, 2022. The increase is

primarily due to higher long-term compensation expense and employee

separation costs incurred in the current period as well as higher

government assistance received in the comparative period partially

offset by lower contract research expenditures incurred in the

current period.

- Loss for the year ended December 31, 2023 was ($5,270,053), an

increase of 38% compared to ($3,824,000) for the year ended

December 31, 2022. Contributing to the higher loss were

higher finance expenses in the current period and higher non-cash

fair value adjustments on government loan advances in the

comparative period.

Detailed financial information about Kane Biotech can be found

in its December 31, 2023 Financial Statements and Management

Discussion and Analysis on SEDAR and the Company’s website.

“In 2023 and early 2024 we signed multiple licensing and

distribution agreements, received US FDA clearance of our revyve™

Antimicrobial Wound Gel, strengthened our Board and signed a

non-binding offer for the sale of Kane’s interest in STEM Animal

Health,” said Marc Edwards, President & CEO. “I am extremely

proud of everything we have accomplished and look forward to more

exciting developments throughout the remainder of 2024.”

2023 and 2024 YTD Corporate Highlights:

- On April 20, 2023, Kane Biotech

announced that it had signed a distribution agreement with

ProgenaCare for its coactiv+™ Antimicrobial Wound Gel in the United

States wound care market. ProgenaCare will have exclusive

distribution rights in the United States wound care market for

Kane’s coactiv+™ Antimicrobial Wound Gel and Kane will receive a

$500,000 USD upfront payment from ProgenaCare once it obtains

510(k) clearance from the FDA.

- On May 25, 2023, the Company

announced that on May 24, 2023 it received 510(k) clearance of its

coactiv+™ Antimicrobial Wound Gel from the U.S. Food and Drug

Administration (FDA) for the management of ulcers (including

diabetic foot and leg ulcers and pressure ulcers), 1st and 2nd

degree burns, partial & full thickness wounds, large surface

area wounds and surgical incisions for adult populations.

- On December 20, 2023, the Company

announced that it received a non-binding offer for its interest in

STEM Animal Health.

- On March 8, 2024, Kane Biotech

announced that at the Bioscience Association of Manitoba (“BAM”)

annual awards dinner held on March 7, 2024, the Company received

the BAM Company of the Year award. The Bioscience Company of the

Year award acknowledges a private sector company based in Manitoba

that has distinguished itself in the past year through demonstrated

leadership, significant achievement and paving the road toward

future wealth and job creation in the region.

- On February 22, 2024, Kane Biotech

announced that at the special meeting of the shareholders of the

Company held on February 20, 2024, Dr. Robert Huizinga was elected

as a director of the Company. The Company also announced that Dr.

Huizinga had been appointed by the directors of the Company as

Executive Chair of the Company.

- On January 31, 2024, the Company

announced that if it had filed a patent on its revyve™

Antimicrobial Would Gel Spray, a follow-on product to its FDA

510(k) cleared revyve™ Antimicrobial Would Gel and would be

introducing it at the Boswick Burn and Wound Care Symposium on the

same date

- On November 16, 2023, Kane Biotech

announced that Dr. John Coleman had been appointed to the Board of

Directors of Kane Biotech.

- On November 02, 2023, the Company

announced the launch of the newly rebranded revyve™ Antimicrobial

Wound Gel (formerly coactiv+™ Antimicrobial Wound Gel). The product

rebranding was being unveiled as part of Kane’s participation in

the Symposium on Advanced Wound Care (SAWC) Fall forum.

- On September 12, 2023, the Company

announced that it had fully subscribed and closed its previously

announced non-brokered private placement offering of $500,000 and

that it had entered into a further amending agreement to its credit

facility with Pivot Financial I Limited Partnership (“Pivot”)

increasing the size of the credit facility from $5 million to $6

million.

- On April 18, 2023, the Company

announced that it had signed a licensing agreement with Skout’s

Honor for its patented coactiv+™ technology in pet oral care

applications. Skout’s Honor has been granted a ten-year license for

the non-exclusive use of Kane’s coactiv+™ technology under their

own brand in North America while STEM will continue to

commercialize its bluestem™ line of pet oral care products.

- On March 2, 2023, Kane Biotech

announced that it had entered into a formal amending agreement with

Pivot, increasing the size of the non-revolving term loan under the

Credit Facility from $4 million to $5 million.

- On January 4, 2023, Kane Biotech

announced that it had signed a distribution agreement with Salud

Pharma S.A. for its coactiv+™ Antimicrobial Wound Gel wound care

and DermaKB™ scalp care products.

Detailed financial information about Kane Biotech can be found

in its December 31, 2023 Financial Statements and Management

Discussion and Analysis on SEDAR and the Company’s website.

Conference Call

Kane Biotech management will host a conference call on Tuesday,

March 26, 2024 at 4:30 p.m. ET to review the financial results and

discuss business developments in the period.

Participants must register for the call using this link:

Pre-registration to Q4 to receive the dial-in numbers and unique

PIN to access the call seamlessly. It is recommended that you join

10 minutes before the event, though you may pre-register at any

time. A webcast of the call will be available on the Company's

website at www.kanebiotech.com in the Investor section of the Kane

Biotech website at ir.kanebiotech.com.

