Los Andes Announces Filing of Updated Preliminary Economic

Assessment and Updated Mineral Resources for Vizcachitas

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb 18, 2014) - Los

Andes Copper Ltd. ("Los Andes", or the "Company") (TSX-VENTURE:LA)

is pleased to announce that the Company has filed a Preliminary

Economic Assessment ("PEA") and an updated resource estimate on its

100% owned Vizcachitas porphyry copper-molybdenum project

("Vizcachitas Project") located in Region V, Chile.

The PEA and updated mineral resources announced on December 13,

2013 was prepared during the process of consolidation of the

non-consumptive water rights over a section of the Rocin River,

Putaendo, Fifth Region, Chile, together with the engineering and

other studies and reports for the development of a run-of-river

hydroelectric project generation facility. Such consolidation took

place effective January 23, 2014. This updated PEA does not change

in any way the resource estimate or the technical and economic

aspects of the PEA except that it removes all references and

economic calculations related to the possibility that these water

rights might not have been included in Los Andes.

The PEA was prepared by Coffey Consultoria y Servicios SpA

(Coffey) and Alquimia Conceptos S.A., and can be accessed under the

Company's profile at www.sedar.com and on the Company's

website.

Resource Estimate Update

As part of the PEA the resource estimate for the Vizcachitas

Project was updated by Coffey. At a 0.3 % copper equivalent (Cu Eq)

cut-off, the Indicated Resources are 1,038 Mt @ 0.434 % Cu Eq

(0.373 % Cu and 0.012 % Mo), containing an estimated 8.5 billion

pounds of copper and 281 million pounds of molybdenum, and the

Inferred Resources are 318 Mt @ 0.405 % Cu Eq (0.345 % Cu and 0.013

% Mo) containing an estimated 2.4 billion pounds of copper and 88

million pounds of molybdenum.

The estimate increases the Indicated Resources from the mineral

resources which had an effective date of June 9, 2008. The resource

estimate was based on a total of 146 drill holes and 40,383 metres

drilled, including a total of 16 drill holes and 5,128 metres of

drilling completed after the June 9, 2008 resource estimate.

The Mineral Resource estimates for different cut-off grades with

an effective date of January 23, 2014 are shown in the tables

below:

INDICATED

|

Cut-Off (Cu Eq %) |

Tonnage Mt |

Cu Eq % |

Cu Grade % |

Mo Grade % |

Cu Mlb |

Mo Mlb |

|

0.20 |

1,317 |

0.396 |

0.341 |

0.011 |

9,913 |

318 |

|

0.25 |

1,191 |

0.414 |

0.356 |

0.012 |

9,353 |

305 |

|

0.30 |

1,038 |

0.434 |

0.373 |

0.012 |

8,539 |

281 |

|

0.35 |

824 |

0.462 |

0.396 |

0.013 |

7,201 |

240 |

|

0.40 |

566 |

0.501 |

0.431 |

0.014 |

5,374 |

179 |

|

0.45 |

368 |

0.543 |

0.467 |

0.015 |

3,788 |

125 |

|

0.50 |

244 |

0.588 |

0.509 |

0.016 |

2,515 |

79 |

INFERRED

|

Cut-Off (Cu Eq %) |

Tonnage Mt |

Cu Eq % |

Cu Grade % |

Mo Grade % |

Cu Mlb |

Mo Mlb |

|

0.20 |

521 |

0.343 |

0.296 |

0.010 |

3,407 |

111 |

|

0.25 |

404 |

0.376 |

0.322 |

0.011 |

2,873 |

101 |

|

0.30 |

318 |

0.405 |

0.345 |

0.013 |

2,415 |

88 |

|

0.35 |

212 |

0.443 |

0.372 |

0.015 |

1,734 |

70 |

|

0.40 |

130 |

0.488 |

0.402 |

0.018 |

1,152 |

51 |

|

0.45 |

76 |

0.533 |

0.428 |

0.022 |

714 |

36 |

|

0.50 |

40 |

0.584 |

0.466 |

0.024 |

415 |

22 |

- Copper equivalent grade has been calculated using the

following expression: Cu Eq (%) = CuT (%) + 4.95 x Mo (%), using

the metal prices: $ 2.75 / lb. Cu and $13.6 / lb. Mo.

- Small discrepancies may exist due to rounding

errors.

- The quantities and grades of reported Inferred Mineral

Resources are uncertain in nature and further exploration may not

result in their upgrading to Indicated or Measured

status.

- Mineral Resources are reported within a Whittle pit shell

based on: Mine Cost - 2.25 USD/t, Process Cost - 6.94 USD/t, Copper

Price - 3.00 USD/lb, Molybdenum Price - 13.6 USD/lb. Conc. Copper

Sales Cost - 0.5537 USD/lb., Conc. Molybdenum Sales Cost - 1.60

USD/lb., Recovery Copper - 90%, Recovery Molybdenum - 60%, Slope

Angles - 42° to 47°.

