Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” today announced its third quarter of fiscal 2024

production and financial results for the three and nine months

ended March 31, 2024. All amounts are expressed in United States

dollars (“US$”) unless otherwise indicated (refer to www.sedar.com

for full financial results).

President and CEO Cathy Zhai commented, "Q3

FY2024 was a significant quarter at the Selinsing Gold Mine with

stabilization of production at the sulphide gold processing plant.

The Company focused on the improvement of flotation plant

performance at the Selinsing Gold Mine to increase cash flow

generation. The cash generation provides a foundation for future

exploration, development and corporate growth. In addition, an

assessment of a potential production restart at the Murchison Gold

Project continues to progress.”

Third Quarter Highlights:

- Positive cashflow from gold concentrate production of $6.20

million during Q3 2024, compared to $1.35 million in Q3 2023 when

gold bullion transitioned to gold concentrate production.

- Gold concentrate production stabilized in Q3 FY 2024 with a

total of 5,448 ounces of gold produced, bringing the year to date

gold production to 19,539 ounces at cash cost of $878 per ounce and

AISC at $1,168 per ounce (YTD FY 2023: a total 6,003 ounces of gold

produced, comprised of 2,440 ounce from gold concentrate production

and 3,563 ounces from gold bullion production at a cash cost of

$1,536 per ounce and AISC at $1,779 per ounce).

- Ongoing upgrades of the filter press through FY 2024 expected

to further increase production capacity.

- 5,488 ounces of gold produced (Q3 2023: 2,412 ounces);

- 8,727 ounces of gold sold at a record average realized price of

$2,097 per ounce with revenue from concentrate sales of $14.91

million (Q3 2023: 1,400 ounces sold at average realized price of

$1,878 per ounce and revenue of $2.63 million from gold bullion

sales) (refer to section 14 “Non-IFRS Performance Measures” for

further details on the calculation of the average realized gold

price in the Q3 FY 2024 Management’s Discussion and Analysis

(“MD&A”));

- Cash cost per ounce sold of $882 per ounce (Q3 2023: $1,580 per

ounce);

- Gross margin of $7.21 million (Q3 2023: $0.42 million);

- All-in sustaining cost (“AISC”) per ounce sold of $1,273 per

ounce (Q3 2023: $1,940 per ounce) (refer to section 14 “Non-IFRS

Performance Measures” in the Q3 FY 2024 MD&A).

