Mkango Resources Ltd (AIM / TSX-V:MKA) (the “Company” or “Mkango”),

is pleased to announce that it has released the Financial

Statements and Management's Discussion and Analysis for the 3-month

period ending 31 March 2023. The reports are available under the

Company's profile on SEDAR (www.sedar.com) and on the Company's

website (https://mkango.ca/investors/financials/).

Furthermore, the Company announces that, subject

to regulatory approval, Mkango has granted 3,350,000 stock options

over 3,350,000 common shares of the Company (“Options”) to

directors, officers, employees and consultants of the Company in

accordance with the Company’s existing Option Plans.

The Options have an exercise price of $0.2025

CDN per common share, being the same price at the equity placing

announced on 13 February 2023. The options will vest over the next

two years and are valid for a period of ten years from the date of

the grant. Furthermore, certain options will, subject to certain

exceptions, only vest if the Company has finalized the Mining

Development Agreement (“MDA”) in Malawi and secured the mining

license for the Songwe Hill rare earths project.

1,775,000 of these Options are granted to the

following directors and officers in accordance with the Company’s

stock Option Plans.

Details of the Options being issued to Directors

and PDMRs are set out below:

|

Name of director/officer |

Proposed New Options |

Total Options held |

Special Vesting Conditions |

|

Derek LinfieldChairman |

250,000 |

3,410,000 |

Finalised MDA and secured Mining License |

|

Alexander LemonPresident |

287,500 |

6,547,500 |

Finalised MDA and secured Mining License |

|

William DawesChief Executive Officer |

287,500 |

6,547,500 |

Finalised MDA and secured Mining License |

|

Shaun TreacyNon-Executive Director |

175,000 |

1,370,000 |

Finalised MDA and secured Mining License |

|

Susan MuirNon-Executive Director |

175,000 |

1,370,000 |

Finalised MDA and secured Mining License |

|

Philipa VarrisNon-Executive Director |

400,000 |

400,000 |

No special vesting conditions |

|

Robert SewellChief Financial Officer |

375,000 |

725,000 |

Finalised MDA and secured Mining License |

The Company has also issued 575,000 Restricted

Share Units (“RSU”) to Will Dawes and Alexander Lemon (287,500

Restricted Share Units each). Each RSU is exchangeable,

on vesting, for 1 common share of the Company. In addition to the

normal vesting condition contained in the RSU Plan, these RSUs will

not vest, until the MDA is finalised and the Mining License is

secured.

Following this grant of Options and RSUs, the

total number of ordinary shares under option is 24,125,000,

representing 9.9 per cent of the Company’s total issued share

capital.

Market Abuse Regulation (MAR)

Disclosure

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ('MAR') which has been incorporated into UK law by the

European Union (Withdrawal) Act 2018. Upon the publication of this

announcement via Regulatory Information Service, this inside

information is now considered to be in the public domain.

For further information, please

contact:

|

Mkango Resources LimitedWilliam DawesChief

Executive Officerwill@mkango.caAlexander

LemonPresidentalex@mkango.caRobert SewellChief Financial

Officerrob@mkango.cawww.mkango.ca@MkangoResources |

Canada: +1 403 444 5979 |

|

|

|

|

TavistockPR and IR AdviserJos Simson, Cath

Drummondmkango@tavistock.co.uk |

UK: +44 (0) 20 7920 3150 |

|

SP Angel Corporate Finance LLPNominated Adviser

and Joint BrokerJeff Keating, Kasia Brzozowska |

UK: +44 20 3470 0470 |

|

Alternative Resource CapitalJoint BrokerAlex Wood,

Keith Dowsing |

UK: +44 20 7186 9004/5 |

|

Bacchus Capital AdvisersFinancial AdviserRichard

Allanrichard.allan@bacchuscapital.co.uk |

UK: +44 203 848 1642UK: +44 7857

857 287 |

About Mkango

Mkango's corporate strategy is to develop new

sustainable primary and secondary sources of neodymium,

praseodymium, dysprosium and terbium to supply accelerating demand

from electric vehicles, wind turbines and other clean technologies.

This integrated Mine, Refine, Recycle strategy differentiates

Mkango from its peers, uniquely positioning the Company in the rare

earths sector. Mkango is listed on the AIM Market of the London

Stock Exchange (“AIM”) and the Toronto Venture Exchange

(“TSX-V”).

Mkango is developing its Songwe Hill rare earths

project (“Songwe Hill”) in Malawi with a Feasibility Study

completed in July 2022 and an Environmental, Social and Health

Impact Assessment approved by the Government of Malawi in January

2023. Malawi is known as "The Warm Heart of Africa", a stable

democracy with existing road, rail and power infrastructure, and

new infrastructure developments underway.

In parallel, Mkango and Grupa Azoty PULAWY,

Poland's leading chemical company and the second

largest manufacturer of nitrogen and compound fertilizers in

the European Union, have agreed to work together towards

development of a rare earth Separation Plant at Pulawy in Poland

(the “Pulawy Separation Plant”). The Pulawy Separation Plant will

process the purified mixed rare earth carbonate produced at Songwe

Hill.

Through its ownership of Maginito

(www.maginito.com), Mkango is also developing green technology

opportunities in the rare earths supply chain, encompassing

neodymium (NdFeB) magnet recycling as well as innovative rare earth

alloy, magnet, and separation technologies.

Mkango also has an extensive exploration

portfolio in Malawi, including the Mchinji rutile exploration

project, the Thambani uranium-tantalum-niobium-zircon project and

Chimimbe nickel-cobalt project.