PEA Highlights

The PEA evaluated four mining scenarios feeding flotation

facilities with a throughput of 44 ktpd, 88 ktpd, 176 ktpd and 88

ktpd with a step up in production to a final throughput of 176

ktpd. The 176 ktpd case was selected to be the base case as it

produced the highest net present values (NPV).

The base case has a life of mine of 28 years, initial capital

expenditures of $2.9 billion, sustaining capital expenditure of

$0.7 billion for the construction of the second tailings dam

facility and mine extensions, and considered flat projected copper

prices of $2.75/lb and molybdenum prices of $13.64/lb.

On a pre-tax basis, the base case, results in an NPV of $746

million, internal rate of return (IRR) of 11.4%, and an estimated

payback period from initial commercial operations (Payback Period)

of 5.9 years. On an unlevered after-tax basis, the base case,

results in an NPV of $274 million, IRR of 9.5%, and a Payback

Period of 6.0 years.

Note: The Preliminary Economic Assessment is considered

preliminary in nature and includes inferred mineral resources that

are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

Preliminary Economic Assessment will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability.

An updated NI 43-101 compliant Technical Report on the

Vizcachitas Copper Molybdenum Porphyry Project has been filed on

www.sedar.com and on the Company's Internet site

www.losandescopper.com.

The Technical Report is authored by independent Qualified

Persons and prepared in accordance with NI 43-101. The contents of

this press release have been approved by the following independent

Qualified Persons:

John Wells BSc, MBA, FSAIMM.

Manuel Hernández, BSc, FAusIMM.

Porfírio Rodriguez, BSc, MAIG.

Román Flores, BSc, Registered Member of Chilean Mining

Commission.

Antony J. Amberg, M.Sc., CGeol., a qualified person as defined

by National Instrument 43-101, supervised the preparation of the

technical information in this news release.

Certain of the information and statements contained herein

that are not historical facts, constitute "forward-looking

information" within the meaning of the Securities Act (British

Columbia), Securities Act (Ontario) and the Securities Act

(Alberta) ("Forward-Looking Information"). Forward-Looking

Information is often, but not always, identified by the use of

words such as "seek", "anticipate", "believe", "plan", "estimate",

"expect" and "intend"; statements that an event or result is "due"

on or "may", "will", "should", "could", or might" occur or be

achieved; and, other similar expressions. More specifically,

Forward-Looking Information involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such Forward-Looking

Information; including, without limitation, the achievement and

maintenance of planned production rates, the evolving legal and

political policies of Chile, the volatility in the Chilean economy,

military unrest or terrorist actions, metal and energy price

fluctuations, favourable governmental relations, the availability

of financing for activities when required and on acceptable terms,

the estimation of mineral resources and reserves, current and

future environmental and regulatory requirements, the availability

and timely receipt of permits, approvals and licenses, industrial

or environmental accidents, equipment breakdowns, availability of

and competition for future acquisition opportunities, availability

and cost of insurance, labour disputes, land claims, the inherent

uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other

risks and uncertainties, including those described in Management's

Discussion and Analysis in the Company's financial statements. Such

Forward-Looking Information is based upon the Company's assumptions

regarding global and Chilean economic, political and market

conditions and the price of metals and energy, and the Company's

production. Among the factors that have a direct bearing on the

Company's future results of operations and financial conditions are

changes in project parameters as plans continue to be refined, a

change in government policies, competition, currency fluctuations

and restrictions and technological changes, among other things.

Should one or more of any of the aforementioned risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from any conclusions,

forecasts or projections described in the Forward-Looking

Information. Accordingly, readers are advised not to place undue

reliance on Forward-Looking Information. Except as required under

applicable securities legislation, the Company undertakes no

obligation to publicly update or revise Forward-Looking

Information, whether as a result of new information, future events

or otherwise.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release

Los Andes Copper Ltd.Eduardo CovarrubiasPresident &

CEO(56-99) 323-3156Los Andes Copper Ltd.Michael KutaCorporate

Secretary604-697-6201info@losandescopper.comwww.losandescopper.com

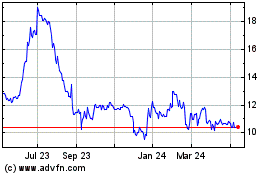

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Dec 2024 to Jan 2025

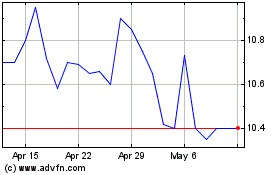

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Jan 2024 to Jan 2025