Third Quarter and YTD Production and Financial

Highlights

|

|

Three months ended March 31, |

|

Nine months ended March 31, |

|

|

|

2024 |

2023 |

|

2024 |

2023 |

|

|

Production |

|

|

|

|

| Ore mined (tonnes) |

200,676 |

82,100 |

|

790,264 |

298,351 |

|

| Waste removed (tonnes) |

2,777,069 |

2,235,216 |

|

7,565,320 |

5,943,868 |

|

| Gold Concentrate

Production |

|

|

|

|

|

Ore processed (tonnes) |

166,478 |

89,151 |

|

536,189 |

98,725 |

|

|

Average mill feed grade (g/t) |

1.49 |

1.99 |

|

1.62 |

1.98 |

|

|

Processing recovery rate (%) |

68.50 |

41.75 |

|

69.82 |

40.86 |

|

|

Gold produced (oz) |

5,488 |

2,412 |

|

19,539 |

2,440 |

|

|

Gold sold (oz) |

8,727 |

- |

|

20,301 |

- |

|

| Gold Bullion

Production |

|

|

|

|

|

Ore processed (tonnes) |

- |

- |

|

- |

195,264 |

|

|

Average mill feed grade (g/t) |

- |

- |

|

- |

1.03 |

|

|

Processing recovery rate (%) |

- |

- |

|

- |

44.90 |

|

|

Gold produced (1) (oz) |

- |

- |

|

- |

3,563 |

|

|

Gold sold (oz) |

- |

1,400 |

|

- |

5,150 |

|

|

|

|

|

|

|

| Financial

(expressed in thousands of US$) |

$ |

$ |

|

$ |

$ |

|

| Revenue |

14,911 |

2,629 |

|

32,819 |

9,209 |

|

| Gross margin from mining

operations |

7,213 |

417 |

|

14,991 |

1,300 |

|

| Income (loss) before other

items |

2,715 |

(894 |

) |

5,606 |

(3,057 |

) |

| Net income (loss) |

884 |

(837 |

) |

204 |

(4,322 |

) |

| Cash flows provided by

operations |

6,201 |

1,346 |

|

8,635 |

3,446 |

|

| Working capital |

17,406 |

14,545 |

|

17,406 |

14,545 |

|

| |

|

|

|

|

|

Earnings (loss) per share – basic (US$/share) |

0.00 |

(0.00 |

) |

0.00 |

(0.01 |

) |

| |

|

|

|

|

| Weighted average gold

price |

US$/oz |

US$/oz |

|

US$/oz |

US$/oz |

|

| Realized price - gold bullion

production (2) |

- |

1,878 |

|

- |

1,788 |

|

| Realized price - gold

concentrate production (2) |

2,097 |

- |

|

1,917 |

- |

|

|

|

|

|

|

|

| Cash cost per ounce

sold |

|

|

|

|

| Mining |

323 |

567 |

|

301 |

557 |

|

| Processing |

349 |

816 |

|

347 |

792 |

|

| Royalties |

149 |

181 |

|

162 |

178 |

|

| Operations, net of silver

recovery |

61 |

16 |

|

68 |

9 |

|

| Total cash cost per

ounce sold (3) |

882 |

1580 |

|

878 |

1536 |

|

|

By-product silver recovery |

- |

1 |

|

- |

1 |

|

|

Operation expenses |

4 |

- |

|

5 |

- |

|

|

Corporate expenses |

8 |

48 |

|

7 |

19 |

|

|

Accretion of asset retirement obligation |

6 |

40 |

|

8 |

29 |

|

|

Exploration and evaluation expenditures |

- |

114 |

|

2 |

99 |

|

|

Sustaining capital expenditures |

373 |

157 |

|

268 |

95 |

|

|

Total all-in sustaining costs per ounce sold

(4) |

1,273 |

1,940 |

|

1,168 |

1,779 |

|

|

(1) |

|

Defined as good delivery gold oxide production according to London

Bullion Market Association (“LBMA”), net of gold dore in transit

and refinery adjustment. |

| (2) |

|

Exclude gold prepaid delivery for comparison purposes. |

| (3) |

|

Total cash cost for both oxide and sulphide plant production

includes production costs such as mining, processing, tailing

facility maintenance and camp administration, royalties, and

operating costs such as storage, temporary mine production closure,

community development cost and property fees, net of by-product

credits. Cash cost excludes amortization, depletion, accretion

expenses, capital costs, exploration costs and corporate

administration costs. |

| (4) |

|

All-in sustaining cost per ounce includes total cash costs,

operation expenses, and adds sustaining capital expenditures,

corporate administrative expenses for the Selinsing Gold Mine

including share-based compensation, exploration and evaluation

costs, and accretion of asset retirement obligations. Certain other

cash expenditures, including tax payments and acquisition costs,

are not included. |

| |

|

|

GOLD PRODUCTION RESULTS

Third quarter gold production

-

A total of 2,977,745 tonnes of material were mined during Q3

FY2024, a 28% increase from 2,317,316 tonnes during Q3 FY2023. This

included 200,676 tonnes of ore mined, up by 144% from 82,100 ore

tonnes mined during Q3 FY2023, and 2,777,069 tonnes of waste mined,

up by 24% from 2,235,216 during Q3 FY2023. The stripping ratio

improved to 13.84 compared to 27.23 during Q3 FY2023.

-

The gold concentrate production in Q3 FY2024 yielded 5,488 ounces

of gold. The mill processed 166,478 tonnes of sulphide ore,

achieving a head grade of 1.49g/t and a recovery rate of 68.50%.

This performance marks a notable improvement from Q3 FY2023, where

2,412 tonnes of sulphide ore at a head grade of 1.99g/t and a

recovery rate of 41.75% were achieved. A key factor in this

enhanced recovery has been the shift from processing old stockpile

ore to feeding high-grade transition ore and fresh sulphide ore,

along with numerous improvements implemented at the processing

plant. Mill availability of the flotation plant was at 84.90%

during Q3 2024 which is lower than planned and was primarily due to

the tie-in of the new rougher tailings hopper and associated

pipework, a TSF powerline failure and high levels of concentrate in

the surge tank at the filter press. To address this, pH adjustment

is now carried out at the filter press surge tank to improve filter

cake quality and easier removal from the filter cloth. Further

upgrades to the filter press have been planned, and are expected to

be completed in October of 2024, with a budget of roughly $1

million.