About Kane Biotech

Kane Biotech is a biotechnology company engaged in the research,

development and commercialization of technologies and products that

prevent and remove microbial biofilms. The Company has a portfolio

of biotechnologies, intellectual property (67 patents and patents

pending, trade secrets and trademarks) and products developed by

the Company's own biofilm research expertise and acquired from

leading research institutions. StrixNB™, DispersinB®, Aledex™,

bluestem™, bluestem®, silkstem™, goldstem™, coactiv+™, coactiv+®,

DermaKB™, DermaKB Biofilm™, and revyve™ are trademarks of Kane

Biotech Inc. The Company is listed on the TSX Venture Exchange

under the symbol "KNE" and on the OTCQB Venture Market under the

symbol “KNBIF”.

For more information:

|

|

|

|

|

|

|

Marc Edwards |

Ray Dupuis |

|

|

Chief Executive Officer |

Chief Financial Officer |

|

|

Kane Biotech Inc |

Kane Biotech Inc |

|

|

medwards@kanebiotech.com |

rdupuis@kanebiotech.com |

|

|

|

|

|

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution Regarding Forward-Looking

InformationThis press release contains certain statements regarding

Kane Biotech Inc. that constitute forward-looking information under

applicable securities law. These statements reflect

management’s current beliefs and are based on information currently

available to management. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. These risks and uncertainties include, but are not

limited to, risks relating to the Company’s: (a) financial

condition, including lack of significant revenues to date and

reliance on equity and other financing; (b) business, including its

early stage of development, government regulation, market

acceptance for its products, rapid technological change and

dependence on key personnel; (c) intellectual property including

the ability of the Company to protect its intellectual property and

dependence on its strategic partners; and (d) capital structure,

including its lack of dividends on its common shares, volatility of

the market price of its common shares and public company costs.

Further information about these and other risks and uncertainties

can be found in the disclosure documents filed by the Company with

applicable securities regulatory authorities, available

at www.sedar.com. The Company cautions that the foregoing list

of factors that may affect future results is

not exhaustive.

|

KANE BIOTECH INC. |

|

|

|

|

|

|

|

|

Selected Financial Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Comprehensive Loss |

Three months endedDecember 31, |

|

Twelve months endedDecember 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue, continuing operations |

$ |

39,770 |

|

|

$ |

23,372 |

|

|

$ |

148,980 |

|

|

$ |

156,733 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit, continuing operations |

|

34,300 |

|

|

|

35,164 |

|

|

|

109,470 |

|

|

|

112,029 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses, current operations |

|

|

|

|

|

|

|

| |

General and administration |

|

872,899 |

|

|

|

484,739 |

|

|

|

2,412,956 |

|

|

|

2,533,613 |

|

|

|

Research |

|

419,736 |

|

|

|

189,926 |

|

|

|

1,053,900 |

|

|

|

1,036,021 |

|

|

|

Total operating expenses, continuing

operations |

|

1,292,635 |

|

|

|

674,665 |

|

|

|

3,466,856 |

|

|

|

3,569,634 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss prior to other expenses, continuing

operations |

|

(1,258,335 |

) |

|

|

(639,501 |

) |

|

|

(3,357,386 |

) |

|

|

(3,457,605 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net other expenses, continuing operations |

|

264,090 |

|

|

|

293,848 |

|

|

|

1,204,959 |

|

|

|

564,033 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss and comprehensive loss for the period, |

|

|

|

|

|

|

|

|

|

continuing operations |

$ |

(1,522,425 |

) |

|

$ |

(933,349 |

) |

|

$ |

(4,562,345 |

) |

|

$ |

(4,021,638 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income (loss) and comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

from discontinued operations |

$ |

(89,469 |

) |

|

$ |

95,199 |

|

|

$ |

(707,708 |

) |

|

$ |

197,638 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and comprehensive loss |

$ |

(1,611,894 |

) |

|

$ |

(838,150 |

) |

|

$ |

(5,270,053 |

) |

|

$ |

(3,824,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss and comprehensive loss attributable

to |

|

|

|

|

|

|

|

|

|

shareholders |

$ |

(1,641,701 |

) |

|

$ |

(806,431 |

) |

|

$ |

(5,034,103 |

) |

|

$ |

(3,889,892 |

) |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share for the

period |

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

|

|

|

|

|

|

|

and diluted |

|

131,844,567 |

|

|

|

124,830,202 |

|

|

|

127,119,957 |

|

|

|

120,702,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Financial Position |

December 31, |

|

December 31 |

|

|

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

749,248 |

|

|

$ |

1,104,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other current assets |

|

502,164 |

|

|

|

1,991,844 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets held-for-sale - current |

|

2,471,694 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

1,799,008 |

|

|

|

2,523,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets held-for-sale - non-current |

|

158,805 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

5,680,919 |

|

|

$ |

5,619,835 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

$ |

10,273,267 |

|

|

$ |

6,341,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities held-for-sale - current |

|

621,133 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

2,366,593 |

|

|

|

3,415,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities held-for-sale - non-current |

|

829,318 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' deficit |

|

(8,409,392 |

) |

|

|

(4,137,711 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

5,680,919 |

|

|

$ |

5,619,835 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

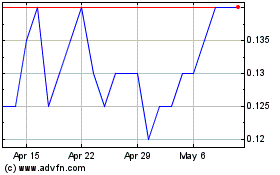

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Jan 2024 to Jan 2025