Kane Biotech Announces Agreement in Principle for the Sale of its Interest in STEM Animal Health

April 11 2024 - 8:45AM

Kane Biotech Inc. (TSX- V:KNE; OTCQB:KNBIF) (the

“

Company” or “

Kane Biotech”)

announces today that it has reached an agreement in principle for

the sale of its entire interest (the “

Interest”)

in STEM Animal Health Inc. (“

STEM”) to a third

party multi-national pharmaceutical company (the

“

Purchaser”) on a cash-free debt-free basis for US

$8,000,000 (the “

Transaction”), subject to

adjustments in accordance with the terms of the agreement in

principle, as well as other consideration including the net cash

held in STEM (estimated at CND $600,000) and a working capital

adjustment (estimated at CND $350,000). Overall, it is anticipated

that the sale of STEM Animal Health will net Kane Biotech in excess

of CND $11,500,000 (including the cash deposits already received,

as noted below). The Purchaser is not a Non-Arm’s Length Party (as

that term is defined by the TSX Venture Exchange) of the Company.

In connection with the Transaction, but not

included in the net amount of the sale, the Company will be

eligible for a US $750,000 sales-based milestone payment and will

also be entering into product development and transitional

manufacturing agreements with STEM.

The Company anticipates using the net proceeds

from the Transaction to repay its outstanding loan to Pivot

Financial I Limited Partnership in the amount of approximately CND

$6,700,000, and for general working capital purposes.

Prior to the completion of the Transaction, as

previously announced, the Company received an aggregate of US

$1,525,000 from the Purchaser in cash deposits that it applied

towards the sale price for the Interest. Accordingly, the Company

is expected to receive US $6,475,000 upon the completion of the

Transaction.

“We are pleased with the outcome of this

transaction,” said Marc Edwards, President & CEO of Kane

Biotech. “Kane Biotech will be receiving full value for the

successful animal health business that it created allowing the

Company to significantly strengthen its balance sheet and narrow

its focus on human health biofilm solutions.”

Prior to the completion of the Transaction, the

Company owned a 2/3 interest in STEM. The remaining 1/3 interest

was owned by an arm’s length third party.

In accordance with the policies of the TSX

Venture Exchange, the Transaction must be consented to by

shareholders of the Company holding over 50% of the common shares

of the Company due to the fact that the Transaction constitutes a

sale of more than 50% of the Company’s assets, business or

undertaking. The Company anticipates that it will be able to

satisfy this requirement through the written consent of

shareholders of the Company holding more than 50% of the common

shares of the Company.

The closing of the Transaction is subject to the

approval of the TSX Venture Exchange.

About Kane Biotech

Kane Biotech is a biotechnology company engaged

in the research, development and commercialization of technologies

and products that prevent and remove microbial biofilms. The

Company has a portfolio of biotechnologies, intellectual property

(67 patents and patents pending, trade secrets and trademarks) and

products developed by the Company's own biofilm research expertise

and acquired from leading research institutions. StrixNB™,

DispersinB®, Aledex™, bluestem™, bluestem®, silkstem™, goldstem™,

coactiv+™, coactiv+®, DermaKB™, DermaKB Biofilm™, and revyve™ are

trademarks of Kane Biotech Inc. The Company is listed on the TSX

Venture Exchange under the symbol "KNE" and on the OTCQB Venture

Market under the symbol “KNBIF”.

For more information:

|

Marc Edwards |

Ray Dupuis |

|

Chief Executive Officer |

Chief Financial Officer |

|

Kane Biotech Inc |

Kane Biotech Inc |

|

medwards@kanebiotech.com |

rdupuis@kanebiotech.com |

|

|

|

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution Regarding Forward-Looking

InformationThis press release contains certain statements regarding

Kane Biotech Inc. that constitute forward-looking information under

applicable securities law. These statements reflect

management’s current beliefs and are based on information currently

available to management. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. These risks and uncertainties include, but are not

limited to, risks relating to the Company’s: (a) financial

condition, including lack of significant revenues to date and

reliance on equity and other financing; (b) business, including its

early stage of development, government regulation, market

acceptance for its products, rapid technological change and

dependence on key personnel; (c) intellectual property including

the ability of the Company to protect its intellectual property and

dependence on its strategic partners; and (d) capital structure,

including its lack of dividends on its common shares, volatility of

the market price of its common shares and public company costs.

Further information about these and other risks and uncertainties

can be found in the disclosure documents filed by the Company with

applicable securities regulatory authorities, available

at www.sedarplus.ca. The Company cautions that the foregoing

list of factors that may affect future results is

not exhaustive.

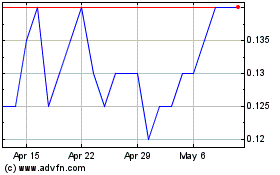

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Jan 2024 to Jan 2025