For more information, please

visit www.mkango.ca

Cautionary Note Regarding Forward-Looking

Statements

This news release contains forward-looking

statements (within the meaning of that term under applicable

securities laws) with respect to Mkango. Generally, forward looking

statements can be identified by the use of words such as “plans”,

“expects” or “is expected to”, “scheduled”, “estimates” “intends”,

“anticipates”, “believes”, or variations of such words and phrases,

or statements that certain actions, events or results “can”, “may”,

“could”, “would”, “should”, “might” or “will”, occur or be

achieved, or the negative connotations thereof. Readers are

cautioned not to place undue reliance on forward-looking

statements, as there can be no assurance that the plans, intentions

or expectations upon which they are based will occur. By their

nature, forward-looking statements involve numerous assumptions,

known and unknown risks and uncertainties, both general and

specific, that contribute to the possibility that the predictions,

forecasts, projections and other forward-looking statements will

not occur, which may cause actual performance and results in future

periods to differ materially from any estimates or projections of

future performance or results expressed or implied by such

forward-looking statements. Such factors and risks include, without

limiting the foregoing, the availability of (or delays in

obtaining) financing to develop Songwe Hill, , governmental action

and other market effects on global demand and pricing for the

metals Mkango is exploring and developing, and geological,

technical and regulatory matters relating to the development of

Songwe Hill, The forward-looking statements contained in this news

release are made as of the date of this news release. Except as

required by law, the Company disclaims any intention and assume no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable law. Additionally, the Company

undertakes no obligation to comment on the expectations of, or

statements made by, third parties in respect of the matters

discussed above.

The TSX Venture Exchange has neither

approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any equity or other

securities of the Company in the United States. The securities of

the Company will not be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities Act") and

may not be offered or sold within the United States to, or for the

account or benefit of, U.S. persons except in certain transactions

exempt from the registration requirements of the U.S. Securities

Act.

NOTIFICATION AND PUBLIC DISCLOSURE OF

TRANSACTIONS BY PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES AND

PERSONS CLOSELY ASSOCIATED WITH THEM

|

|

|

|

|

1. |

Details of the person discharging managerial

responsibilities/person closely associated |

|

a) |

Name: |

1) Derek Linfield |

|

2) Alexander Lemon |

|

3) William Dawes |

|

4) Shaun Treacy |

|

5) Susan Muir |

|

6) Philipa Varris |

|

7) Robert Sewell |

|

2. |

Reason for the notification |

|

a) |

Position/status: |

8) Chairman |

|

9) President |

|

10) Chief Executive Officer |

|

11) Non-Executive Director |

|

12) Non-Executive Director |

|

13) Non-Executive Director |

|

14) Chief Financial Officer |

|

b) |

Initial notification/Amendment: |

Initial notification |

|

3. |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name: |

Mkango Resources Limited |

|

b) |

LEI: |

213800RPILRWRUYNTS85 |

|

4. |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument: |

Common shares of nil pence each |

|

Identification code: |

|

|

|

CA60686A4090 |

|

b) |

Nature of the transaction: |

Issue of options exercisable for Common Shares with no par

value |

|

c) |

Price(s) and volume(s): |

Price(s) |

Volume(s) |

|

1) C$0.2025 |

250,000 |

|

2) C$0.2025 |

287,500 |

|

3) C$0.2025 |

287,500 |

|

4) C$0.2025 |

175,000 |

|

5) C$0.2025 |

175,000 |

|

6) C$0.2025 |

400,000 |

|

7) C$0.2025 |

375,000 |

|

|

Aggregated information: |

1,950,000 |

|

Aggregated volume: |

|

|

Price: |

Price(s) |

Volume(s) |

|

|

1)-7) C$0.2025 |

1,950,000 |

|

|

|

|

e) |

Date of the transaction: |

30-May-23 |

|

f) |

Place of the transaction: |

Outside a trading venue |

|

|

|

|

|

|

|

|

|

|

|

1. |

Details of the person discharging managerial

responsibilities/person closely associated |

|

a) |

Name: |

1) William Dawes |

|

2) Alexander Lemon |

|

2. |

Reason for the notification |

|

a) |

Position/status: |

1) Chief Executive Officer |

|

2) President |

|

b) |

Initial notification/Amendment: |

Initial notification |

|

3. |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name: |

Mkango Resources Limited |

|

b) |

LEI: |

213800RPILRWRUYNTS85 |

|

4. |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument: |

Restricted Share Units exchangeable for common shares with no par

value |

|

Identification code: |

|

|

|

CA60686A4090 |

|

b) |

Nature of the transaction: |

Issue |

|

c) |

Price(s) and volume(s): |

Price(s) |

Volume(s) |

|

1) C$0.2025 |

287,500 |

|

2) C$0.2025 |

287,500 |

|

|

Aggregated information: |

575,000 |

|

Aggregated volume: |

|

|

Price: |

Price(s) |

Volume(s) |

|

|

1)-2) C$0.2025 |

575,000 |

|

|

|

|

e) |

Date of the transaction: |

30-May-23 |

|

f) |

Place of the transaction: |

Outside a trading venue |

|

|

|

|

|

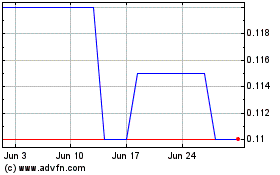

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Jan 2024 to Jan 2025