YTD 2024 gold production

-

Mine production included total material mined of 8,355,584 tonnes

(nine months ended March 31, 2023: 6,242,220 tonnes), comprising

790,264 tonnes of ore (nine months ended March 31, 2023: 298,351

tonnes) and 7,565,320 tonnes of waste (nine months ended March 31,

2023: 5,943,868 tonnes). The stripping ratio improved to 9.57

compared to 19.92 during YTD FY2023.

-

The mill processed 536,189 tonnes of sulphide ore during the nine

months ended March 31, 2024, averaging a head grade of 1.62 g/t and

a recovery of 69.82%. This compares with 98,725 tonnes of sulphide

ore at a head grade of 1.98g/t and a recovery rate of 40.86%

processed during the nine months ended March 31, 2023.

FINANCIAL RESULTS

Third quarter financial results

-

Revenue of $14.91 million from the sale of 6,004 dry metric tonnes

(“DMT”) of gold concentrates, containing 8,727 oz of gold sold at

the average realized gold price of $2,097/oz (Q3 FY2023: revenue of

$2.63 million for 1,400 oz of gold bullion sold at the average

realized price at $1,878 per ounce).

- Total mining cost of

$2.82 million compared to $0.79 million during Q3 FY2023.

-

For the three months ended March 31, 2024, total processing costs

related to the gold concentrate operations were $3.05 million

compared to $1.14 million related to the gold bullion operations

during the three months ended March 31, 2023.

-

Mining operations before non-cash amortization and depreciation

generated a gross margin of $7.21 million, an increase of $6.79

million from $0.42 million in Q3 FY2023.

-

The cash cost from the gold concentrate production was $882/oz (Q3

FY2023: $1,580/oz for the gold bullion operations).

YTD 2024 financial results

-

Revenue of $32.82 million from the sale of 14,914 DMT of gold

concentrates, containing 20,301 oz of gold sold at the average

realized gold price of $1,917/oz (YTD FY2023: revenue of $9.21

million for 5,150 oz of gold bullion sold at the average realized

price at $1,788 per ounce).

-

Total mining cost of $6.12 million compared to $2.87 million during

the nine months ended March 31, 2024.

-

For the nine months ended March 31, 2024, total processing costs

related to the gold concentrate operations were $7.04 million

compared to $4.08 million related to the gold bullion operations

during the nine months ended March 31, 2023.

-

Mining operations before non-cash amortization and depreciation

generated a gross margin of $14.99 million, an increase of $13.69

million from $1.30 million during YTD FY2023.

-

The cash cost from the gold concentrate production was $878/oz (YTD

FY2023: $1,536 for the gold bullion operations).

DEVELOPMENT

Selinsing Gold Mine

Plant Improvements

As part of the ongoing plant optimization, a new

rougher tailings hopper was installed, along with the rougher

tailings pumps upgraded with new motors and power supply. A bigger

rougher concentrate launder was also installed to replace the

original undersized unit and solve excessive spillage issues.

Further upgrades to the filter press have been planned and are

expected to be completed in October of 2024.

Tailing Storage Facility (TSF) Upgrade

Expansion of the Tailings Storage Facilities

(“TSF”) was initiated in 2021 in order to raise the TSF’s level to

540m RL at the main embankment. This was to accommodate an

additional three-year TSF capacity in relation to the sulphide

concentrate production. The final stage of the 0.75m RL TSF

expansion was achieved in Q2 2024. A new spillway at the saddle dam

at 539.2m RL was also completed by the end of Q3 2024.

A monitoring system, which comprises 11 prisms

installed at the TSF main embankment, has been instrumental in

ensuring structural integrity. Bi-weekly readings indicated a total

vertical movement of only 6.30mm for the quarter, with no

significant deviations observed. As of the end of Q3 2024, the

total progress of the fill work stands at 100%.

Murchison Gold Project

During Q3 2024, the Company continued working on

a review of the Murchison Gold Project, including reassessment of

the economics of potential cash flow generation. The Company also

continued to review all historical and recent drill hole data for

the Gabanintha tenement holdings, in order to plan infill drilling

programs for completion in subsequent quarters with a view to

updating the SRK NI 43-101 Report “Mineral Resource estimation at

Burnakura” dated July 2018.

Construction of a new core shed was completed in

March 2024, including new core yard racking and trays. Drill cores

samples have been reorganized to be ready for geological

inspection. A heritage specialist was engaged after Q3 2024 to

research and update the regulatory changes in this regard and other

regulatory compliance was also under review. Processing plant,

accommodation, catering facilities, offices, and associated

infrastructure were maintained to a high standard ensuring

operational readiness for commissioning in the event that

production restarts.

EXPLORATION

Malaysia

There was no exploration drilling undertaken at

Selinsing during the quarter. Exploration activities to identify

additional oxide and sulphide mineralization are expected to resume

later in FY2024.

Western Australia

Burnakura

During Q3 2024, the Company continued to review

and update internal studies for production opportunities at

Burnakura, following the completion of the Selinsing Sulfide Gold

Project during fiscal 2023. During the quarter, construction was

completed on a new drill core storage yard located at Burnakura

with optimized racking, cutting, and core logging facilities. Cores

have been reorganized ready for geological inspection. A heritage

specialist was engaged after Q3 2024 to research and update the

regulatory changes in this regard and other regulatory compliance

was also under review.

Gabanintha

A review of the historic resources at Gabanintha

continued during the quarter, including reviews of historical data

received from regulators in Q2 2024, with conformation and infill

drilling programs for the historical main pits to follow.

Tuckanarra

On August 3, 2023, the Company was notified by

Odyssey Gold Ltd. that a major milestone of resources had been

achieved at the Tuckanarra Joint Venture Project. This triggered an

AUD$1.00 million Performance Payment; the payment plus interest was

received by Monument on February 23, 2024.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE:D7Q1)

is an established Canadian gold producer that 100% owns and

operates the Selinsing Gold Mine in Malaysia and the Murchison Gold

Project in the Murchison area of Western Australia. It has 20%

interest in Tuckanarra Gold Project jointly owned with Odyssey Gold

Ltd in the same region. The Company employs approximately 250

people in both regions and is committed to the highest standards of

environmental management, social responsibility, and health and

safety for its employees and neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville StreetVancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver

T: +1-604-638-1661

x102

rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Disclaimer Regarding Forward-Looking

Statements

This news release includes statements containing

forward-looking information about Monument, its business and future

plans ("forward-looking statements"). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company's plans with respect to its mineral projects, expectations

regarding the completion of the ramp-up period to target production

level at Selinsing and the timing thereof, expectations regarding

the Company’s continuing ability to source explosives from

suppliers, expectations regarding completion of the proposed

storage shed and ammonium nitrate depot and the timing thereof, and

the timing and results of the other proposed programs and events

referred to in this news release. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". The forward-looking

statements in this news release are subject to various risks,

uncertainties and other factors that could cause actual results or

achievements to differ materially from those expressed or implied

by the forward-looking statements. These risks and certain other

factors include, without limitation: risks related to general

business, economic, competitive, geopolitical and social

uncertainties; uncertainties regarding the results of current

exploration activities; uncertainties in the progress and timing of

development activities, including those related to the ramp-up

process at Selinsing and the completion of the proposed storage

shed and ammonium nitrate depot; uncertainties and risks related to

the Company’s ability to source explosives from suppliers; foreign

operations risks; other risks inherent in the mining industry and

other risks described in the management discussion and analysis of

the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Material factors and assumptions used to

develop forward-looking statements in this news release include:

expectations regarding the estimated cash cost per ounce of gold

production and the estimated cash flows which may be generated from

the operations, general economic factors and other factors that may

be beyond the control of Monument; assumptions and expectations

regarding the results of exploration on the Company's projects;

assumptions regarding the future price of gold of other minerals;

the timing and amount of estimated future production; assumptions

regarding the timing and results of development activities,

including the ramp-up process at Selinsing and the completion of

the proposed storage shed and ammonium nitrate depot; expectations

that the Company will continue to be able to source explosives from

suppliers in a timely manner; costs of future activities; capital

and operating expenditures; success of exploration activities;

mining or processing issues; exchange rates; and all of the factors

and assumptions described in the management discussion and analysis

of the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company does not

undertake to update any forward-looking statements, except in

accordance with applicable securities laws.

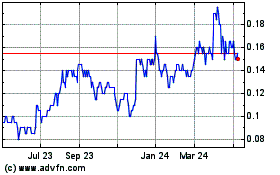

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

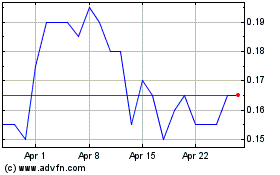

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024